The End Of Mississippi Income Tax: What Does It Mean For Hernando?

Table of Contents

Economic Implications for Hernando

The elimination of Mississippi income tax is expected to have profound economic repercussions for Hernando. While the potential for growth is significant, careful consideration of the challenges is equally important.

Potential for Increased Investment and Job Growth

The absence of state income tax could act as a powerful magnet, attracting businesses seeking a more favorable tax environment. This influx of businesses could translate into substantial job growth across various sectors in Hernando. We might see increased activity in:

- Retail: A rise in disposable income could lead to increased retail sales and the establishment of new retail outlets.

- Manufacturing: Lower operating costs could incentivize manufacturers to relocate or expand their operations within Hernando.

- Technology: The potential for remote work and a lower cost of living could attract technology companies and professionals to the area.

- Tourism: Reduced tax burdens could make Hernando a more attractive destination for tourists, boosting the local hospitality sector.

This increased economic activity could lead to higher property values and a general improvement in the overall economic health of Hernando. However, concrete data and projections are still needed to fully assess the extent of this potential growth. Further research from organizations like the Mississippi Economic Council will be vital in painting a clearer picture.

Impact on Local Government Revenue

The elimination of Mississippi income tax presents a significant challenge to Hernando's local government. The loss of this revenue stream will necessitate adjustments to the local budget. Potential solutions include:

- Increased Property Taxes: Raising property taxes could help offset the lost income tax revenue. However, this option may be unpopular among residents.

- Sales Tax Increases: Increasing the local sales tax rate could generate additional revenue but could impact consumers' purchasing power.

- Seeking Grants and Federal Funding: Actively pursuing grants and federal funding opportunities could help alleviate budgetary pressures.

- Spending Cuts: Difficult choices regarding cuts to public services or infrastructure projects may be unavoidable.

The long-term consequences depend heavily on the effectiveness of these mitigation strategies and the overall economic response to the tax reform. Careful financial planning and community engagement will be crucial for navigating these budgetary adjustments.

Changes in the Cost of Living

The impact on the cost of living in Hernando is a complex issue. While residents will benefit from the elimination of state income tax, other factors could influence overall costs.

- Increased Sales Tax: The state might increase sales taxes to compensate for the loss of income tax revenue, potentially offsetting some of the individual tax savings.

- Property Tax Adjustments: Changes in property tax rates could significantly impact the cost of housing and homeownership.

- Demand-Driven Price Increases: Increased economic activity could lead to higher prices for goods and services due to increased demand.

The net effect on the cost of living remains uncertain and will likely depend on the interplay of these various factors. Careful monitoring of these economic indicators will be critical.

How Residents of Hernando Will Be Affected

The elimination of Mississippi income tax will have both immediate and long-term effects on Hernando residents.

