The Geopolitics Of Rare Earth Minerals: A Looming Cold War

Table of Contents

China's Dominance in Rare Earth Mining and Processing

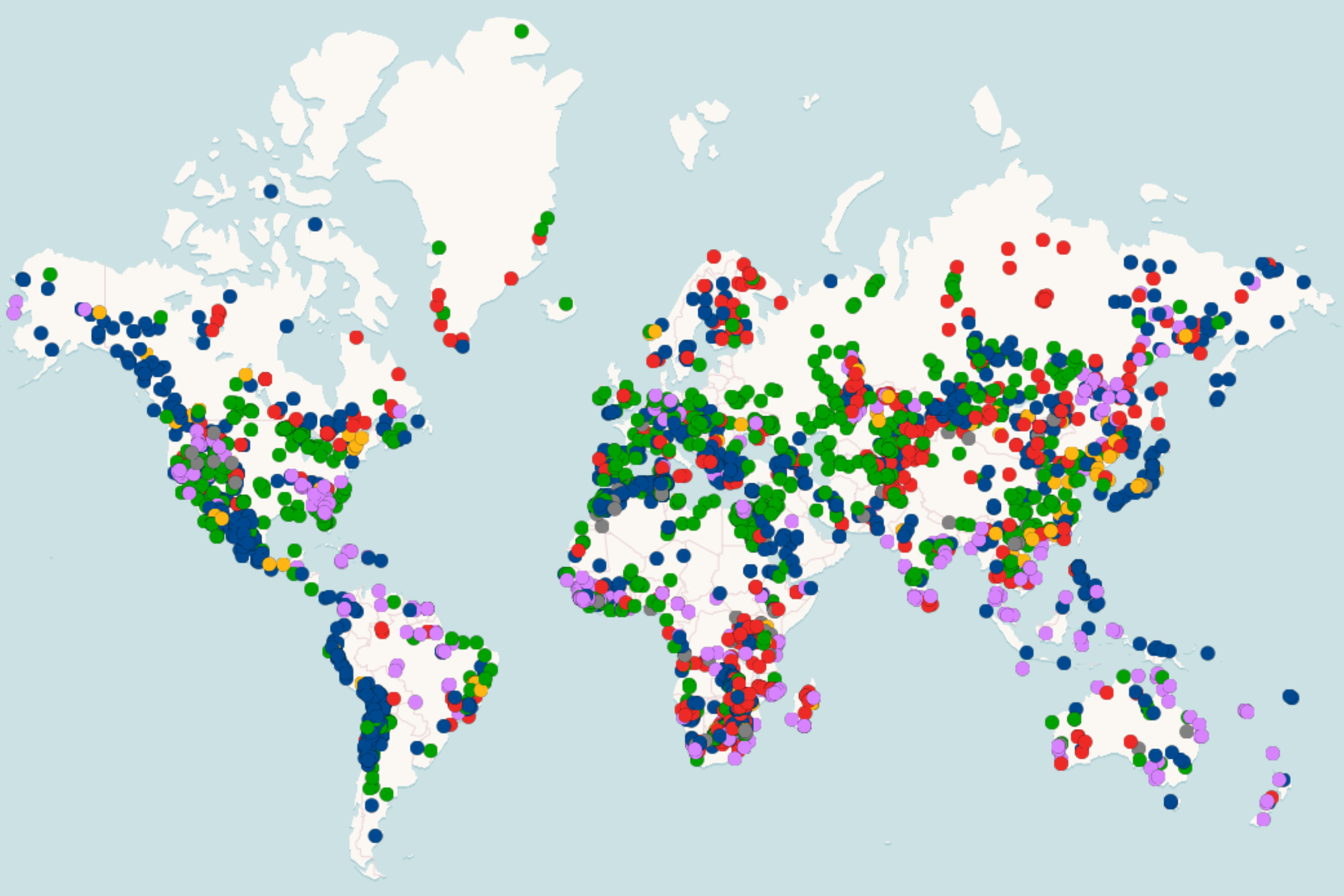

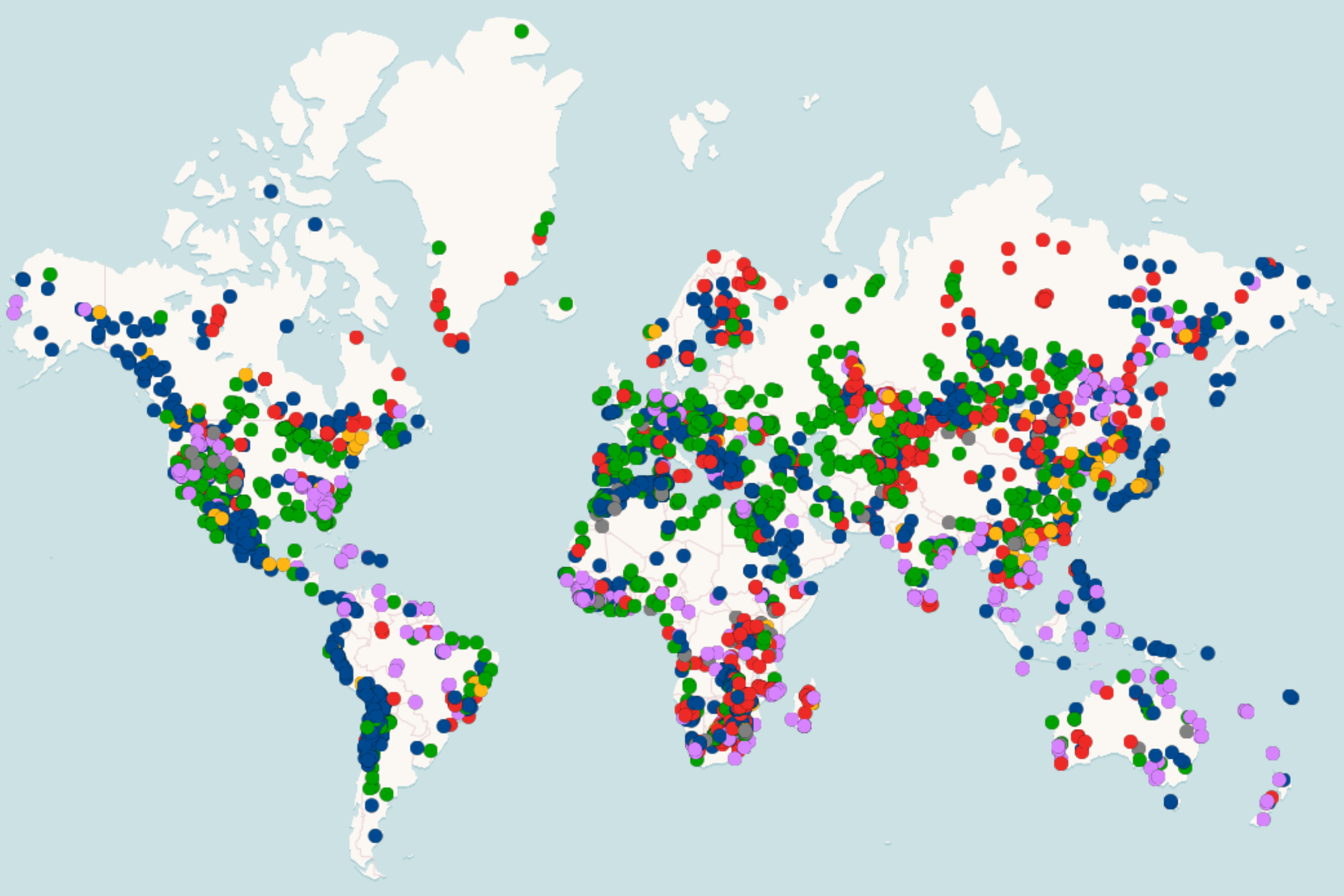

China's overwhelming control over the global rare earth supply chain is the defining feature of this geopolitical landscape. This dominance extends from mining and processing to refining, creating a significant vulnerability for nations reliant on these essential materials.

Production Capacity: China boasts an unparalleled production capacity, holding approximately 70% of global rare earth production. This dominance stems from decades of investment in mining infrastructure and refining technology. Key mining locations such as Bayan Obo in Inner Mongolia are central to this control.

Environmental Concerns and Impacts: The extraction and processing of rare earth minerals are notoriously environmentally damaging, resulting in significant pollution and land degradation. China's approach to mitigating these environmental impacts has been a subject of international debate, with concerns raised about the lack of stringent environmental regulations in certain areas.

- China controls over 70% of global rare earth production.

- Key rare earth mining locations in China include Bayan Obo and Ganzhou.

