The Connection Between Federal Debt And Your Mortgage Payments

Table of Contents

How Federal Debt Influences Interest Rates

High levels of federal debt significantly influence interest rates, directly impacting your mortgage payments. This connection is primarily driven by the actions of the Federal Reserve and the dynamics of the bond market.

The Federal Reserve and Monetary Policy

The Federal Reserve (often called "the Fed") plays a central role in managing the U.S. economy. Its primary mandate is to maintain price stability and full employment. When federal debt rises, it can lead to inflationary pressures. To combat this, the Fed may implement contractionary monetary policy, which typically involves:

- Increased interest rates: Raising interest rates makes borrowing more expensive, slowing down economic growth and reducing inflation. This directly affects mortgage rates, making home financing more costly.

- Reduced money supply: By controlling the money supply, the Fed aims to curb inflation. This can also lead to higher interest rates.

- Quantitative easing (QE) considerations: While QE can initially lower interest rates, its long-term effects on inflation and subsequent interest rate adjustments are complex and debated by economists. The impact of past QE programs is still being felt today.

Government Borrowing and Market Demand

Increased government borrowing to finance the national debt competes with private sector borrowing for available funds. This competition drives up interest rates.

- Bond markets and government debt: The government issues bonds to finance its debt. Increased issuance increases the supply of bonds, potentially affecting yields (interest rates) if demand remains constant or decreases.

- Investor confidence: Investor confidence in the ability of the government to repay its debt is crucial. If confidence wanes, investors may demand higher yields to compensate for increased risk, further raising interest rates.

- The crowding-out effect: This describes the phenomenon where increased government borrowing crowds out private investment by driving up interest rates, making it more expensive for businesses to borrow and invest.

The Impact of Inflation on Mortgage Payments

Inflation, the rate at which the general level of prices for goods and services is rising, is another crucial factor impacting mortgage payments, often linked to high federal debt levels.

Inflation's Relationship to Federal Debt

High levels of federal debt can contribute to inflation through several mechanisms:

- Increased money supply: Government borrowing and spending can increase the money supply, potentially leading to inflation. This is particularly true if the government finances spending by printing money rather than through borrowing.

- Demand-pull inflation: Increased government spending can boost aggregate demand, outpacing the economy's capacity to produce goods and services, resulting in inflationary pressures.

- Erosion of purchasing power: High inflation erodes the purchasing power of your mortgage payments. What you pay today may buy significantly less in the future, making your mortgage feel more expensive in real terms.

Adjustable-Rate Mortgages (ARMs) and Inflation

Homeowners with adjustable-rate mortgages (ARMs) are particularly vulnerable to inflation's effects.

- ARM interest rate adjustments: ARM interest rates adjust periodically based on a benchmark index, such as the prime rate or the London Interbank Offered Rate (LIBOR). These indices are often influenced by inflation and overall interest rate movements.

- Inflationary risks with ARMs: In inflationary environments, ARM interest rates tend to rise, leading to significantly higher monthly mortgage payments.

- Advice for ARM holders: Homeowners with ARMs should carefully monitor inflation rates, interest rate forecasts, and their mortgage terms. Consider refinancing to a fixed-rate mortgage if inflation and interest rates rise significantly.

Long-Term Implications for Homeowners

Predicting the long-term impact of federal debt on mortgage rates is challenging due to the complex interplay of economic factors.

Predicting Future Mortgage Rates

Accurately forecasting interest rate movements is difficult, even for experts. Several factors influence future rates, including economic growth, inflation expectations, and international events.

- Understanding your personal finances: Focus on your personal financial situation. A solid understanding of your income, expenses, and debt levels is crucial for weathering economic uncertainty.

- Financial planning and budgeting: Create a realistic budget, including your mortgage payments, and establish an emergency fund to cushion against unexpected financial shocks.

- Seek professional guidance: Consider consulting a financial advisor for personalized advice on managing your mortgage and other financial goals.

Strategies for Managing Mortgage Costs

Proactive strategies can help homeowners mitigate the impact of rising interest rates and high federal debt.

- Refinancing: Consider refinancing your mortgage if interest rates fall significantly. This can reduce your monthly payments and potentially save you money over the life of the loan.

- Debt reduction: Reducing other debts, such as credit card debt, improves your overall financial health and may make you eligible for better mortgage rates.

- Credit score improvement: A higher credit score qualifies you for more favorable mortgage interest rates.

Conclusion

The relationship between federal debt and your mortgage payments is complex, but understanding the key connections – particularly the influence on interest rates and inflation – is vital for responsible homeownership. By staying informed about national fiscal policy and its impact on the economy, you can better manage your mortgage costs and make informed financial decisions. Learn more about how changes in federal debt may affect your mortgage payments by researching reputable financial resources and consulting with a financial advisor. Don't let rising interest rates catch you off guard; proactively manage your mortgage and your financial future.

