Tim Cook's Tariff Warning Sends Apple Stock Lower

Table of Contents

Cook's Tariff Warning: A Detailed Look

Tim Cook's warning highlighted the escalating impact of tariffs on Apple's manufacturing and supply chain. He specifically referenced increased tariffs on various components sourced from China, impacting several key product lines. These tariffs weren't a surprise, but their potential magnitude and effect on pricing were a significant concern for the tech giant.

- Specific tariff percentage increases mentioned: While the exact percentages weren't explicitly stated in all instances, Cook alluded to increases that significantly added to the cost of production. News reports suggested increases ranging from 10% to 25% on certain components.

- Products most vulnerable to tariff increases: iPhones, Macs, Apple Watches, and iPads are among the products most vulnerable to increased component costs due to tariffs. The impact is felt throughout the product lifecycle, from manufacturing to final assembly and shipping.

- Quote from Tim Cook's statement regarding the impact: While a direct quote needs to be sourced from the original statement (which needs to be linked below), a paraphrased version could be included here, such as: "The escalating tariffs are adding significant cost pressures to our manufacturing process and are negatively impacting the overall profitability of our products."

[Link to original source of Cook's statement - Insert relevant news article or Apple press release link here]

Market Reaction to the Tariff News

The market reacted swiftly and negatively to Cook's tariff warning. Apple's stock price experienced a significant drop immediately following the announcement, reflecting investor concern about the potential long-term financial implications.

- Stock price drop percentage immediately following the announcement: Insert the percentage drop here, referencing a reliable financial source (e.g., "Apple stock dropped by X% within the first hour of the announcement, according to Yahoo Finance.").

- Trading volume increase post-announcement: The trading volume for Apple stock likely surged following the news, indicating increased investor activity and volatility. Insert data here if available, citing the source.

- Analyst reactions and predictions regarding future stock performance: Include a summary of analyst opinions, noting both bullish and bearish predictions. Cite the sources of these opinions (e.g., "Analysts at Morgan Stanley predict a Y% decline in earnings, while Goldman Sachs remains cautiously optimistic, forecasting a Z% growth.")

[Insert relevant chart or graph illustrating the stock price fluctuations here. Cite the source of the financial data, e.g., Yahoo Finance, Google Finance.]

Impact on Consumers and Global Supply Chains

The consequences of these tariffs extend beyond Apple's bottom line; consumers will likely experience the impact through higher prices and potential product shortages.

- Predicted price increases for affected Apple products: Analysts predict price increases ranging from a few percentage points to potentially more significant hikes depending on the component cost increases.

- Potential delays in product availability: Increased production costs and logistical challenges may lead to delays in product availability, potentially impacting the launch timelines of new products.

- Impact on Apple's global supply chain and manufacturing: The tariffs force Apple to reconsider its global supply chain strategy, potentially leading to shifts in manufacturing locations or sourcing alternatives.

Long-Term Implications for Apple

The long-term effects of this tariff situation on Apple's profitability, market share, and strategic decisions are significant and uncertain.

- Potential strategies Apple might employ to mitigate the impact of tariffs: Apple may explore options such as shifting production to countries with more favorable trade agreements, negotiating with suppliers, or absorbing some of the increased costs to maintain competitive pricing.

- Impact on Apple's competitiveness in the global market: The increased costs could make Apple products less competitive compared to rivals, especially in price-sensitive markets.

- Potential for changes in Apple's product development or pricing strategies: Apple may adjust its product development strategy, focusing on components less affected by tariffs, or implement price adjustments to offset the increased costs.

Conclusion

Tim Cook's tariff warning significantly impacted Apple's stock price, highlighting the vulnerability of tech giants to global trade policies. The warning underscored the potential for increased prices and supply chain disruptions for consumers. The long-term implications for Apple remain to be seen, but the company will likely need to adapt its strategies to navigate this challenging environment. The impact of the Tim Cook tariff warning on Apple stock will continue to unfold.

Call to Action: Stay informed about the evolving situation surrounding the Tim Cook tariff warning and its impact on Apple stock. Regularly check reputable financial news sources for updates and analysis on the Tim Cook Tariff Warning Apple Stock situation. Understanding the impact of these tariffs is crucial for investors and consumers alike.

