The High Stakes Of Tariff Turbulence: ABI Research On The Tech Industry's Trade War Experience

Table of Contents

H2: The Impact of Tariffs on Semiconductor Manufacturing and Supply Chains

The semiconductor industry, the backbone of modern electronics, has been particularly vulnerable to tariff turbulence. The complex global supply chains involved in semiconductor manufacturing, from raw material sourcing to finished product assembly, have been significantly disrupted.

H3: Increased Costs and Reduced Profit Margins:

Increased costs directly impact profitability. Higher import tariffs on essential raw materials like silicon wafers and specialized chemicals significantly increase production costs. Furthermore, higher tariffs on finished semiconductor goods reduce competitiveness in global markets, squeezing profit margins.

- Specific examples: A 10% tariff increase on imported silicon wafers could translate to a X% increase in the cost of producing a specific type of microprocessor. Similarly, increased tariffs on finished memory chips have reduced the export competitiveness of major producers in [Country A].

- Case Study: [Company X], a major semiconductor manufacturer, reported a Y% decline in profits in Q[Quarter] due to increased tariff costs on imported materials and finished goods.

- Bullet points detailing specific tariff increases and their effects:

- 25% tariff on certain types of memory chips led to a 5% price increase for consumers.

- 15% tariff on specialized chemicals used in chip fabrication increased production costs by 3%.

- 10% tariff on imported silicon wafers resulted in a 2% increase in the cost of producing microprocessors.

H3: Supply Chain Diversification and Reshoring Initiatives:

In response to tariff turbulence, many semiconductor companies are actively diversifying their supply chains and exploring reshoring initiatives. This involves shifting manufacturing from tariff-affected regions to countries with more favorable trade policies.

- Analysis of company shifts: Many companies are moving manufacturing to regions such as Southeast Asia and parts of Europe to mitigate tariff impacts.

- Reshoring Costs and Benefits: While reshoring can reduce reliance on tariff-affected regions, it comes with substantial costs, including establishing new manufacturing facilities and retraining workforces.

- Examples of diversification strategies: [Company Y]'s successful diversification into multiple sourcing regions for critical components demonstrates a proactive approach. Conversely, [Company Z]'s delayed response resulted in significant supply chain disruptions.

- Bullet points highlighting challenges and opportunities in reshoring and diversification:

- Challenge: High capital expenditure required for establishing new manufacturing facilities.

- Challenge: Finding skilled labor in alternative manufacturing locations.

- Opportunity: Access to new markets and reduced reliance on single-source suppliers.

- Opportunity: Improved geopolitical stability by diversifying sourcing regions.

H2: The Effects of Tariff Turbulence on Consumer Electronics

The impact of tariff turbulence extends to the consumer electronics sector, affecting both manufacturers and consumers.

H3: Price Increases and Consumer Demand:

Tariffs on imported components and finished goods directly translate into higher prices for consumers. This impacts consumer purchasing power and demand, particularly in price-sensitive markets.

- Analysis of price increases: Tariffs on imported components have led to an average X% increase in the price of smartphones in [Country B].

- Impact on consumer demand: Increased prices have led to a decline in demand for certain types of consumer electronics, particularly in developing markets.

- Consumer behavior shifts: Consumers are increasingly looking for cheaper alternatives, potentially favoring brands that have successfully mitigated tariff increases.

- Bullet points showing price increases for specific products:

- Smartphones: 5-10% price increase across various models.

- Laptops: 3-7% price increase depending on components and origin.

- Televisions: 2-5% price increase, mainly affecting larger screen sizes.

H3: Shifting Manufacturing Locations and Market Share:

Many consumer electronics brands are relocating manufacturing to avoid tariffs, leading to a shifting market landscape.

- Examination of manufacturing relocation: Several brands have shifted production to countries such as Vietnam and India.

- Changes in market share: Companies that successfully adapt to tariff changes gain market share, while others lag behind.

- Case studies: [Brand A]'s strategic relocation to Vietnam allowed it to maintain price competitiveness and market share.

- Bullet points showing winners and losers:

- Winner: Brands that successfully diversified their manufacturing base.

- Loser: Brands that relied heavily on single-source manufacturing in tariff-affected regions.

H2: Navigating the Uncertainties: Mitigation Strategies for Tech Companies

Successfully navigating tariff turbulence requires proactive strategies.

H3: Proactive Risk Assessment and Management:

Forecasting and analyzing potential tariff impacts are crucial.

- Importance of forecasting: Implementing robust risk management frameworks allows companies to anticipate and mitigate potential disruptions.

