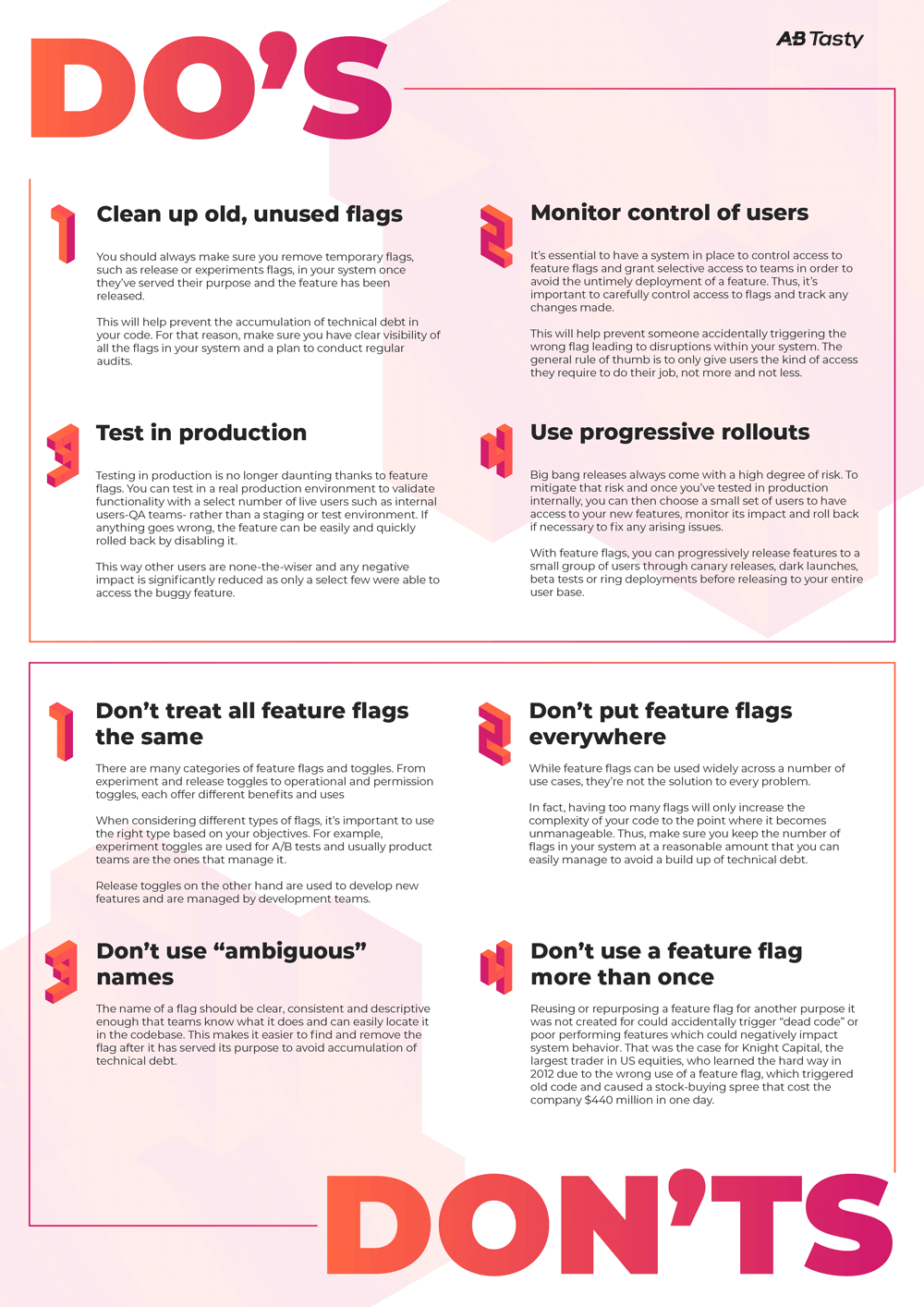

The Private Credit Job Market: 5 Do's And Don'ts For Success

Table of Contents

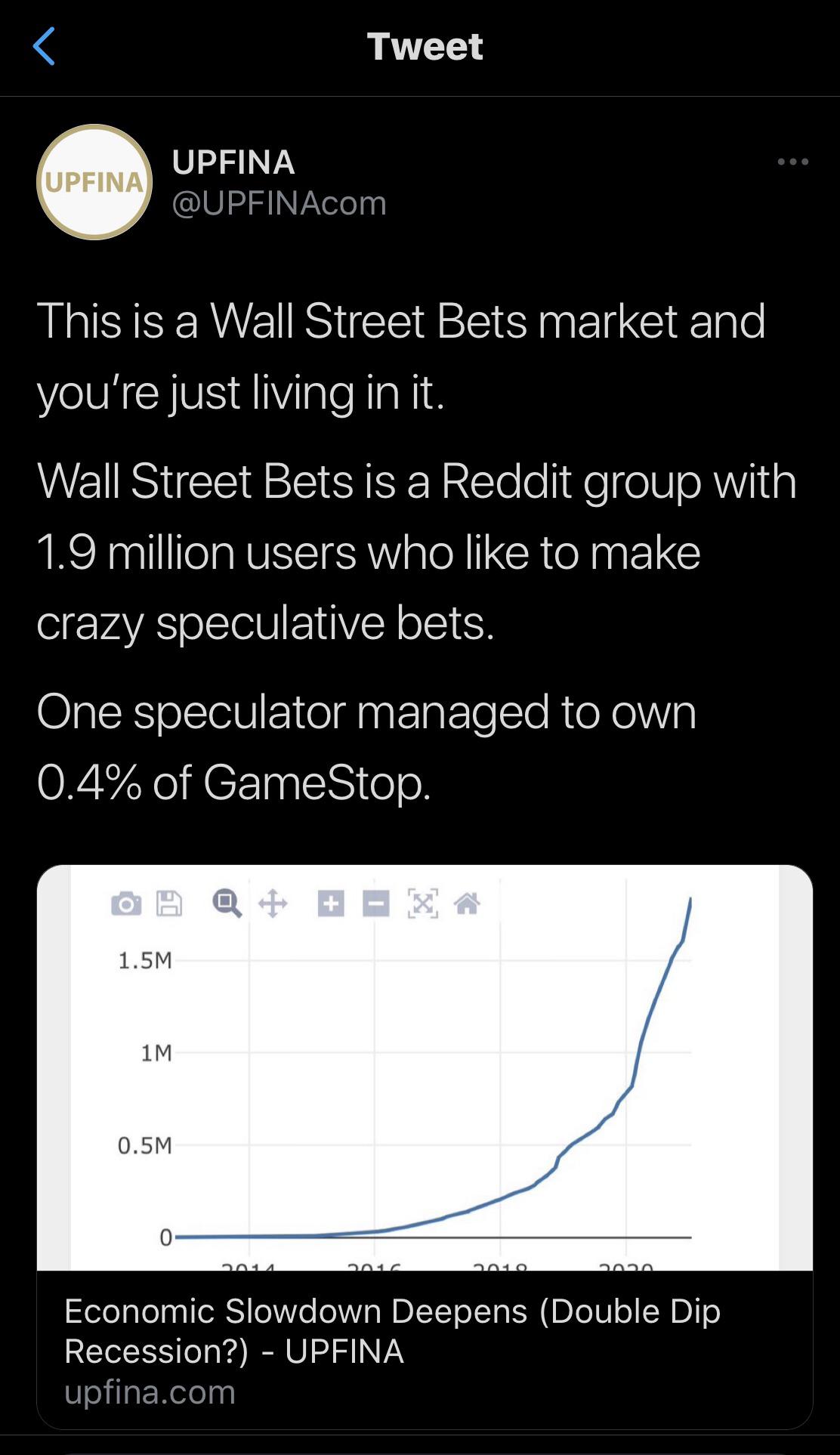

Do's for Success in the Private Credit Job Market

1. Network Strategically

Building a strong network is paramount in the private credit industry. It's a relationship-driven field, and personal connections can significantly boost your job prospects.

