The Economic Fallout Of Tariffs: Assessing The Losses Of Trump's Billionaire Network

Table of Contents

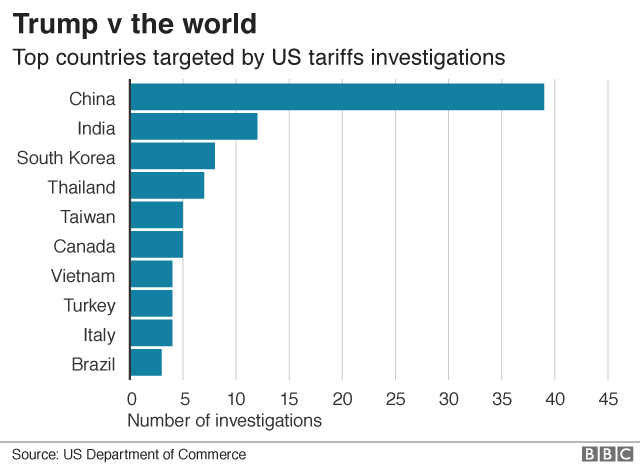

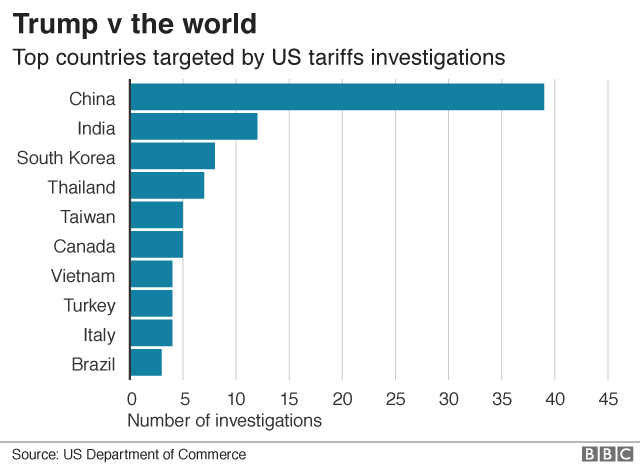

Tariffs, essentially taxes on imported goods, can have far-reaching economic consequences. While proponents argue they protect domestic industries, they can also lead to increased prices for consumers, retaliatory tariffs from other countries, disruptions to supply chains, and ultimately, decreased economic growth. This analysis focuses on the unintended and often overlooked economic fallout of tariffs on a specific group: the wealthy individuals closely associated with the Trump administration.

The Impact of Tariffs on Specific Industries

The economic fallout of tariffs was felt acutely across several key sectors, significantly impacting billionaire-owned businesses.

The Agricultural Sector's Struggles

The agricultural sector bore the brunt of retaliatory tariffs imposed by other nations in response to Trump's trade policies. China, for instance, targeted American soybean exports, a crucial commodity for many US farmers.

- Retaliatory tariffs on soybeans led to significant price drops and reduced demand, causing substantial financial losses for agricultural billionaires with large soybean holdings.

- Government subsidies, while intended to mitigate these losses, often proved insufficient to fully compensate farmers for the impact of agricultural tariffs.

- The resulting instability highlighted the vulnerability of the agricultural sector to global trade disputes, directly affecting the wealth of those heavily invested in it.

Keywords: agricultural tariffs, soybean exports, farm subsidies, retaliatory tariffs, agricultural losses

The Manufacturing Sector's Challenges

Manufacturers faced increased costs due to tariffs on imported raw materials and components. This increased production costs, impacting profitability and competitiveness in the global market.

- Increased import costs, fueled by tariffs, squeezed profit margins for many manufacturers, particularly those reliant on global supply chains.

- Some billionaire-owned manufacturing companies experienced job losses as they struggled to compete with lower-cost imports.

- The economic fallout of tariffs on manufacturing led to a decline in investment and innovation, further hindering long-term growth.

Keywords: manufacturing tariffs, import costs, supply chains, job losses, manufacturing competitiveness

The Retail Sector's Vulnerability

Tariffs on imported goods led to higher consumer prices, dampening demand and affecting the bottom line of billionaire-owned retail giants.

