The Impact Of Trump Tariffs On Fintech IPOs: A Deep Dive Into Affirm Holdings' Experience

Table of Contents

The Macroeconomic Landscape During Affirm's IPO

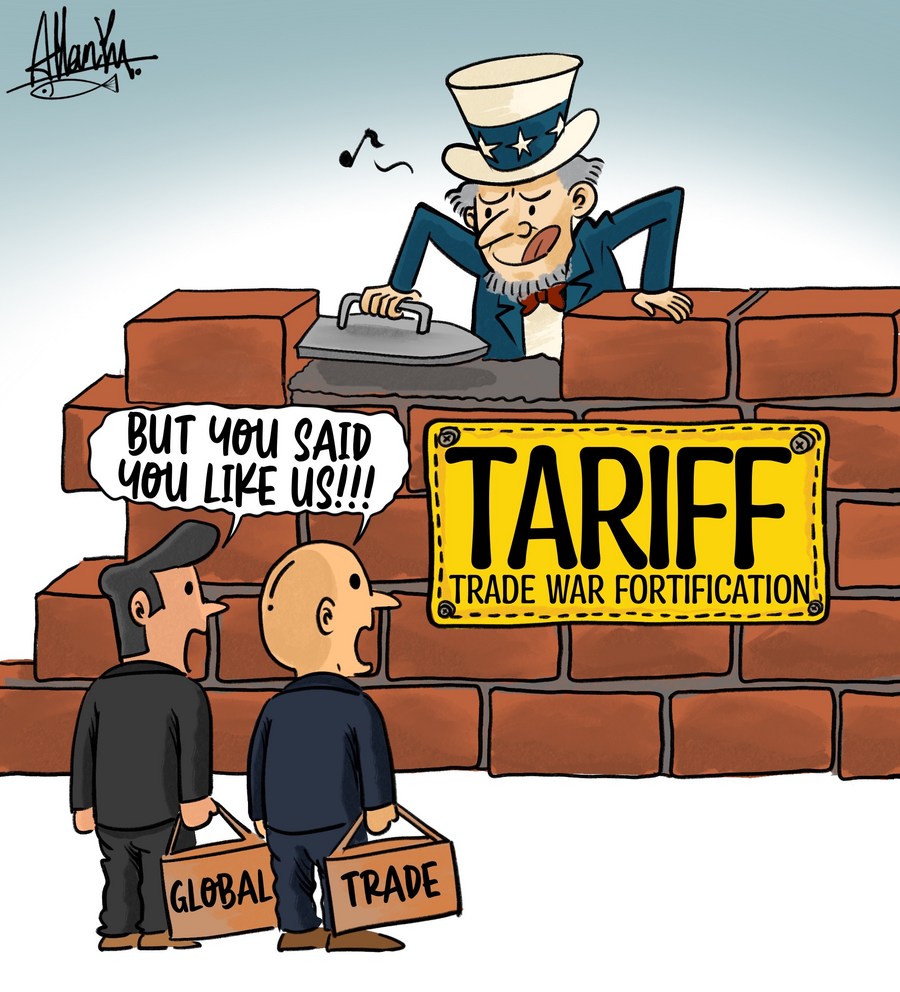

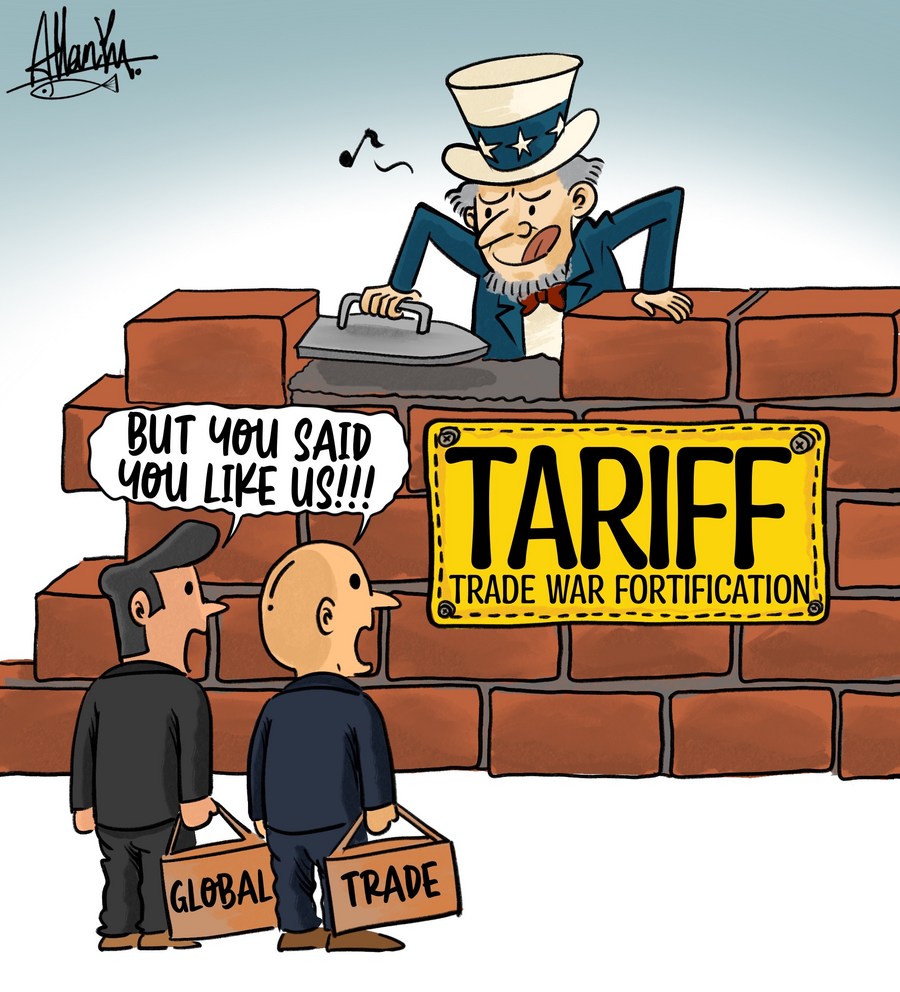

Global Trade Tensions and Tariffs

The Trump administration implemented a series of tariffs on goods imported from various countries, primarily China. These tariffs, ranging from a few percent to as high as 25%, significantly impacted global supply chains. The resulting trade war created a ripple effect across the global economy:

- Increased Costs: Businesses faced higher input costs due to tariffs on imported materials and components.

- Supply Chain Disruptions: Tariffs led to delays and uncertainty in global supply chains, impacting production and delivery timelines.

- Inflationary Pressures: Increased import costs contributed to inflation, impacting consumer spending and overall economic growth.

- Market Volatility: The uncertainty surrounding trade policy created significant volatility in global financial markets, influencing investor sentiment and impacting investment decisions.

For example, tariffs on steel and aluminum impacted manufacturers reliant on these materials, while tariffs on technology components affected the electronics and semiconductor industries. Inflation in the US reached levels not seen in decades during this period. Market volatility was significantly higher than in previous years, as investors grappled with uncertainty.

The Fintech Sector's Vulnerability to Macroeconomic Shifts

Fintech companies, often reliant on consumer spending and access to capital, are inherently sensitive to macroeconomic shifts. The Trump tariffs created a challenging environment:

- Reduced Consumer Spending: Inflation and economic uncertainty led to reduced consumer discretionary spending, potentially impacting the growth of businesses like Affirm that rely on consumer credit.