- Build relationships with professionals in private credit firms: Attend industry events, connect with professionals on LinkedIn, and engage in relevant online communities. Don't be afraid to reach out and schedule informational interviews.

- Attend industry conferences and events: SuperReturn, ACG conferences, and other specialized events offer excellent networking opportunities. Actively participate, exchange business cards, and follow up with new contacts.

- Leverage LinkedIn effectively: Optimize your profile to highlight your skills and experience in private credit. Connect with recruiters, hiring managers, and professionals working in the field. Engage with industry discussions and share relevant content.

- Participate in relevant online forums and communities: Join online groups focused on private credit, alternative investments, or finance. Contribute to discussions and establish yourself as a knowledgeable participant.

- Target networking efforts towards specific private credit niches: Focus your efforts on areas that align with your interests and expertise, such as real estate private credit, distressed debt, mezzanine financing, or private equity. This shows focused ambition.

- Follow key industry influencers on social media: Stay updated on industry trends and gain insights by following thought leaders on platforms like LinkedIn and Twitter.

2. Highlight Relevant Skills & Experience

Your resume and cover letter are your first impression. Tailoring them to each job description is crucial for showcasing your suitability.

- Tailor your resume and cover letter: Highlight the specific skills and experience requested in the job description. Use keywords from the job posting to improve your applicant tracking system (ATS) ranking.

- Quantify your accomplishments: Instead of simply stating your responsibilities, quantify your achievements whenever possible. For example, "increased portfolio returns by 15%" is far more impactful than "managed portfolio investments."

- Showcase experience with relevant software: Mention proficiency in Bloomberg Terminal, Argus, Excel, and other software commonly used in private credit analysis and deal structuring.

- Emphasize your understanding of different private credit strategies: Demonstrate knowledge of direct lending, fund investing, and other key strategies.

- Demonstrate knowledge of regulatory compliance in private credit: Showcase your awareness of relevant regulations, such as those related to Dodd-Frank and other industry-specific compliance requirements.

3. Master the Art of the Interview

The interview stage requires thorough preparation and the ability to showcase your personality and skills.

- Prepare for behavioral questions using the STAR method: Structure your answers using the STAR method (Situation, Task, Action, Result) to provide concrete examples of your skills and experience.

- Research the firm and the interviewer: Understanding the firm's investment strategy, recent deals, and the interviewer's background demonstrates genuine interest.

- Practice your answers to common private credit interview questions: Prepare answers to questions about your investment philosophy, risk assessment, and experience with financial modeling.

- Demonstrate your understanding of market trends and economic factors: Show your awareness of current market conditions and their impact on private credit investments.

- Ask insightful questions: Prepare thoughtful questions to demonstrate your engagement and understanding of the role and the firm.

4. Develop Specialized Knowledge

Continuous learning is vital in the dynamic private credit market. Expanding your knowledge base increases your competitiveness.

- Pursue relevant certifications: Obtaining certifications like the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) demonstrates a commitment to professional development.

- Continuously update your knowledge: Stay informed about private credit market trends through industry publications, research reports, and attending webinars.

- Develop expertise in specific asset classes: Focus your knowledge on specific areas within private credit, such as real estate debt, leveraged loans, or distressed debt.

- Stay informed about regulatory changes: Keep up-to-date on regulatory changes impacting the private credit industry.

- Consider pursuing an MBA or a specialized finance degree: A graduate degree can enhance your credentials and provide a deeper understanding of finance and investment principles.

5. Build a Strong Online Presence

Your online presence is often the first impression a potential employer will have of you.

- Create a professional LinkedIn profile: Highlight your skills and experience, using relevant keywords from the private credit job market.

- Develop a strong online portfolio: Showcase your work and accomplishments through a website or portfolio platform.

- Engage in relevant industry discussions: Participate in online forums and discussions related to private credit.

- Showcase your expertise through thought leadership: Write blog posts, articles, or contribute to industry publications to establish yourself as a knowledgeable professional.

