The Complete Guide To Finance Loans: Interest Rates, EMIs, And Tenure Explained

Table of Contents

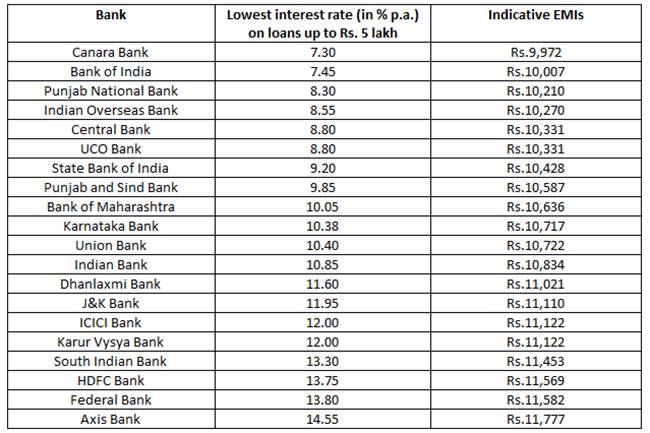

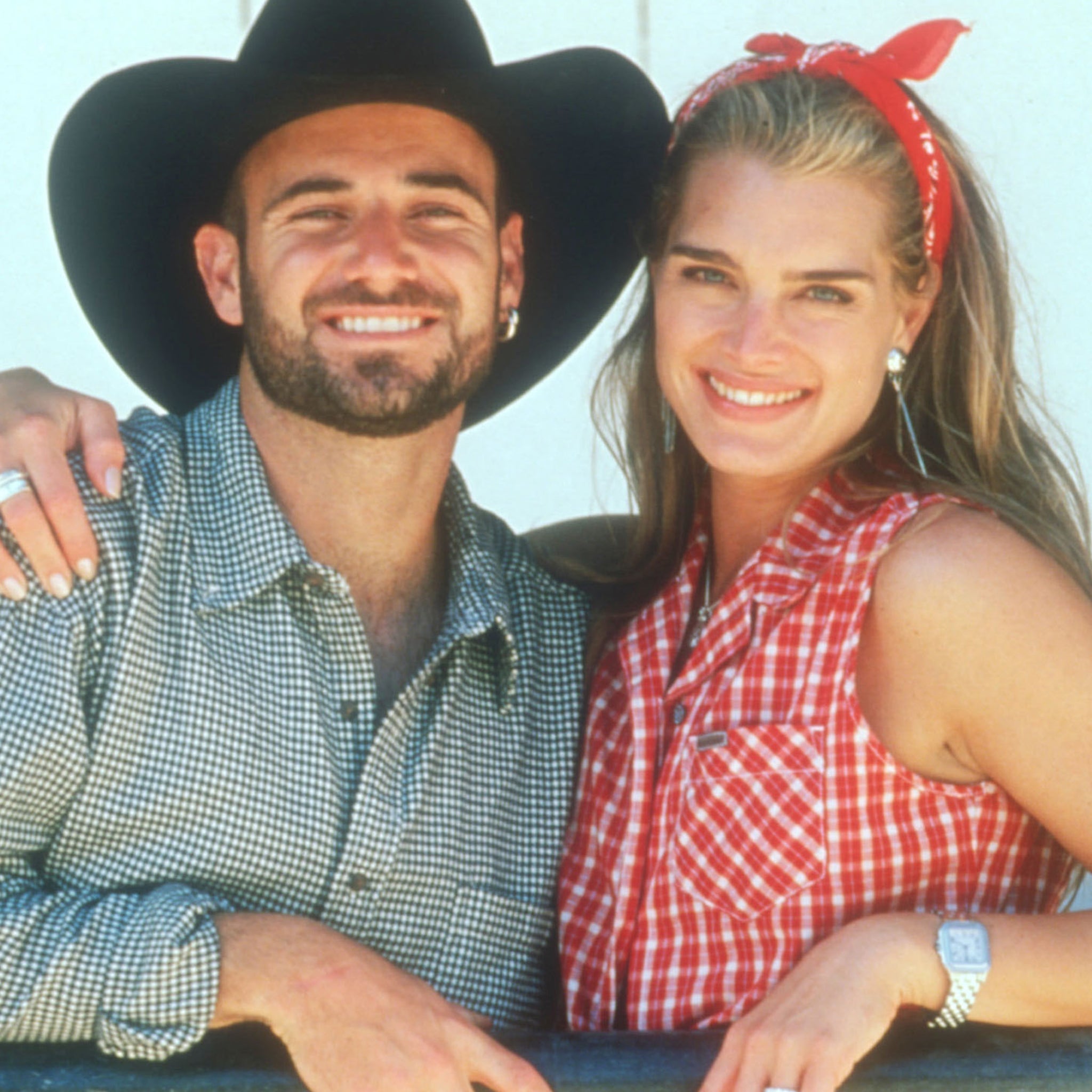

Understanding Interest Rates in Finance Loans

Interest rates are the cost of borrowing money. They represent the percentage of the principal loan amount that you'll pay as interest to the lender over the loan's term. A higher interest rate means a higher total cost for your loan. Understanding interest rates is crucial when comparing finance loan offers and making informed borrowing decisions.

