The Bond Market's Silent Crisis: Assessing The Potential Impact

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The bond market, essentially a marketplace for debt instruments, plays a pivotal role in global finance. Governments and corporations issue bonds to raise capital, while investors purchase them for their relatively stable income stream. However, a critical inverse relationship exists between interest rates and bond prices. When interest rates rise, the value of existing bonds with lower fixed interest rates falls, as newly issued bonds offer higher yields.

This phenomenon has significant implications for existing bond portfolios. Rising interest rates lead to:

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and businesses to borrow money, potentially hindering economic growth and investment.

- Potential for bond defaults and downgrades: Companies with high debt burdens may struggle to meet their obligations, leading to defaults and credit rating downgrades. This can trigger a domino effect, impacting the entire bond market.

- Reduced investor demand for existing bonds: Investors will naturally gravitate towards newer bonds offering higher yields, reducing the demand and hence the price of older bonds.

- Differentiated effects across bond types: The impact of rising rates varies across different bond types. Government bonds, generally considered safer, may see less dramatic price drops compared to corporate or municipal bonds, which carry higher default risk.

Inflation's Eroding Power and its Effect on Bond Yields

Inflation, the persistent increase in the general price level, significantly impacts bond yields. Bonds represent a fixed-income investment; therefore, high inflation erodes the purchasing power of future interest payments and the principal repayment at maturity. This compels investors to demand higher yields to compensate for the inflation risk.

The consequences of high inflation on bond yields include:

- Investors demanding higher yields: To maintain real returns (returns adjusted for inflation), investors will demand higher yields to offset the erosion of purchasing power caused by inflation.

- Challenges for central banks: Central banks face a delicate balancing act. They must control inflation without triggering a sharp contraction in economic activity, a task made more complex by the bond market's sensitivity to interest rate changes.

- Impact of unexpected inflation spikes: Unexpected surges in inflation can dramatically impact bond prices, leading to significant losses for investors who haven't hedged against inflation risk.

Geopolitical Risks and their Influence on Bond Market Stability

Geopolitical events significantly influence investor sentiment and market stability. Uncertainty and instability lead to increased risk aversion, causing investors to seek safer havens, often government bonds.

Several geopolitical factors impact bond market stability:

- Increased demand for safe-haven assets: During times of crisis, investors flock to government bonds of stable economies, driving up their prices and lowering yields.

- Potential capital flight from emerging markets: Geopolitical risks can trigger capital flight from emerging markets, leading to currency depreciation and impacting the value of their sovereign bonds.

- Impact of sanctions and trade disputes: International sanctions and trade disputes create uncertainty, negatively affecting bond markets involved in affected countries or regions.

Assessing the Potential for a Systemic Crisis

The bond market is deeply interconnected with other financial markets, creating the potential for contagion. A crisis in one area could easily spill over into others, leading to a broader systemic crisis.

Potential systemic risks include:

- Financial institutions' exposure: Many financial institutions hold significant bond portfolios, making them vulnerable to losses in a market downturn.

- Liquidity crises: A sudden surge in selling pressure can trigger a liquidity crisis, as institutions struggle to offload bonds quickly without significantly impacting prices.

- Importance of regulatory oversight: Strong regulatory oversight and effective risk management practices are crucial to mitigating the risk of a systemic crisis within the bond market.

Conclusion: Understanding and Navigating the Bond Market's Silent Crisis

The potential for a bond market crisis is real and multifaceted. Rising interest rates, persistent inflation, and geopolitical instability all contribute to increased risks. The interconnectedness of the bond market with other financial sectors amplifies the potential for contagion and systemic impact. Monitoring the bond market for signs of instability is crucial. Investors should consider diversifying their portfolios, employing appropriate risk management strategies, and staying informed about global economic developments. Policymakers must strengthen regulatory frameworks and encourage responsible lending and borrowing practices. Understanding the bond market's silent crisis is crucial for navigating the current economic climate. Stay informed and take proactive measures to protect your investments.