- Maintain a consistent and professional online brand: Ensure your online presence reflects your professional image and values.

Don'ts for the Private Credit Job Market

1. Neglect Networking: Don't underestimate the power of building relationships. The private credit world thrives on personal connections.

2. Submit Generic Applications: Tailor your resume and cover letter to each specific job and company to demonstrate genuine interest.

3. Underprepare for Interviews: Thorough preparation is essential. Practice your answers and research the firm extensively.

4. Lack Industry Knowledge: Staying updated on market trends is crucial. Demonstrate your understanding of current events and their impact on the private credit market.

5. Ignore Your Online Presence: Your online profile is your digital resume. Make sure it represents you in the best possible light.

Conclusion

Securing a position in the competitive private credit job market requires dedication, strategic planning, and a proactive approach. By following these "do's" and avoiding the "don'ts," you significantly increase your chances of success. Remember to network effectively, highlight your relevant skills, master the interview process, develop specialized knowledge, and maintain a strong online presence. Take control of your career journey in the private credit industry today! Start building your network and applying for your dream private credit job market opportunities now.

Featured Posts

-

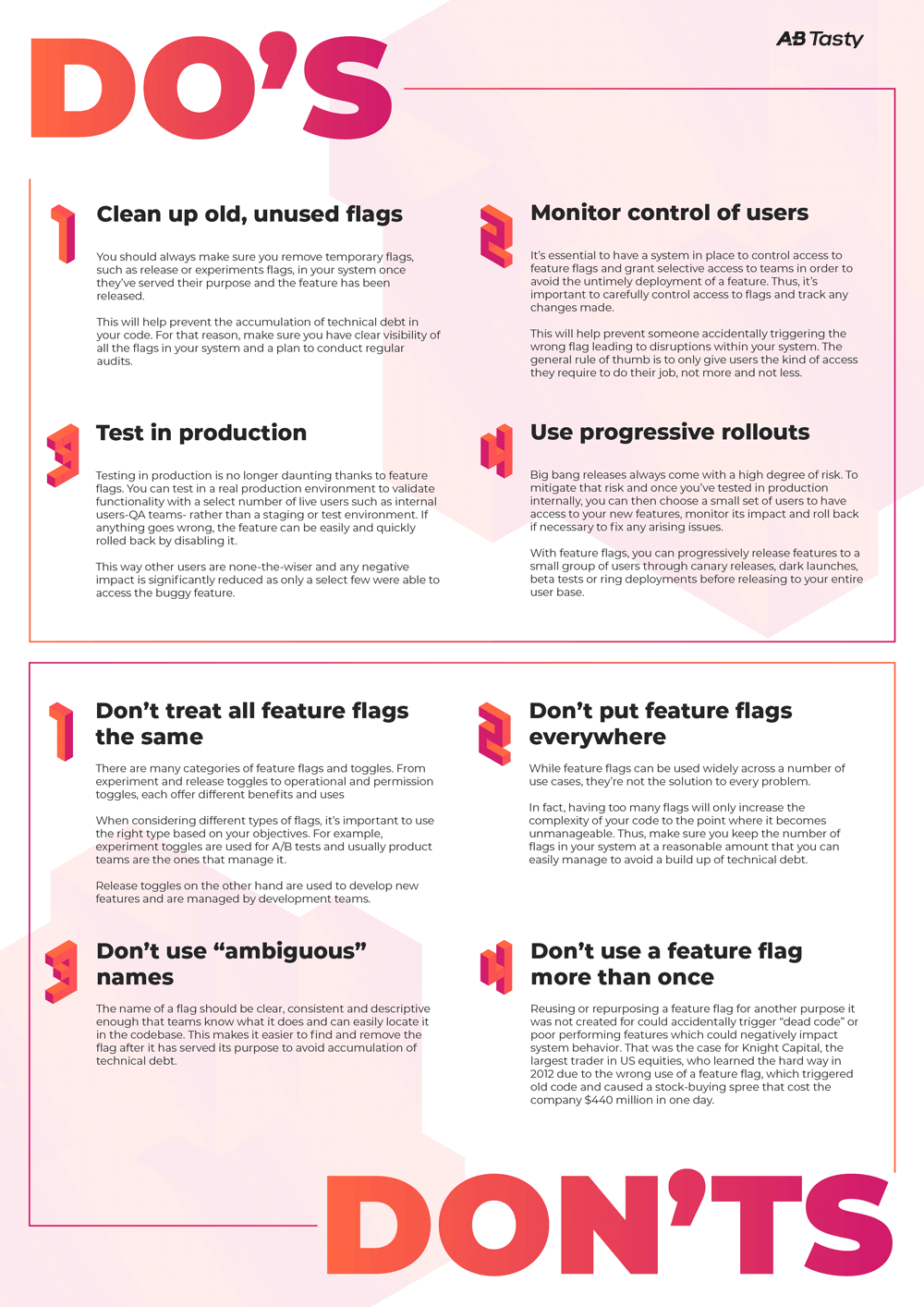

Chinas Automotive Market Assessing The Difficulties For Brands Like Bmw And Porsche

May 10, 2025

Chinas Automotive Market Assessing The Difficulties For Brands Like Bmw And Porsche

May 10, 2025 -

Detencion De Estudiante Transgenero Por Usar Bano De Mujeres Analisis Del Incidente

May 10, 2025

Detencion De Estudiante Transgenero Por Usar Bano De Mujeres Analisis Del Incidente

May 10, 2025 -

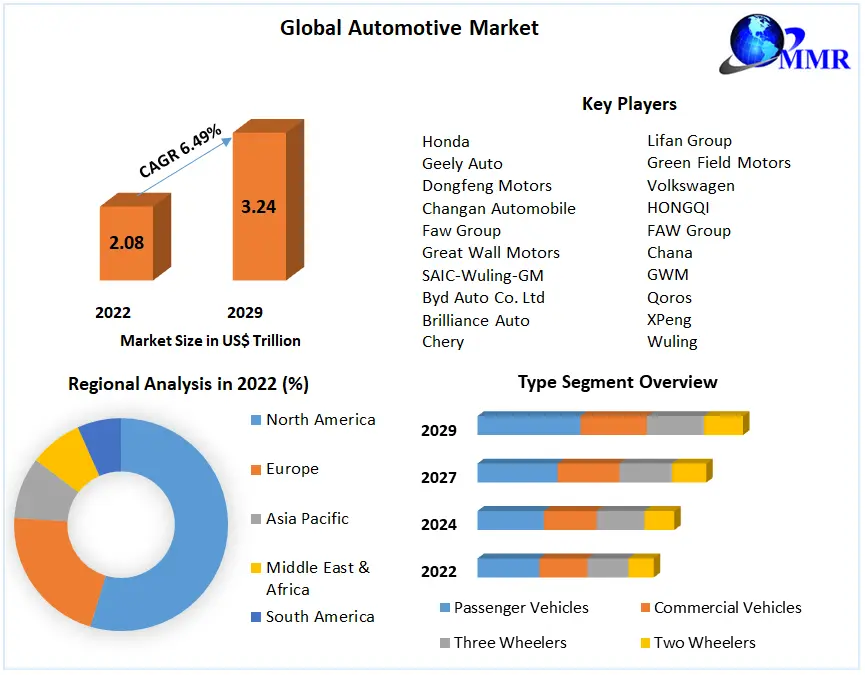

Bear Market Bets Falter Wall Streets Strong Comeback

May 10, 2025

Bear Market Bets Falter Wall Streets Strong Comeback

May 10, 2025 -

Uusi Britannian Kruununperimysjaerjestys Yksityiskohtainen Katsaus

May 10, 2025

Uusi Britannian Kruununperimysjaerjestys Yksityiskohtainen Katsaus

May 10, 2025 -

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

May 10, 2025

January 6th Witness Cassidy Hutchinson Announces Fall Memoir Release

May 10, 2025