The Simplest Dividend Strategy Is The Most Profitable

Table of Contents

Selecting High-Yield Dividend Stocks for Consistent Returns

The foundation of any successful simplest dividend strategy lies in choosing the right stocks. Don't chase flashy, high-yield stocks with questionable histories; instead, focus on companies with a proven track record of consistent dividend payments and sustainable dividend growth. This requires careful analysis of several key financial metrics:

- Dividend Payout Ratio: This ratio indicates the percentage of a company's earnings that are paid out as dividends. A healthy payout ratio is generally below 70%, suggesting the company has enough retained earnings to reinvest in growth and maintain its dividend payments even during economic downturns.

- Debt-to-Equity Ratio: A low debt-to-equity ratio signifies financial stability and a lower risk of dividend cuts. High debt can strain a company's ability to meet its obligations, including dividend payments.

- Free Cash Flow (FCF): FCF represents the cash a company generates after covering its operating expenses and capital expenditures. Strong FCF is crucial for sustaining dividend payments and future growth.

- Earnings Per Share (EPS) Growth: Consistent growth in earnings per share indicates a healthy and expanding business, making future dividend increases more likely.

Sectors known for strong dividend yields include:

- REITs (Real Estate Investment Trusts): These companies own and operate income-producing real estate, often providing high and consistent dividend yields.

- Utilities: Utility companies, providing essential services like electricity and gas, tend to have stable cash flows and consistent dividend payouts.

- Consumer Staples: Companies that produce essential goods, like food and household products, generally experience stable demand, leading to reliable dividends.

Utilize screening tools and resources like those offered by major financial websites to identify high-yield dividend stocks that meet your criteria. Thorough research is key to implementing a successful simplest dividend strategy.

The Power of Dividend Reinvestment for Accelerated Growth

Dividend reinvestment plans (DRIPs) are a cornerstone of the simplest dividend strategy. Instead of receiving dividend payments in cash, you automatically reinvest them to purchase more shares of the same company. This seemingly small action unleashes the incredible power of compounding. The more shares you own, the more dividends you receive, leading to an exponential increase in your holdings over time.

Example: Imagine investing $10,000 in a stock yielding 5% annually. With dividend reinvestment, your returns compound year after year, significantly outpacing an investment where dividends are withdrawn. The difference becomes increasingly significant over longer time horizons.

While DRIPs offer substantial tax advantages in some jurisdictions, it's crucial to understand the potential tax implications in your region and consult a financial advisor if needed to optimize your tax strategy.

Minimize Trading Costs to Maximize Profits

The beauty of the simplest dividend strategy lies in its simplicity. Frequent trading, driven by short-term market fluctuations, can significantly erode profits and undermine the benefits of long-term dividend growth. Minimizing trading costs is paramount.

- Use Low-Cost Brokerage Accounts: Choose a brokerage with low or no commission fees to reduce your expenses.

- Embrace the "Buy and Hold" Approach: Once you've identified high-quality dividend stocks, hold them for the long term. Avoid impulsive trades based on short-term market noise.

Long-Term Perspective: The Key to Success with a Simple Dividend Strategy

Patience is a virtue, especially when it comes to dividend investing. The simplest dividend strategy is a marathon, not a sprint. The primary goal is consistent, long-term growth, not chasing short-term gains. Market corrections and volatility are inevitable, but with a long-term horizon, these fluctuations become less significant.

Historical data consistently shows the long-term outperformance of dividend-paying stocks compared to non-dividend-paying stocks. This underscores the importance of patience and discipline in your simplest dividend strategy.

Reap the Rewards of the Simplest Dividend Strategy

A simple, long-term approach to dividend investing, focused on quality stocks and dividend reinvestment, consistently outperforms more complex strategies. The key steps are straightforward: select high-yield dividend stocks, reinvest your dividends, minimize trading costs, and maintain a long-term perspective. Start implementing the simplest dividend strategy today! Research high-yield stocks, utilize online resources to help you build your portfolio, and begin your journey toward financial freedom and long-term wealth creation with this profitable dividend approach and simple dividend investing strategy. The power of a simple, easy dividend strategy is within your reach – seize it!

