The Trump Administration And The Nippon-U.S. Steel Merger: A Comprehensive Overview

Table of Contents

The Trump Administration's Trade Policies and their Impact on the Steel Industry

The Trump administration's trade policies significantly influenced the landscape of the steel industry, directly impacting the feasibility of the Nippon-U.S. Steel merger.

Section 301 Tariffs and their Influence on Merger Considerations

The Trump administration imposed Section 301 tariffs on steel imports from various countries, aiming to protect domestic steel producers like U.S. Steel.

- Tariffs Imposed: These tariffs, ranging from 25% to 50%, significantly increased the cost of imported steel.

- Impact on Competitiveness: This made imported steel less competitive, potentially benefiting U.S. Steel. However, it also increased the price of steel for American manufacturers, impacting their competitiveness globally.

- Benefits and Drawbacks for U.S. Steel: While the tariffs provided a temporary boost to U.S. Steel's market share, they also led to retaliatory tariffs from other countries, impacting U.S. Steel's export opportunities. The increased prices could also stifle demand, ultimately impacting profitability.

"America First" Policy and its Relevance to the Merger Evaluation

The "America First" policy emphasized protecting American industries and jobs. This directly impacted the administration's evaluation of the Nippon-U.S. Steel merger.

- Protecting American Industries: The administration's focus was on ensuring the merger didn't compromise the competitiveness of the American steel industry.

- Influence on Merger Assessment: Concerns arose regarding potential job losses in the U.S. if the merger led to plant closures or reduced production. The administration's review scrutinized this aspect rigorously.

- National Security Implications: The administration also considered national security implications, assessing whether the merger could compromise the U.S.'s steel supply chain, particularly during times of conflict or economic instability.

Antitrust Concerns and Regulatory Scrutiny of the Nippon-U.S. Steel Merger

The proposed merger faced significant antitrust scrutiny from the Department of Justice (DOJ) and the Federal Trade Commission (FTC).

The Role of the Department of Justice (DOJ) and the Federal Trade Commission (FTC)

The DOJ and FTC are responsible for preventing mergers that could substantially lessen competition.

- Standard Antitrust Review: The agencies conducted a thorough review, analyzing market concentration, potential price increases, and the elimination of competition.

- Potential Anti-competitive Effects: The merger raised concerns about the creation of a dominant player in the steel market, potentially leading to higher prices and reduced innovation.

- Market Concentration Investigation: The agencies carefully examined the combined market share of NSSMC and U.S. Steel, assessing whether the merger would create a monopoly or oligopoly.

Public Opinion and Stakeholder Concerns about the Merger

The proposed merger generated considerable public debate and stakeholder concerns.

- Public Opposition and Support: Labor unions, fearing job losses, largely opposed the merger. Some consumers also expressed concerns about potential price increases. However, some argued that the merger could strengthen the U.S. steel industry's global competitiveness.

- Concerns Raised by Competitors: Competitors in the steel industry voiced concerns about reduced competition and potential anti-competitive behavior.

- Media Coverage and its Influence: Extensive media coverage played a crucial role in shaping public opinion and influencing the regulatory process.

Economic Impacts – Projected and Actual

The potential economic consequences of the merger were widely debated.

- Projected Impacts: Proponents argued the merger could lead to increased efficiency, economies of scale, and potential job creation through investments in new technologies. Conversely, critics feared job losses due to plant closures and higher steel prices for consumers.

- Actual Economic Outcomes: Since the merger ultimately did not proceed, we can only analyze the avoided economic consequences. The absence of the merger likely prevented substantial market concentration and maintained a more competitive landscape in the steel industry.

- Comparison of Predicted and Actual Impacts: The lack of the merger prevented the potential negative impacts predicted by critics, but also negated the potential positive outcomes envisioned by supporters.

The Outcome of the Nippon-U.S. Steel Merger Attempt

The Nippon-U.S. Steel merger ultimately failed.

- Unsuccessful Merger: The merger was abandoned due to a combination of factors, including significant antitrust concerns, regulatory hurdles, and potentially, the uncertainty created by the Trump administration's volatile trade policies.

- Reasons for Failure: The extensive regulatory scrutiny, along with the potential for protracted legal battles, made the merger too risky and costly for the involved companies.

- Alternative Strategies: Both companies likely pursued alternative strategies to improve their competitive positions, focusing on internal improvements and strategic alliances.

- Long-term Consequences: The failure likely preserved a more competitive steel market in the U.S., although it's difficult to quantify the precise long-term economic consequences.

Conclusion: Understanding the Legacy of the Trump Administration and the Nippon-U.S. Steel Merger

The attempted Nippon-U.S. Steel merger serves as a case study illustrating the complex interplay of trade policy, antitrust regulations, and economic considerations. The Trump administration's protectionist policies, particularly the Section 301 tariffs, created a backdrop of uncertainty that, combined with substantial antitrust concerns, ultimately doomed the merger. The case highlights the significant role of antitrust regulations in shaping mergers and acquisitions in the steel industry and beyond. It also underscores the need for a careful consideration of the potential economic and social implications of such large-scale corporate actions. To further understand the complexities of international trade and antitrust regulations, research the impact of the Trump administration's policies on other industries using keywords like "Trump administration trade policies," "impact of tariffs," "antitrust law in the steel industry", and conduct a deeper "Nippon-U.S. Steel merger analysis."

