The Trump Tax Cut Bill: A Breakdown Of The House Republican Plan

Table of Contents

Individual Income Tax Changes

The House Republican plan, instrumental in shaping the final Trump Tax Cut Bill, brought significant changes to individual income taxes.

Changes to Tax Brackets

The plan reduced the number of individual income tax brackets and lowered the rates within those brackets. This resulted in lower tax burdens for many taxpayers, particularly those in higher income brackets.

- Before: The pre-2017 tax code featured several brackets with higher rates for higher earners.

- After: The number of brackets was reduced, and the top marginal tax rate was lowered from 39.6% to 37%. The standard deduction was also significantly increased.

- Impact: While many benefited from lower tax rates, the changes disproportionately favored higher-income earners. The elimination or modification of certain deductions, discussed further below, also affected various income levels differently.

Child Tax Credit Modifications

The Trump Tax Cut Bill, heavily influenced by the House Republican plan, expanded the Child Tax Credit (CTC).

- Before: The CTC was a smaller, less generous credit, with limitations on refundability.

- After: The plan increased the maximum CTC amount and made a larger portion of the credit refundable, benefiting low and middle-income families.

- Impact: Families with children saw a considerable tax break, although the full benefit wasn't felt equally across income levels. Higher-income families received a substantial credit, while lower-income families benefitted from the increased refundability.

Impact on Itemized Deductions

The House Republican plan made notable changes to itemized deductions, impacting taxpayers who itemize rather than take the standard deduction.

- Mortgage Interest Deduction: While retained, limitations were considered in the initial House plan proposals.

- State and Local Taxes (SALT): The plan initially proposed eliminating the SALT deduction, sparking controversy and ultimately leading to some modifications in the final bill. This change disproportionately affected taxpayers in high-tax states.

- Charitable Contributions: No major changes were implemented regarding charitable contributions, but discussions of potential limits arose during the legislative process.

- Impact: Taxpayers who heavily relied on itemized deductions, particularly those in high-tax states, experienced a significant tax increase, offsetting the benefits of lower tax brackets for some.

Corporate Tax Rate Reductions

A central component of the House Republican plan was a dramatic reduction in the corporate tax rate.

Lowering the Corporate Tax Rate

The plan significantly reduced the top corporate tax rate from 35% to 21%.

- Before: A 35% corporate tax rate was considered high compared to other developed nations, potentially hindering US competitiveness.

- After: The 21% rate was intended to boost business investment, increase competitiveness, and stimulate economic growth.

- Impact: While some businesses experienced a significant tax reduction, critics argued that the lowered rate disproportionately benefitted large corporations, potentially widening the income inequality gap. The impact on job creation and wages remain a topic of ongoing debate.

Impact on Business Investment

Proponents of the corporate tax cuts argued that the lower rate would incentivize increased capital investment, research and development, and job creation.

- Small Businesses: The impact on small businesses was varied, with some seeing benefits and others facing challenges in adapting to the changes.

- Large Corporations: Large corporations, generally better equipped to benefit from lower tax rates, were expected to see a boost in profits and investment.

- Impact: The actual impact on business investment and economic growth is a subject of ongoing economic analysis, with varied and sometimes contradictory findings depending on the metrics and methodologies used.

Long-Term Economic Effects and Debates

The Trump Tax Cut Bill, profoundly shaped by the House Republican plan, continues to fuel economic debate.

Projected Economic Growth

The administration projected significant economic growth as a result of the tax cuts.

- GDP Growth: Predictions varied, with some economists forecasting substantial increases in GDP, while others remained skeptical.

- Inflationary Pressures: Concerns arose about potential inflationary pressures as a result of increased consumer spending and business investment.

- Impact: The actual economic growth experienced following the tax cuts was a subject of much debate, with varying interpretations of the data.

National Debt Implications

A major concern surrounding the tax cuts was their impact on the national debt.

- Increased Deficit: The tax cuts were expected to increase the federal budget deficit significantly.

- Long-Term Sustainability: Debates emerged concerning the long-term sustainability of the plan and the potential for future tax increases or spending cuts to address the growing deficit.