- Contingency planning: Developing backup plans for sourcing components and manufacturing is essential.

- Hedging strategies: Hedging against currency fluctuations and price increases can help mitigate financial risks.

- Bullet points summarizing key steps:

- Regularly monitor global trade policies and tariff changes.

- Develop detailed supply chain maps to identify potential vulnerabilities.

- Implement robust risk management protocols.

- Diversify sourcing and manufacturing locations.

H3: Strategic Partnerships and Supply Chain Optimization:

Strategic partnerships and optimized supply chains are key.

- Benefits of partnerships: Forming strategic partnerships with suppliers across multiple regions can provide greater resilience.

- Supply chain technologies: Implementing advanced technologies for greater visibility and agility in the supply chain is crucial.

- Negotiating favorable terms: Strong relationships with suppliers are essential for negotiating favorable terms and mitigating tariff impacts.

- Bullet points summarizing key aspects:

- Develop strong relationships with key suppliers.

- Invest in supply chain visibility tools.

- Explore alternative logistics solutions.

- Negotiate favorable payment terms.

3. Conclusion:

The ABI Research data clearly shows that tariff turbulence poses significant challenges to the tech industry, impacting supply chains, manufacturing costs, and ultimately, consumer prices. Companies must adapt by diversifying their supply chains, employing proactive risk management strategies, and forging strong partnerships to navigate the complexities of international trade. The resulting supply chain disruptions and increased costs are real and require immediate attention. Understanding the high stakes of tariff turbulence is critical for survival and growth in today's globalized tech market. Download our complete ABI Research report to gain deeper insights and develop a robust strategy for mitigating the risks of future trade wars and tariff increases. Don't let tariff turbulence derail your business – prepare for the future of international trade today.

