The Looming Bond Market Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact on Bond Values

The inverse relationship between interest rates and bond prices is a fundamental principle of fixed income investing. When interest rates rise, the yields on newly issued bonds increase, making existing bonds with lower coupon payments less attractive. This leads to a decline in the price of existing bonds to match the higher prevailing yields. The Federal Reserve's monetary policy plays a crucial role in this dynamic. By raising the federal funds rate, the Fed increases borrowing costs throughout the economy, directly impacting bond yields.

- Higher interest rates lead to lower bond prices. As interest rates climb, the present value of a bond's future cash flows decreases, resulting in a lower market price.

- Existing bonds become less attractive compared to newly issued bonds with higher yields. Investors seeking higher returns will naturally gravitate towards newer bonds offering more competitive yields.

- The risk of capital losses increases for bondholders. In a rising interest rate environment, bondholders face the risk of significant capital losses if they need to sell their bonds before maturity.

For instance, the recent aggressive rate hikes by the Federal Reserve have already caused significant declines in the prices of long-term Treasury bonds and corporate bonds. Investors holding these bonds have experienced substantial capital losses.

Inflation's Erosive Effect on Bond Returns

High inflation significantly diminishes the real return on bond investments. Inflation erodes the purchasing power of future bond payments, reducing the real value of the investment. Unexpected inflation spikes can trigger a sell-off in the bond market as investors demand higher yields to compensate for the increased inflation risk.

- Inflation reduces the purchasing power of future bond payments. If inflation is higher than the bond's yield, the investor's real return is negative.

- Investors demand higher yields to compensate for inflation risk. This increased demand for higher yields pushes bond prices down.

- High inflation can trigger a sell-off in the bond market. As investors flee to protect their capital from inflation, bond prices can plummet.

The current elevated inflation rate is a major concern for bond investors. Data showing inflation consistently exceeding expectations has led to a significant decline in the real return on many bond investments, impacting everything from government bonds to corporate debt.

Geopolitical Risks and Their Influence on the Bond Market

Geopolitical events, such as wars, political instability, and trade disputes, introduce significant uncertainty into the bond market. These events can trigger a "flight-to-safety," where investors flock to perceived safe-haven assets like government bonds, driving up their prices and lowering their yields. Conversely, heightened uncertainty can also lead to increased volatility and unpredictable price swings across the bond market.

- Increased uncertainty leads to higher demand for safe-haven assets like government bonds. This increased demand can push prices of these bonds higher and yields lower.

- Geopolitical risks can cause volatility and unpredictable price swings. The market reacts swiftly to unexpected events, leading to sharp price fluctuations.

- Diversification across different bond types and geographies is crucial. This strategy can help mitigate the impact of specific geopolitical risks.

The ongoing war in Ukraine, for example, has significantly impacted global bond markets, creating uncertainty and driving investors towards safer investments.

Strategies for Navigating a Bond Market Crisis

Proactive portfolio management is essential for navigating a potential bond market crisis. Investors should consider several strategies to mitigate the risks associated with rising interest rates, inflation, and geopolitical uncertainties.

- Shorten the duration of your bond portfolio to reduce interest rate risk. Shorter-term bonds are less sensitive to interest rate changes.

- Diversify across different sectors and geographies. This diversification can help to reduce the overall risk of your bond portfolio.

- Consider inflation-protected securities (TIPS). TIPS offer protection against inflation by adjusting their principal based on the inflation rate.

- Rebalance your portfolio regularly. This ensures your portfolio remains aligned with your risk tolerance and investment objectives.

Consulting with a qualified financial advisor is highly recommended to develop a personalized strategy tailored to your specific financial situation and risk tolerance.

Conclusion

The confluence of rising interest rates, persistent inflation, and ongoing geopolitical risks presents significant challenges to the bond market. A potential bond market crisis is a real possibility, demanding careful consideration from investors. Understanding these threats and actively managing your bond portfolio is crucial to mitigating potential losses. Prepare for a potential bond market crisis by carefully evaluating your current bond holdings, diversifying your investments, and considering the strategies outlined above to protect your bond portfolio. To understand the risks in the bond market and to take the necessary steps to safeguard your investments, consult with a financial advisor today. [Link to financial advisor finder or relevant resource]