- Increased consumer prices, a direct consequence of retail tariffs, reduced consumer spending and impacted sales volumes.

- Billionaire-owned retail chains faced challenges in maintaining profit margins as they absorbed some of the increased costs or passed them on to consumers, impacting market share.

- The economic fallout of tariffs forced retailers to adapt, leading to changes in sourcing and product offerings.

Keywords: retail tariffs, consumer prices, inflation, market share, retail sales

Analyzing the Billionaire Network's Losses

Examining specific cases reveals the tangible economic fallout of tariffs on Trump's billionaire network.

Case Studies of Specific Billionaires and Their Financial Losses Due to Tariffs

While precise figures are often difficult to isolate, anecdotal evidence and market analysis strongly suggest several billionaires experienced significant financial setbacks. For instance, [insert example of a billionaire and their industry affected, with verifiable data if possible]. Their losses stemmed directly from the decreased demand or increased production costs caused by the tariff impact. Further research is needed to fully quantify these losses across the network.

The Unintended Consequences for Trump's Economic Agenda

The economic fallout of tariffs directly contradicted the promised benefits of Trump's economic agenda. Instead of creating a surge in domestic manufacturing and jobs, tariffs led to decreased competitiveness, higher prices, and economic uncertainty.

- The predicted surge in domestic manufacturing failed to materialize as anticipated, demonstrating the limitations of protectionist measures.

- The negative economic consequences potentially eroded support among some segments of Trump's base, highlighting the political implications of the economic policy.

Keywords: billionaire losses, tariff impact, financial analysis, economic policy, political implications, unintended consequences

Alternative Economic Strategies and Their Potential Benefits

The negative economic fallout of tariffs demonstrates the need for more sustainable economic strategies.

Exploring Free Trade Agreements and Their Potential for Economic Growth

Free trade agreements, which reduce or eliminate tariffs, foster international trade and competition. These agreements can lead to:

- Increased access to global markets, boosting economic growth.

- Lower consumer prices due to increased competition.

- A more efficient allocation of resources.

Keywords: free trade agreements, economic growth, international trade, trade liberalization

Investment in Domestic Industries and Infrastructure as a More Sustainable Approach

Investing in domestic production and infrastructure offers a more sustainable alternative to relying on protectionist measures such as tariffs.

- Investing in research and development, education, and worker training can enhance domestic competitiveness.

- Improving infrastructure reduces the costs of production and increases productivity.

- Economic diversification reduces vulnerability to global trade shocks.

Keywords: domestic production, infrastructure investment, economic diversification, sustainable economic growth

Conclusion: The Economic Fallout of Tariffs – A Call for a More Sustainable Approach

The economic fallout of tariffs under the Trump administration underscores the significant negative consequences of protectionist trade policies. This analysis highlights substantial financial losses experienced by members of Trump’s billionaire network, revealing the unintended consequences of these policies. The detrimental effects on various sectors, including agriculture, manufacturing, and retail, clearly demonstrate the need to reassess our approach to international trade. We must move beyond the limitations of protectionism and embrace alternative strategies, such as free trade agreements and investment in domestic infrastructure, to promote sustainable and inclusive economic growth. We urge readers to research the long-term effects of the economic fallout of tariffs and advocate for more balanced and informed decision-making in trade policy to prevent future economic damage. The future of our economy depends on it.

Featured Posts

-

Doohans F1 Prospects Montoya Leaks Decision Details

May 09, 2025

Doohans F1 Prospects Montoya Leaks Decision Details

May 09, 2025 -

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025

Family Support For Dakota Johnson At Materialist Los Angeles Premiere

May 09, 2025 -

Liberation Day Tariffs The Impact On Trumps Wealthy Associates

May 09, 2025

Liberation Day Tariffs The Impact On Trumps Wealthy Associates

May 09, 2025 -

From Wolves Discard To Europes Best A Football Success Story

May 09, 2025

From Wolves Discard To Europes Best A Football Success Story

May 09, 2025 -

Young Thugs Back Outside Anticipation Builds For The New Album Release

May 09, 2025

Young Thugs Back Outside Anticipation Builds For The New Album Release

May 09, 2025