The Trump Media And Crypto.com ETF Partnership: What Investors Need To Know

Table of Contents

Understanding the Potential Partnership

A hypothetical partnership between TMTG and Crypto.com presents intriguing possibilities. The motivations behind such a collaboration could be multifaceted:

-

TMTG's need for capital infusion and expansion into new financial markets: TMTG, like many new media companies, might require substantial capital to fuel growth and expansion. Partnering with a major cryptocurrency exchange like Crypto.com could provide access to significant investment capital and broaden its financial reach. This aligns with TMTG's stated goal of building a powerful media and technology ecosystem.

-

Crypto.com's strategic move to broaden its user base and tap into a politically engaged demographic: Crypto.com, seeking to expand its market share, might see a partnership with TMTG as a way to attract a large and politically active demographic. This strategy aims to capitalize on TMTG's substantial following and brand recognition.

-

Synergies between a media company and a cryptocurrency exchange: The partnership could create significant synergies. TMTG's media platforms could be utilized to effectively market and promote the Trump Media and Crypto.com ETF, significantly increasing brand awareness and potentially driving investor interest. This cross-promotion could benefit both entities, increasing brand recognition and market penetration.

Analyzing the Hypothetical Trump Media and Crypto.com ETF

A hypothetical Trump Media and Crypto.com ETF would likely be a complex investment vehicle.

-

Potential underlying assets: The ETF could potentially hold assets related to both TMTG and the broader cryptocurrency market. This could include TMTG stock, other TMTG-related investments, and a basket of cryptocurrencies. Such diversification aims to mitigate risk but also introduces complexities. Regulatory hurdles related to the inclusion of both traditional and digital assets would need careful navigation. Compliance with SEC regulations would be paramount.

-

Expected returns and volatility: Projecting the performance of such an ETF is challenging. The inherent volatility of the cryptocurrency market, combined with the political sensitivities surrounding TMTG, suggests a potentially high-risk, high-reward scenario. Investors should anticipate significant price fluctuations.

-

Target audience: The ideal investor for this ETF would likely have a high-risk tolerance and a strong interest in both the cryptocurrency market and TMTG. It might appeal to politically engaged investors seeking exposure to a unique investment opportunity.

Risks and Considerations for Investors

Investing in a hypothetical Trump Media and Crypto.com ETF carries considerable risks:

-

Political risk: The political controversies surrounding TMTG could significantly influence the ETF's performance. Negative news or changes in the political landscape could negatively impact investor sentiment and the ETF's price.

-

Regulatory uncertainty: The regulatory environment for cryptocurrencies remains fluid and uncertain. Changes in regulations could affect the ETF's composition, trading, and overall value. Government intervention, either domestically or internationally, is a significant risk factor.

-

Market volatility: Cryptocurrency markets are notoriously volatile. The ETF's price could experience significant fluctuations, potentially leading to substantial losses for investors. Diversification within a broader investment portfolio is crucial to mitigate this risk.

-

Reputation risk: The reputations of both TMTG and Crypto.com could influence investor confidence. Negative publicity or scandals involving either company could negatively impact the ETF's price and attractiveness to potential investors.

Alternatives to a Trump Media and Crypto.com ETF

Investors seeking exposure to the cryptocurrency market or similar investment opportunities should explore alternatives:

-

Diversified cryptocurrency ETFs: Several existing ETFs offer diversified exposure to the cryptocurrency market without the political baggage associated with TMTG. These options provide broader market participation and potentially lower risk.

-

Traditional investment options: More established and less volatile investment options, such as stocks, bonds, and real estate, offer a safer alternative for risk-averse investors.

-

Due diligence: Before investing in any asset, conduct thorough due diligence. Research the underlying assets, understand the associated risks, and consult with a qualified financial advisor to make informed investment decisions.

Conclusion: Making Informed Decisions about the Trump Media and Crypto.com ETF

A potential Trump Media and Crypto.com ETF presents a complex investment opportunity. The potential for high returns is balanced against significant risks related to political factors, regulatory uncertainty, and market volatility. Before investing in any Trump Media and Crypto.com ETF, or similar ventures, carefully weigh the potential benefits and drawbacks. Remember to conduct thorough research, diversify your portfolio, and seek professional financial advice to make informed decisions that align with your risk tolerance and investment goals.

