The Emerging Bond Crisis: A Deep Dive For Investors

Table of Contents

H2: Understanding the Current State of the Emerging Bond Market

The emerging bond market, a significant segment of the global fixed income landscape, is currently facing headwinds on multiple fronts. Let's examine the key contributing factors:

H3: Rising Interest Rates and Their Impact

Rising interest rates in developed economies, primarily the US, exert significant pressure on emerging markets. This impact manifests in several ways:

- Increased borrowing costs for emerging economies: Higher rates make it more expensive for emerging market governments and corporations to borrow internationally, increasing their debt burden.

- Capital flight from emerging markets: Investors often shift funds from emerging markets to developed markets seeking higher returns, leading to capital outflows.

- Currency depreciation: Capital flight weakens emerging market currencies, making it more costly to service dollar-denominated debt.

- Increased risk premiums on bonds: Investors demand higher yields (risk premiums) on emerging market bonds to compensate for the increased risk.

Higher interest rates in the US, for example, make US Treasury bonds more attractive, drawing investment away from emerging markets. This capital outflow puts downward pressure on emerging market currencies and increases the cost of servicing debt, ultimately increasing the risk of default.

H3: Geopolitical Instability and its Influence

Geopolitical events significantly impact investor sentiment and emerging market bond prices. Uncertainty and instability trigger risk aversion, leading to:

- Reduced investor confidence: Geopolitical risks (e.g., war, political coups, sanctions) deter investors from emerging markets perceived as unstable.

- Increased risk aversion: Investors move to safer assets like US Treasuries, reducing demand for emerging market bonds.

- Capital flight: Investors withdraw funds from perceived high-risk areas, further weakening the local currency and bond prices.

- Higher bond yields reflecting increased risk: To compensate for the heightened risk, investors demand higher yields on emerging market bonds.

The ongoing war in Ukraine, for example, has created significant geopolitical uncertainty, impacting investor confidence in several emerging markets and leading to increased bond yields.

H3: Slowing Global Economic Growth and its Ripple Effect

A slowdown in global economic growth has a cascading effect on emerging markets, affecting their ability to service their debt:

- Lower commodity prices (for commodity-exporting countries): Reduced global demand leads to lower prices for commodities, hurting the revenues of many emerging economies.

- Reduced export revenues: Slower global growth reduces demand for exports from emerging markets, impacting their foreign exchange earnings.

- Increased debt burdens: Lower revenues make it harder to manage existing debt levels, increasing the risk of default.

- Higher default risk: A combination of lower revenues and higher borrowing costs increases the likelihood of sovereign debt defaults.

A global recession, for example, would severely impact the ability of many emerging economies to repay their debts, leading to a potential wave of defaults on emerging market bonds.

H2: Assessing the Risks Associated with Emerging Market Bonds

Investing in emerging market bonds involves several inherent risks that investors must carefully consider:

H3: Currency Risk

Fluctuations in exchange rates can significantly impact returns on emerging market bonds:

- Losses from currency depreciation: If the local currency depreciates against the investor's home currency, the returns will be reduced or even negative.

- Hedging strategies: Investors can use hedging strategies (e.g., currency forwards) to mitigate currency risk, but these strategies come with their own costs.

- Impact on bond returns: Currency fluctuations can significantly alter the final return on an investment, potentially leading to substantial losses.

Investing in bonds denominated in a volatile currency introduces significant currency risk, potentially outweighing any yield advantage.

H3: Credit Risk

The risk of default or downgrade by emerging market issuers is substantial:

- Credit ratings: Credit rating agencies assess the creditworthiness of bond issuers, providing an indication of default risk.

- Default probabilities: Sophisticated models calculate the probability of default for various issuers.

- Impact on bond prices: A downgrade or default can severely impact bond prices, leading to substantial losses for investors.

- Debt restructuring: In case of default, debt restructuring negotiations can be lengthy and complex, further impacting investor returns.

Thorough credit analysis is essential to minimize the risk of investing in potentially defaulting issuers.

H3: Liquidity Risk

Trading emerging market bonds can be challenging, especially during times of stress:

- Limited trading volume: Some emerging market bonds have low trading volume, making it difficult to buy or sell quickly.

- Wider bid-ask spreads: The difference between the buying and selling price (bid-ask spread) is often wider for less liquid bonds, reducing potential returns.

- Difficulty exiting positions quickly: During times of stress, it may be difficult to sell bonds quickly at a fair price, leading to potential losses.

Liquidity risk can be particularly significant during periods of market turmoil when investors rush to exit their positions.

H2: Strategies for Navigating the Emerging Bond Crisis

Investors can employ several strategies to mitigate risks and potentially capitalize on opportunities in this challenging environment:

H3: Diversification

Diversification is crucial to reduce overall portfolio risk:

- Geographic diversification: Spreading investments across different emerging markets reduces exposure to country-specific risks.

- Sector diversification: Investing in bonds issued by companies in different sectors mitigates sector-specific risks.

- Asset class diversification: Combining emerging market bonds with other asset classes (e.g., equities, real estate) further reduces risk.

