The Posthaste Threat: Unrest In The Global Bond Market

Table of Contents

Rising Interest Rates and Their Impact on Bond Yields

The inverse relationship between bond prices and interest rates is a fundamental principle of fixed-income investing. When interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive. This leads to a decrease in the price of existing bonds to match the market's new yield. Central bank policy plays a crucial role in this dynamic.

- Increased rates lead to lower bond prices: As central banks raise interest rates to combat inflation, the yields on newly issued bonds increase, causing the prices of existing bonds to fall.

- Investors seek higher yields in a rising rate environment: Investors constantly seek the best return for their risk. A rising rate environment incentivizes them to shift towards higher-yielding bonds, further depressing prices of existing lower-yielding bonds.

- This shift impacts long-term bond strategies: Long-term bonds are particularly susceptible to interest rate risk. Their prices can decline significantly when interest rates rise, impacting the overall return of long-term bond portfolios.

These effects differ across bond types. Government bonds, considered relatively safer, might experience less dramatic price drops than corporate bonds, whose yields reflect credit risk in addition to interest rate risk. Understanding this dynamic is crucial for managing a bond portfolio effectively, especially during periods of rising interest rates.

Geopolitical Uncertainty and its Influence on Bond Markets

Global events, from wars and political coups to trade disputes and terrorist attacks, significantly influence investor sentiment and the bond market. Uncertainty creates risk aversion, leading investors to seek safety.

- Safe-haven assets like US Treasuries often see increased demand: During times of geopolitical turmoil, investors flock to perceived safe-haven assets, such as US Treasury bonds, driving up their prices and lowering their yields.

- Emerging market bonds become more volatile: Bonds issued by countries in politically unstable regions experience heightened volatility as investors reassess their risk profiles.

- Increased risk premiums affect bond yields: Investors demand higher yields to compensate for the increased risk associated with geopolitical uncertainty, impacting overall bond market performance.

Geopolitical risk is a significant factor contributing to bond market volatility. Understanding and anticipating potential geopolitical events and their potential impact on different bond markets is essential for effective risk management.

Inflation's Persistent Pressure on Bond Returns

Inflation erodes the purchasing power of fixed-income investments. The relationship between inflation and bond yields is best understood by considering real versus nominal returns. Nominal return is the stated yield on a bond, while real return accounts for inflation. Unexpected inflation negatively impacts bond values.

- Inflation erodes the purchasing power of fixed-income investments: If inflation rises faster than the bond's yield, the investor's real return is reduced, diminishing the value of their investment.

- Central banks respond by raising interest rates, impacting bond prices: Central banks often combat inflation by increasing interest rates, leading to the downward pressure on bond prices as discussed previously.

- Investors demand higher yields to compensate for inflation risk: Investors will only invest in bonds offering yields that adequately compensate for the anticipated rate of inflation; otherwise, they risk losing purchasing power.

To mitigate inflation risk, investors might consider inflation-protected securities (TIPS), which adjust their principal based on inflation, or diversify into assets that historically perform well during inflationary periods.

Strategies for Navigating the Posthaste Threat in the Bond Market

Navigating the current volatile bond market requires a proactive and well-informed approach. Diversification and active management are key.

- Diversification strategies for bond portfolios: Diversify across different maturities (short-term, medium-term, long-term), credit ratings (high-grade, investment-grade, high-yield), and geographies to reduce overall portfolio risk.

- Active management in a volatile market: Active management allows for adjustments based on changing market conditions. This includes:

- Regular portfolio rebalancing: Maintain a desired asset allocation by periodically adjusting holdings.

- Careful selection of bond issuers: Thoroughly research the creditworthiness of bond issuers to mitigate default risk.

- Considering inflation-protected securities: Include TIPS or other inflation-hedged instruments to protect against inflation's eroding effect.

- Professional financial advice: A financial advisor can provide personalized guidance tailored to your risk tolerance and financial goals.

Conclusion:

The current unrest in the global bond market, presenting a significant "posthaste threat," demands careful consideration and proactive strategies. Rising interest rates, geopolitical uncertainty, and persistent inflation are creating a complex and challenging environment for investors. By understanding the interconnectedness of these factors and implementing a diversified, actively managed approach, investors can mitigate risk and potentially navigate this volatile market successfully. Don't wait for the posthaste threat to impact your portfolio; seek professional advice and develop a robust bond investment strategy tailored to your risk tolerance and financial goals. Learn more about mitigating the posthaste threat and protecting your bond investments today.

