The Impact Of Climate Risk On Homebuyers' Credit Scores

Table of Contents

How Climate Change Impacts Property Values

Increased risk of flooding, wildfires, or extreme weather events directly lowers property values. Properties in high-risk zones become less desirable, leading to a decrease in demand and, consequently, a decline in their market value. This "climate risk" is now a major factor considered by potential buyers and appraisers alike.

- Decreased demand for properties in high-risk areas: Buyers are increasingly wary of purchasing homes susceptible to flooding, wildfires, or extreme weather, leading to a reduction in the number of offers and lower sale prices.

- Increased insurance premiums or difficulty obtaining insurance: Properties in high-risk areas face significantly higher insurance premiums, or may even be uninsurable, making them less attractive to potential buyers. This added cost can dramatically reduce a home's perceived value.

- Governmental restrictions and building codes impacting property value: Governments are implementing stricter building codes and regulations in climate-vulnerable areas, which can increase construction costs and limit property development, thus impacting existing property values.

- Examples of specific areas affected and the resulting value drops: Coastal communities experiencing increased flooding and inland areas facing heightened wildfire risk have seen significant drops in property values. For instance, studies have shown a correlation between proximity to wildfire-prone areas and a decrease in home value.

The Effect on Mortgage Applications and Approval

Lenders are increasingly incorporating climate risk into their mortgage application review processes. This means that properties in high-risk zones face increased scrutiny, potentially leading to higher interest rates, stricter lending criteria, or even outright denial of mortgage applications. The climate risk assessment is now a significant component of the creditworthiness evaluation.

- Increased scrutiny of properties in high-risk zones: Lenders are employing more sophisticated risk assessments, analyzing flood maps, wildfire risk models, and other climate-related data to determine the risk associated with a particular property.

- Higher interest rates or stricter lending criteria for properties in vulnerable areas: To offset the increased risk, lenders may charge higher interest rates or impose stricter lending criteria for mortgages on properties located in areas vulnerable to climate-related hazards.

- Potential denial of mortgage applications due to climate-related concerns: In extreme cases, lenders may completely deny mortgage applications for properties deemed too high-risk due to climate change impacts.

- The role of appraisal reports in assessing climate risk: Appraisal reports now frequently include assessments of climate risk, influencing the final property valuation and impacting the lender's decision-making process.

Rising Home Insurance Costs and Credit Scores

The rising cost of home insurance in high-risk areas directly impacts homebuyers' credit scores. Difficulty obtaining affordable insurance can affect debt-to-income ratios, and late or missed payments can severely damage creditworthiness. Understanding the interconnectedness of home insurance, debt, and credit scores is critical.

- Difficulty obtaining affordable home insurance in high-risk areas: In areas prone to flooding, wildfires, or other extreme weather events, obtaining affordable home insurance can be extremely challenging, if not impossible.

- Impact of high insurance premiums on debt-to-income ratios: High insurance premiums increase monthly expenses, potentially impacting a homebuyer's debt-to-income ratio, a crucial factor in mortgage approval.

- How unpaid or late insurance payments can negatively affect credit scores: Failure to pay insurance premiums on time can result in negative marks on credit reports, significantly lowering credit scores.

- The role of insurance scores in the overall credit profile: Insurance scores, which factor into insurance premiums, are increasingly being considered by lenders as part of a broader credit assessment.

Protecting Your Credit Score in a Changing Climate

Proactive measures can help homebuyers mitigate climate risk and protect their credit scores. Careful planning and informed decision-making are key to navigating the challenges posed by climate change.

- Researching properties in low-risk areas: Thoroughly research potential properties and their susceptibility to climate-related hazards using resources like flood maps and wildfire risk assessments.

- Understanding flood and wildfire insurance options: Explore various insurance options and understand the coverage available to protect your investment from climate-related risks.

- Maintaining a healthy credit score before applying for a mortgage: A strong credit score significantly improves your chances of mortgage approval, even when considering properties in higher-risk areas.

- Seeking professional advice from financial advisors and real estate agents: Consult with professionals experienced in navigating the complexities of climate risk and its impact on real estate transactions.

Conclusion

Climate risk significantly impacts property values, mortgage approvals, and home insurance costs, all of which can negatively affect a homebuyer's credit score. Understanding the impact of climate risk on homebuyers' credit scores is crucial for making informed decisions. Thoroughly research potential properties, obtain appropriate insurance, and maintain a strong credit profile to protect your financial future. Explore resources like FEMA flood maps and credit score improvement guides to ensure you are well-prepared before making significant real estate investments.