Featured Posts

-

The U S Bolsters Europes Northern Front Amid Rising Russia Tensions

May 28, 2025

The U S Bolsters Europes Northern Front Amid Rising Russia Tensions

May 28, 2025 -

Mart 2024 Te Abd Tueketici Kredilerindeki Artis

May 28, 2025

Mart 2024 Te Abd Tueketici Kredilerindeki Artis

May 28, 2025 -

Paw Patrol Piratas 15 Minutos De Rescates En You Tube Espanol

May 28, 2025

Paw Patrol Piratas 15 Minutos De Rescates En You Tube Espanol

May 28, 2025 -

2025 American Music Awards Free Online Streaming Guide

May 28, 2025

2025 American Music Awards Free Online Streaming Guide

May 28, 2025 -

Is Alejandro Garnacho Headed To Chelsea Latest Transfer News

May 28, 2025

Is Alejandro Garnacho Headed To Chelsea Latest Transfer News

May 28, 2025

Latest Posts

-

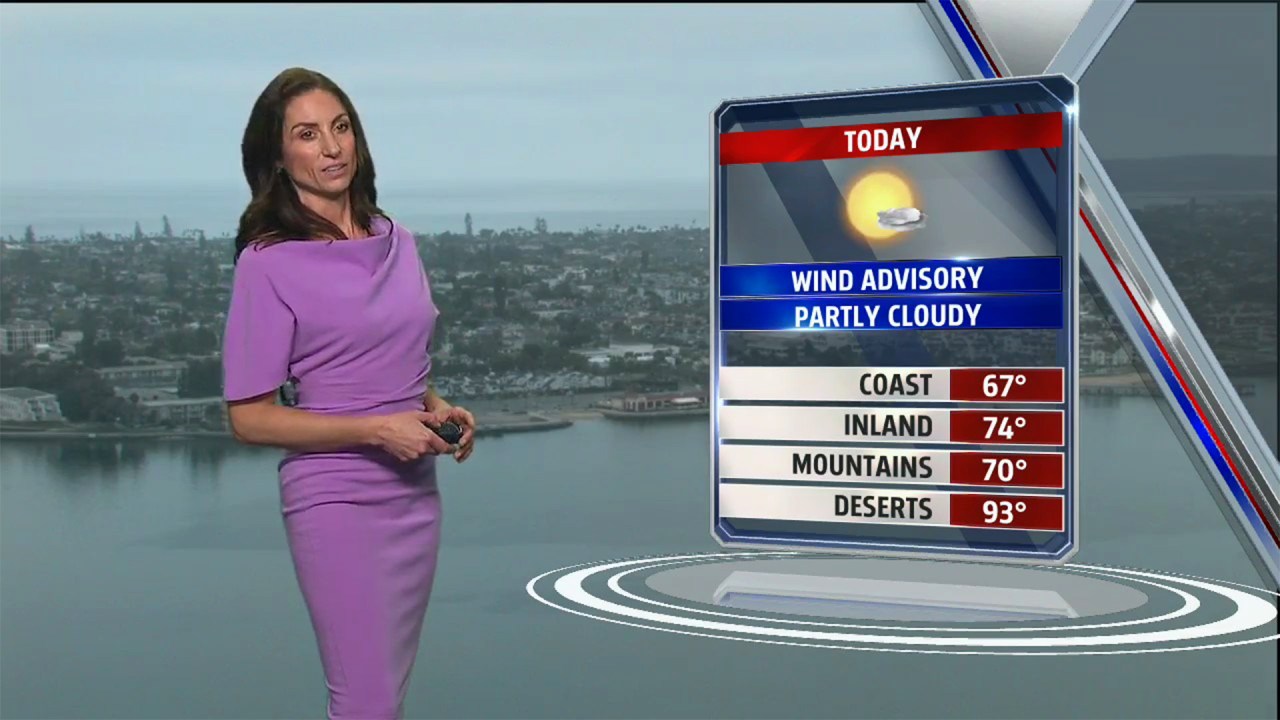

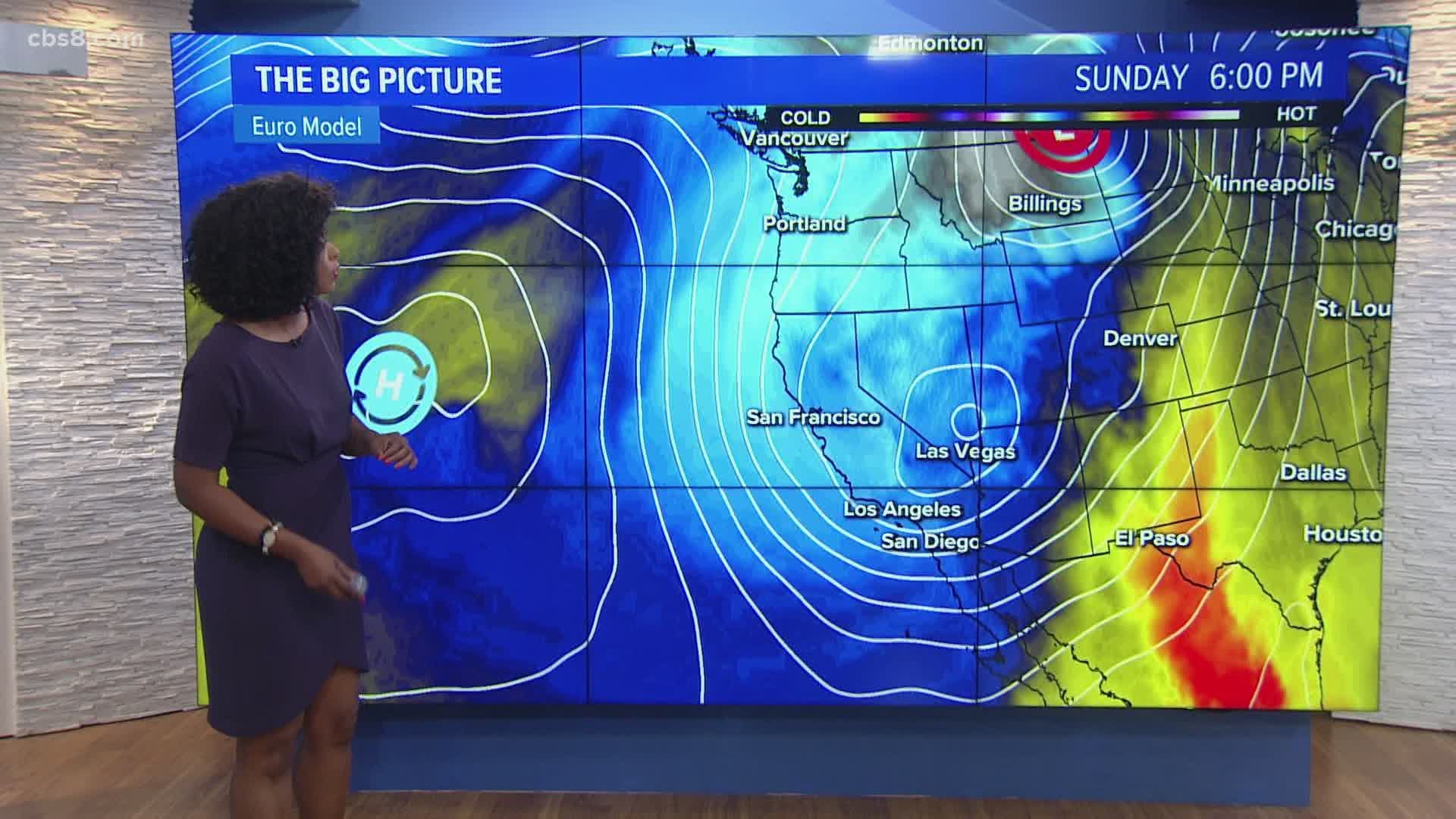

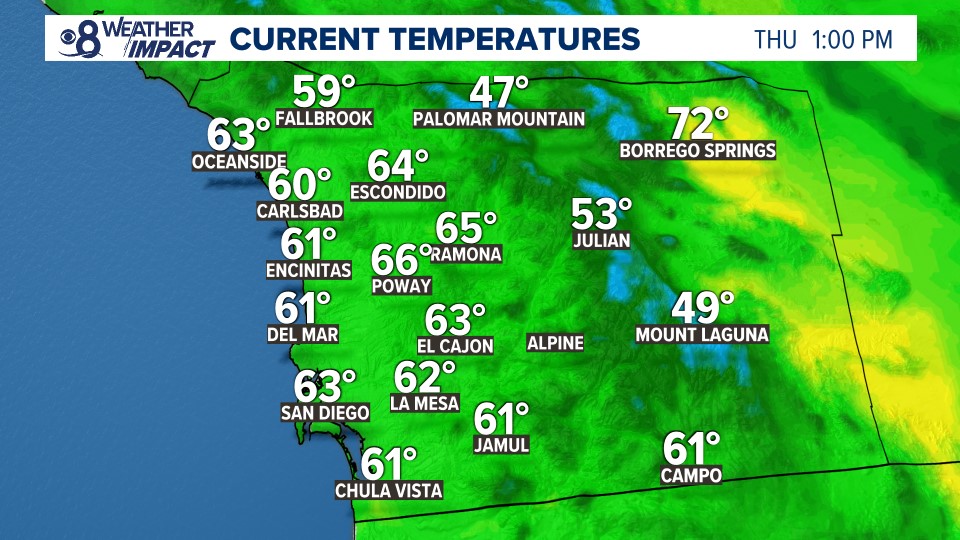

Expect Cool Wet And Windy Weather In San Diego County

May 30, 2025

Expect Cool Wet And Windy Weather In San Diego County

May 30, 2025 -

San Diego Weather Forecast Expect Fog Cool Temperatures And A Chance Of Showers

May 30, 2025

