The Impact Of Trump's First 100 Days On Elon Musk's Net Worth

Table of Contents

Regulatory Changes and Their Ripple Effect on Tesla's Stock

Trump's early policy decisions, particularly regarding environmental regulations and tax policies, had a significant, albeit complex, effect on Tesla's stock price and, consequently, Elon Musk's net worth.

Easing of Environmental Regulations

The Trump administration's stated intention to roll back Obama-era environmental regulations created both opportunities and uncertainties for Tesla. While some argued that loosened regulations could lower production costs, others worried about the potential weakening of incentives for electric vehicle adoption.

- Specific examples: Proposed changes to fuel efficiency standards and the Clean Power Plan were key areas of concern and impacted investor sentiment.

- Market reactions: The stock market's response was mixed, with periods of both gains and losses reflecting the uncertainty surrounding the long-term effects of these regulatory changes on Tesla's market position.

- Expert opinions: Analysts offered varied opinions, with some predicting a boost to Tesla's competitiveness due to reduced regulatory burdens and others cautioning about potential damage to the brand's image as an environmentally conscious company.

- Data points: A thorough analysis of Tesla's stock price during this period, correlating price movements with specific regulatory announcements, would illustrate the market's reaction. For example, a graph showing Tesla's stock performance from inauguration day to day 100, overlaid with key regulatory announcements, would offer valuable insights.

Tax Policy Shifts

Proposed changes to corporate tax rates under Trump also influenced Tesla's profitability and Musk's wealth. Lower corporate tax rates, if implemented, could have increased Tesla's net income, thus boosting its stock price and Musk's net worth.

- Details about the tax proposals: The specifics of the proposed tax cuts, including the corporate tax rate reduction and potential changes to deductions, are crucial to understanding the potential impact.

- Implications for Tesla's business model: Analyzing how these tax changes could affect Tesla's capital investment strategies and long-term profitability is essential. Did lower taxes lead to increased investment in research and development or expansion?

- Stock market response: Tracking Tesla's stock performance in relation to announcements about tax policy reveals investor confidence levels tied to these changes.

- Data points: Charts illustrating Tesla's stock performance alongside announcements concerning corporate tax rate changes are key to demonstrating this correlation.

The Broader Economic Climate and its Influence on Musk's Businesses

The overall economic climate during Trump's first 100 days significantly impacted consumer demand for Tesla vehicles and SpaceX services, indirectly influencing Musk's net worth.

Economic Growth and Consumer Confidence

Trump's early economic policies aimed to stimulate growth through deregulation and tax cuts. Increased consumer confidence, in theory, should have boosted sales of luxury goods like Tesla vehicles.

- Indicators of economic growth: Analyzing GDP growth, job creation numbers, and consumer spending data from this period provides context for Tesla's sales figures.

- Link to Tesla's sales and SpaceX contracts: A correlation between economic indicators and Tesla's sales during this time would reveal the impact of the economic climate on Musk's businesses. SpaceX's success in securing contracts might also be influenced by broader economic confidence.

- Data points: Presenting sales figures for Tesla vehicles and SpaceX contracts alongside relevant economic data (GDP growth, consumer confidence index) would provide a compelling visual representation of this relationship.

Geopolitical Factors and International Trade

Trump's early foreign policy decisions, including renegotiations of trade deals, could have impacted Tesla's international operations and SpaceX's global ambitions.

- Specific international trade policies: Identifying policies relevant to Tesla's supply chains and international sales (e.g., potential tariffs on imported materials or changes to trade agreements) is critical.

- Impacts on Tesla’s supply chains or international sales: Analyzing how trade policies affected Tesla's production costs, international sales, and supply chain efficiency is key. Did any disruptions occur?

- Effects on Musk’s wealth: Any negative impacts on Tesla's international sales or supply chains would directly affect Musk's net worth.

- Data points: Statistics on Tesla's international sales, supply chain disruptions, and import/export data would strengthen the analysis.

Public Sentiment and Media Coverage's Role

Public opinion and media coverage played a crucial role in shaping investor sentiment towards Tesla and SpaceX, indirectly affecting Musk's net worth.

Trump's Tweets and their Impact

Trump's public statements, especially his tweets, could have directly impacted Tesla's stock price and public perception of the company.

- Examples of Trump's comments or tweets: Analyzing specific instances where Trump mentioned Tesla or Musk allows assessment of the market's response.

- Media responses and market reaction: Tracking media coverage following Trump's statements shows how public opinion influenced the stock market.

- Data points: Stock price fluctuations immediately following significant statements by Trump would illustrate the direct impact of his words.

Overall Media Narrative

The overall media narrative surrounding the Trump administration and its economic policies influenced investor confidence in Tesla and SpaceX.

- Prevailing media sentiment: Assessing the prevailing media sentiment toward the Trump administration and its impact on the economy helps to determine whether this overall sentiment influenced investor decisions regarding Tesla and SpaceX.

- Correlation with stock market trends: Analyzing whether positive or negative media narratives correlated with increases or decreases in Tesla’s stock price is critical.