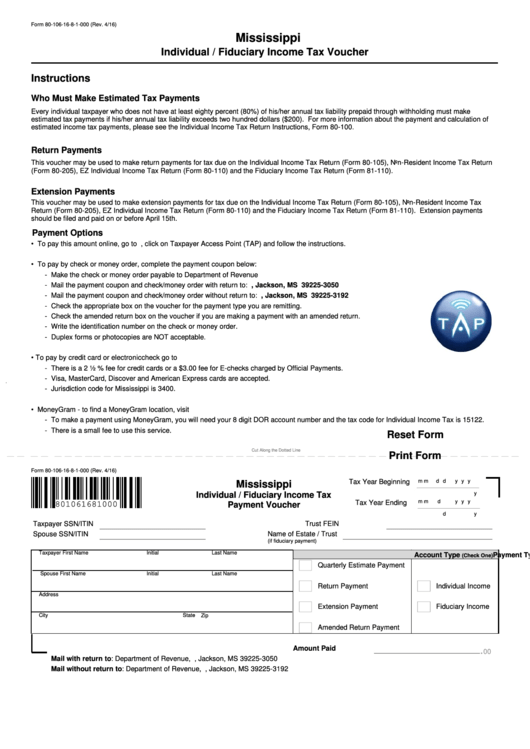

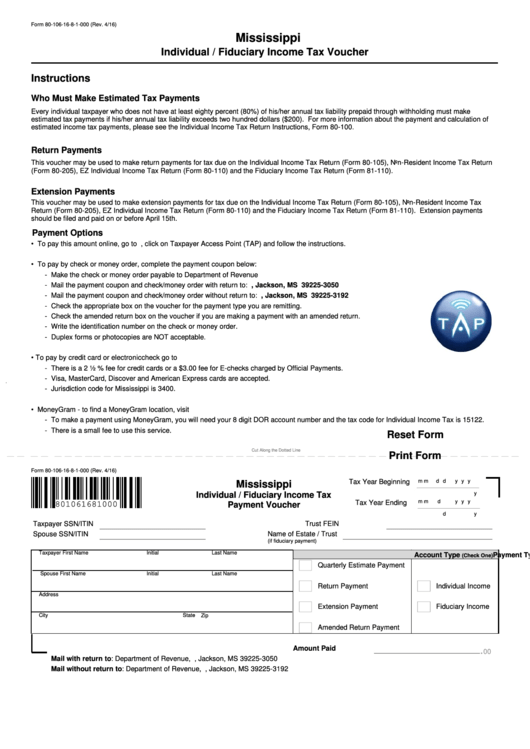

Immediate Impacts on Individual Taxpayers

The most immediate impact is the elimination of state income tax liability for most residents. This means:

- Direct Savings: Individuals will see a direct reduction in their tax burden, leading to increased disposable income.

- Simpler Tax Filing: The tax filing process will become simpler, requiring less paperwork and potentially reducing the need for professional tax preparation.

However, it's important to note that the complexity of the changes might require time for residents to fully understand and adapt to the new tax system.

Long-Term Effects on Personal Finances

The long-term impact on personal finances is multifaceted.

- Increased Savings and Investment: The extra disposable income could lead to increased savings, investment opportunities, and potentially higher rates of homeownership.

- Changes in Spending Habits: Residents may alter their spending habits, potentially increasing spending on discretionary items or investing more in local businesses.

- Potential for Increased Wealth: The cumulative effect of these changes could potentially contribute to an increase in overall personal wealth for many Hernando residents.

However, these benefits are contingent on the broader economic consequences of the tax reform and careful financial planning on the part of individual residents.

Comparison to Other Mississippi Cities

While the elimination of Mississippi income tax impacts all cities, the specific effects will vary depending on their unique economic structures and demographics. Larger cities with diverse economies might experience different growth patterns compared to smaller towns like Hernando. Further research comparing Hernando's projected growth with those of similar cities, such as Olive Branch or Southaven, can provide valuable insights into potential outcomes. This comparative analysis will help paint a fuller picture of the tax reform's statewide impact.

Conclusion: Understanding the Future of Hernando After the End of Mississippi Income Tax

The elimination of Mississippi income tax presents a complex picture for Hernando, offering both significant opportunities and potential challenges. While the potential for increased investment, job growth, and individual financial benefits is substantial, careful planning is needed to address potential budgetary shortfalls at the local government level and navigate changes in the cost of living. Staying informed about further developments related to Mississippi tax changes and their effect on Hernando is crucial. Engage in local discussions, plan your finances accordingly, and contribute to shaping a prosperous future for your community. The future of Hernando hinges on understanding and proactively adapting to the end of Mississippi income tax.

Featured Posts

-

Gazze De Balikcilik Krizi Hayatta Kalma Muecadelesi Ve Suerdueruelebilirlik Sorunu

May 19, 2025

Gazze De Balikcilik Krizi Hayatta Kalma Muecadelesi Ve Suerdueruelebilirlik Sorunu

May 19, 2025 -

Everything You Need To Know About The Bbcs Eurovision 2025 Coverage

May 19, 2025

Everything You Need To Know About The Bbcs Eurovision 2025 Coverage

May 19, 2025 -

Sokaristika Nea Stoixeia Gia Aneksixniastoys Fonoys To Tampoy

May 19, 2025

Sokaristika Nea Stoixeia Gia Aneksixniastoys Fonoys To Tampoy

May 19, 2025 -

Kiprskiy Konflikt Gensek Oon Sozyvaet Neformalnye Peregovory V Zheneve

May 19, 2025

Kiprskiy Konflikt Gensek Oon Sozyvaet Neformalnye Peregovory V Zheneve

May 19, 2025 -

Wide Awake Mighty Hoopla And More Cancelled A Crushing Loss For Londons Cultural Scene

May 19, 2025

Wide Awake Mighty Hoopla And More Cancelled A Crushing Loss For Londons Cultural Scene

May 19, 2025