Featured Posts

-

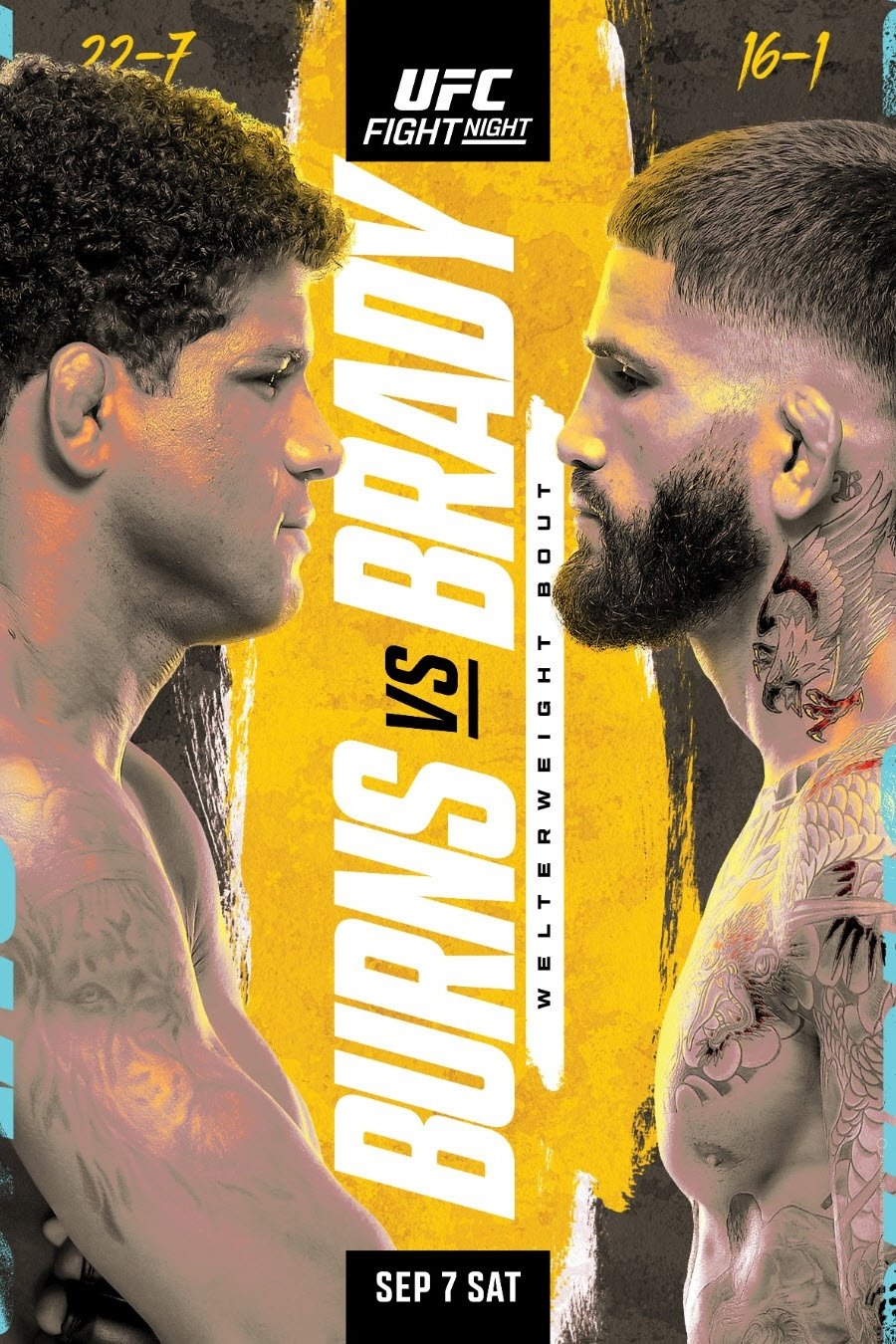

Ufc Vegas 106 In Depth Look At Burns Vs Morales And Fight Card Odds

May 19, 2025

Ufc Vegas 106 In Depth Look At Burns Vs Morales And Fight Card Odds

May 19, 2025 -

Cannes Gala Alessandra Ambrosios Stunning Black Gown Steals The Show

May 19, 2025

Cannes Gala Alessandra Ambrosios Stunning Black Gown Steals The Show

May 19, 2025 -

10 Key Points In The Jyoti Malhotra Espionage Case

May 19, 2025

10 Key Points In The Jyoti Malhotra Espionage Case

May 19, 2025 -

Ufc 313 Preview Full Fight Card How To Watch And Where To Get Tickets

May 19, 2025

Ufc 313 Preview Full Fight Card How To Watch And Where To Get Tickets

May 19, 2025 -

Norway Cruises Past Moldova In World Cup Qualifier Thanks To Haaland

May 19, 2025

Norway Cruises Past Moldova In World Cup Qualifier Thanks To Haaland

May 19, 2025