The Trump Factor: How Presidential Policies Could Affect Bitcoin's Price

Table of Contents

Regulatory Uncertainty and Bitcoin's Price

The cryptocurrency market thrives on clarity and consistency. Regulatory uncertainty, however, can trigger significant price swings.

Trump Administration's Stance on Crypto Regulation

The Trump administration's approach to cryptocurrency regulation was characterized by a notable lack of clear, cohesive policy.

- Conflicting statements from the SEC and CFTC regarding Bitcoin and other cryptocurrencies.

- Absence of comprehensive federal legislation specifically addressing cryptocurrencies.

- Varying regulatory approaches across different states, creating a fragmented landscape.

This inconsistent regulatory environment fostered uncertainty among investors, impacting Bitcoin's price. A lack of clear guidelines hindered institutional investment and created an atmosphere of caution. Periods of greater uncertainty often coincided with dips in Bitcoin's value, demonstrating the clear link between regulatory clarity and market stability.

Potential Future Republican Approaches to Crypto

Future Republican administrations could adopt several approaches to crypto regulation:

- Stricter Regulation: Increased oversight, potentially mirroring traditional financial regulations, could dampen enthusiasm but enhance market stability in the long run. This could lead to short-term price drops as investors adapt to the new rules.

- Lenient Approach: A more hands-off approach, emphasizing innovation and free markets, could attract investment and potentially boost Bitcoin's price. However, this could also lead to increased risk and volatility.

- Continued Ambiguity: Maintaining the status quo, with unclear rules and inconsistent enforcement, would likely perpetuate the volatility observed during the Trump era.

The future regulatory landscape will significantly influence Bitcoin's price trajectory. Predicting the approach of future administrations is impossible, but understanding the potential scenarios is critical for informed investment decisions.

Economic Policies and Bitcoin's Safe Haven Status

Economic policies play a pivotal role in shaping investor sentiment towards Bitcoin.

Impact of Fiscal and Monetary Policies

Trump's economic policies, including tax cuts and deregulation, had a complex relationship with Bitcoin's price.

- Tax cuts initially boosted market optimism and potentially fueled some upward price movements.

- Periods of increased government spending and expansionary monetary policy could have driven investors seeking inflation hedges towards Bitcoin.

- However, the correlation between specific policy decisions and Bitcoin's price movements is not always straightforward, with other global factors often playing a larger role.

Whether Bitcoin consistently acted as a safe haven asset during the Trump administration is debatable. While some periods of economic uncertainty saw Bitcoin's price rise, this was often alongside a rise in other "safe haven" assets, such as gold.

Potential Future Economic Policies and Bitcoin

Future Republican administrations might pursue different economic strategies.

- Increased government spending could lead to inflation, potentially increasing Bitcoin's appeal as a hedge.

- Tax increases, conversely, might reduce investor enthusiasm and negatively impact Bitcoin's price.

- Changes in monetary policy, such as interest rate hikes, could affect the attractiveness of Bitcoin relative to other investment options.

Analyzing the potential impact of these economic policies is crucial for understanding how they might influence Bitcoin's position as a store of value or investment asset.

Geopolitical Events and Bitcoin's Price

Geopolitical instability can significantly impact Bitcoin's price.