A well-diversified portfolio is better equipped to withstand shocks in specific markets or sectors.

H3: Due Diligence

Thorough research is essential before investing in emerging market bonds:

- Credit ratings: Carefully review credit ratings from reputable agencies to assess the creditworthiness of issuers.

- Macroeconomic indicators: Analyze macroeconomic indicators (e.g., GDP growth, inflation, current account balance) to assess the overall health of the economy.

- Political risk analysis: Assess the political stability and risk of the issuing country.

Careful due diligence helps to identify potentially risky investments and avoid significant losses.

H3: Risk Management

Effective risk management techniques are crucial for protecting investments:

- Hedging strategies: Employ hedging strategies (e.g., currency forwards, options) to mitigate specific risks.

- Stop-loss orders: Set stop-loss orders to automatically sell bonds if prices fall below a certain level.

- Portfolio rebalancing: Regularly rebalance the portfolio to maintain the desired asset allocation and risk level.

Proactive risk management strategies help to limit potential losses and protect capital.

3. Conclusion:

The potential emerging bond crisis presents significant challenges for investors, requiring a careful assessment of risks and a proactive investment strategy. Rising interest rates, geopolitical uncertainty, and slowing global growth are all contributing factors to the increased volatility in this market. By understanding the current state of the emerging bond market, assessing the inherent risks, and employing effective diversification and risk management techniques, investors can better navigate this turbulent environment and potentially capitalize on opportunities. Don't wait for the full impact of the emerging bond crisis to unfold – take proactive steps to safeguard your portfolio and develop a resilient investment strategy today. Learn more about mitigating risks in the emerging bond market and building a diversified portfolio suited to these uncertain times.

Featured Posts

-

Space Xs Starship Program Flight 9 Results And Preparations For Future Tests

May 29, 2025

Space Xs Starship Program Flight 9 Results And Preparations For Future Tests

May 29, 2025 -

50 Days Of Impact Pakistan Crypto Councils Global Achievements

May 29, 2025

50 Days Of Impact Pakistan Crypto Councils Global Achievements

May 29, 2025 -

Capello Vs Ancelotti A Managerial Comparison

May 29, 2025

Capello Vs Ancelotti A Managerial Comparison

May 29, 2025 -

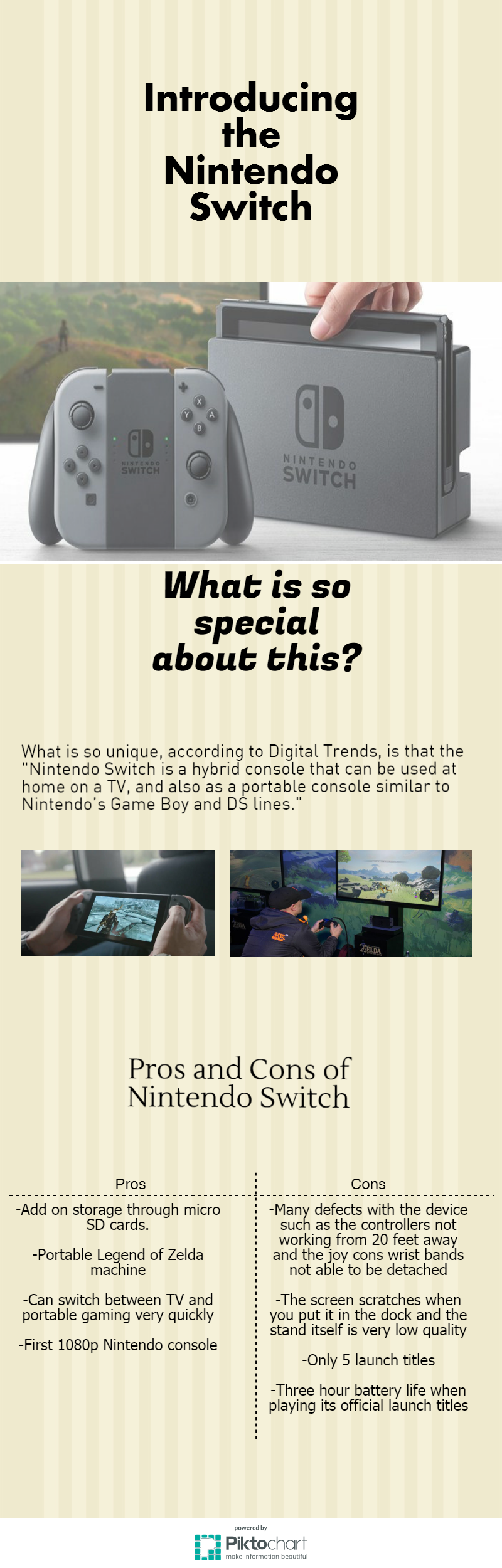

How The Nintendo Switch Revolutionized Nintendos Technology

May 29, 2025

How The Nintendo Switch Revolutionized Nintendos Technology

May 29, 2025 -

Joshlin Sale Smiths Denial Lombaard And Letoni Implicated

May 29, 2025

Joshlin Sale Smiths Denial Lombaard And Letoni Implicated

May 29, 2025