The Relationship Between Elon Musk's Net Worth And US Economic Performance

Table of Contents

Elon Musk's Net Worth as a Reflection of Market Sentiment

Elon Musk's immense wealth is largely tied to the performance of Tesla, his electric vehicle company. Understanding the link between Elon Musk's net worth and US economic performance requires a close examination of Tesla's stock performance and its reflection of broader market trends.

Tesla's Stock Performance and Investor Confidence

Tesla's stock price is a significant driver of Elon Musk's net worth. Its volatility mirrors shifts in investor confidence, both in the company itself and in the broader technology and automotive sectors.

- Positive market sentiment: When investor confidence is high, Tesla's stock price tends to rise, directly increasing Musk's net worth. This often correlates with positive economic indicators, such as strong GDP growth and low unemployment.

- Negative market sentiment: Conversely, periods of market uncertainty or negative news cycles (e.g., concerns about production delays, competition, or regulatory changes) can lead to a drop in Tesla's stock price, impacting Musk's net worth negatively. These often coincide with dips in broader market indices like the S&P 500.

- Correlation with S&P 500: While not perfectly correlated, Tesla's stock price often shows a degree of correlation with the performance of the S&P 500, reflecting the influence of broader economic factors on investor sentiment.

The Impact of Innovation and Technological Advancements

Musk's ventures, including Tesla and SpaceX, are at the forefront of technological innovation. Their success significantly impacts related sectors and the overall US economy.

- Tesla's impact on the EV market: Tesla's pioneering role in the electric vehicle market has spurred significant growth and investment in related industries, including battery technology, charging infrastructure, and renewable energy. This creates jobs and stimulates economic activity.

- SpaceX's contribution to space exploration: SpaceX's advancements in reusable rocket technology and its ambitions in space exploration contribute to the burgeoning space industry, fostering innovation and creating high-skilled jobs. Potential economic spin-offs from space-based technologies and resources remain significant long-term possibilities.

The Broader Economic Context: Wealth Inequality and its Implications

The concentration of wealth in the hands of a few individuals, including Elon Musk, raises significant questions about wealth inequality and its broader implications for the US economy.

The Concentration of Wealth and its Social/Economic Effects

Elon Musk's extraordinary net worth represents an extreme case of wealth concentration. This raises concerns about:

- Economic growth: Some economists argue that extreme wealth inequality can stifle economic growth by reducing aggregate demand and limiting social mobility.

- Social mobility: A highly unequal distribution of wealth can hinder upward social mobility, creating a less equitable society.

- Political stability: High levels of inequality have been linked to increased social unrest and political instability. The concentration of power associated with significant wealth also raises concerns.

Data from sources like the World Inequality Database can be used to analyze the trends in wealth concentration and its impact on various aspects of the US economy.

Musk's Influence on Policy and Regulation

Elon Musk's public pronouncements and actions carry significant weight and influence policy debates in several key sectors.

- Electric vehicle policy: Musk's advocacy for electric vehicles has influenced government policies aimed at promoting EV adoption and reducing carbon emissions.

- Space exploration policy: SpaceX's success has shaped discussions around the future of space exploration and the role of private companies in this domain. Government funding and regulation of space activities are directly influenced.

- Potential conflicts of interest: Musk's significant influence necessitates careful consideration of potential conflicts of interest between his business interests and the regulatory environment in which his companies operate.

Limitations and Caveats: Correlation vs. Causation

While there might be a correlation between Elon Musk's net worth and certain aspects of US economic performance, it's crucial to avoid assuming causation.

Distinguishing Between Correlation and Causation

Many factors influence both Musk's net worth and the US economy:

- Global economic events: Global financial crises, recessions, and geopolitical instability impact both stock markets and the overall health of the US economy.

- Interest rates: Changes in interest rates affect investor sentiment, stock valuations, and borrowing costs for businesses, influencing both Tesla's performance and broader economic activity.