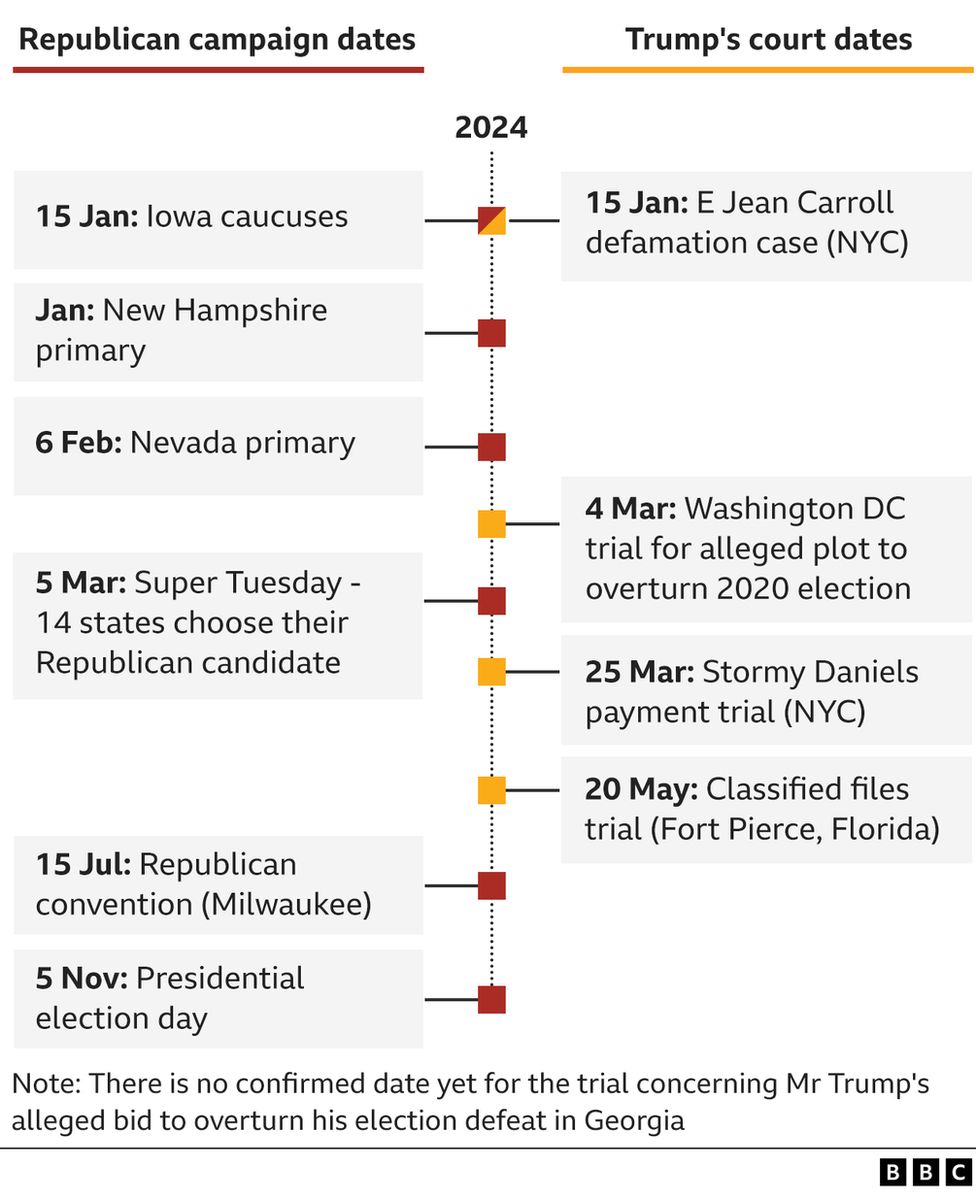

Trump's Foreign Policy and Bitcoin

Trump's often unpredictable foreign policy created periods of geopolitical tension.

- Trade disputes with China and other nations.

- Strained relationships with key allies.

- Uncertainties surrounding international agreements.

The relationship between these events and Bitcoin's price is complex. While Bitcoin sometimes rose during periods of uncertainty, its behavior wasn't always consistent with its perceived role as a safe haven asset. Other factors, such as market sentiment and overall economic conditions, frequently played a more decisive role.

Potential Future Geopolitical Influences

Future Republican administrations might face different geopolitical challenges.

- Escalating trade wars could negatively impact global markets, influencing Bitcoin’s price.

- International sanctions or conflicts could create uncertainty and drive investors towards Bitcoin as a safe haven, depending on the severity and duration of the crisis.

- Shifts in global alliances could lead to market volatility, affecting Bitcoin's price.

Conclusion

The "Trump Factor Bitcoin Price" connection underscores the significant influence of presidential policies on the cryptocurrency market. Regulatory clarity, economic stability, and geopolitical events all play a crucial role in shaping investor sentiment and Bitcoin's price. It's vital to remember that Bitcoin's volatility is influenced by many factors, and the "Trump Factor" is merely one piece of the puzzle. Understanding the interplay between political developments and market dynamics is crucial for informed investment decisions. To stay abreast of these crucial connections, follow reputable crypto news sources and monitor political developments closely. Understanding the "Trump Factor Bitcoin Price" connection is crucial for navigating the crypto market. Stay informed, stay ahead.

Featured Posts

-

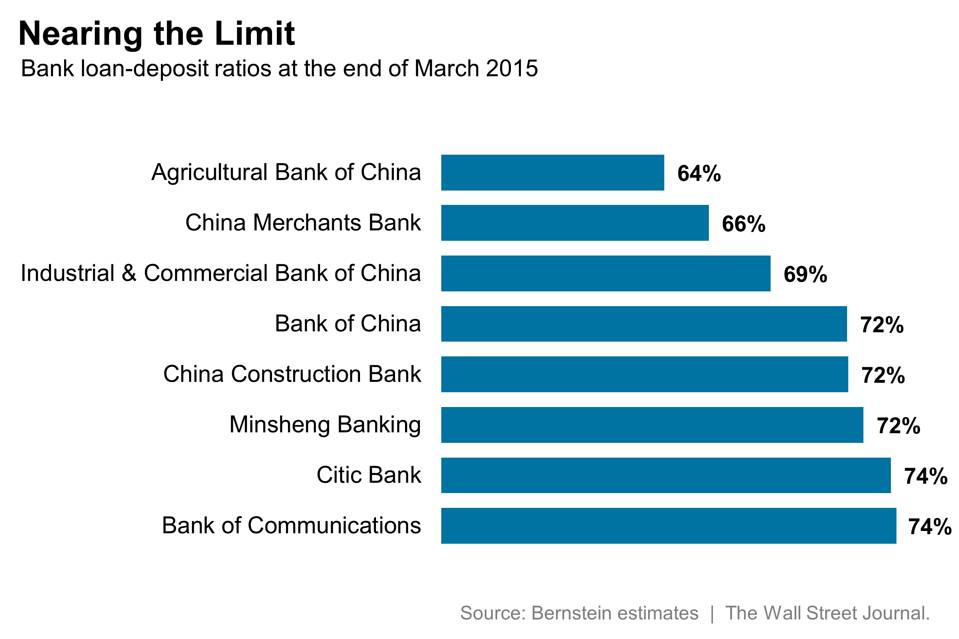

How Chinas Reduced Rates And Easier Bank Lending Affect Businesses

May 08, 2025

How Chinas Reduced Rates And Easier Bank Lending Affect Businesses

May 08, 2025 -

Carneys First D C Meeting Trump Described As Transformational

May 08, 2025

Carneys First D C Meeting Trump Described As Transformational

May 08, 2025 -

Desetta Pobeda Za Vesprem Shokantna Pobeda Nad Ps Zh

May 08, 2025

Desetta Pobeda Za Vesprem Shokantna Pobeda Nad Ps Zh

May 08, 2025 -

Bitcoin Madenciligi Son Durak

May 08, 2025

Bitcoin Madenciligi Son Durak

May 08, 2025 -

Saturday April 12th Lotto Draw Winning Numbers Announced

May 08, 2025

Saturday April 12th Lotto Draw Winning Numbers Announced

May 08, 2025