The Risky Bet That Paid Off: A $TRUMP Short And A White House Dinner

Table of Contents

The Genesis of the $TRUMP Short

The decision to take a $TRUMP Short wasn't impulsive. Our investor, let's call him Alex, was a seasoned political risk analyst with a keen eye for market trends. His rationale stemmed from a deep dive into several key factors:

- Political Climate Analysis: Alex meticulously analyzed the highly polarized political climate leading up to the 2016 election. He identified significant divisions within the electorate and potential for policy gridlock.

- Economic Forecasts and Their Implications: Pre-election economic forecasts, while varied, indicated potential challenges under Trump's proposed protectionist trade policies and fiscal spending plans.

- Specific Policies that Informed the Short Position: Alex zeroed in on specific policy proposals, like the renegotiation of NAFTA and the potential impact on the US manufacturing sector and global trade. These formed the cornerstone of his short-selling strategy.

- Market Sentiment and Investor Behavior: Alex observed a surge in market optimism, potentially overinflated by hopes of deregulation and tax cuts. He perceived this as an opportunity to capitalize on potential market corrections.

These considerations led Alex to believe that a significant portion of the market's positive sentiment regarding Trump's presidency was overly optimistic, creating a ripe environment for a well-timed short selling strategy focusing on specific market sectors highly sensitive to Trump's political actions. Keywords like short selling, political risk, market prediction, election betting, and Trump presidency were central to his research and investment thesis.

Navigating the Volatility of the $TRUMP Short

The next four years were a rollercoaster. Alex's $TRUMP Short wasn't a smooth ride; the Trump presidency presented unprecedented volatility:

- Unexpected Policy Shifts and Their Market Impact: Unexpected policy changes, like tariffs on imported goods, created significant market fluctuations, testing Alex's risk management skills.

- Global Events Affecting the Investment: Global events – from trade wars to geopolitical tensions – directly impacted the performance of Alex's short position, requiring constant monitoring and adjustments.

- Emotional Market Reactions and Managing Risk: Managing the emotional swings in the market was crucial. Alex employed sophisticated hedging strategies to mitigate potential losses during periods of extreme market reaction.

- Times When the Short Position Was Almost Lost: There were moments when the market defied his predictions, and the short position seemed on the verge of collapse. However, Alex's disciplined approach and ability to adapt to changing circumstances proved invaluable.

Keywords like market volatility, risk management, hedging strategies, unexpected events, and economic uncertainty became synonymous with Alex's daily challenges. This required not just financial acumen, but also an understanding of political psychology and its impact on market sentiment.

The Unexpected Turnaround and the White House Dinner

The success of Alex's $TRUMP Short came not from one event, but from a confluence of factors:

- Specific Policy Failures or Unforeseen Circumstances: While not entirely predictable, certain policy failures and unforeseen circumstances contributed significantly to the downturn in specific market sectors Alex had shorted.

- Market Reactions to These Events: The market reacted negatively to these developments, validating Alex's initial assessment and creating opportunities to maximize profit.

- The Investor's Strategic Moves that Maximized Profits: Alex expertly timed his exits, capitalizing on market downturns and securing substantial gains. His strategic decision-making played a crucial role in his success.

- The Story Behind the White House Dinner Invitation: Ironically, Alex's insightful analysis, detailed in a widely circulated research paper, caught the attention of the new administration. Recognizing his ability to predict market trends based on policy changes, they invited him to a White House dinner to discuss economic policy, a surreal reward for a successful, though unconventional, investment.

Conclusion

Alex's journey with his $TRUMP Short is a compelling case study in high-stakes investing. It underscores the potential rewards, but also the significant risks, inherent in betting against prevailing political and economic trends. His success was a testament to meticulous research, careful risk management, and the ability to adapt to unexpected circumstances. The story serves as a reminder that even seemingly impossible bets, like a successful $TRUMP Short, can sometimes yield extraordinary results – even a White House dinner invite. To learn more about navigating the complexities of political risk and exploring $TRUMP Short strategies or other high-risk, high-reward political investments, consider further research into political risk analysis and market prediction models.