Featured Posts

-

Naomi Kempbell Pokazala Povzroslevshikh Detey Pravda O Romane S Millionerom

May 26, 2025

Naomi Kempbell Pokazala Povzroslevshikh Detey Pravda O Romane S Millionerom

May 26, 2025 -

55 Richna Naomi Kempbell Stil Ta Kar Yera Legendi

May 26, 2025

55 Richna Naomi Kempbell Stil Ta Kar Yera Legendi

May 26, 2025 -

Hsv Aufstieg Und Die Zukunft In Der Bundesliga Nach Sieben Jahren

May 26, 2025

Hsv Aufstieg Und Die Zukunft In Der Bundesliga Nach Sieben Jahren

May 26, 2025 -

Craig Mc Ilquham Hells Angels Member Remembered At Sundays Service

May 26, 2025

Craig Mc Ilquham Hells Angels Member Remembered At Sundays Service

May 26, 2025 -

Sirkuit Ayrton Senna Goiania Persiapan Moto Gp Di Brasil Untuk Tahun Depan

May 26, 2025

Sirkuit Ayrton Senna Goiania Persiapan Moto Gp Di Brasil Untuk Tahun Depan

May 26, 2025

Latest Posts

-

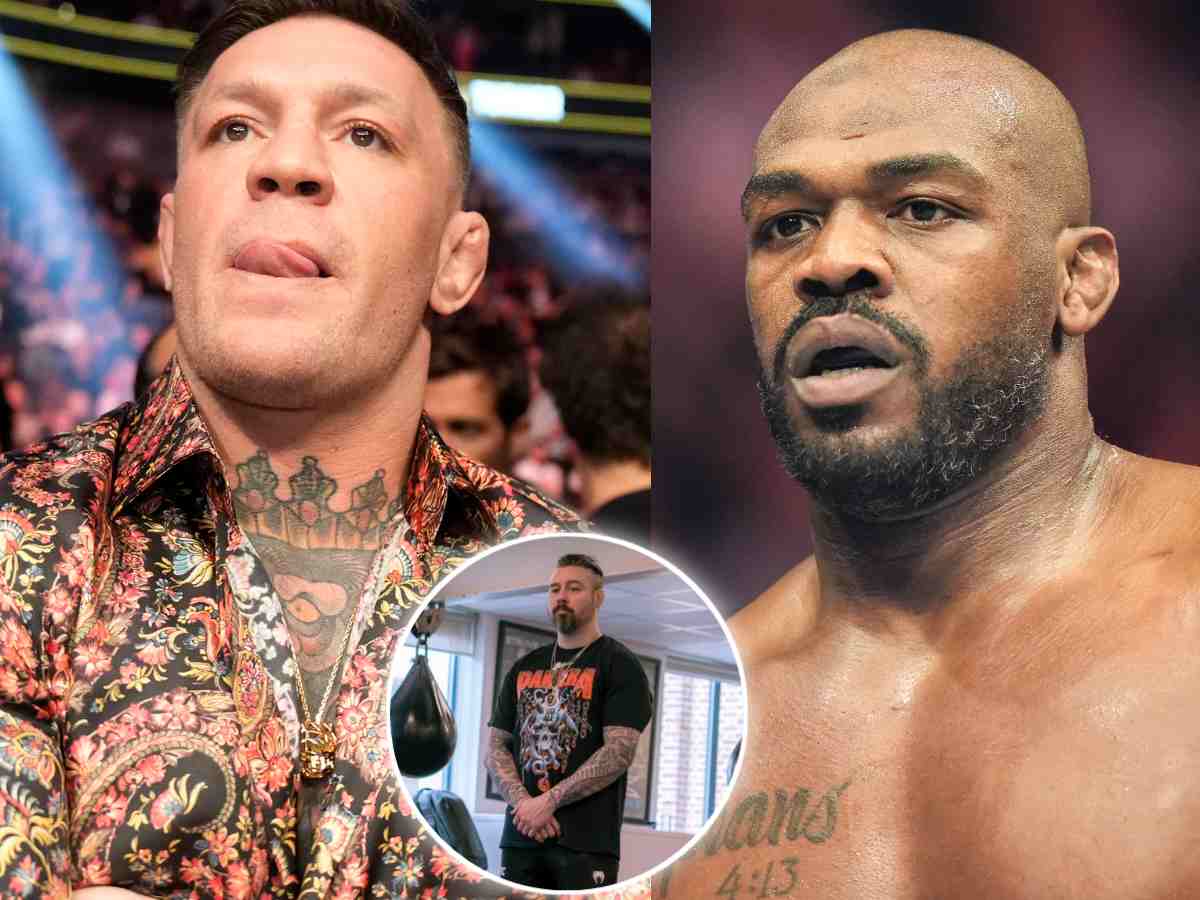

Jon Jones Accused Of Mentally Exhausting Tom Aspinall Former Opponents Claim After Dana White Update

May 30, 2025

Jon Jones Accused Of Mentally Exhausting Tom Aspinall Former Opponents Claim After Dana White Update

May 30, 2025 -

Paddy Pimbletts Bold Prediction Jones Vs Aspinall Heavyweight Showdown

May 30, 2025

Paddy Pimbletts Bold Prediction Jones Vs Aspinall Heavyweight Showdown

May 30, 2025 -

Fan Backlash 100 000 Sign Petition To Strip Jon Jones Of Ufc Title

May 30, 2025

Fan Backlash 100 000 Sign Petition To Strip Jon Jones Of Ufc Title

May 30, 2025 -

Jon Jones Title In Jeopardy Massive Petition Reaches 100 000 Signatures

May 30, 2025

Jon Jones Title In Jeopardy Massive Petition Reaches 100 000 Signatures

May 30, 2025 -

100 000 Signatures Fans Petition To Strip Jon Jones Of Title

May 30, 2025

100 000 Signatures Fans Petition To Strip Jon Jones Of Title

May 30, 2025