The Stark Math On The GOP Tax Plan: Deficit Impact Analysis

Table of Contents

Projected Revenue Losses from the GOP Tax Plan

The core argument against many GOP tax plans centers on projected revenue losses. Proposed tax cuts, often aimed at stimulating economic growth through supply-side economics, significantly reduce the government's tax revenue. This reduction creates a budget shortfall that needs to be addressed. The magnitude of this revenue loss is a key factor in determining the plan's overall fiscal impact.

-

Examining Specific Tax Cuts: Analyzing individual tax cuts—like reductions in corporate tax rates or individual income tax brackets—allows for a granular understanding of their individual contribution to the overall revenue loss. Each reduction needs to be assessed against its projected impact.

-

Economic Modeling and its Limitations: Various economic models predict the revenue impact of tax cuts, but these models have inherent limitations. They rely on assumptions about economic growth, behavioral responses to tax changes, and other factors that are difficult to predict with certainty. Different models often yield varying results, highlighting the uncertainty involved.

-

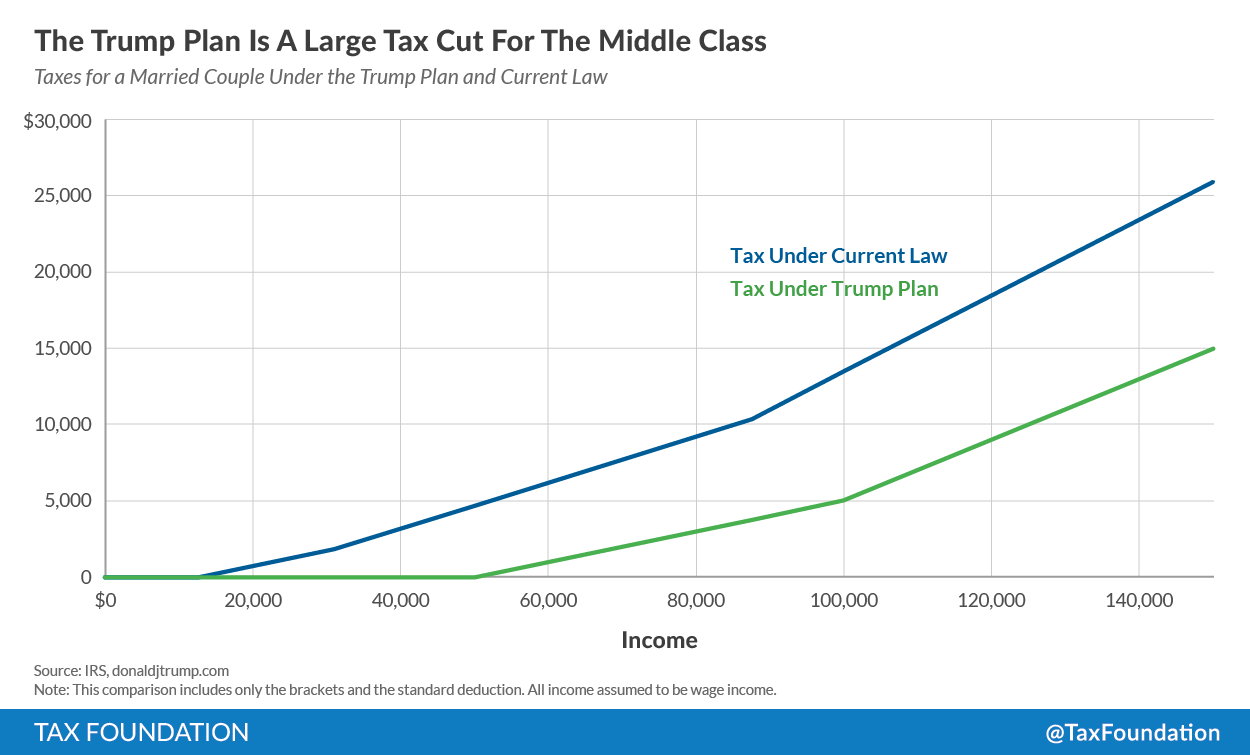

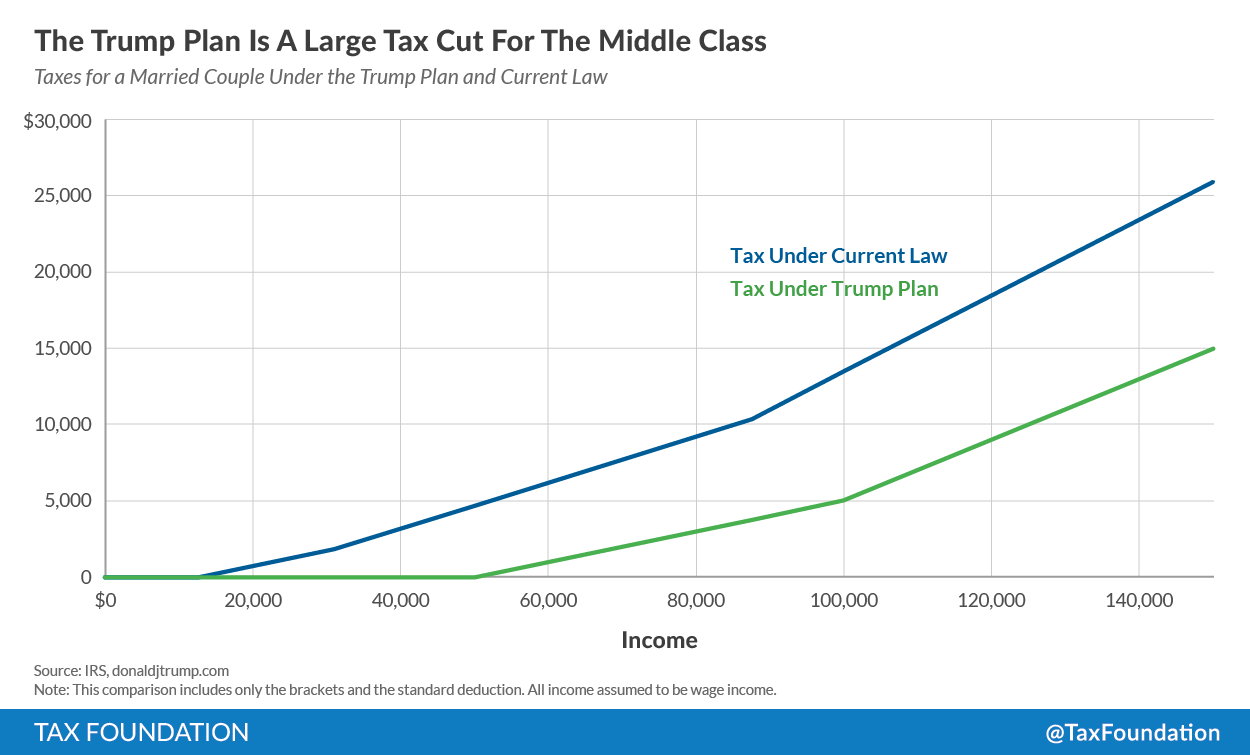

Illustrative Charts and Graphs: Visual representations are crucial. Charts and graphs depicting the projected revenue decline over a 5, 10, and 20-year period can effectively communicate the scale of the potential problem.

-

Addressing Counterarguments: Proponents of these plans often argue that economic growth stimulated by the tax cuts will ultimately offset the initial revenue losses. This is a crucial point of contention that requires thorough investigation. We'll examine this claim in more detail later.

Increased National Debt Under the GOP Tax Plan

The projected revenue losses directly translate into a larger national debt. The increased deficit spending necessary to maintain government operations exacerbates the existing national debt, leading to significant long-term consequences.

-

Debt Projections: Projecting the increase in the national debt over different timeframes (5, 10, 20 years) provides a clear picture of the accumulating burden. These projections must be grounded in realistic assumptions about economic growth and interest rates.

-

Consequences of Increased Debt: A larger national debt can lead to several negative consequences, including higher interest rates, which increase the cost of borrowing for both the government and the private sector. It can also lead to reduced government spending in other crucial areas like education and infrastructure.

-

Comparative Analysis: Comparing the projected debt increase under the GOP plan with alternative fiscal scenarios highlights the relative magnitude of the potential fiscal burden. This comparison helps understand the trade-offs involved.