-

Types of interest rates:

- Fixed interest rates: Remain constant throughout the loan tenure, providing predictable monthly payments. This offers stability and allows for easier budgeting.

- Variable interest rates: Fluctuate based on market conditions. While they might start lower, they can increase or decrease over time, impacting your monthly EMIs.

-

Factors influencing interest rates:

- Credit score: A higher credit score typically qualifies you for lower interest rates. Lenders perceive you as a lower risk.

- Loan amount: Larger loan amounts might attract higher interest rates due to increased risk for the lender.

- Loan type: Different loan types (personal loans, home loans, business loans) carry different interest rates based on perceived risk and market conditions.

- The prevailing economic climate: General economic conditions and central bank policies significantly influence interest rate trends.

-

How to compare interest rates:

- Look beyond the advertised rate. Consider all associated fees and charges.

- Use online loan comparison tools to easily compare offers from multiple lenders.

- Pay attention to the Annual Percentage Rate (APR), which includes all fees and charges, giving a true picture of the loan's cost.

-

Impact of interest rate fluctuations on EMIs: With variable interest rate loans, your monthly EMIs can increase or decrease as the interest rate changes. This can impact your budget, so it's important to understand the potential risks involved.

Decoding EMIs (Equated Monthly Installments)

Your EMI is the fixed amount you pay each month to repay your finance loan. It covers both the principal loan amount and the interest accrued. Understanding your EMI is vital for effective budgeting and loan repayment planning.

-

Factors affecting EMI calculations:

- Principal amount: The total amount of money borrowed.

- Interest rate: The percentage charged on the loan.

- Loan tenure: The repayment period (in months or years).

-

Simplified EMI Calculation (Illustrative): While the precise formula is complex, a simplified representation is: EMI ≈ (P x R x (1+R)^N) / ((1+R)^N-1), where P is the principal, R is the monthly interest rate, and N is the loan tenure in months. Using online EMI calculators is highly recommended for accurate calculations.

-

Using EMI calculators: Many online tools allow you to input the loan amount, interest rate, and tenure to calculate your EMI quickly and easily. This helps in comparing different loan offers and choosing the most suitable option.

-

Strategies for managing EMIs:

- Budgeting: Carefully plan your monthly expenses to ensure you can comfortably afford your EMI.

- Debt consolidation: Combining multiple loans into a single loan with a potentially lower interest rate can simplify payments and reduce your overall cost.

Choosing the Right Loan Tenure

Loan tenure is the period over which you repay your loan. Choosing the right tenure significantly impacts your EMIs and the total interest paid.

-

Relationship between loan tenure and EMI amount: A longer tenure results in lower EMIs, but you pay significantly more interest overall. A shorter tenure means higher EMIs but less interest paid in total.

-

Advantages and disadvantages of shorter vs. longer loan tenures:

- Shorter tenure: Advantages include lower total interest paid and faster debt repayment. Disadvantages include higher EMIs.

- Longer tenure: Advantages include lower EMIs, making monthly payments more manageable. Disadvantages include higher total interest paid and a longer period of debt.

-

Factors to consider when choosing a loan tenure:

- Financial goals: Consider your ability to manage higher EMIs.

- Risk tolerance: Weigh the benefits of lower EMIs against the higher overall interest cost of a longer tenure.

-

Calculating the total interest paid: Use online loan calculators or spreadsheets to calculate the total interest payable over different loan tenures to make informed decisions.

Types of Finance Loans

Various finance loans cater to different needs. Understanding their nuances is crucial for informed borrowing.

- Personal loans: Unsecured loans for personal expenses, with relatively higher interest rates and shorter tenures.

- Home loans: Secured loans for purchasing property, generally offering lower interest rates and longer tenures.

- Business loans: Loans for business purposes, interest rates varying based on the business's financial health and the loan's purpose.

- Auto loans: Loans for purchasing vehicles, with terms specific to the vehicle's value and market conditions.