- Data points: Illustrating public opinion polls and survey data alongside Tesla stock performance would visually represent this correlation.

Conclusion: Unraveling the Complex Relationship Between Trump's Presidency and Elon Musk's Fortune

The impact of Trump's first 100 days on Elon Musk's net worth was multifaceted. Regulatory changes, economic shifts, and public sentiment all played a role, creating a complex interplay of positive and negative influences. While some policies might have potentially benefited Tesla through tax cuts or deregulation, other factors, such as fluctuating consumer confidence and geopolitical uncertainties, could have had a negative impact. The influence of Trump's public statements and the overall media narrative further complicated this relationship. Understanding this intricate dance between political events and the fortunes of high-profile business figures requires further investigation. To delve deeper into this fascinating relationship, we encourage you to continue researching the impact of Trump's policies on Elon Musk's net worth and the effects of Trump's first 100 days on Tesla and SpaceX. Further reading on "The Impact of Trump's Policies on Elon Musk's Net Worth" and "Trump's First 100 Days and its effect on Tesla" will provide a more comprehensive understanding of this complex issue.

Featured Posts

-

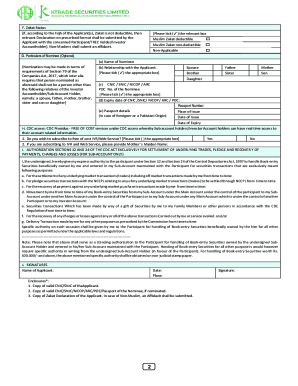

Jazz Cash And K Trade A New Era Of Accessible Stock Trading

May 09, 2025

Jazz Cash And K Trade A New Era Of Accessible Stock Trading

May 09, 2025 -

Go Compare Drops Wynne Evans Following Mail On Sundays Sex Slur Report

May 09, 2025

Go Compare Drops Wynne Evans Following Mail On Sundays Sex Slur Report

May 09, 2025 -

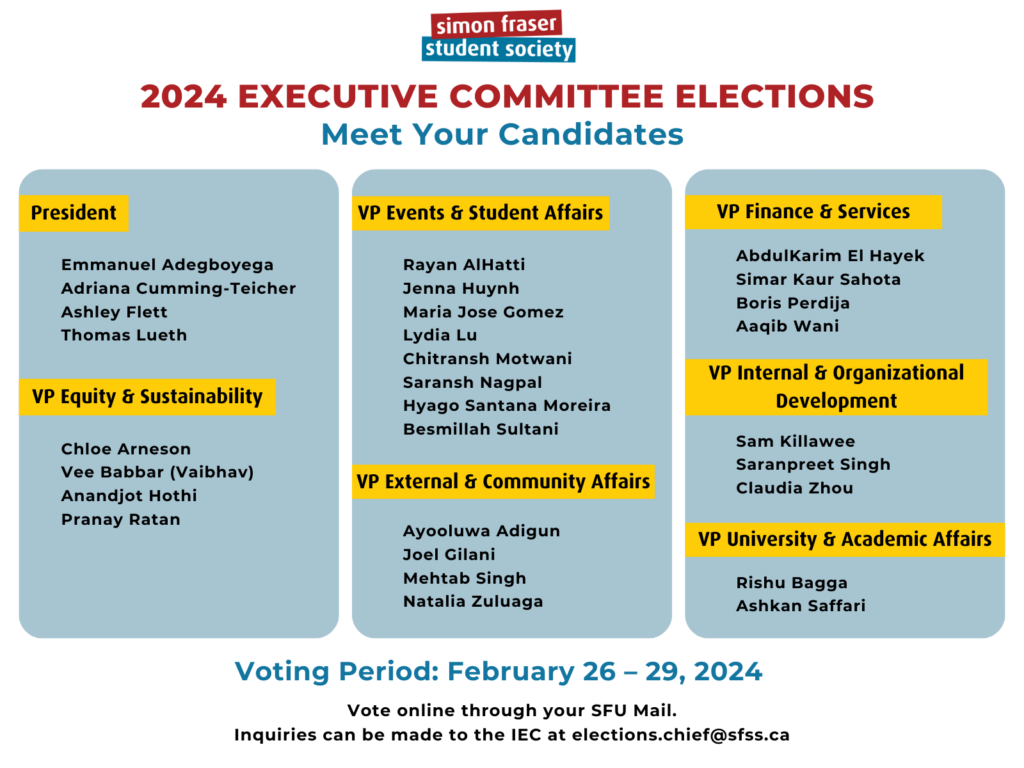

Nl Federal Election Candidate Profiles And Platforms

May 09, 2025

Nl Federal Election Candidate Profiles And Platforms

May 09, 2025 -

9 Maya Bez Makrona Starmera Mertsa I Tuska Kiev Ostanetsya Bez Vazhnykh Gostey

May 09, 2025

9 Maya Bez Makrona Starmera Mertsa I Tuska Kiev Ostanetsya Bez Vazhnykh Gostey

May 09, 2025 -

1 420

May 09, 2025

1 420

May 09, 2025