- Technological disruptions: Rapid technological change can create both opportunities and challenges, impacting the performance of companies like Tesla and the broader economic landscape.

The Challenges of Measuring Economic Impact

Precisely quantifying Elon Musk's economic impact is inherently difficult.

- Indirect effects: Measuring the indirect economic effects of his companies (job creation, innovation spillover effects) is complex and requires sophisticated econometric modeling.

- Data limitations: Available data may not fully capture the long-term consequences of Musk's actions and technological innovations on the US economy.

Conclusion

In summary, while a correlation might exist between Elon Musk's net worth and certain aspects of US economic performance, establishing a direct causal relationship is complex and requires further research. Numerous other factors influence both his wealth and the overall health of the US economy. The relationship between Elon Musk's net worth and US economic performance is multifaceted and influenced by market sentiment, technological innovation, wealth inequality, and policy considerations. To further explore this topic, consider researching reports from organizations like the Federal Reserve, academic papers on wealth inequality and technological innovation, and analyses of Tesla's market performance. Ultimately, the question remains: how will this complex interplay continue to shape the future of both Elon Musk's wealth and the trajectory of the US economy?

Featured Posts

-

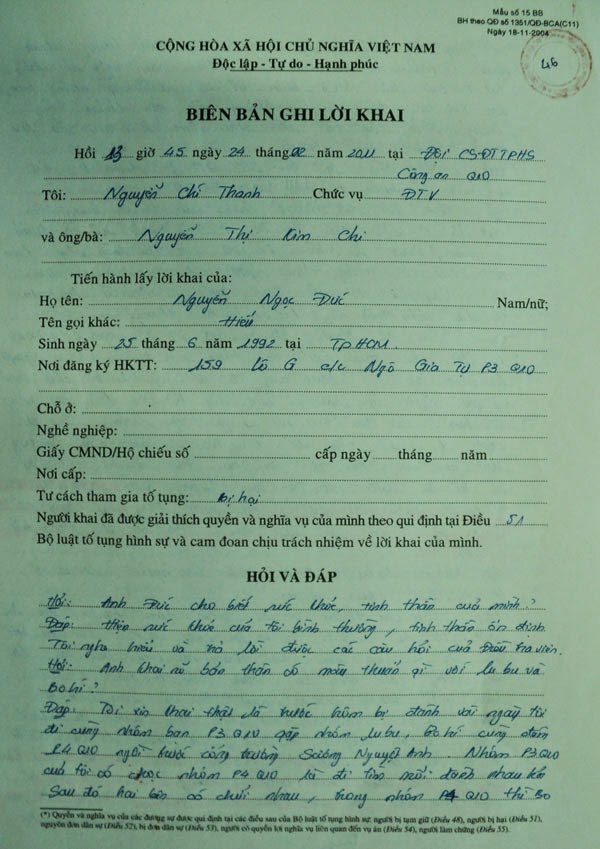

Dieu Tra Vu Bao Hanh Tre Loi Khai Cua Bao Mau O Tien Giang

May 09, 2025

Dieu Tra Vu Bao Hanh Tre Loi Khai Cua Bao Mau O Tien Giang

May 09, 2025 -

Man Faces Felony Charges After Crashing Car Through Jennifer Anistons Gate

May 09, 2025

Man Faces Felony Charges After Crashing Car Through Jennifer Anistons Gate

May 09, 2025 -

Elizabeth City Weekend Shooting Arrest Made Investigation Continues

May 09, 2025

Elizabeth City Weekend Shooting Arrest Made Investigation Continues

May 09, 2025 -

Policia Prende Mulher Que Afirma Ser Madeleine Mc Cann No Reino Unido

May 09, 2025

Policia Prende Mulher Que Afirma Ser Madeleine Mc Cann No Reino Unido

May 09, 2025 -

Nc Daycare Suspension Reasons Process And Parental Rights

May 09, 2025

Nc Daycare Suspension Reasons Process And Parental Rights

May 09, 2025