Featured Posts

-

Ezhednevnye Goroskopy I Predskazaniya

May 23, 2025

Ezhednevnye Goroskopy I Predskazaniya

May 23, 2025 -

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 23, 2025

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 23, 2025 -

Dylan Dreyer And Brian Fichera New Social Media Post Creates Buzz

May 23, 2025

Dylan Dreyer And Brian Fichera New Social Media Post Creates Buzz

May 23, 2025 -

Horoscope Predictions For April 14 2025 5 Lucky Zodiac Signs

May 23, 2025

Horoscope Predictions For April 14 2025 5 Lucky Zodiac Signs

May 23, 2025 -

The Making Of Alpha Tahar Rahims Performance And Ducournaus Vision

May 23, 2025

The Making Of Alpha Tahar Rahims Performance And Ducournaus Vision

May 23, 2025

Latest Posts

-

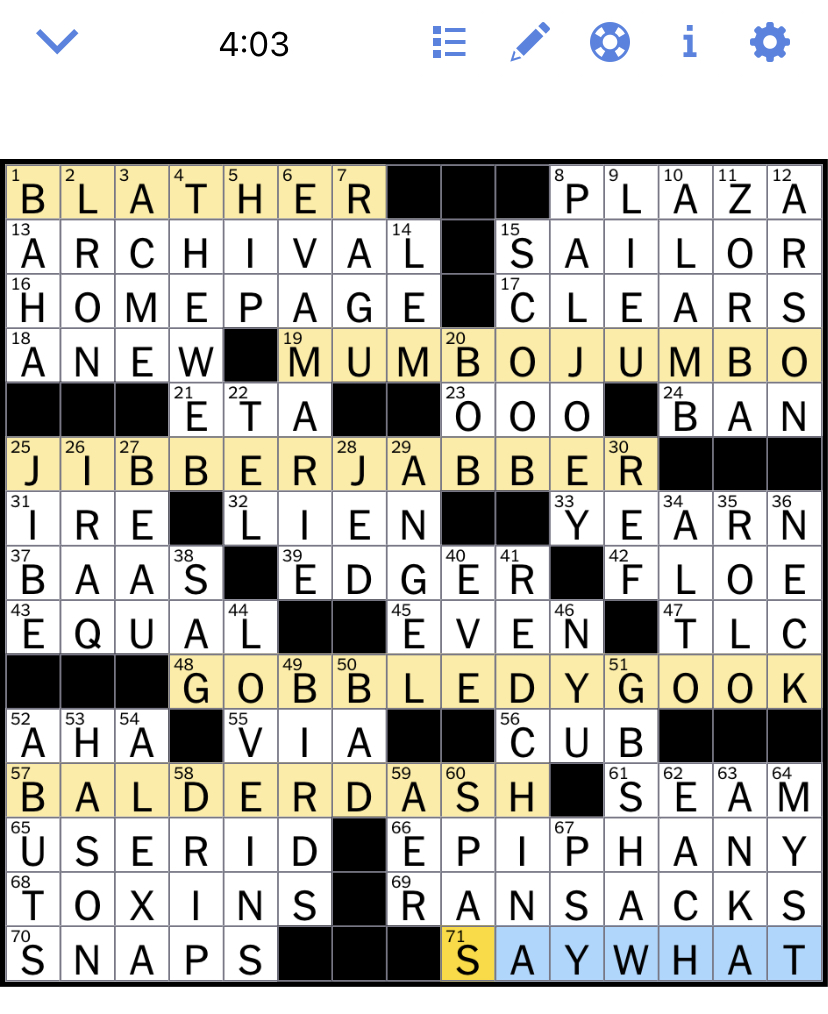

Nyt Mini Crossword March 6 2025 Complete Solution

May 23, 2025

Nyt Mini Crossword March 6 2025 Complete Solution

May 23, 2025 -

Nyt Mini Crossword Answers For March 6 2025

May 23, 2025

Nyt Mini Crossword Answers For March 6 2025

May 23, 2025 -

Nyt Mini Crossword March 13 2025 Hints To Help You Solve

May 23, 2025

Nyt Mini Crossword March 13 2025 Hints To Help You Solve

May 23, 2025 -

Just In Time Review Groffs Performance Makes This Bobby Darin Musical A Must See

May 23, 2025

Just In Time Review Groffs Performance Makes This Bobby Darin Musical A Must See

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025