Featured Posts

-

Tottenham Vs Az Alkmaar In Depth Preview Analysis And Line Up Predictions

May 29, 2025

Tottenham Vs Az Alkmaar In Depth Preview Analysis And Line Up Predictions

May 29, 2025 -

Liverpools Premier League Dominance Their Last League Title Win

May 29, 2025

Liverpools Premier League Dominance Their Last League Title Win

May 29, 2025 -

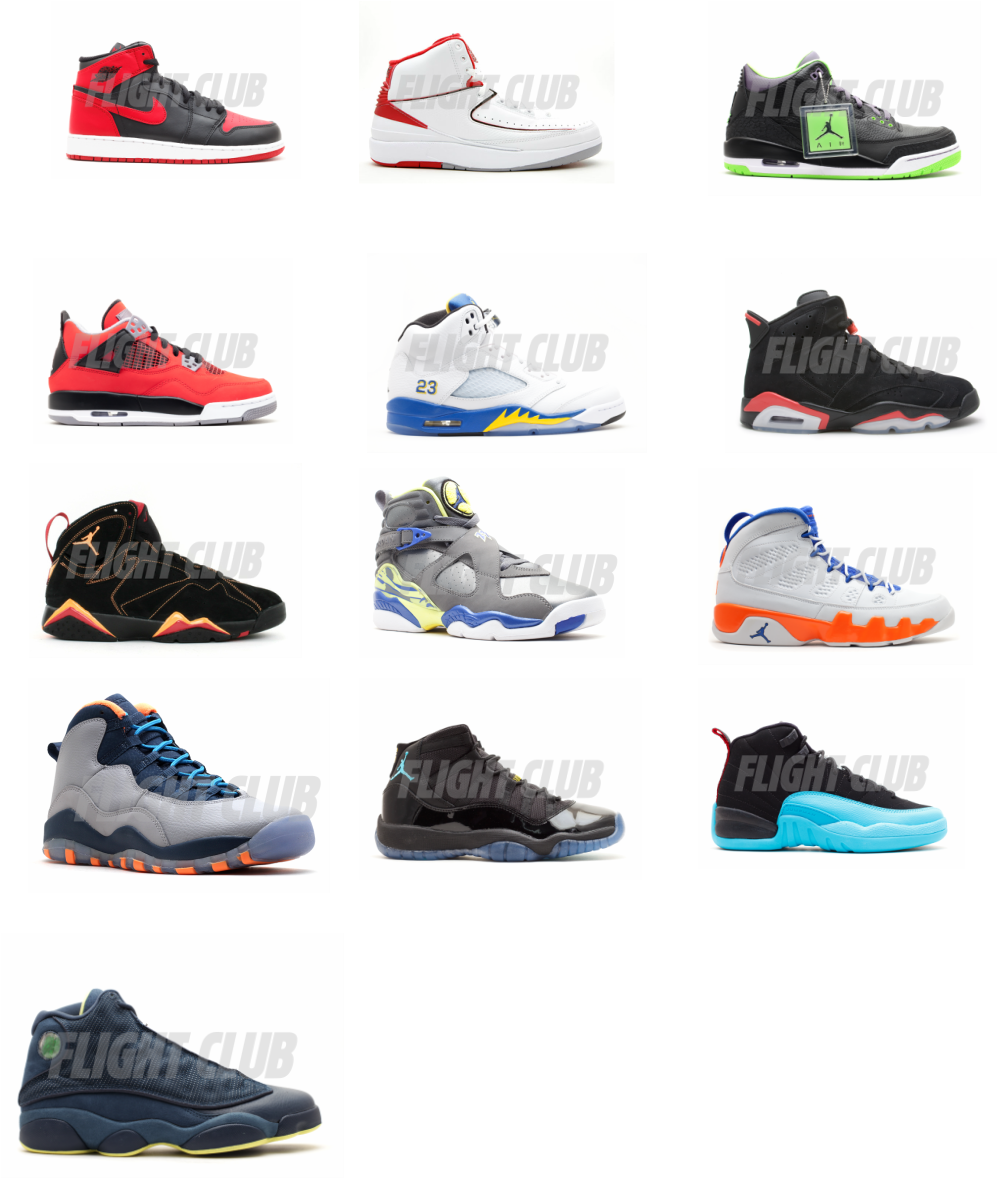

Air Jordan May 2025 Release Dates Must Know Information

May 29, 2025

Air Jordan May 2025 Release Dates Must Know Information

May 29, 2025 -

Stranger Things Final Season Everything We Know About The 2025 Premiere Cast And Plot

May 29, 2025

Stranger Things Final Season Everything We Know About The 2025 Premiere Cast And Plot

