The Unseen Costs: ‘Liberation Day’ Tariffs And Their Effect On Stock Markets

Table of Contents

Immediate Market Reactions to ‘Liberation Day’ Tariffs

Volatility and Market Downturns

The announcement of "Liberation Day" tariffs triggered immediate volatility across major stock market indices. The Dow Jones Industrial Average, S&P 500, and NASDAQ all experienced significant drops within the first trading days following the announcement. The impact varied across sectors, with technology and manufacturing companies particularly affected.

- Specific Examples: The Dow Jones dropped by 2.5% on the day of the announcement, while the tech-heavy NASDAQ fell by 3%.

- Affected Sectors: The manufacturing sector saw a sharper decline than others, reflecting its greater reliance on international trade and imported materials. Technology companies, heavily reliant on global supply chains, also suffered significant losses.

- Data Points: Preliminary estimates suggest a loss of over $1 trillion in global market capitalization within the first week of the tariff implementation.

Investor Sentiment and Confidence

The implementation of "Liberation Day" tariffs significantly dampened investor sentiment and confidence. The uncertainty surrounding the long-term economic consequences led to a widespread increase in risk aversion.

- Shift in Sentiment: A clear shift from optimism to fear, uncertainty, and doubt (FUD) was observed across market participants. News outlets reported a surge in negative sentiment among investors.

- Increased Risk Aversion: Investors shifted their portfolios towards safer assets like government bonds, leading to a decrease in equity investments.

- Decreased Trading Volume/Increased Volatility: Initial high trading volume quickly gave way to decreased activity as investors adopted a wait-and-see approach. However, increased volatility persisted, reflecting the uncertainty in the market.

Long-Term Economic Consequences of ‘Liberation Day’ Tariffs

Inflationary Pressures

"Liberation Day" tariffs are expected to contribute significantly to inflationary pressures. The increased cost of imported goods and raw materials, coupled with supply chain disruptions, will likely translate into higher prices for consumers.

- Supply Chain Disruptions: Tariffs disrupt established supply chains, forcing businesses to seek alternative suppliers, often at higher costs. This adds to production expenses.

- Increased Cost of Goods: The tariffs directly increase the price of imported goods, making them less affordable for consumers. This effect is particularly pronounced for goods with limited domestic substitutes.

- Examples: Increased prices for consumer electronics, automobiles, and certain raw materials used in manufacturing are expected.

Impact on Corporate Profits and Earnings

The tariffs are projected to negatively impact corporate profits and earnings reports. Companies face increased costs, decreased export opportunities, and challenges in managing complex tariff compliance procedures.

- Decreased Export Opportunities: Retaliatory tariffs from other countries reduce the export potential for many businesses. This shrinks their overall revenue stream.

- Increased Costs: The direct cost of tariffs, combined with the added complexities of compliance, increases operational expenses for businesses. Many companies are forced to absorb these costs, affecting profit margins.

- Examples: Companies with significant international operations and those heavily reliant on imported components have reported decreased profitability due to the tariffs.

International Trade Relations and Geopolitical Risks

"Liberation Day" tariffs have significant implications for international trade relations and geopolitical stability. The potential for retaliatory tariffs and increased trade tensions could lead to further economic uncertainty.

- Retaliatory Tariffs: Other countries are likely to impose retaliatory tariffs, escalating trade disputes and creating a negative feedback loop.

- Impact on International Trade Agreements: The tariffs could undermine existing trade agreements and lead to a breakdown in global cooperation on trade matters.

- Increased Geopolitical Tensions: The tariffs exacerbate geopolitical tensions, creating an environment of uncertainty that impacts business investments and consumer confidence.

Strategies for Navigating the ‘Liberation Day’ Tariff Impact on Investments

Diversification and Risk Management

Diversification and robust risk management strategies are crucial for navigating the volatile market environment created by "Liberation Day" tariffs.

- Invest in Less Affected Sectors: Focus on sectors less dependent on international trade or those expected to benefit from increased domestic demand.

- Risk Mitigation Strategies: Implement hedging strategies to mitigate potential losses from currency fluctuations or price increases.

- Diversify geographically: Investing in assets and companies located in countries unaffected by the tariffs can reduce overall portfolio risk.

Analyzing the Affected Sectors and Identifying Opportunities

Despite the challenges, "Liberation Day" tariffs also present opportunities for investors who can identify sectors poised to benefit from changing market dynamics.

- Increased Domestic Demand: Companies that focus on domestic production and cater to increased domestic demand may see growth opportunities.

- Companies Investing in Domestic Production: Businesses investing in domestic manufacturing to avoid tariffs may experience long-term benefits. Analyzing this investment will reveal future growth potential.

