The Canadian Tire-Hudson's Bay Merger: Implications And Analysis

Table of Contents

Strategic Rationale Behind the Merger

Both Canadian Tire and HBC sought significant advantages through this merger. For Canadian Tire, already a retail giant, the acquisition offered a pathway to expand its market share and solidify its dominance in the Canadian retail sector. The acquisition of HBC's iconic brands and established retail presence provided access to new customer demographics and expanded product offerings, potentially attracting a more affluent customer base.

- Increased market share and dominance: The combined entity would control a significantly larger portion of the Canadian retail market, potentially leading to greater pricing power and negotiating leverage with suppliers.

- Access to new customer demographics: HBC's brands, such as Hudson's Bay and Saks Fifth Avenue, cater to a different customer segment than Canadian Tire's core audience, allowing for diversification and expansion.

- Synergies in supply chain management and distribution networks: Combining their logistics and distribution networks could lead to significant cost savings and efficiencies.

- Potential for cost reductions and operational efficiencies: Economies of scale resulting from the merger could streamline operations and reduce overhead costs.

- Diversification of revenue streams: Reducing reliance on a single sector (automotive for Canadian Tire) makes the combined company more resilient to economic fluctuations.

The potential benefits to shareholders included increased share value driven by anticipated growth and cost synergies. The merger positioned the combined entity to better compete against other large retailers, both domestically and internationally. This strengthened competitive position is a key driver behind the strategic rationale.

Potential Synergies and Benefits

The combination of Canadian Tire's robust retail network and HBC's strong brand recognition presents several opportunities for synergy. These synergies could lead to significantly increased profitability and market share.

- Enhanced loyalty programs and customer engagement strategies: A unified loyalty program could reward customers across both retail networks, increasing engagement and customer lifetime value.

- Combined purchasing power leading to lower costs: The increased buying power allows for better negotiation with suppliers, resulting in lower costs for goods.

- Cross-promotion and marketing opportunities: Marketing campaigns could leverage the strengths of both brands to reach a wider audience.

- Expansion of online and omnichannel capabilities: Integration of online platforms could create a more seamless and efficient shopping experience for consumers.

- Potential for joint ventures and expansion into new markets: The combined entity may explore new ventures and market expansion based on the expanded resources and expertise.

Successful mergers in similar retail sectors, such as the integration of Kroger and others, provide precedents for the potential outcomes of successful synergy exploitation.

Challenges and Risks Associated with the Merger

Integrating two large companies with distinct corporate cultures presents considerable challenges. A successful integration strategy is crucial to mitigate these risks.

- Potential for job losses and employee unrest: Overlapping roles and operational streamlining may lead to job cuts, causing potential employee unrest and impacting morale.

- Difficulties in integrating disparate IT systems and supply chains: Combining different IT infrastructure and supply chain management systems can be complex and time-consuming.

- Regulatory hurdles and potential antitrust concerns: Regulatory bodies may scrutinize the merger for potential anti-competitive practices, leading to delays or even blocking the deal.

- Potential for negative consumer sentiment and brand dilution: Consumers might react negatively to the merger if they perceive a loss of brand identity or a decline in service quality.

- Difficulty in managing a diverse range of brands and product categories: Balancing the needs and strategies of multiple brands under one umbrella can be challenging.

The impact on competitors will depend largely on how effectively the merged entity manages the integration process. A well-defined integration strategy that addresses the cultural differences and operational complexities is essential to overcome these hurdles.

Impact on Consumers and the Canadian Economy

The Canadian Tire-Hudson's Bay merger will have a significant impact on consumers and the Canadian economy.

- Potential for lower prices due to increased purchasing power: Increased bargaining power with suppliers may translate to lower prices for consumers.

- Wider product selection and expanded retail footprint: Consumers will have access to a broader range of products across more retail locations.

- Improved customer service and loyalty programs: A unified loyalty program could provide enhanced rewards and benefits.

- Potential for job losses in certain areas: Overlapping roles and efficiencies may lead to job losses in some areas.

- Impact on smaller, independent retailers: The combined entity's increased market share may put pressure on smaller retailers.

The overall impact on the Canadian economy will involve job creation in some areas and potential job displacement in others. Consumer spending patterns may shift as consumers adapt to the changes in the retail landscape. The long-term effects on Canadian retail and consumer behavior are subject to further observation and analysis.

Conclusion

The Canadian Tire-Hudson's Bay Merger presents a complex scenario with significant implications for the Canadian retail landscape. While the potential synergies and benefits are substantial, challenges related to integration and competition must be carefully addressed. The success of this merger hinges on a well-executed integration strategy, addressing potential consumer concerns, and navigating the regulatory environment. A thorough understanding of the Canadian Tire-Hudson's Bay Merger is crucial for investors, businesses, and consumers alike. Further analysis and monitoring of the merger's progress will be critical in evaluating its long-term impact on the Canadian retail sector. Stay informed about the evolving developments surrounding this significant Canadian Tire-Hudson's Bay Merger.

Featured Posts

-

Winning Strategies And Shortcomings Padres Vs Cubs Series Analysis

May 28, 2025

Winning Strategies And Shortcomings Padres Vs Cubs Series Analysis

May 28, 2025 -

Increased Torpedo Bat Usage Among Marlin Fishermen

May 28, 2025

Increased Torpedo Bat Usage Among Marlin Fishermen

May 28, 2025 -

Rayan Cherki What A German Source Says

May 28, 2025

Rayan Cherki What A German Source Says

May 28, 2025 -

Rome Champ Beyond The Victory A Champions Mindset

May 28, 2025

Rome Champ Beyond The Victory A Champions Mindset

May 28, 2025 -

Kyle Stowers Delivers Walk Off Grand Slam For Miami Marlins

May 28, 2025

Kyle Stowers Delivers Walk Off Grand Slam For Miami Marlins

May 28, 2025

Latest Posts

-

Odigos Tileoptikon Programmaton Gia To Savvato 15 Martioy

May 30, 2025

Odigos Tileoptikon Programmaton Gia To Savvato 15 Martioy

May 30, 2025 -

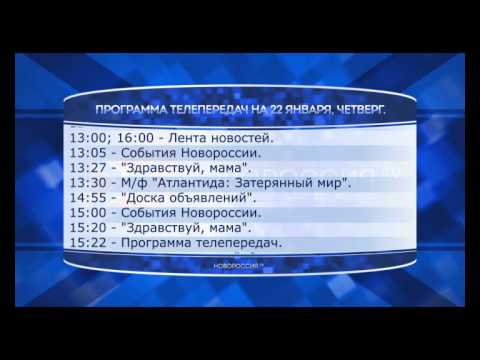

Teleprogramma Na Subbotu 15 Marta

May 30, 2025

Teleprogramma Na Subbotu 15 Marta

May 30, 2025 -

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025

Programma Tileoptikon Metadoseon Savvatoy 15 3

May 30, 2025 -

Plires Programma Tileorasis Gia Tin Kyriaki 16 3

May 30, 2025

Plires Programma Tileorasis Gia Tin Kyriaki 16 3

May 30, 2025 -

The Nissan Primera Electric Comeback Or Just A Rumor

May 30, 2025

The Nissan Primera Electric Comeback Or Just A Rumor

May 30, 2025