The Private Credit Job Market: 5 Dos And Don'ts For Applicants

Table of Contents

DO: Network Strategically within the Private Credit Industry

Networking is paramount for success in the private credit job market. It's not just about handing out resumes; it's about building genuine relationships and learning about opportunities before they're publicly advertised.

-

Leverage LinkedIn: Optimize your LinkedIn profile to showcase your private credit-related skills and experience. Actively engage with posts, join relevant groups, and connect with professionals in the field. Look for private credit professionals at target firms and engage with their content.

-

Attend Industry Events: Conferences, workshops, and networking events provide invaluable opportunities to meet people in the private credit industry. These events are hotbeds for learning about new roles and making connections that could lead to job opportunities.

-

Conduct Informational Interviews: Reach out to professionals working in private credit for informational interviews. These conversations are excellent for gaining insights into the industry and learning about potential job openings. Remember to prepare thoughtful questions beforehand.

-

Target Specific Firms: Research private credit firms that align with your career goals and interests. Focus your networking efforts on these firms, demonstrating a genuine interest in their specific investment strategies and culture.

-

Build Genuine Relationships: Focus on building long-term connections rather than solely transactional interactions. Nurture these relationships; you never know when a connection could lead to a job opportunity.

-

Follow Up Effectively: After each interaction (networking event, informational interview, etc.), send a personalized thank-you note reiterating your interest and highlighting key points from your conversation.

DON'T: Neglect Your Online Presence

Your online presence is your first impression in the private credit job market. A strong online profile conveys professionalism and expertise.

-

Update Your LinkedIn Profile: Ensure your LinkedIn profile is up-to-date, professional, and highlights your relevant skills and experience in private credit. Use keywords related to private credit, leveraged finance, and credit analysis.

-

Proofread Everything: Errors in your resume, cover letter, or online profiles can reflect poorly on your attention to detail. Always proofread meticulously before submitting any application materials.

-

Ignore Your Online Reputation: Be mindful of your digital footprint. Clean up any potentially problematic content on social media platforms.

-

Underestimate the Importance of a Professional Website: Creating a personal website can showcase your expertise and projects, further strengthening your online presence and demonstrating your commitment to the field. This is especially helpful for showcasing your analytical and modeling abilities.

DO: Tailor Your Resume and Cover Letter to Each Private Credit Role

Generic applications rarely succeed in a competitive market like private credit. Tailoring your application materials is crucial.

-

Highlight Relevant Skills: Emphasize skills directly relevant to private credit, such as financial modeling, credit analysis, due diligence, debt financing, and LBO modeling.

-

Quantify Your Achievements: Use numbers and data to showcase your accomplishments in previous roles. Instead of saying "Improved efficiency," say "Improved efficiency by 15% by implementing X strategy."

-

Use Keywords Strategically: Incorporate relevant keywords found in job descriptions to improve your chances of getting noticed by Applicant Tracking Systems (ATS) and recruiters.

-

Showcase Your Understanding of Private Credit: Demonstrate your knowledge of the industry through relevant examples and experiences. Mention specific strategies, investments, or market trends that interest you.

DON'T: Underprepare for the Interview Process

The interview process is your chance to shine. Thorough preparation is essential.

-

Research the Firm Thoroughly: Demonstrate a deep understanding of the firm's investment strategy, portfolio companies, and recent transactions. Show genuine interest in their work.

-

Practice Your Answers: Prepare for common interview questions, including behavioral questions (e.g., "Tell me about a time you failed") and technical questions related to private credit (e.g., "Explain your understanding of covenant violations").

-

Fail to Ask Insightful Questions: Asking thoughtful questions shows your engagement and genuine interest. Prepare questions beforehand that demonstrate your understanding of the firm and the private credit industry.

-

Neglect to Follow Up Post-Interview: Send a thank-you note to reiterate your interest and highlight key points from the conversation. This reinforces your positive impression.

DO: Emphasize Your Financial Acumen and Analytical Skills in the Private Credit Sector

Private credit roles demand strong financial skills. Highlight your abilities strategically.

-

Showcase Your Financial Modeling Skills: Highlight proficiency in Excel and financial modeling software (e.g., Argus, Bloomberg Terminal). Be ready to discuss your experience building complex models.

-

Demonstrate Your Understanding of Credit Analysis: Explain your knowledge of credit metrics (e.g., leverage ratios, interest coverage ratios), risk assessment, and due diligence procedures.

-

Highlight Your Experience with Leveraged Finance: Showcase any experience with LBOs, debt financings, or restructuring. These experiences demonstrate your familiarity with the core of private credit operations.

-

Present Your Problem-Solving Skills: Provide specific examples of situations where you successfully solved complex financial problems. Use the STAR method (Situation, Task, Action, Result) to structure your responses.

Conclusion

Securing a position in the competitive private credit job market requires a well-defined strategy. By following these dos and don'ts—networking effectively, maintaining a strong online presence, tailoring your application materials, preparing meticulously for interviews, and highlighting your financial expertise—you significantly increase your chances of success. Remember, the private credit job market rewards dedication, preparation, and a genuine understanding of the industry. Start applying these tips today and elevate your chances of landing your dream private credit job!

