The Power Of Simplicity: A High-Yield Dividend Strategy

Table of Contents

Understanding High-Yield Dividend Investing

High-yield dividend investing involves selecting stocks that pay out a substantial portion of their earnings as dividends, offering investors a higher income stream than traditional investments. The potential benefits are significant: a steady flow of income, the possibility of capital appreciation as the stock price increases, and the opportunity to reinvest dividends for compounding growth. However, it's crucial to understand the inherent risks.

High-yield dividend stocks are often more volatile than lower-yield counterparts. Companies paying high dividends might be facing financial difficulties, leading to potential dividend cuts or even bankruptcy. This increased volatility underscores the importance of careful due diligence.

Diversification is paramount in mitigating these risks. Don't put all your eggs in one basket! A diversified high-yield portfolio reduces your exposure to the potential failure of any single company.

- Higher income potential: Generate a substantial income stream exceeding that of low-yield investments.

- Capital appreciation: Benefit from potential increases in stock value alongside dividend income.

- Requires careful due diligence: Thorough research is essential to identify reliable, sustainable dividend payers.

- Dividend reinvestment: Reinvesting dividends accelerates wealth accumulation through the power of compounding.

Identifying Reliable High-Yield Dividend Stocks

Selecting the right high-yield dividend stocks is crucial for long-term success. Analyzing key financial metrics provides valuable insights into a company's ability to sustain its dividend payments.

Key metrics to consider include:

