The Looming Bond Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The relationship between interest rates and bond prices is inverse. This means that as interest rates rise, bond prices generally fall, and vice versa. This is because newly issued bonds will offer higher yields, making existing bonds with lower yields less attractive. This impact is felt most acutely on longer-term bonds due to their higher duration. Rising interest rates significantly impact existing bond portfolios:

- Higher interest rates make new bonds more attractive: Investors seeking higher returns will gravitate towards newer bonds offering better yields.

- Existing bonds lose value as their yields become less competitive: The market price of your existing bonds will adjust downwards to reflect the new, higher interest rate environment. This creates interest rate risk.

- The risk of capital loss increases for bondholders: If you need to sell your bonds before maturity, you may face a loss of principal. This reinvestment risk also necessitates careful planning for future cash flows.

Understanding bond yield and its sensitivity to interest rate changes is crucial for mitigating losses. Investors must carefully consider the duration of their bond holdings to assess their vulnerability to interest rate fluctuations.

Inflation's Squeeze on Bond Returns

Inflation erodes the purchasing power of money, and this effect is keenly felt by bondholders. Unexpectedly high inflation puts significant pressure on bond yields and prices. When inflation rises faster than the yield on a bond, the real return – the return after accounting for inflation – becomes negative.

- Inflation reduces the real return on bonds: If inflation is 5% and your bond yields 3%, your real return is -2%.

- Investors demand higher yields to compensate for inflation: This pushes bond prices down as investors seek higher returns to offset inflation.

- Central bank actions to combat inflation can negatively impact bond markets: Aggressive interest rate hikes aimed at curbing inflation can cause a sharp decline in bond prices, creating significant inflation risk.

To protect against this, consider investing in inflation-protected securities (TIPS), which adjust their principal value to reflect inflation, thus safeguarding your purchasing power. Closely monitoring the real yield of your bonds is crucial for gauging their true return in the face of inflation.

Assessing the Risk of Default

The risk of a bond issuer failing to make its interest payments or repay the principal (default risk) is a significant concern, especially during economic downturns. Government debt levels, economic growth prospects, and the issuer's financial health all contribute to the likelihood of default.

- Importance of credit ratings (e.g., Moody's, S&P, Fitch): Credit ratings provide an independent assessment of a bond's creditworthiness. Higher ratings indicate lower default risk.

- Analyzing a bond issuer's financial statements: Scrutinize financial statements to assess the issuer's profitability, debt levels, and cash flow.

- Diversification to mitigate default risk: Spreading investments across different issuers and sectors reduces the impact of a single default. A sovereign debt crisis, for instance, highlights the importance of geographical diversification. Analyzing high-yield bonds, often associated with greater credit risk, requires careful consideration.

Understanding credit risk and employing sound due diligence are essential to managing default risk.

Strategies for Navigating a Potential Bond Crisis

Proactive portfolio management is crucial for weathering a potential bond crisis. Several strategies can help protect your investments:

- Shifting to shorter-term bonds: Shorter-term bonds are less sensitive to interest rate changes than longer-term bonds.

- Investing in inflation-protected securities (TIPS): TIPS offer protection against inflation, preserving the real value of your investments.

- Considering alternative investments (e.g., real estate, commodities): Diversifying beyond traditional bonds can reduce overall portfolio risk.

- Rebalancing your portfolio regularly: Rebalancing ensures your portfolio remains aligned with your risk tolerance and investment objectives. This aspect of risk management is vital.

Implementing a robust bond strategy that incorporates these elements can significantly improve your ability to navigate market volatility. This includes improving your portfolio diversification and embracing defensive investing principles.

Conclusion

A potential bond crisis presents significant risks, including capital losses due to rising interest rates and inflation, as well as the potential for defaults. However, by understanding these risks and employing proactive strategies such as diversifying your portfolio, shifting to shorter-term bonds, and considering alternative investments, you can mitigate the impact on your investments. Don't wait for the looming bond crisis to impact your investments. Consult with a financial advisor today to develop a robust bond strategy tailored to your specific needs and risk tolerance, ensuring you are effectively managing bond market risks and preparing for a potential bond market downturn.

Featured Posts

-

Leaving California A Reflection On The American Dream

May 28, 2025

Leaving California A Reflection On The American Dream

May 28, 2025 -

Cuaca Bali Besok Denpasar Diprediksi Hujan

May 28, 2025

Cuaca Bali Besok Denpasar Diprediksi Hujan

May 28, 2025 -

Are Taylor Swifts Easter Eggs Pointing To A Big Memorial Day Ama Announcement

May 28, 2025

Are Taylor Swifts Easter Eggs Pointing To A Big Memorial Day Ama Announcement

May 28, 2025 -

Stay Updated The Latest On Nicolas Anelka

May 28, 2025

Stay Updated The Latest On Nicolas Anelka

May 28, 2025 -

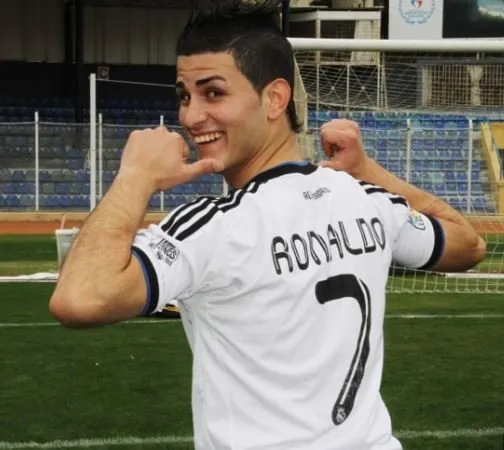

Cok Cirkinsin Diyen Ronaldoya Adanali Ronaldodan Net Bir Yanit

May 28, 2025

Cok Cirkinsin Diyen Ronaldoya Adanali Ronaldodan Net Bir Yanit

May 28, 2025