- Increased Interest Rates: As a response to inflation, central banks often increase interest rates. Higher interest rates increase borrowing costs for Fintech companies and can reduce the attractiveness of their products to consumers.

- Supply Chain Disruptions: Fintech firms, while less directly impacted than manufacturers, might still experience supply chain issues relating to software components or data center infrastructure.

- Funding Challenges: Economic uncertainty and market volatility can make it more difficult for Fintech companies to secure funding through venture capital or debt financing, impacting their growth trajectories.

During this period, fintech funding rounds experienced a degree of slowdown, while IPO activity also saw some contraction compared to earlier periods of rapid growth. Market valuations of publicly traded Fintech companies also experienced fluctuations reflecting the overall market uncertainty.

Direct and Indirect Impacts of Tariffs on Affirm's Business

Direct Impact

While Affirm's primary business – providing point-of-sale financing – doesn't directly involve the import or export of physical goods in a large way, indirect impacts were still considerable. It's unlikely Affirm faced substantial direct tariff impacts on its operations. Its supply chain is primarily focused on software development, data processing, and customer service. However, a potential indirect impact could relate to the cost of cloud services, some components of which may be sourced internationally and could potentially have been affected by tariffs.

- Software and Infrastructure: Costs associated with cloud services or server hardware might have been affected, although the degree of impact is likely to be minor compared to other sectors.

- Minimal Direct Tariff Exposure: The relatively small direct impact is notable, highlighting that the indirect economic consequences were more significant.

Detailed analysis of Affirm’s financial statements would be needed to definitively quantify any direct cost increases due to tariffs.