Featured Posts

-

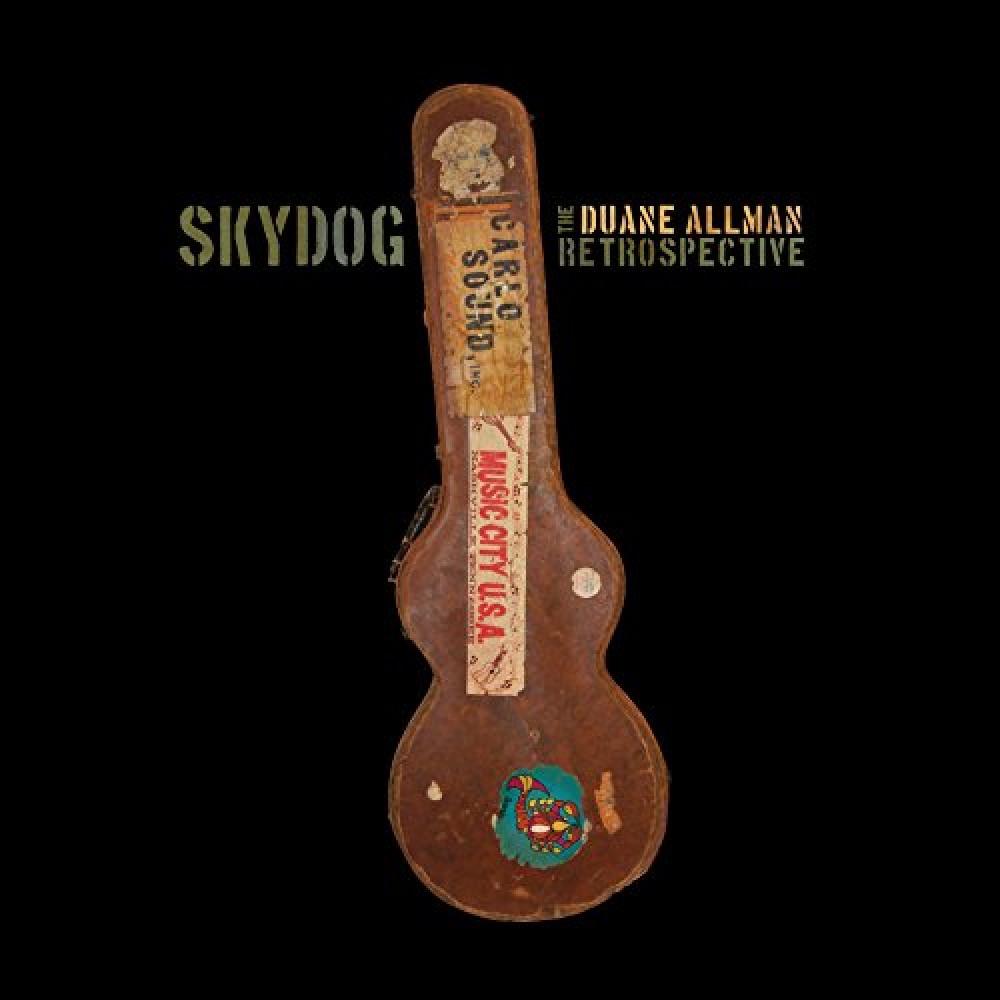

Stallone And Partons Musical Comedy A Retrospective On A Box Office Failure

May 11, 2025

Stallone And Partons Musical Comedy A Retrospective On A Box Office Failure

May 11, 2025 -

Billetera Virtual Uruguaya Cuentas Gratuitas Para Argentinos

May 11, 2025

Billetera Virtual Uruguaya Cuentas Gratuitas Para Argentinos

May 11, 2025 -

Payton Pritchards Childhood Influence On A Defining Career Moment

May 11, 2025

Payton Pritchards Childhood Influence On A Defining Career Moment

May 11, 2025 -

Celtics Blowout Win Secures Division Championship

May 11, 2025

Celtics Blowout Win Secures Division Championship

May 11, 2025 -

Thibodeaus Plea For Resolve Knicks Suffer Crushing 37 Point Loss

May 11, 2025

Thibodeaus Plea For Resolve Knicks Suffer Crushing 37 Point Loss

May 11, 2025