The Future Of Transportation: ETF Strategies For Uber's Autonomous Vehicle Push

Table of Contents

Understanding Uber's Autonomous Vehicle Strategy

Uber's ambitions in the self-driving car market are significant. They envision a future where autonomous vehicles form the backbone of their ride-hailing service, drastically reducing operational costs and improving efficiency. Uber's Advanced Technologies Group (ATG) is the driving force behind this initiative, investing heavily in research, development, and deployment of self-driving technology. However, the path to autonomous vehicle dominance is fraught with challenges. Technological hurdles, including perfecting sensor technology, handling unpredictable situations, and ensuring safety, remain significant obstacles. Furthermore, intense competition from other tech giants like Waymo (Google's self-driving car project), Tesla, and traditional automakers such as General Motors and Ford, adds another layer of complexity.

- Key Partnerships and Acquisitions: Uber has strategically acquired and partnered with several companies specializing in mapping, sensor technology, and artificial intelligence to bolster its autonomous vehicle capabilities.

- Uber ATG Program: Uber's ATG is responsible for developing and testing its self-driving technology, currently operating in select cities across the United States.

- Geographic Focus: Uber is strategically deploying its autonomous vehicles in areas with favorable regulatory environments and high-density populations to maximize the impact of its investment.

Identifying Relevant ETFs for Autonomous Vehicle Investment

Exchange Traded Funds (ETFs) offer a diversified and efficient way to gain exposure to the autonomous vehicle sector. Unlike investing directly in individual companies, ETFs provide a basket of stocks related to the industry, mitigating risk and simplifying the investment process. Several ETF categories can offer exposure to this exciting space:

- Technology ETFs: These ETFs typically hold shares of leading technology companies involved in software, hardware, and AI development crucial for autonomous vehicles.

- Robotics ETFs: Robotics plays a pivotal role in autonomous vehicle development, and ETFs focusing on this sector can provide valuable exposure.

- Transportation ETFs: These ETFs often include companies involved in various aspects of transportation, including those developing and deploying autonomous vehicles.

Examples of ETFs that may offer indirect or direct exposure to Uber and the broader autonomous vehicle market (always perform your due diligence before investing):

- Ticker 1 (Example): [Insert Ticker and Brief Description, e.g., Invesco QQQ Trust (QQQ) - A broad technology ETF with potential exposure to Uber and related companies]. Expense Ratio: [Insert Percentage], Asset Allocation Strategy: [Describe]

- Ticker 2 (Example): [Insert Ticker and Brief Description, e.g., Global X Robotics & Artificial Intelligence ETF (BOTZ) - Focuses on companies involved in robotics and AI]. Expense Ratio: [Insert Percentage], Asset Allocation Strategy: [Describe]

- Ticker 3 (Example): [Insert Ticker and Brief Description, e.g., iShares Self-Driving EV and Tech ETF (IDRV) - Focuses on companies involved in self-driving car technology and electric vehicles]. Expense Ratio: [Insert Percentage], Asset Allocation Strategy: [Describe]

Assessing Risk and Return in Autonomous Vehicle ETFs

Investing in emerging technologies like autonomous vehicles comes with inherent risks. Technological setbacks, regulatory hurdles (varying significantly by location), and unexpected market shifts can all negatively impact returns. However, the potential rewards are equally substantial. Successful autonomous vehicle adoption could lead to significant growth in the transportation sector, creating lucrative investment opportunities.

- Potential Financial Rewards: The widespread adoption of self-driving technology could unlock substantial cost savings and efficiency gains across various industries, leading to significant returns for early investors.

- Potential Downsides and Risks: Technological failures, regulatory delays, and intense competition pose significant risks that could negatively affect investment performance.

- Diversification Strategies: Diversifying your portfolio across different ETF categories and asset classes can help mitigate the risks associated with investing in a single, rapidly evolving sector.

Due Diligence and Investment Strategies for Autonomous Vehicle ETFs

Thorough research is crucial before investing in any ETF. Carefully examine the ETF's holdings, past performance, expense ratio, and management fees. Consider your risk tolerance and investment goals when selecting an ETF.

- Resources for ETF Research: Utilize reputable financial news websites, brokerage platforms, and ETF research providers to gather information.

- Criteria for Selecting ETFs: Look for ETFs with low expense ratios, substantial asset size, and a consistent track record of performance.

- Investment Strategies: Dollar-cost averaging (regularly investing a fixed amount) can help mitigate risk by averaging out the cost per share over time, and may be a suitable strategy for this volatile sector.

Conclusion: Investing in the Future of Transportation with ETF Strategies

Uber's autonomous vehicle push represents a significant opportunity within the transportation industry. By carefully examining "ETF Strategies for Uber's Autonomous Vehicle Push," investors can access this exciting sector through diversified investment vehicles like ETFs. Remember to conduct thorough due diligence, assess your risk tolerance, and consider diversification strategies. While the potential for high returns is significant, understanding and managing the inherent risks is crucial. Start your research today and consider how you can participate in this transformative technology. Explore further resources on ETF investing and autonomous vehicle technology to make informed decisions.

