The Return Of "Angry" Elon: Implications For Tesla Investors

Table of Contents

Elon Musk's recent public outbursts and controversial decisions have reignited concerns among Tesla investors. The "Angry Elon" persona, characterized by impulsive tweets and unpredictable behavior, has historically correlated with significant stock market volatility. This article examines the implications of this recent resurgence of this behavior on Tesla investors and offers insights for navigating this potentially turbulent period.

Understanding the "Angry Elon" Effect on Tesla Stock

Historical Correlation Between Musk's Behavior and Tesla Stock Performance

Analyzing past instances reveals a clear correlation between Elon Musk's actions and Tesla's stock performance. When controversial news breaks about Elon Musk, the stock price often reacts dramatically. This isn't just about the news itself; it's also about the broader impact on investor confidence. A CEO's public image significantly influences how the market perceives their company.

-

Visual Representation: (Imagine a chart here showing historical Tesla stock price fluctuations correlated with key events involving Elon Musk's public behavior. Data sources would be cited here). This would visually demonstrate the impact of “Angry Elon” moments on Tesla's stock price.

-

Psychological Impact: Investor confidence is fragile. Negative news, especially concerning the leadership of a company, can lead to panic selling, driving down the stock price. Conversely, positive news or signs of improved behavior can lead to a surge in buying.

-

Examples of Past Controversies:

- The infamous "funding secured" tweet regarding Tesla's privatization in 2018 resulted in significant stock price volatility and SEC investigations.

- Public criticisms of analysts and short-sellers have also triggered negative market reactions.

- Lawsuits and regulatory actions involving Elon Musk have consistently impacted Tesla's stock.

The Impact of Musk's Twitter Activity

Elon Musk's Twitter account has become a powerful tool, capable of influencing the Tesla stock price instantaneously. His frequent and sometimes controversial tweets can sway market sentiment in a matter of minutes. This presents a unique risk for Tesla investors.

-

Recent Controversial Tweets and Market Impact: (Here, specific examples of recent tweets and their immediate effects on the Tesla stock price would be detailed, with links to reputable news sources). This section needs up-to-date information for accuracy.

-

Regulatory Scrutiny: The SEC closely monitors Musk's public statements, and any violation of securities regulations can result in hefty fines and other consequences for both Musk and Tesla. The potential for future regulatory actions adds another layer of uncertainty for investors.

-

Twitter's Influence: Twitter's own evolution under Elon Musk's leadership also plays a role. Changes in content moderation policies might indirectly impact how news about Tesla and Elon Musk spreads, thereby influencing market sentiment.

Assessing the Risks for Tesla Investors

Increased Market Volatility and Uncertainty

Elon Musk's unpredictable behavior significantly increases the risk profile of Tesla investments. The stock's price is far more susceptible to sudden and dramatic swings compared to companies with more stable leadership.

-

Importance of Risk Tolerance and Diversification: Investors need to honestly assess their risk tolerance before investing in Tesla. Diversifying a portfolio across multiple assets is crucial to mitigate the potential losses associated with Tesla stock's volatility.

-

Potential Risks:

- Negative press coverage related to Elon Musk's actions can severely impact Tesla's brand reputation.

- The unpredictable nature of Musk’s leadership makes predicting Tesla’s future performance extremely challenging.

- Internal conflicts and leadership changes can negatively affect operational efficiency and innovation.

Potential Impact on Tesla's Operations and Innovation

Elon Musk's leadership style, while undeniably driving, can also create challenges for Tesla. His public persona and frequent shifts in focus can impact the company's ability to attract and retain top talent, hindering innovation and operational efficiency.

-

Attracting and Retaining Talent: Top engineers and executives may be hesitant to join or stay with a company where leadership is perceived as volatile and unpredictable.

-

Impact on Innovation: A distracted or erratic leadership style can disrupt Tesla's product development and innovation pipeline.

Strategies for Tesla Investors

Developing a Robust Investment Strategy

Investing in Tesla requires a well-defined, long-term strategy that isn't overly influenced by short-term market fluctuations driven by Elon Musk's behavior.

-

Long-Term vs. Short-Term: Focus on the company's long-term growth potential, not daily stock price movements.

-

Diversification: Diversify your portfolio to reduce your overall risk exposure. Don’t put all your eggs in one basket.

-

Specific Strategies:

- Dollar-cost averaging: Invest a fixed amount regularly, regardless of the stock price.

- Stop-loss orders: Set predetermined limits to minimize potential losses.

- Seek professional financial advice: Consult a financial advisor to create a personalized investment plan.

Monitoring Market Sentiment and News

Staying informed is crucial for navigating the complexities of Tesla investment. Actively monitor news related to Elon Musk and Tesla, paying close attention to market sentiment.

-

Reputable News Sources: Use reputable financial news outlets and analysis tools to gather information. Avoid unreliable or biased sources.

-

Market Sentiment Analysis: Understanding market sentiment—the overall feeling of investors towards Tesla—can help you anticipate potential price movements.