May 29, 2025 -

Mbappes Double Propels Real Madrid Past Celta Vigo Keeps La Liga Race Alive

May 29, 2025

Mbappes Double Propels Real Madrid Past Celta Vigo Keeps La Liga Race Alive

May 29, 2025

Latest Posts

-

Dragon Den Star Invests In Chafford Hundred Padel Courts

May 31, 2025

Dragon Den Star Invests In Chafford Hundred Padel Courts

May 31, 2025 -

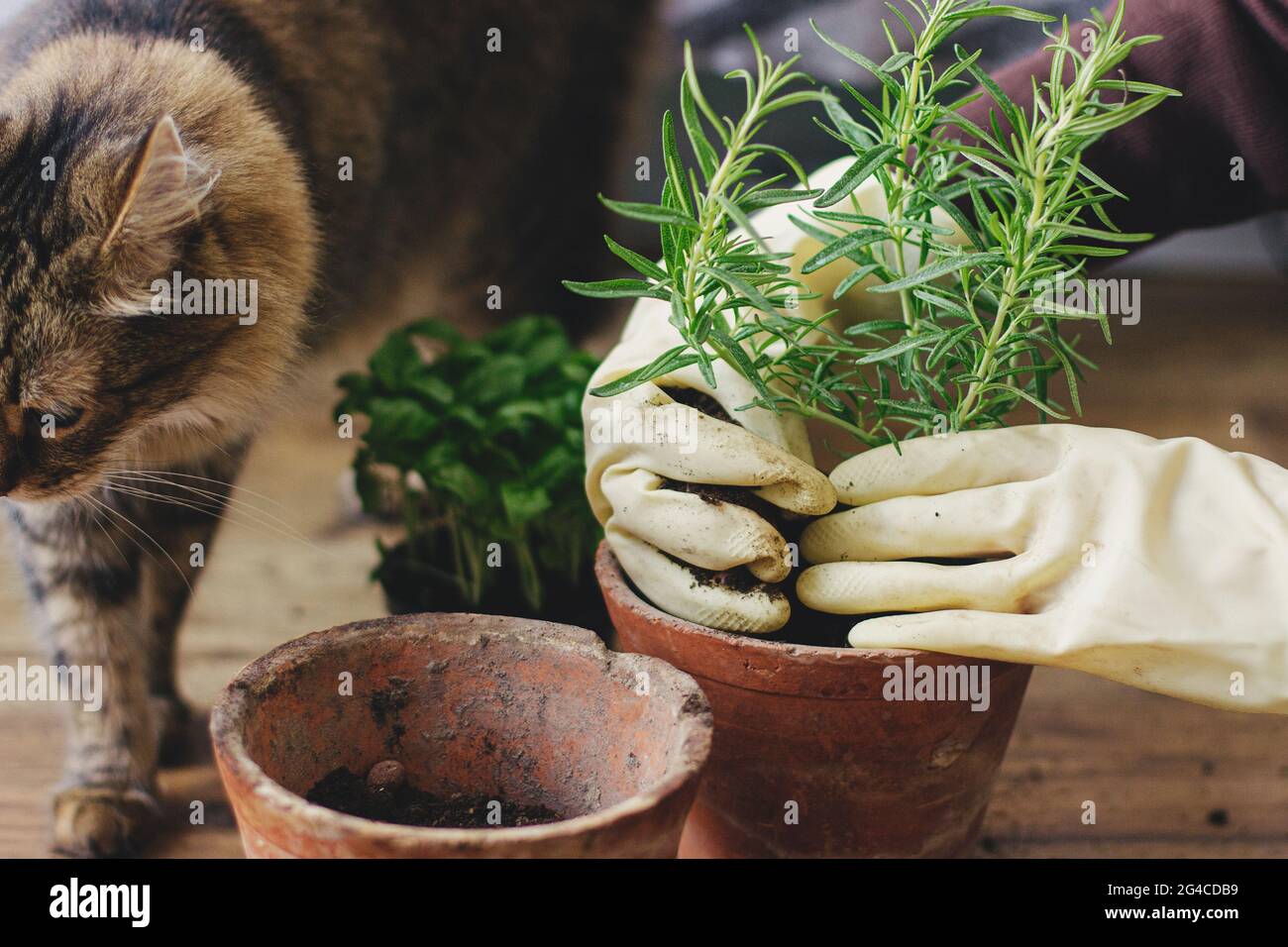

The History And Folklore Of Rosemary And Thyme

May 31, 2025

The History And Folklore Of Rosemary And Thyme

May 31, 2025 -

Rosemary And Thyme Your Guide To Cultivating These Powerful Herbs

May 31, 2025

Rosemary And Thyme Your Guide To Cultivating These Powerful Herbs

May 31, 2025 -

A Guide To Combining Rosemary And Thyme For Maximum Flavor

May 31, 2025

A Guide To Combining Rosemary And Thyme For Maximum Flavor

May 31, 2025 -

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025

Exploring The Differences Between Rosemary And Thyme Flavor Profiles And Uses

May 31, 2025