The High Cost Of Entry: Down Payments And The Canadian Housing Market

Table of Contents

The Rising Cost of Homes and its Impact on Down Payments

Home prices in Canada have skyrocketed in recent years, making the dream of homeownership increasingly elusive for many. This dramatic increase in average house prices directly impacts the size of the down payment needed, creating a significant barrier to entry for first-time home buyers and even seasoned investors. This escalating cost affects different regions differently, with major urban centers like Toronto and Vancouver experiencing the most significant price hikes.

-

Average house price increases in major Canadian cities: Toronto has seen average house prices increase by over X% in the last 5 years, while Vancouver has experienced a Y% increase. Montreal and Calgary also show significant, albeit less dramatic, increases. Specific figures should be added here, referencing reliable sources like the Canadian Real Estate Association (CREA).

-

Percentage increase in down payment requirements over the past 5 years: The needed down payment has consequently risen sharply. A 5% down payment on a $500,000 home five years ago is drastically different from the down payment required on a similar home today, reflecting the increase in average house prices. (Insert specific percentage increase data here, referencing reliable sources.)

-

The role of CMHC and mortgage insurance in relation to down payment amounts: The Canada Mortgage and Housing Corporation (CMHC) plays a crucial role in the Canadian mortgage market. For high-ratio mortgages (down payments less than 20%), CMHC insurance is mandatory, protecting lenders against potential losses. This insurance, however, adds to the overall cost of borrowing. The higher the loan-to-value ratio (the portion of the home's value borrowed), the higher the insurance premiums, impacting the overall affordability.

Saving for a Down Payment: Strategies and Challenges

Saving for a down payment is a significant undertaking, requiring discipline, planning, and often, considerable time. For first-time home buyers, this represents a substantial financial hurdle. Successfully navigating this process requires a comprehensive strategy.

-

Creating a realistic budget and tracking expenses: The first step is meticulously tracking income and expenses to identify areas for savings. Budgeting apps and financial advisors can be invaluable tools.

-

High-yield savings accounts and investment options: Maximizing returns on savings is key. High-yield savings accounts, Tax-Free Savings Accounts (TFSAs), and Registered Retirement Savings Plans (RRSPs) can all play a role, depending on individual circumstances and financial goals. It’s crucial to understand the tax implications of each option.

-

Government programs and incentives for first-time home buyers: Several government programs offer assistance to first-time home buyers. The First-Time Home Buyers' Incentive, for instance, can help reduce the down payment required. Researching and understanding these programs is vital.

-

The psychological impact of saving for a large down payment: Saving for a large down payment can be emotionally taxing. Setting realistic goals, celebrating milestones, and maintaining a positive mindset are crucial for long-term success. Professional financial advice can help manage the psychological challenges.

Alternative Financing Options and Their Implications

While saving diligently is ideal, alternative financing options can help potential homebuyers overcome the significant barrier of a large down payment. These options come with both advantages and disadvantages.

-

First-Time Home Buyers' Incentive program: This government program provides a shared-equity mortgage loan, reducing the down payment needed. It's crucial to fully understand the terms and conditions before applying.

-

Using family assistance for a down payment (legal and tax implications): Family members may offer financial assistance, but careful consideration of the legal and tax implications is essential. Formal agreements are crucial to protect both parties.

-

Exploring options with alternative lenders: Alternative mortgage lenders may offer more flexible terms, though often with higher interest rates. Comparing options and understanding the terms carefully is crucial.

-

The potential risks and benefits of using different financing methods: Each financing method comes with inherent risks and benefits. Thorough research and potentially seeking independent financial advice are recommended before making any decisions.

The Broader Impact on the Canadian Housing Market

The high cost of entry, particularly the significant down payment requirements, has far-reaching consequences for the Canadian housing market.

-

Limited homeownership opportunities for young Canadians: High down payment requirements are significantly limiting homeownership opportunities for younger generations, potentially impacting social mobility and economic growth.

-

Increased demand in the rental market: The inability to afford a down payment drives increased demand in the rental market, further impacting rental prices and affordability.

-

Impact on economic growth and social mobility: Reduced homeownership opportunities can hinder economic growth and contribute to social inequality.

-

Potential for future market instability: The current dynamics could potentially lead to future market instability.

Conclusion

The high cost of entry, largely driven by substantial down payment requirements, presents a significant challenge in the Canadian housing market. This obstacle impacts affordability, limits homeownership opportunities, and contributes to broader economic concerns. Understanding the complexities of down payments and exploring available options are crucial for navigating the Canadian housing market successfully. Research government programs, develop a robust savings plan, and consider alternative financing options to achieve your dream of homeownership and overcome the high cost of entry in the Canadian housing market. Don't let the down payment deter you; with careful planning and research, homeownership in Canada remains attainable.

Featured Posts

-

Supporting The Transgender Community Practical Allyship On International Transgender Day

May 10, 2025

Supporting The Transgender Community Practical Allyship On International Transgender Day

May 10, 2025 -

Wynne Evans Health Scare Recent Illness And Potential Stage Comeback

May 10, 2025

Wynne Evans Health Scare Recent Illness And Potential Stage Comeback

May 10, 2025 -

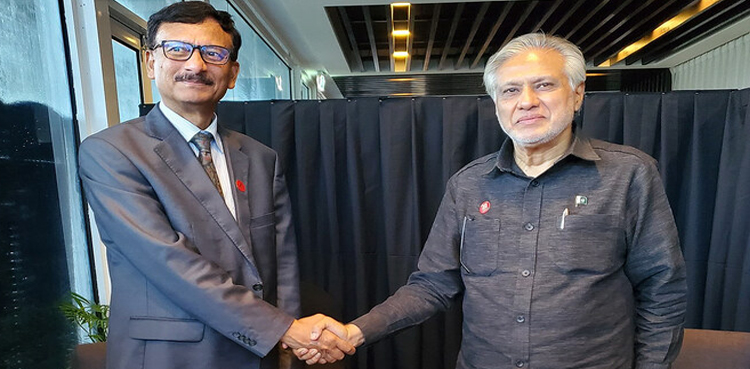

Pakistan Sri Lanka And Bangladesh To Strengthen Capital Market Ties

May 10, 2025

Pakistan Sri Lanka And Bangladesh To Strengthen Capital Market Ties

May 10, 2025 -

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Hathaway Shares

May 10, 2025

Warren Buffetts Canadian Successor A Billionaire Without Many Berkshire Hathaway Shares

May 10, 2025 -

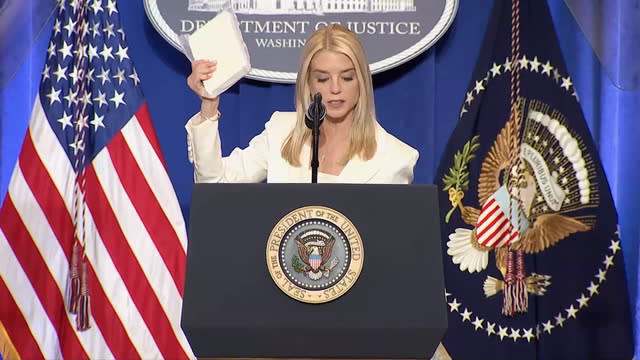

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025

Press Conference Controversy Attorney General And The Fentanyl Block

May 10, 2025