The SEC And XRP: Navigating The Commodity Classification Debate

Table of Contents

The SEC's Case Against Ripple Labs

The SEC alleges that Ripple Labs sold XRP as an unregistered security, violating federal securities laws. Their argument hinges on the Howey Test, a framework used to determine whether an investment contract qualifies as a security. The SEC contends that XRP meets all criteria of the Howey Test.

- The SEC's definition of an "investment contract": The SEC defines an investment contract as an investment of money in a common enterprise with a reasonable expectation of profits derived primarily from the efforts of others.

- The role of Ripple's sales and distribution of XRP: The SEC points to Ripple's extensive sales and distribution of XRP, arguing this constituted an offering of securities. They highlight the significant amounts of XRP sold to institutional investors.

- The expectation of profit based on Ripple's efforts: The SEC argues that investors purchased XRP with the expectation of profit based on Ripple's development efforts and market manipulation.

- The common enterprise aspect of the investment: The SEC claims that purchasers of XRP were part of a common enterprise, sharing in the success or failure of Ripple's business.

Ripple's Defense and Arguments

Ripple vehemently denies the SEC's claims, arguing that XRP is a decentralized digital asset functioning as a currency, not a security. They emphasize XRP's utility and its independent operation outside of Ripple's direct control.

- Arguments regarding XRP's decentralized exchange and use cases: Ripple highlights XRP's use in cross-border payments and its operation on decentralized exchanges.

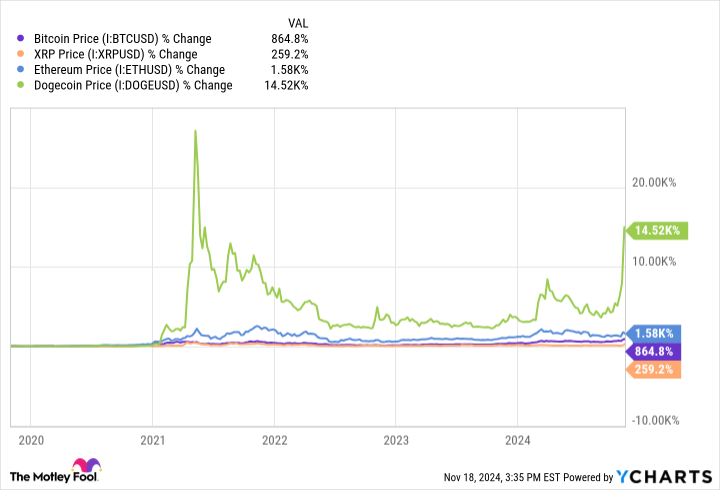

- Comparison with other cryptocurrencies not classified as securities: Ripple points to other cryptocurrencies, like Bitcoin and Ethereum, that haven't been classified as securities by the SEC, arguing that XRP's characteristics are similar.

- The lack of direct control Ripple exerts over the XRP market: Ripple stresses that it doesn't control the price or trading of XRP, a key difference from a typical security offering.

- The distinction between XRP's sale and the sale of securities: Ripple argues that their sales of XRP were not equivalent to the sale of securities, citing differences in investor protections and regulatory frameworks.

Legal Precedents and the Howey Test

The Howey Test is central to this case. It requires a court to consider four elements: an investment of money, a common enterprise, an expectation of profits, and profits derived from the efforts of others. Applying this test to digital assets presents significant challenges.

- Key aspects of the Howey Test: Each element of the Howey Test needs to be thoroughly examined in the context of XRP's decentralized nature and its use as a digital currency.

- Examples of previous court rulings relevant to cryptocurrency classification: Previous cases involving other digital assets provide some guidance, but each case is unique and the legal landscape is still evolving.

- Ambiguities and complexities in applying the test to decentralized cryptocurrencies: The decentralized nature of many cryptocurrencies makes it difficult to definitively establish the "efforts of others" element of the Howey Test.

Implications for the Cryptocurrency Market

The SEC vs. Ripple case has far-reaching implications for the cryptocurrency market. The outcome will shape regulatory clarity, investor confidence, and future innovation.

- Potential chilling effect on cryptocurrency development and investment: A ruling against Ripple could stifle innovation and discourage investment in the cryptocurrency space.

- Impact on regulatory frameworks for digital assets across different jurisdictions: The case's outcome will influence how other countries regulate digital assets.

- Increased scrutiny on other cryptocurrencies and their classification: Other cryptocurrencies might face increased scrutiny from regulatory bodies.

- The uncertainty facing investors and the potential for market volatility: The ongoing uncertainty creates volatility and makes it challenging for investors to make informed decisions.

Potential Outcomes and Future of XRP

Several outcomes are possible in the SEC vs. Ripple lawsuit. Each scenario has significant implications for XRP and the broader cryptocurrency market.

- Scenario: SEC wins – implications for XRP and the broader market: An SEC victory could lead to XRP being classified as a security, potentially resulting in significant fines for Ripple and impacting XRP's trading.

- Scenario: Ripple wins – implications for XRP and the broader market: A Ripple victory could provide much-needed regulatory clarity and boost investor confidence.

- Scenario: Settlement – potential terms and their impact: A settlement could involve Ripple paying fines or agreeing to stricter regulatory compliance measures.

- The long-term outlook for XRP regulation and adoption: Regardless of the outcome, the case will shape the future of XRP regulation and its adoption in the market.

Understanding the SEC and XRP Debate – A Path Forward

The SEC and Ripple present contrasting arguments regarding XRP's classification. The SEC emphasizes the potential for investor deception, while Ripple highlights XRP's decentralized nature and utility. This case is crucial for the future of cryptocurrency regulation. Staying informed about legal developments is paramount. Continue researching the "SEC and XRP" debate and stay updated on any further legal developments. Explore resources from reputable legal and financial news outlets for deeper insights. Understanding the complexities of this case is vital for navigating the evolving cryptocurrency landscape.

Featured Posts

-

Kripto Varliklarda Miras Sorunu Sifre Kaybinin Yasal Sonuclari

May 08, 2025

Kripto Varliklarda Miras Sorunu Sifre Kaybinin Yasal Sonuclari

May 08, 2025 -

Racha Imparable De Los Dodgers Historico Inicio De Temporada

May 08, 2025

Racha Imparable De Los Dodgers Historico Inicio De Temporada

May 08, 2025 -

Ligue 1 El Psg Se Impone Al Lyon En Casa

May 08, 2025

Ligue 1 El Psg Se Impone Al Lyon En Casa

May 08, 2025 -

Anons Pivfinalnikh Matchiv Ligi Chempioniv Arsenal Ps Zh Barselona Inter 2024 2025

May 08, 2025

Anons Pivfinalnikh Matchiv Ligi Chempioniv Arsenal Ps Zh Barselona Inter 2024 2025

May 08, 2025 -

Xrp Poised For A Parabolic Move 3 Reasons To Watch

May 08, 2025

Xrp Poised For A Parabolic Move 3 Reasons To Watch

May 08, 2025