Featured Posts

-

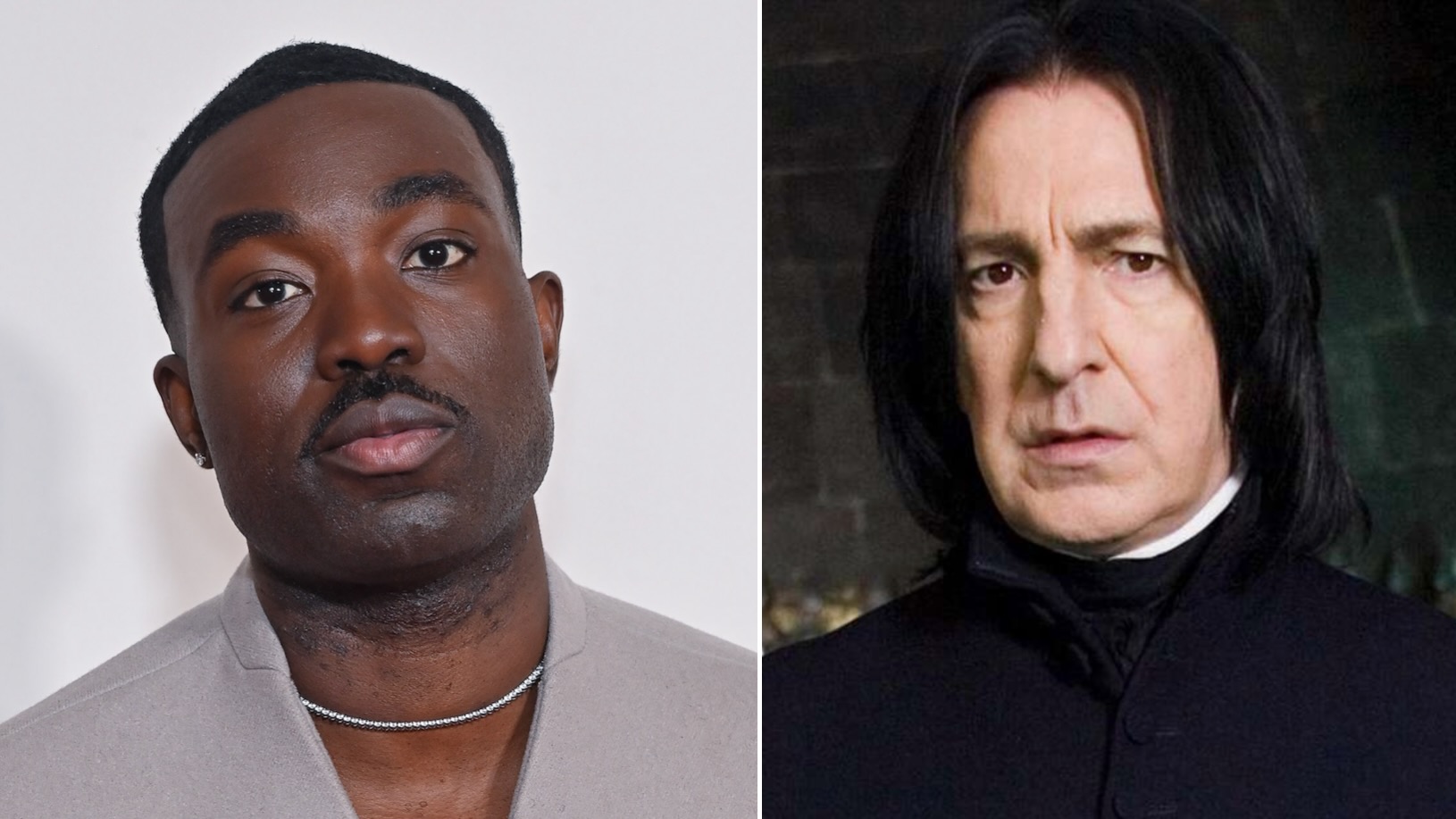

New Harry Potter Tv Series Casting News For Lead Roles

May 29, 2025

New Harry Potter Tv Series Casting News For Lead Roles

May 29, 2025 -

Arcane Coldplay Stromae Et Pomme Interpretent Ma Meilleure Ennemie

May 29, 2025

Arcane Coldplay Stromae Et Pomme Interpretent Ma Meilleure Ennemie

May 29, 2025 -

Your Guide To Smooth Sailing Avoiding Traffic Jams In France This Weekend

May 29, 2025

Your Guide To Smooth Sailing Avoiding Traffic Jams In France This Weekend

May 29, 2025 -

Sorteo Escolar En Aragon 58 Colegios Afectados

May 29, 2025

Sorteo Escolar En Aragon 58 Colegios Afectados

May 29, 2025 -

The Allure Of A Winning Honda Motorcycle

May 29, 2025

The Allure Of A Winning Honda Motorcycle

May 29, 2025

Latest Posts

-

Constance Lloyd The Untold Story Of Oscar Wildes Wife And Her Sacrifice

May 31, 2025

Constance Lloyd The Untold Story Of Oscar Wildes Wife And Her Sacrifice

May 31, 2025 -

Rosita Sweetman Constance Lloyd Oscar Wildes Wife And The Cost Of His Fame

May 31, 2025

Rosita Sweetman Constance Lloyd Oscar Wildes Wife And The Cost Of His Fame

May 31, 2025 -

Plumber Makes Odd Find In Homeowners Basement

May 31, 2025

Plumber Makes Odd Find In Homeowners Basement

May 31, 2025 -

Womans Basement Holds A Surprise A Plumbers Unexpected Discovery

May 31, 2025

Womans Basement Holds A Surprise A Plumbers Unexpected Discovery

May 31, 2025 -

Unusual Basement Discovery Plumbers Strange Find During Home Visit

May 31, 2025

Unusual Basement Discovery Plumbers Strange Find During Home Visit

May 31, 2025