Conclusion

Successfully navigating the world of finance loans requires a clear understanding of interest rates, EMIs, and loan tenure. This guide has provided a comprehensive overview of these critical components, equipping you with the knowledge to make informed decisions. Remember to carefully compare offers from different lenders, consider your financial capabilities, and choose a loan that aligns with your long-term financial goals. By understanding the intricacies of finance loans, you can secure the funding you need while minimizing financial risks. Start exploring your finance loan options today and take control of your financial future!

Featured Posts

-

O Kosmos Toy Goyes Anterson Zontaneyei Se Ekthesi Sto Londino

May 28, 2025

O Kosmos Toy Goyes Anterson Zontaneyei Se Ekthesi Sto Londino

May 28, 2025 -

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 128 Go Avis Prix Et Bon Plan

May 28, 2025 -

Ramalan Cuaca Kaltim Update Terkini Ikn Balikpapan Samarinda

May 28, 2025

Ramalan Cuaca Kaltim Update Terkini Ikn Balikpapan Samarinda

May 28, 2025 -

Kaupallinen Yhteistyoe Lainaa Korkeiden Korkojen Aikana Loeydae Edullisempi Laina Vertailun Avulla

May 28, 2025

Kaupallinen Yhteistyoe Lainaa Korkeiden Korkojen Aikana Loeydae Edullisempi Laina Vertailun Avulla

May 28, 2025 -

Nba Playoffs Tyrese Haliburton Player Props And Game 2 Betting Guide Pacers Vs Knicks

May 28, 2025

Nba Playoffs Tyrese Haliburton Player Props And Game 2 Betting Guide Pacers Vs Knicks

May 28, 2025

Latest Posts

-

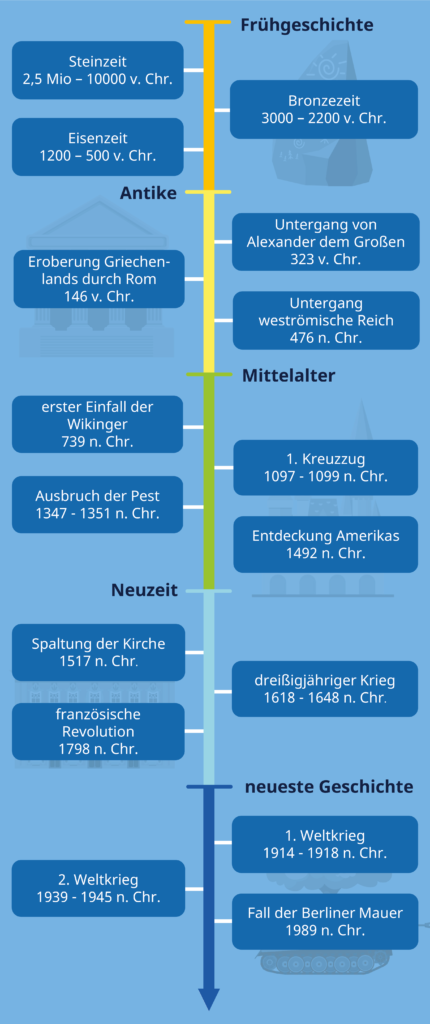

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025

Andre Agassi O Noua Era In Cariera Sa Pickleball

May 30, 2025 -

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025

Legenda Tenisului Andre Agassi Joaca Pickleball

May 30, 2025 -

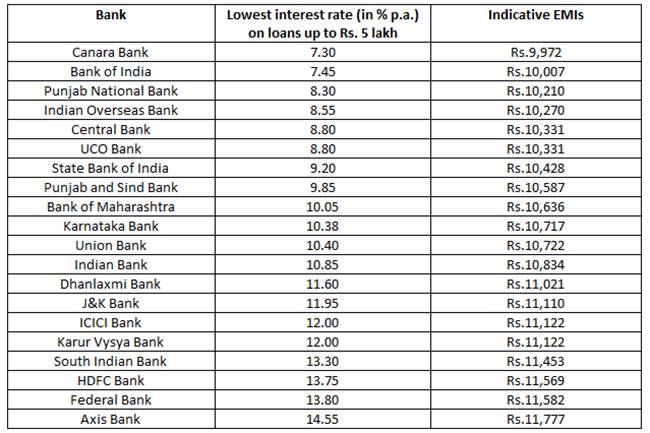

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025

Der 10 April In Der Geschichte Daten Fakten Und Ereignisse

May 30, 2025 -

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025

Andre Agassi Prima Partida Profesionala De Pickleball

May 30, 2025 -

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025

Andre Agassi Revine In Competitie Debutul In Pickleball

May 30, 2025