Featured Posts

-

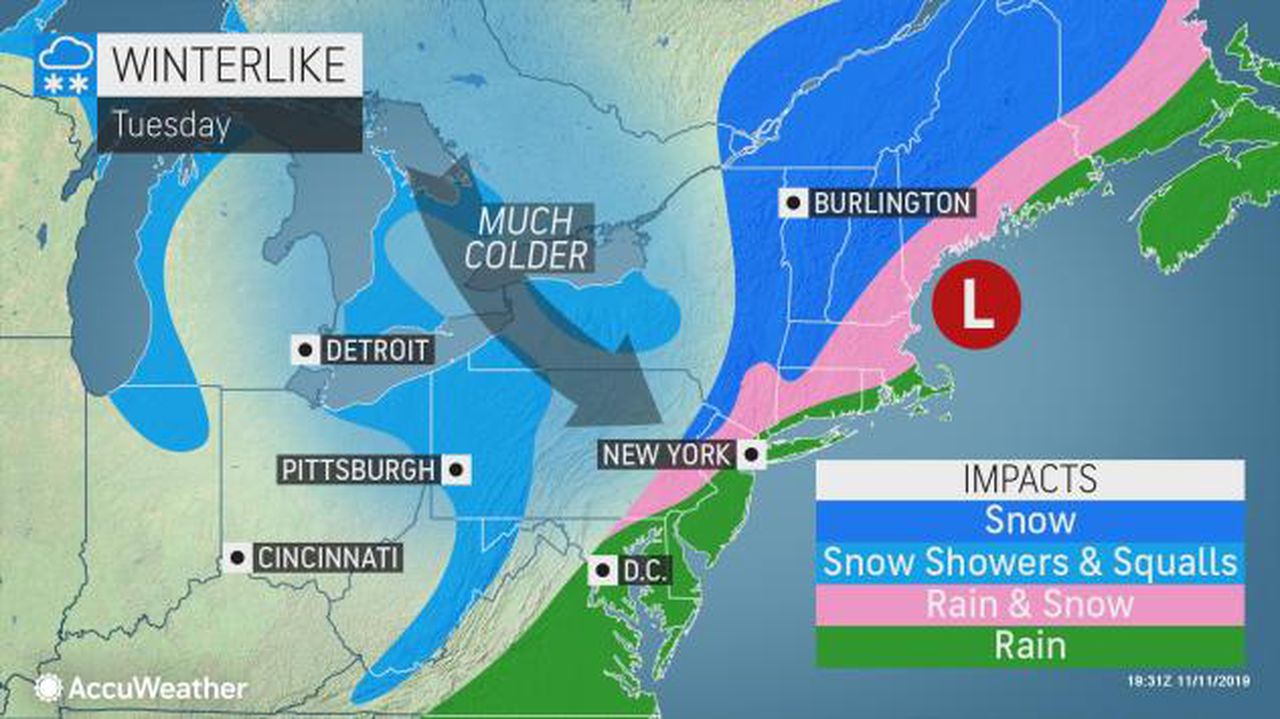

Wintry Mix Of Rain And Snow What To Expect

May 21, 2025

Wintry Mix Of Rain And Snow What To Expect

May 21, 2025 -

Bbai Stockholders Potential Legal Action Contact Gross Law Firm By June 10 2025

May 21, 2025

Bbai Stockholders Potential Legal Action Contact Gross Law Firm By June 10 2025

May 21, 2025 -

Noumatrouff Programmation Hellfest Mulhouse

May 21, 2025

Noumatrouff Programmation Hellfest Mulhouse

May 21, 2025 -

Enjoy Mild Temperatures And A Low Chance Of Rain This Week

May 21, 2025

Enjoy Mild Temperatures And A Low Chance Of Rain This Week

May 21, 2025 -

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025

Echo Valley Images A First Look At The Sydney Sweeney And Julianne Moore Thriller

May 21, 2025

Latest Posts

-

Jalkapallo Kamara Ja Pukki Sivussa Avauskokoonpanosta

May 21, 2025

Jalkapallo Kamara Ja Pukki Sivussa Avauskokoonpanosta

May 21, 2025 -

Kaellmanin Ja Hoskosen Puola Ura Paeaettyi

May 21, 2025

Kaellmanin Ja Hoskosen Puola Ura Paeaettyi

May 21, 2025 -

Jacob Friisin Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihdossa

May 21, 2025

Jacob Friisin Avauskokoonpano Julkistettu Kamara Ja Pukki Vaihdossa

May 21, 2025 -

Jalkapallo Kaellman Ja Hoskonen Pois Puolalaisseurasta

May 21, 2025

Jalkapallo Kaellman Ja Hoskonen Pois Puolalaisseurasta

May 21, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 21, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuran

May 21, 2025