Featured Posts

-

Evreyskaya Avtonomnaya Oblast Vyplaty Veteranam K 80 Letiyu Velikoy Pobedy

May 13, 2025

Evreyskaya Avtonomnaya Oblast Vyplaty Veteranam K 80 Letiyu Velikoy Pobedy

May 13, 2025 -

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025

Rpts Poluchila Razreshenie Na Religioznuyu Deyatelnost V Myanme

May 13, 2025 -

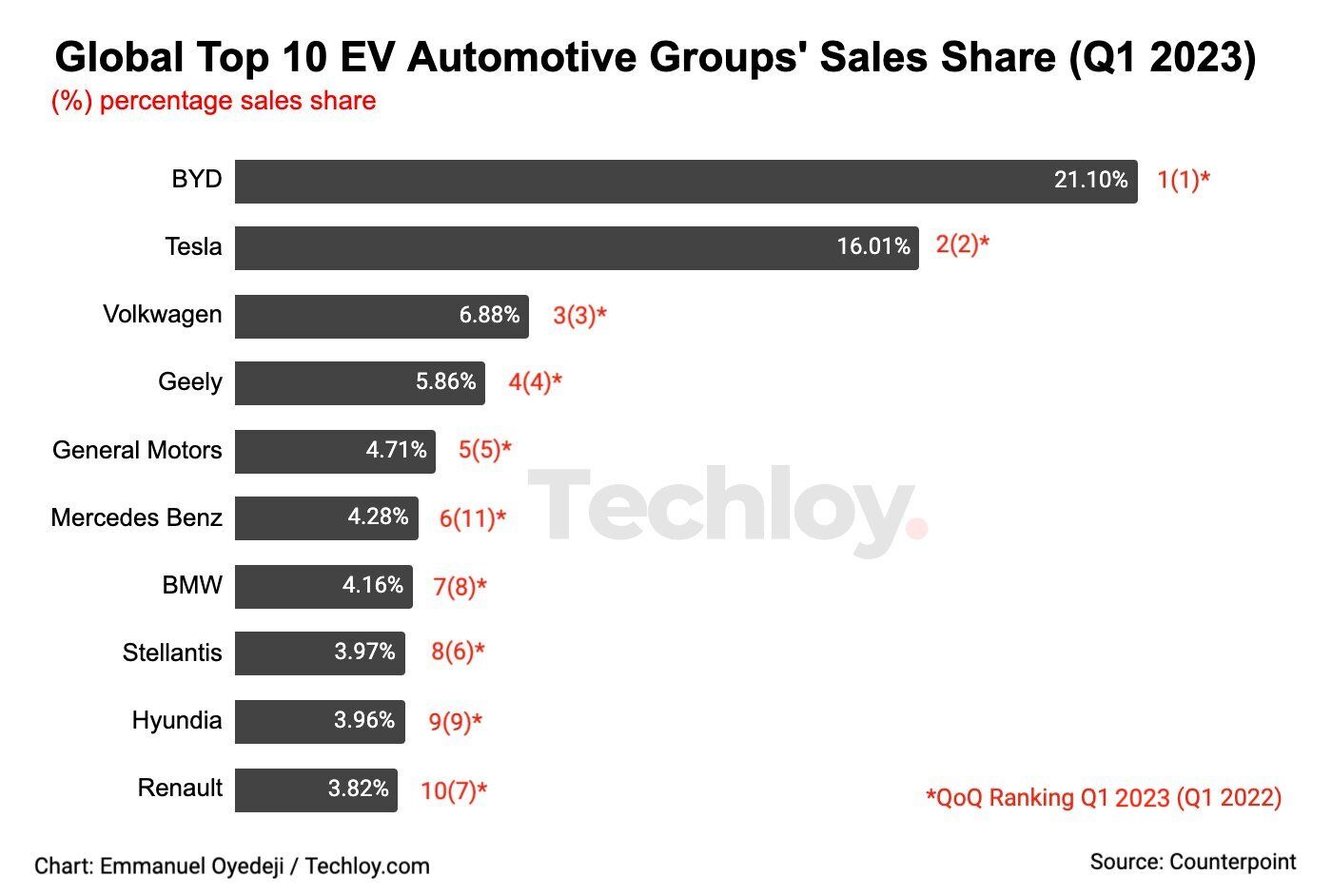

Brazilian Ev Market Shift Byds Growth And Fords Decline

May 13, 2025

Brazilian Ev Market Shift Byds Growth And Fords Decline

May 13, 2025 -

Rossiysko Myanmanskiy Biznes Forum V Moskve Itogi I Dostizheniya

May 13, 2025

Rossiysko Myanmanskiy Biznes Forum V Moskve Itogi I Dostizheniya

May 13, 2025 -

How Well Do You Know The Nba Draft Lottery Winners Since 2000

May 13, 2025

How Well Do You Know The Nba Draft Lottery Winners Since 2000

May 13, 2025

Latest Posts

-

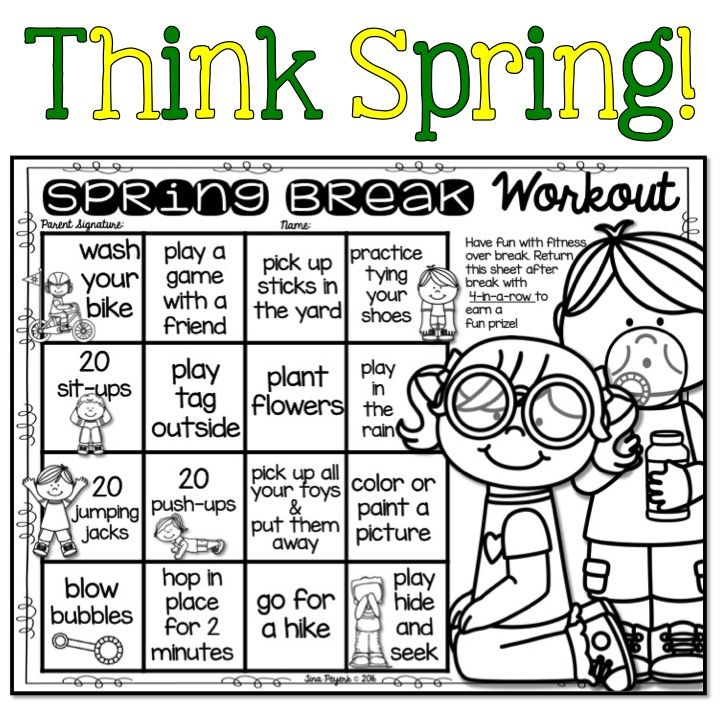

Top Tips For A Successful Spring Break With Kids

May 13, 2025

Top Tips For A Successful Spring Break With Kids

May 13, 2025 -

Making Spring Break Unforgettable For Kids Tips And Planning Guide

May 13, 2025

Making Spring Break Unforgettable For Kids Tips And Planning Guide

May 13, 2025 -

The Future Of Evs In Brazil Byds Impact On The Market

May 13, 2025

The Future Of Evs In Brazil Byds Impact On The Market

May 13, 2025 -

Spring Break With Kids Fun Engaging And Educational Activities

May 13, 2025

Spring Break With Kids Fun Engaging And Educational Activities

May 13, 2025 -

Byds 2030 Vision A Global Automotive Powerhouse

May 13, 2025

Byds 2030 Vision A Global Automotive Powerhouse

May 13, 2025