Conclusion

The "Angry Elon" persona presents significant challenges and risks for Tesla investors. While Tesla's underlying business remains strong, Elon Musk's unpredictable leadership significantly impacts market sentiment and stock price volatility. By understanding the historical correlation between Musk's actions and Tesla's stock performance, assessing potential risks, and implementing a robust investment strategy, investors can better navigate the complexities of investing in Tesla during this period of uncertainty. Remember to always perform your own due diligence and consider seeking professional financial advice before making any investment decisions related to Tesla stock or other investments affected by the actions of "Angry Elon" and his leadership style.

Featured Posts

-

Italian Open Zheng Qinwens Semifinal Berth After Sabalenka Upset

May 26, 2025

Italian Open Zheng Qinwens Semifinal Berth After Sabalenka Upset

May 26, 2025 -

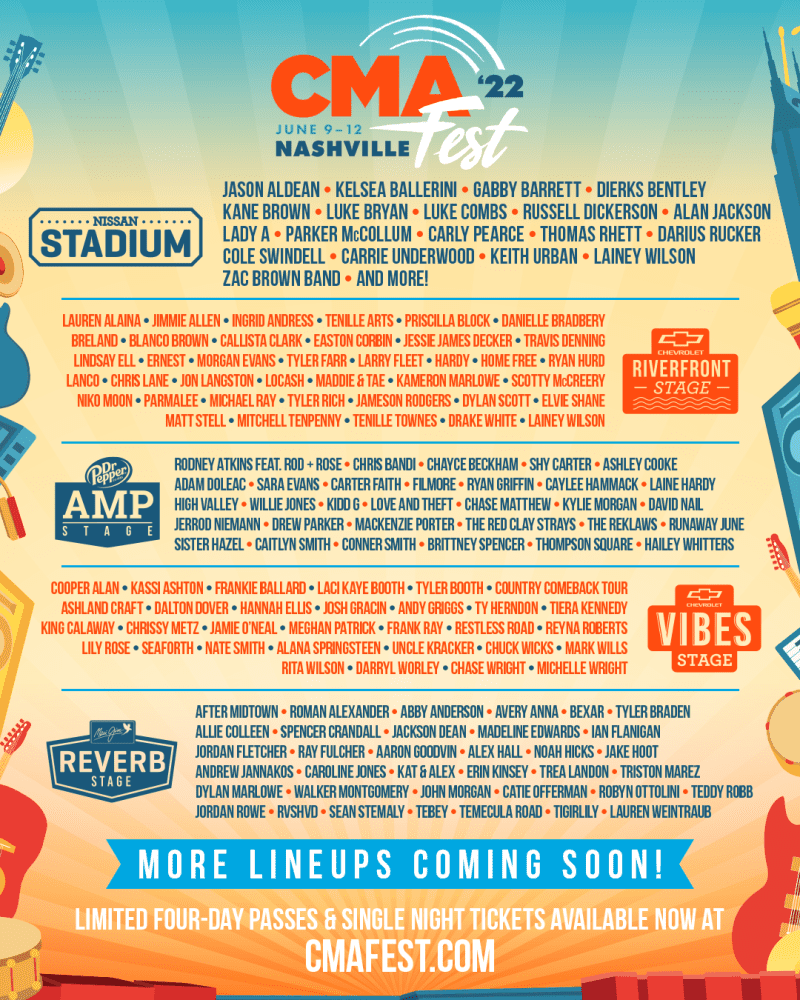

Carolina Country Music Fest 2025 No Tickets Remaining

May 26, 2025

Carolina Country Music Fest 2025 No Tickets Remaining

May 26, 2025 -

Naomi Kempbell 55 Rokiv Ikonichni Obrazi Supermodeli

May 26, 2025

Naomi Kempbell 55 Rokiv Ikonichni Obrazi Supermodeli

May 26, 2025 -

Analise De Um Classico A Frase Iconica Que Marcou O Cinema Ha Quase 20 Anos

May 26, 2025

Analise De Um Classico A Frase Iconica Que Marcou O Cinema Ha Quase 20 Anos

May 26, 2025 -

Canada Post Strike Customer Loyalty At Stake

May 26, 2025

Canada Post Strike Customer Loyalty At Stake

May 26, 2025

Latest Posts

-

Casper Ruuds Knee Problem Leads To French Open 2025 Defeat

May 30, 2025

Casper Ruuds Knee Problem Leads To French Open 2025 Defeat

May 30, 2025 -

Ruuds Knee Injury Costs Him French Open Match Against Borges

May 30, 2025

Ruuds Knee Injury Costs Him French Open Match Against Borges

May 30, 2025 -

French Open 2025 Ruuds Knee Injury Costs Him Victory Against Borges

May 30, 2025

French Open 2025 Ruuds Knee Injury Costs Him Victory Against Borges

May 30, 2025 -

Roland Garros Swiateks Smooth Sailing Ruud And Tsitsipas Stumble

May 30, 2025

Roland Garros Swiateks Smooth Sailing Ruud And Tsitsipas Stumble

May 30, 2025 -

French Open Early Elimination For Top Seeds Ruud And Tsitsipas

May 30, 2025

French Open Early Elimination For Top Seeds Ruud And Tsitsipas

May 30, 2025