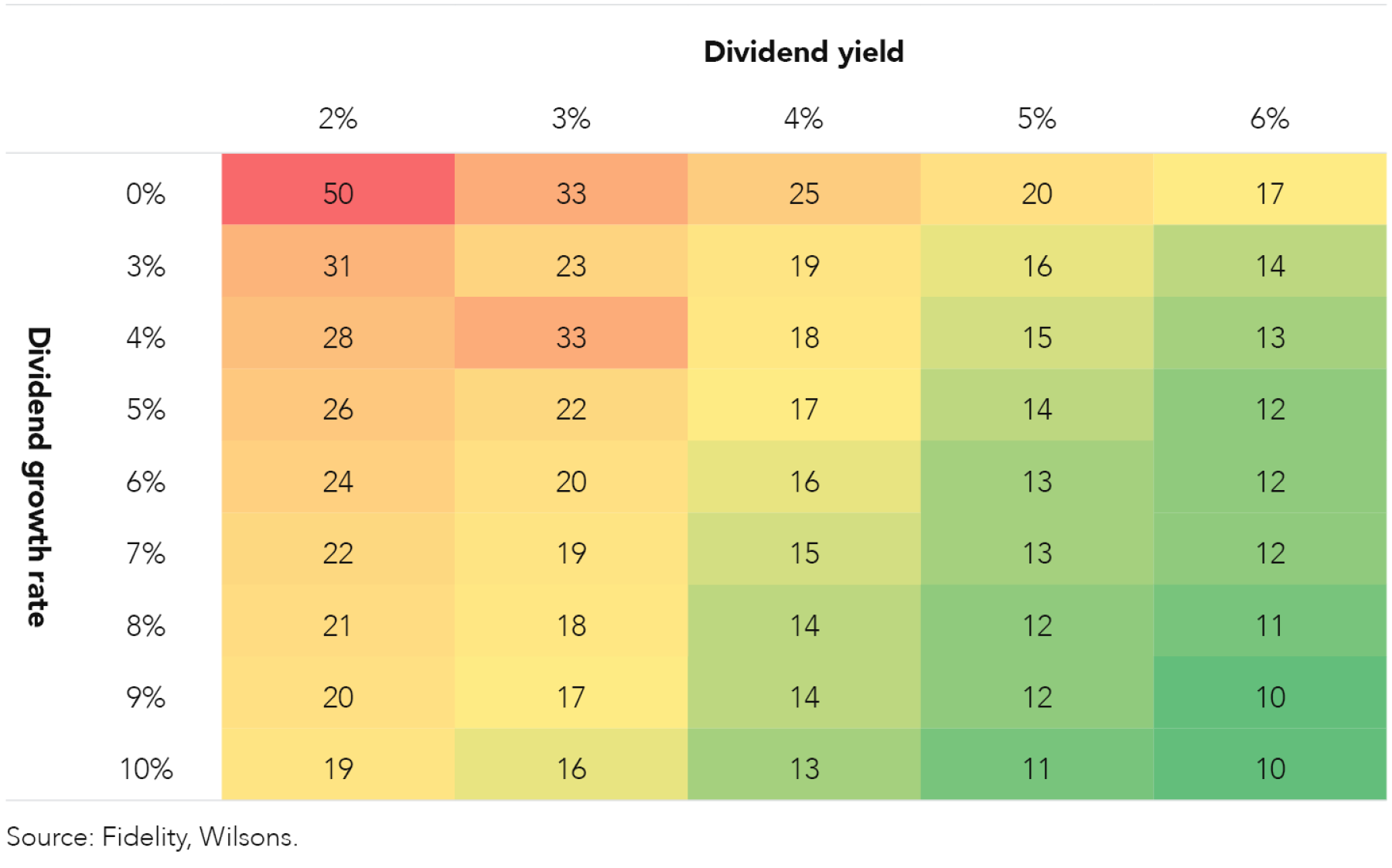

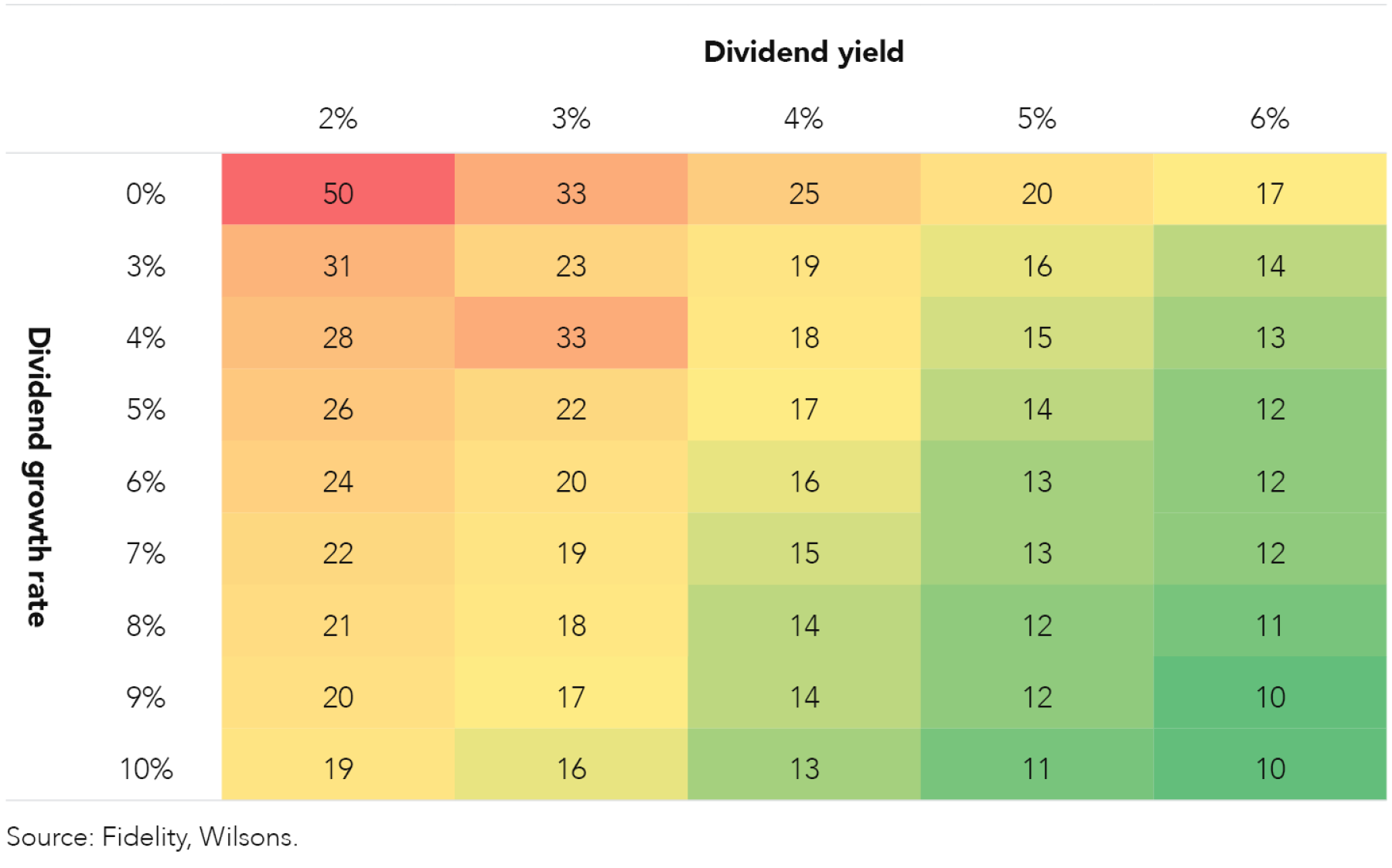

- Dividend yield: This represents the annual dividend payment relative to the stock price. A higher yield doesn't automatically mean better, as it could indicate higher risk. Compare the yield to industry averages and historical trends to gauge its sustainability.