Indirect Impact

The indirect effects of tariffs on Affirm were more significant than any direct ones. These include:

- Reduced Consumer Spending: Reduced consumer discretionary income due to inflation and economic uncertainty likely decreased demand for Affirm's Buy Now, Pay Later services.

- Investor Sentiment: Negative market sentiment and uncertainty surrounding the trade war could have impacted investor confidence in Affirm's IPO.

- Market Conditions: Overall market volatility during the period of tariff implementation likely affected Affirm's IPO valuation and subsequent stock price performance.

Analyzing Affirm's financial performance around its IPO and comparing it to broader market trends reveals the likely influence of these indirect factors. Its stock price performance in the initial post-IPO period would be a crucial metric to consider in this regard.

Affirm's IPO Performance in the Context of Trade Uncertainty

IPO Pricing and Market Reception

Affirm's IPO was conducted during a period of significant macroeconomic uncertainty driven, in part, by the trade war. Understanding how this uncertainty influenced the pricing and market reception of the IPO is crucial.

- IPO Valuation: The initial valuation of Affirm at its IPO reflected investors’ assessment of its long-term prospects, balanced against the risk of a less favorable economic environment.

- Market Reaction: The initial day's trading and the subsequent stock price performance would directly indicate the level of investor confidence in Affirm despite the macroeconomic headwinds.

- Share Offering: The number of shares offered and the price per share would reflect the company's and its underwriters’ assessment of market conditions.

Specific figures regarding Affirm's IPO pricing, the number of shares offered, and its first-day trading performance would be needed for a more complete analysis.

Investor Sentiment and Risk Assessment

Investor sentiment towards Affirm during its IPO was undoubtedly influenced by the prevailing trade uncertainty.

- Risk Factors: Affirm's IPO prospectus likely included risk factors related to macroeconomic uncertainty, including the potential impact of tariffs on its business.

- Analyst Reports: Analyst reports and news articles from the period would have reflected investor concerns about the impact of tariffs and the broader economic climate on Affirm's prospects.

- Competitive Landscape: The overall health and investment sentiment within the broader Fintech industry would further contribute to investors’ assessment of Affirm's risks and opportunities.

Examining these factors alongside Affirm's financial projections and statements provides a comprehensive understanding of how investor sentiment interacted with the broader macroeconomic conditions.

Conclusion: Synthesizing the Impact of Trump Tariffs on Fintech IPOs – Lessons from Affirm Holdings

Our analysis of Affirm Holdings' IPO reveals a complex interplay between global trade policy and the performance of Fintech companies. While Affirm's direct exposure to tariffs was likely minimal, the indirect effects—including reduced consumer spending, increased market volatility, and altered investor sentiment—were significant. This case study highlights the challenge of isolating the precise impact of macroeconomic factors like tariffs on individual company performance. The success of an IPO during periods of economic uncertainty is never solely determined by one factor, but rather through a combination of internal company performance and broader market and investor sentiment.

Key Takeaways: The Trump-era tariffs impacted Affirm's IPO indirectly through macroeconomic channels, primarily influencing consumer spending and investor sentiment. Assessing the precise impact requires disentangling these indirect effects from other concurrent factors affecting the Fintech market.

Broader Implications: This analysis offers valuable insights for other Fintech companies contemplating IPOs during periods of economic or geopolitical uncertainty. Thorough risk assessment, considering potential direct and indirect impacts of global events, is crucial.

Want to learn more about how geopolitical factors influence Fintech IPO success? Continue your research by exploring relevant financial news sources and analyzing the IPOs of other companies during similar periods of macroeconomic uncertainty.

Featured Posts

-

Stream Every Mission Impossible Movie Your Complete Guide

May 14, 2025

Stream Every Mission Impossible Movie Your Complete Guide

May 14, 2025 -

Analyzing The Potential Of Dean Huijsen At Barcelona

May 14, 2025

Analyzing The Potential Of Dean Huijsen At Barcelona

May 14, 2025 -

Expulsion Oqtf Deux Collegiens Et Leur Mere Separes De Leurs Amis

May 14, 2025

Expulsion Oqtf Deux Collegiens Et Leur Mere Separes De Leurs Amis

May 14, 2025 -

Liverpool Transfer News Focus On Dean Huijsen From Bournemouth

May 14, 2025

Liverpool Transfer News Focus On Dean Huijsen From Bournemouth

May 14, 2025 -

I Os 19 Revolutionizing Battery Life With Ai

May 14, 2025

I Os 19 Revolutionizing Battery Life With Ai

May 14, 2025