- Environmental challenges include radioactive waste, water pollution, and soil contamination.

- China's policies on rare earth exports have fluctuated, impacting global markets and causing price volatility.

The Strategic Importance of Rare Earths in Modern Technology

The strategic importance of rare earth minerals extends far beyond consumer electronics. These elements are indispensable components of numerous high-tech applications, with significant implications for national security.

Essential Components: Rare earth elements are essential for creating powerful magnets used in wind turbines, electric vehicles, and military equipment. They are also critical components in lasers, catalysts, and other advanced technologies.

Technological Dependence: Many countries, including the US and members of the European Union, are heavily reliant on China for their rare earth mineral supply. This dependence creates significant vulnerabilities, raising concerns about supply chain disruptions and economic coercion.

- Neodymium magnets, reliant on rare earth elements, are crucial for wind turbines and electric vehicle motors.

- Rare earth elements are essential for guided missiles, radar systems, and other military technologies.

- Dependence on China for rare earths poses significant economic and national security risks.

Diversification Efforts and Geopolitical Competition

Recognizing the strategic vulnerability created by China's dominance, several nations and alliances are undertaking significant efforts to diversify their rare earth sourcing.

US and EU Initiatives: The United States and the European Union have launched initiatives to boost domestic rare earth production and processing, investing in research and development and incentivizing private sector investment. These efforts, however, face significant hurdles, including the high environmental costs of extraction and the complex technological requirements of refining.

Other Key Players: Australia, Canada, and several other countries possess significant rare earth deposits and are working to develop their own industries. However, establishing a truly competitive rare earth supply chain outside of China requires substantial investment and technological expertise.

- The US is investing in domestic rare earth mining and processing to reduce reliance on China.

- The EU is pursuing similar strategies, emphasizing responsible sourcing and environmental sustainability.

- Australia and Canada are expanding their rare earth mining and processing capacities.

- Challenges to diversification include high upfront capital costs and stringent environmental regulations.

The Future of Rare Earth Geopolitics

The geopolitics of rare earth minerals are poised to become increasingly complex and potentially volatile.

Potential for Conflict: Competition over dwindling rare earth resources could escalate tensions between nations, potentially leading to conflicts over access to critical deposits. Secure and reliable supply chains will become increasingly important for national security.

Technological Innovations: Developments in recycling technologies and research into alternative materials could eventually reduce dependence on rare earth minerals. However, these breakthroughs are unlikely to offer a short-term solution to the current geopolitical challenges.

- Increased demand for rare earths, coupled with limited supply, could fuel geopolitical tensions.

- Technological advancements in recycling and substitution materials offer potential long-term solutions.

- International cooperation and responsible resource management are essential to mitigate future conflicts.

Conclusion

The geopolitics of rare earth minerals are shaping a new era of geopolitical tension. China's dominance, the critical role of rare earths in modern technology, and ongoing diversification efforts highlight the complexities of this issue. Understanding the strategic importance of these resources is paramount. The potential for conflict underscores the urgent need for proactive strategies, including investments in domestic production, international collaborations focused on responsible sourcing, and the development of innovative technologies to mitigate future scarcity. Understanding the geopolitics of rare earth minerals is crucial for navigating the complexities of the 21st-century global economy. Stay informed and advocate for responsible resource management strategies to mitigate future conflict and ensure a stable supply of these critical materials.

Featured Posts

-

Watch Ny Knicks Vs La Clippers Live Free Nba Stream Game Time And Tv Channel March 26 2025

May 17, 2025

Watch Ny Knicks Vs La Clippers Live Free Nba Stream Game Time And Tv Channel March 26 2025

May 17, 2025 -

Andor Season 2 Premiere What To Remember Before Watching

May 17, 2025

Andor Season 2 Premiere What To Remember Before Watching

May 17, 2025 -

Emirates Id Fees For Newborn Babies A Guide For Parents In The Uae March 2025

May 17, 2025

Emirates Id Fees For Newborn Babies A Guide For Parents In The Uae March 2025

May 17, 2025 -

Josh Alexander Aew Don Callis And The Future 97 1 Double Q Interview

May 17, 2025

Josh Alexander Aew Don Callis And The Future 97 1 Double Q Interview

May 17, 2025 -

Navigating Late Student Loan Payments And Their Credit Consequences

May 17, 2025

Navigating Late Student Loan Payments And Their Credit Consequences

May 17, 2025