-

Impact on Future Generations: The accumulation of national debt places a significant burden on future generations, who will inherit the responsibility of paying off this debt. This long-term sustainability issue is a critical consideration.

Analysis of Economic Growth Claims to Offset Deficit Impacts

A central argument in favor of GOP tax plans is that the resulting economic growth will offset the revenue losses. This argument relies on supply-side economics or trickle-down economics, positing that tax cuts incentivize investment and job creation, ultimately leading to increased tax revenue.

-

Historical Evidence: Examining the historical record of previous tax cuts and their impact on economic growth is crucial. Did past tax cuts deliver the promised economic growth? What were the actual outcomes?

-

Underlying Assumptions: The economic models predicting growth make several assumptions—regarding the responsiveness of investment to tax cuts, the elasticity of labor supply, and the overall macroeconomic environment—that need careful scrutiny.

-

Unintended Consequences: Tax cuts can have unintended consequences, such as increased income inequality and environmental damage due to lack of investment in green technology. A comprehensive analysis must weigh these potential outcomes.

-

Comparison with Previous Growth Rates: Comparing the projected growth rates under the GOP plan with those achieved under previous administrations provides valuable context for evaluating the plausibility of these predictions.

Alternative Fiscal Policies and their Deficit Impacts (Comparative Analysis)

To provide a balanced perspective, it's important to briefly consider alternative fiscal policies and their projected impact on the deficit. This comparative analysis allows for a more informed judgment on the GOP tax plan's fiscal responsibility. For example, exploring alternative tax reforms focused on closing tax loopholes or increasing taxes on higher earners can offer contrasting scenarios. These alternatives often present different trade-offs between economic growth and fiscal sustainability.

Conclusion

This analysis reveals the stark mathematical realities of the GOP tax plan's potential impact on the national deficit. The projected revenue losses are substantial, leading to a significant increase in the national debt with potentially severe long-term consequences. While proponents argue that economic growth will offset these losses, a critical examination of historical evidence and underlying assumptions reveals significant uncertainty. Understanding the GOP tax plan deficit and its long-term consequences is crucial for informed civic engagement. Further research into the fiscal impact of various tax cuts and government spending plans is encouraged to promote a more responsible and sustainable fiscal future. Continue your research by exploring reputable sources analyzing the fiscal impact of various tax cuts and government spending plans.

Featured Posts

-

Significant Hmrc Changes To Side Hustle Tax The Implications For You

May 20, 2025

Significant Hmrc Changes To Side Hustle Tax The Implications For You

May 20, 2025 -

Learn To Write Like Agatha Christie With Bbcs Ai Courses

May 20, 2025

Learn To Write Like Agatha Christie With Bbcs Ai Courses

May 20, 2025 -

Extreme Price Increase For V Mware At And T Sounds The Alarm

May 20, 2025

Extreme Price Increase For V Mware At And T Sounds The Alarm

May 20, 2025 -

Kaellman Ja Hoskonen Puola Ura Paeaettynyt

May 20, 2025

Kaellman Ja Hoskonen Puola Ura Paeaettynyt

May 20, 2025 -

F1 Miami Hamilton And Ferraris Tense Tea Break Moment

May 20, 2025

F1 Miami Hamilton And Ferraris Tense Tea Break Moment

May 20, 2025

Latest Posts

-

Jacob Friis Julkisti Avauskokoonpanonsa Kamara Ja Pukki Vaihdossa

May 20, 2025

Jacob Friis Julkisti Avauskokoonpanonsa Kamara Ja Pukki Vaihdossa

May 20, 2025 -

Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia Kaellman Sivussa

May 20, 2025

Huuhkajien Avauskokoonpanossa Merkittaeviae Muutoksia Kaellman Sivussa

May 20, 2025 -

Kaksi Tuttua Nimeae Ulos Huuhkajien Avauskokoonpanosta

May 20, 2025

Kaksi Tuttua Nimeae Ulos Huuhkajien Avauskokoonpanosta

May 20, 2025 -

Huuhkajien Yllaetyskaeaenne Avauskokoonpanossa Kolme Muutosta

May 20, 2025

Huuhkajien Yllaetyskaeaenne Avauskokoonpanossa Kolme Muutosta

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025