Featured Posts

-

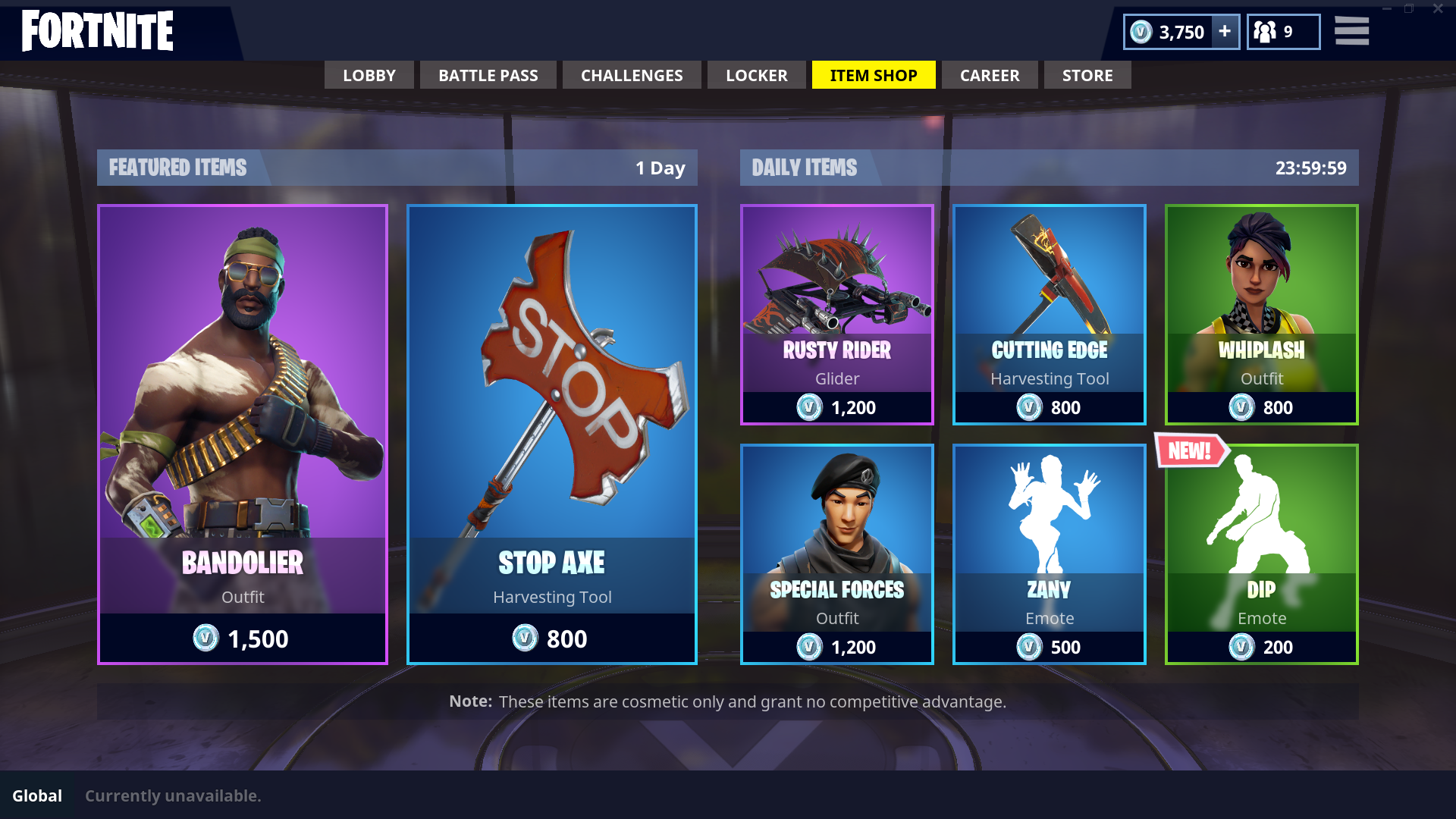

Backlash Against Fortnites Latest Item Shop Refresh

May 17, 2025

Backlash Against Fortnites Latest Item Shop Refresh

May 17, 2025 -

Celebrity Couple Cassie And Alex Fine Make Red Carpet Debut At Mob Land

May 17, 2025

Celebrity Couple Cassie And Alex Fine Make Red Carpet Debut At Mob Land

May 17, 2025 -

Knicks Strategy Mitigating The Cade Cunningham Threat From The Pistons

May 17, 2025

Knicks Strategy Mitigating The Cade Cunningham Threat From The Pistons

May 17, 2025 -

Open Ai Facing Ftc Probe Examining The Future Of Ai And Data Privacy

May 17, 2025

Open Ai Facing Ftc Probe Examining The Future Of Ai And Data Privacy

May 17, 2025 -

Is Jackbit The Best Crypto Casino For Fast Withdrawals

May 17, 2025

Is Jackbit The Best Crypto Casino For Fast Withdrawals

May 17, 2025