San Diego Weather Forecast Expect Fog Cool Temperatures And A Chance Of Showers

May 30, 2025 -

San Diego County Weather Fog Cooler Temperatures And Possible Light Showers

May 30, 2025

San Diego County Weather Fog Cooler Temperatures And Possible Light Showers

May 30, 2025 -

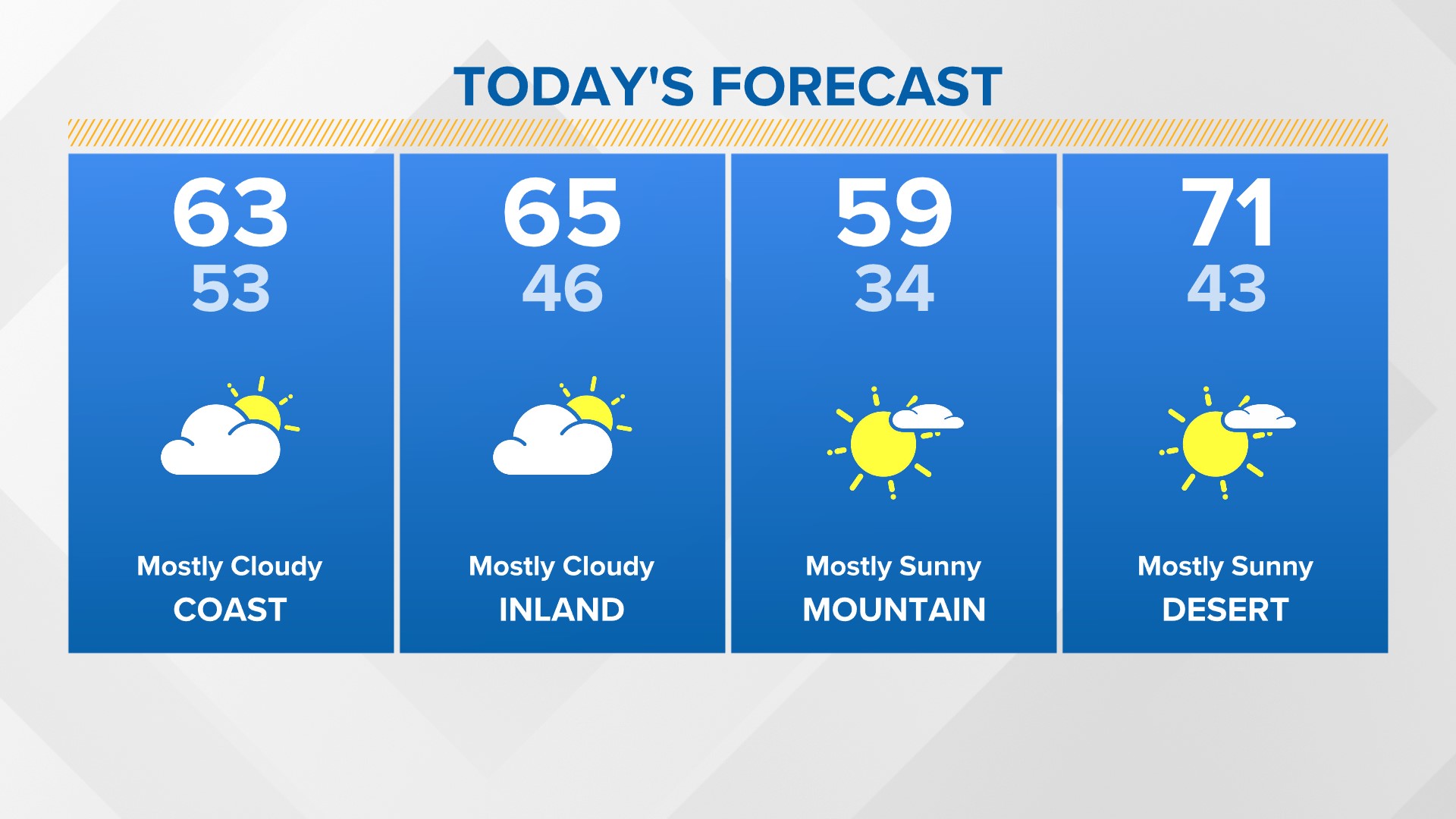

San Diego Weather 4 Day Forecast Of Warm Sunny Conditions

May 30, 2025

San Diego Weather 4 Day Forecast Of Warm Sunny Conditions

May 30, 2025 -

Four Days Of Sunshine San Diego County Weather Forecast

May 30, 2025

Four Days Of Sunshine San Diego County Weather Forecast

May 30, 2025