- Impact: The national debt increased following the tax cuts, leading to concerns about the country's fiscal health and potential future economic challenges.

Political and Social Consequences

The Trump Tax Cut Bill generated considerable political and social division.

- Public Opinion: Public opinion on the tax cuts was highly partisan, with supporters and critics largely divided along political lines.

- Partisan Divides: The tax cuts became a major point of contention between the Republican and Democratic parties, further fueling political polarization.

- Impact: The long-term political and social consequences of the tax cuts are still unfolding, impacting future tax policy debates and broader political discourse.

Conclusion

The Trump Tax Cut Bill, heavily influenced by the House Republican plan, significantly altered the US tax code, affecting both individual taxpayers and corporations. While proponents claimed the changes stimulated economic growth and investment, critics raised concerns about increased income inequality, the growing national debt, and the long-term sustainability of the plan. The complexities of the bill and the ongoing debates surrounding its long-term effects underscore the need for continued analysis. To further your understanding of the Trump Tax Cut Bill and its ongoing impact, research “Trump tax reform analysis,” “House Republican tax plan effects,” or “impact of Trump tax cuts” using reputable sources like the Congressional Budget Office or independent economic analysis websites.

Featured Posts

-

Dodgers Pursuit Of Next Mlb Luxury Free Agent A Closer Look

May 13, 2025

Dodgers Pursuit Of Next Mlb Luxury Free Agent A Closer Look

May 13, 2025 -

The R2 Crore Disaster How One Salman Khan Film Changed Lives

May 13, 2025

The R2 Crore Disaster How One Salman Khan Film Changed Lives

May 13, 2025 -

Diskriminatsi A Roma U Srbi I Marinika Tepi I Odgovor Uni E Roma Srbi E

May 13, 2025

Diskriminatsi A Roma U Srbi I Marinika Tepi I Odgovor Uni E Roma Srbi E

May 13, 2025 -

Scarlett Johansson And Chris Evans Undiscovered Comedy Now Streaming On Netflix

May 13, 2025

Scarlett Johansson And Chris Evans Undiscovered Comedy Now Streaming On Netflix

May 13, 2025 -

Eintracht Braunschweig Vs Hannover 96 Jannes Horns Weg Zwischen Den Rivalen

May 13, 2025

Eintracht Braunschweig Vs Hannover 96 Jannes Horns Weg Zwischen Den Rivalen

May 13, 2025

Latest Posts

-

Catch John Barrys From York With Love At Your Local Everyman

May 14, 2025

Catch John Barrys From York With Love At Your Local Everyman

May 14, 2025 -

John Barrys From York With Love An Everyman Film Event

May 14, 2025

John Barrys From York With Love An Everyman Film Event

May 14, 2025 -

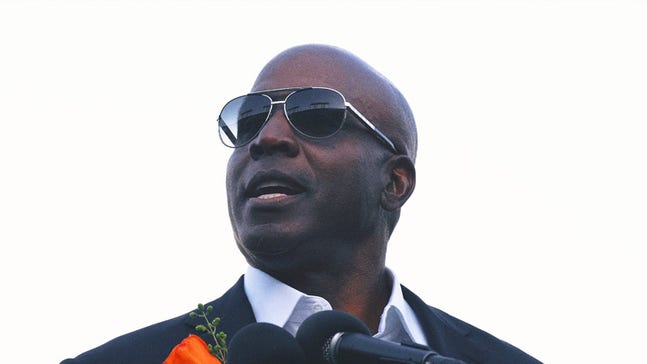

The Get Off My Lawn Vibe Barry Bonds And His Comments On Shohei Ohtanis Success

May 14, 2025

The Get Off My Lawn Vibe Barry Bonds And His Comments On Shohei Ohtanis Success

May 14, 2025 -

Everyman Cinema Presents John Barry From York With Love

May 14, 2025

Everyman Cinema Presents John Barry From York With Love

May 14, 2025 -

Bonds Vs Ohtani A Generational Talent Comparison And The Get Off My Lawn Controversy

May 14, 2025

Bonds Vs Ohtani A Generational Talent Comparison And The Get Off My Lawn Controversy

May 14, 2025