Featured Posts

-

Idf Soldiers Held Captive In Gaza Stories Of Courage And Resilience

May 26, 2025

Idf Soldiers Held Captive In Gaza Stories Of Courage And Resilience

May 26, 2025 -

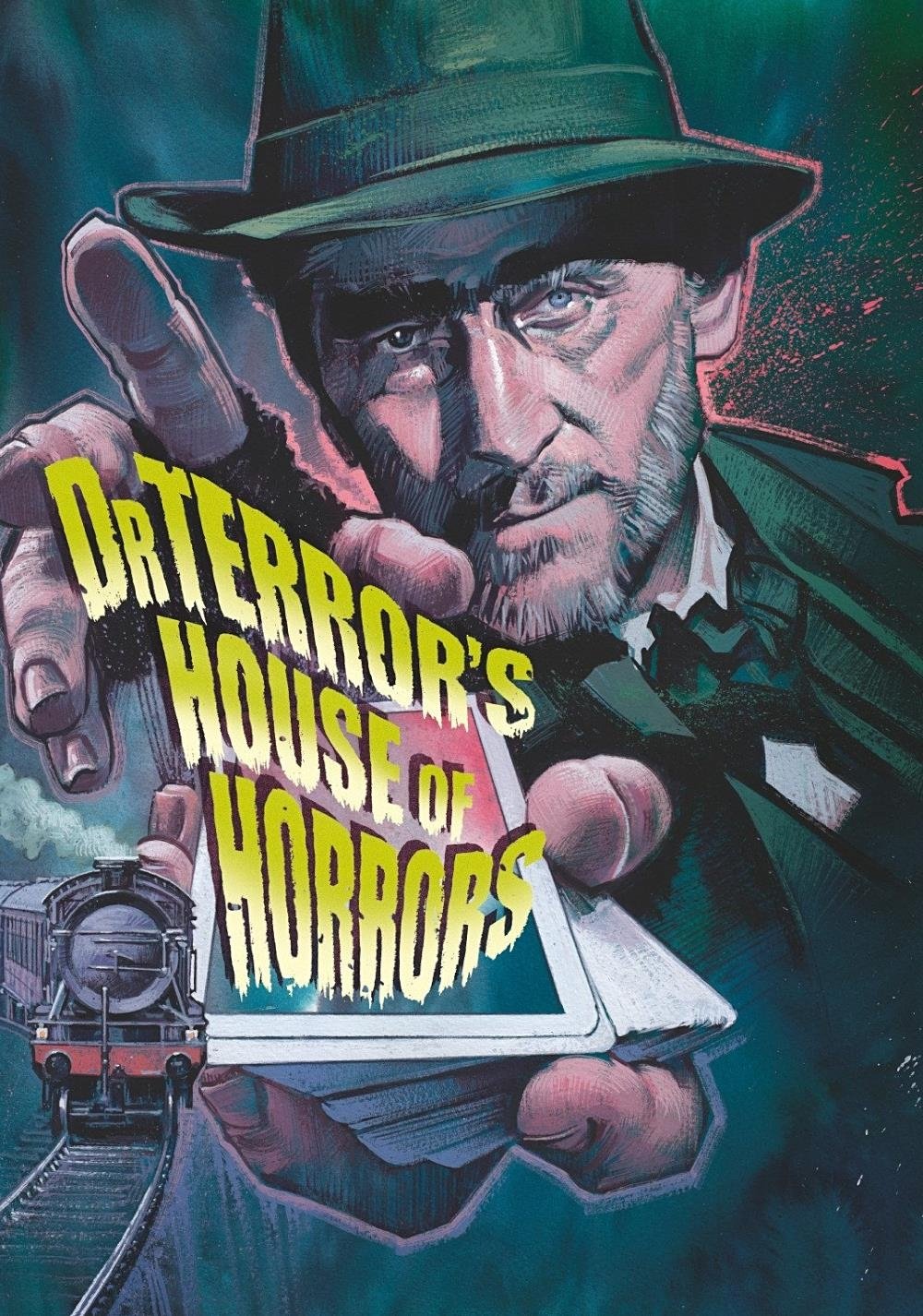

Dr Terrors House Of Horrors Everything You Need To Know

May 26, 2025

Dr Terrors House Of Horrors Everything You Need To Know

May 26, 2025 -

Saksikan Live Trans7 Sprint Race Moto Gp Inggris Rins Pecah Rekor Marquez Jatuh

May 26, 2025

Saksikan Live Trans7 Sprint Race Moto Gp Inggris Rins Pecah Rekor Marquez Jatuh

May 26, 2025 -

Real Madrid De Arda Gueler Ve Takim Arkadaslarina Uefa Sorusturmasi

May 26, 2025

Real Madrid De Arda Gueler Ve Takim Arkadaslarina Uefa Sorusturmasi

May 26, 2025 -

George Russell Clears 1 5 Million Debt Speculation Mounts Over Mercedes Deal

May 26, 2025

George Russell Clears 1 5 Million Debt Speculation Mounts Over Mercedes Deal

May 26, 2025

Latest Posts

-

Video Replay De Loeil De Philippe Caveriviere 24 Avril 2025 Face A Philippe Tabarot

May 30, 2025

Video Replay De Loeil De Philippe Caveriviere 24 Avril 2025 Face A Philippe Tabarot

May 30, 2025 -

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Sud Ouest

May 30, 2025

A69 L Etat Saisit La Justice Pour Relancer Le Chantier Sud Ouest

May 30, 2025 -

Philippe Caveriviere Vs Philippe Tabarot Replay Complet De Loeil Du 24 04 2025

May 30, 2025

Philippe Caveriviere Vs Philippe Tabarot Replay Complet De Loeil Du 24 04 2025

May 30, 2025 -

Loeil De Philippe Caveriviere 24 Avril 2025 Replay Avec Philippe Tabarot

May 30, 2025

Loeil De Philippe Caveriviere 24 Avril 2025 Replay Avec Philippe Tabarot

May 30, 2025 -

Le Tunnel De Tende Rouvrira T Il En Juin La Reponse Du Ministre Tabarot

May 30, 2025

Le Tunnel De Tende Rouvrira T Il En Juin La Reponse Du Ministre Tabarot

May 30, 2025