- Payout ratio: This metric shows the percentage of earnings paid out as dividends. A high payout ratio (e.g., above 80%) might signal a lack of reinvestment in growth and future dividend sustainability. Aim for companies with a manageable payout ratio.

- Debt-to-equity ratio: High levels of debt can hinder a company's ability to maintain dividend payments. Analyze a company's balance sheet to assess its financial health and debt burden.

- Consistent dividend history: Prioritize companies with a long and consistent track record of dividend payments. This demonstrates financial stability and a commitment to returning value to shareholders.

Focus on established, large-cap companies. These companies tend to have more stable earnings and a greater capacity to maintain their dividend payouts, reducing the risk associated with high-yield investments.

- Analyze dividend yield: Benchmark against industry averages and historical data.

- Assess payout ratio: Ensure the company can comfortably sustain its dividend payments.

- Examine debt levels: High debt can severely impact future dividend payments.

- Research company history: Review past performance and future growth prospects thoroughly.

Building a Simple, Diversified Portfolio

A simple, well-diversified portfolio is more effective than a complex one. Rather than chasing numerous stocks, focus on a smaller number of carefully selected, high-yield dividend stocks. This simplifies management and allows for more in-depth research on each investment.

Diversification across different sectors is key to mitigating risk. Don't concentrate your investments in a single industry. Spread your holdings across sectors like real estate, utilities, consumer staples, and healthcare to reduce the impact of sector-specific downturns.

Exchange-Traded Funds (ETFs) and mutual funds offer a convenient way to diversify your portfolio instantly. These funds invest in a basket of stocks across various sectors, providing broad market exposure with minimal effort.

- Start small: Begin with 5-10 carefully researched high-yield dividend stocks.

- Diversify across sectors: Reduce risk by investing in different industries.

- Consider ETFs/Mutual Funds: Use these for easy diversification and broad market exposure.

- Regular review and rebalancing: Periodically adjust your portfolio to maintain your desired asset allocation.

The Importance of Long-Term Investing

The power of compounding is crucial for high-yield dividend investing. Consistent dividend reinvestment accelerates wealth growth over the long term. Patience is key; avoid emotional decision-making based on short-term market fluctuations. Focus on the long-term growth potential of your investments.

- Long-term perspective: Minimize the impact of short-term market volatility.

- Dividend reinvestment: Accelerate wealth growth through the power of compounding.

- Avoid emotional decisions: Don't react impulsively to short-term market news.

Conclusion

This article has explored the power of simplicity in crafting a high-yield dividend strategy. By focusing on a few key metrics, diversifying your holdings, and maintaining a long-term perspective, you can build a portfolio that generates consistent income and contributes significantly to your financial goals. Remember, a simple, well-researched approach to high-yield dividend investing can be incredibly effective. Start building your high-yield dividend portfolio today!

Featured Posts

-

Knights Edge Wild In Ot Barbashev The Hero Series Tied 2 2

May 10, 2025

Knights Edge Wild In Ot Barbashev The Hero Series Tied 2 2

May 10, 2025 -

Rising Rents After La Fires A Selling Sunset Stars Account Of Landlord Exploitation

May 10, 2025

Rising Rents After La Fires A Selling Sunset Stars Account Of Landlord Exploitation

May 10, 2025 -

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 10, 2025

Pam Bondi Accused Of Concealing Epstein Records Senate Democrats Speak Out

May 10, 2025 -

Uk Government Considers Stricter Student Visa Rules For Certain Countries

May 10, 2025

Uk Government Considers Stricter Student Visa Rules For Certain Countries

May 10, 2025 -

Beyonces Cowboy Carter A Tour Driven Streaming Success

May 10, 2025

Beyonces Cowboy Carter A Tour Driven Streaming Success

May 10, 2025