Conclusion

The implementation of "Liberation Day" tariffs presents a complex and multifaceted challenge for investors. The immediate market reactions, along with the longer-term economic consequences, require careful consideration and strategic adaptation. Understanding the inflationary pressures, the impact on corporate profits, and the shifting geopolitical landscape are crucial for navigating this challenging investment environment. By diversifying investments, implementing robust risk management strategies, and actively analyzing the affected sectors, investors can strive to mitigate potential losses and identify new opportunities. Stay informed about the ongoing developments surrounding "Liberation Day" tariffs and their impact on stock markets to make well-informed investment decisions. Continuously monitoring the effect of "Liberation Day" tariffs on your portfolio is essential for successful long-term financial planning.

Featured Posts

-

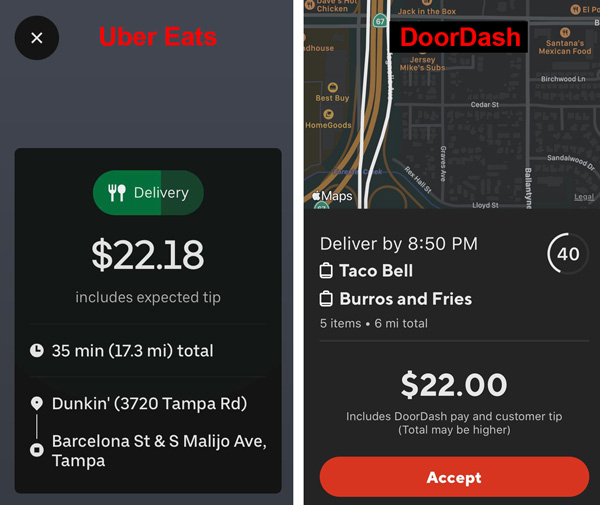

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025

Uber Vs Door Dash A Legal Battle Over Food Delivery Dominance

May 08, 2025 -

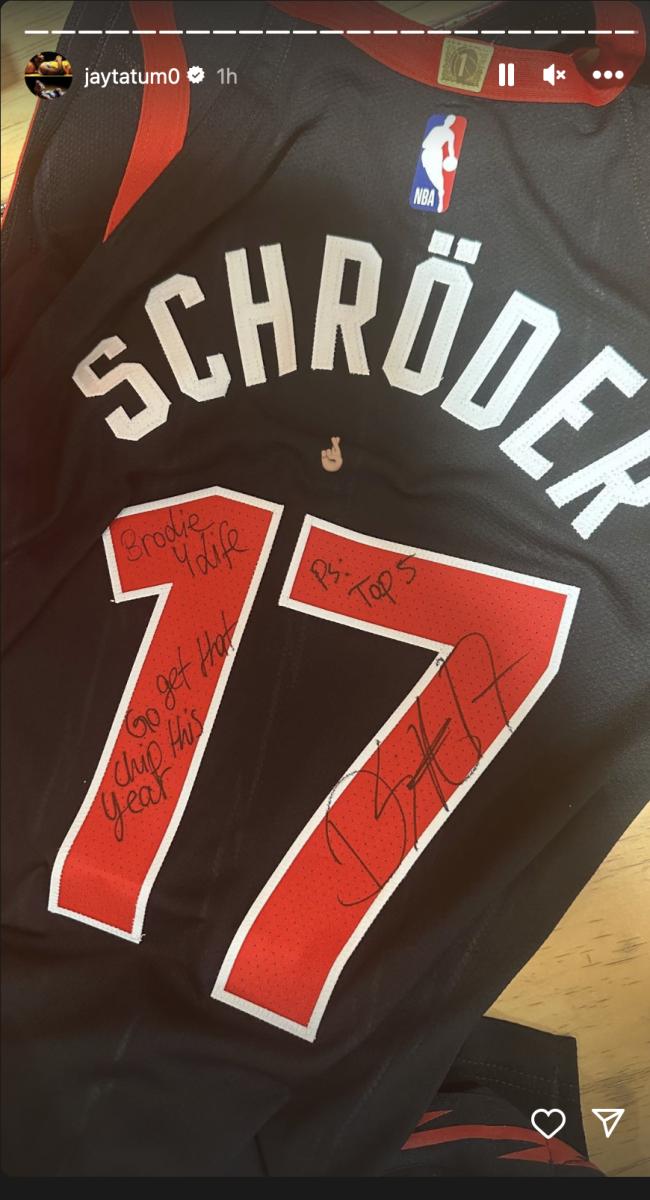

Kyle Kuzmas Reaction To Jayson Tatums Viral Instagram Post

May 08, 2025

Kyle Kuzmas Reaction To Jayson Tatums Viral Instagram Post

May 08, 2025 -

Fqdan Alasnan Qst Barbwza Fy Merkt Marakana

May 08, 2025

Fqdan Alasnan Qst Barbwza Fy Merkt Marakana

May 08, 2025 -

Us Tariffs Are They A Pretext For Gms Reduced Canadian Activity

May 08, 2025

Us Tariffs Are They A Pretext For Gms Reduced Canadian Activity

May 08, 2025 -

2025 Ptt Personel Alim Tarihleri Ve Basvuru Bilgileri

May 08, 2025

2025 Ptt Personel Alim Tarihleri Ve Basvuru Bilgileri

May 08, 2025