Featured Posts

-

Dwp Hardship Payments Reclaiming Money You Re Entitled To

May 08, 2025

Dwp Hardship Payments Reclaiming Money You Re Entitled To

May 08, 2025 -

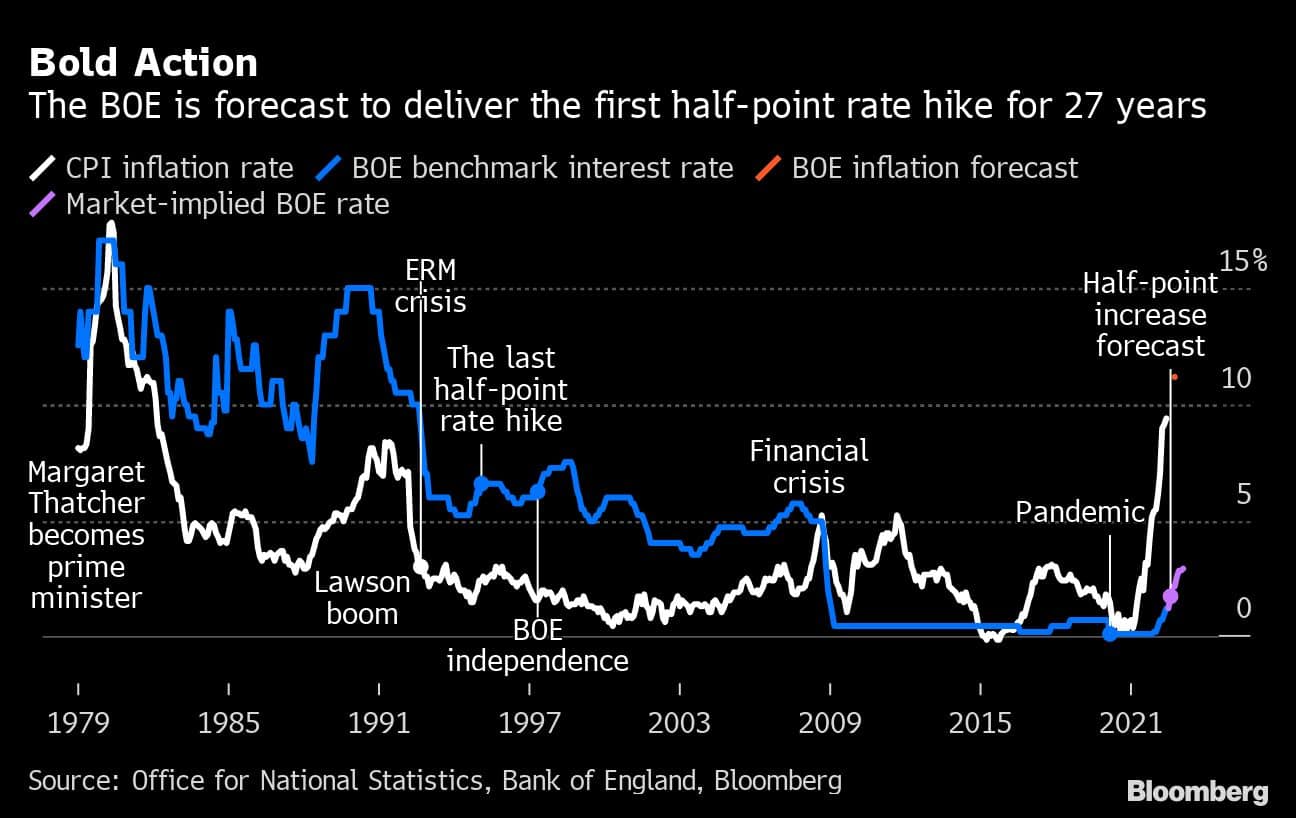

A Half Point Rate Cut The Bank Of Englands Path Forward

May 08, 2025

A Half Point Rate Cut The Bank Of Englands Path Forward

May 08, 2025 -

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025 -

Revisiting Historic Double Performances In Okc Thunder History

May 08, 2025

Revisiting Historic Double Performances In Okc Thunder History

May 08, 2025 -

Secure Your Psl 10 Seat Tickets On Sale

May 08, 2025

Secure Your Psl 10 Seat Tickets On Sale

May 08, 2025