Featured Posts

-

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Muhii

May 24, 2025

Tuukka Taponen F1 Debyytti Jo Taenae Vuonna Jymypaukku Muhii

May 24, 2025 -

13 Vuotias Moottoriurheilun Ihmelapsen Nimi Ferrari Teki Sopimuksen

May 24, 2025

13 Vuotias Moottoriurheilun Ihmelapsen Nimi Ferrari Teki Sopimuksen

May 24, 2025 -

Ranking The 10 Fastest Standard Production Ferraris Track Performance

May 24, 2025

Ranking The 10 Fastest Standard Production Ferraris Track Performance

May 24, 2025 -

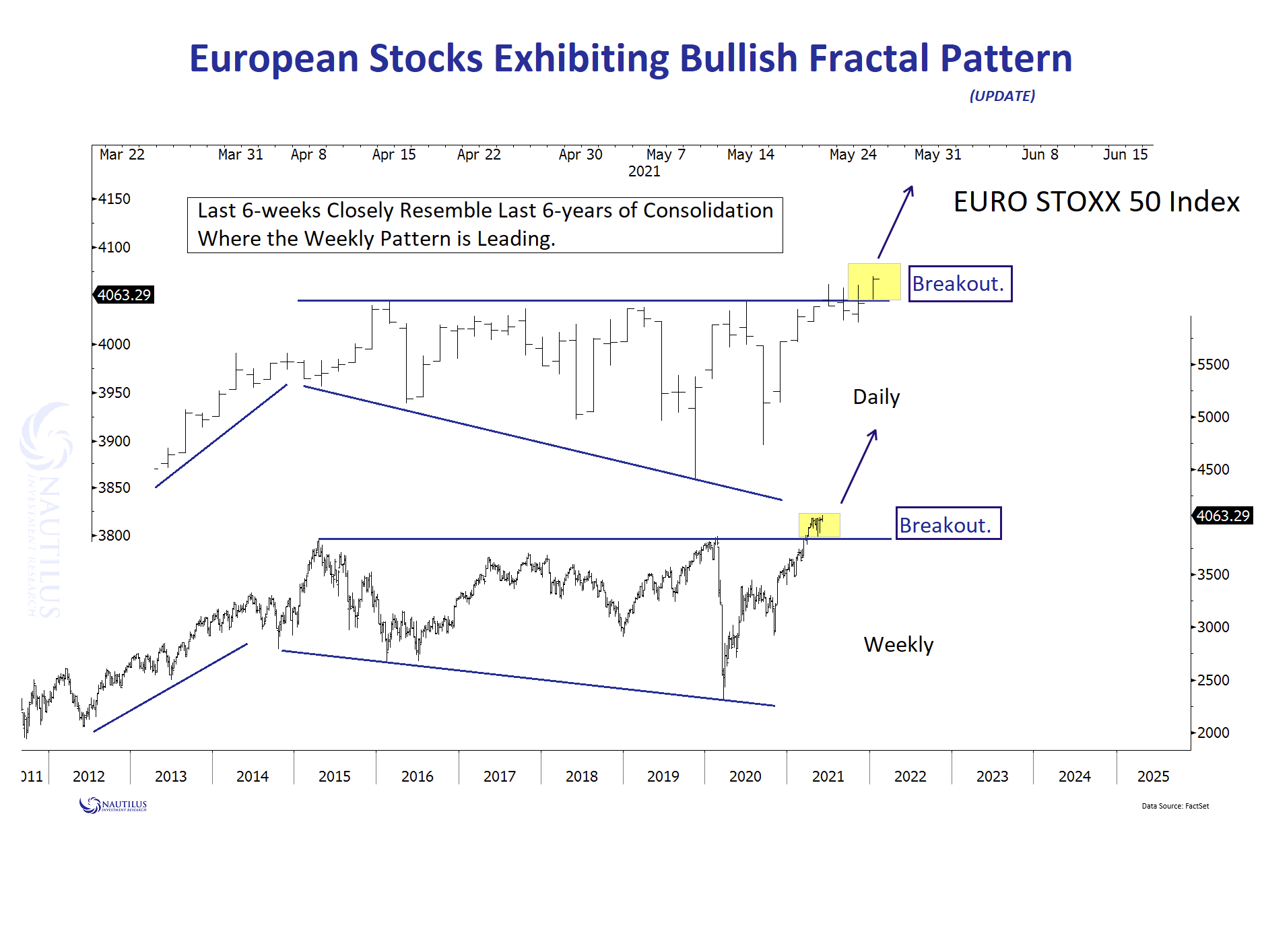

Analyse Snelle Marktverschuiving Europese Aandelen Vervolg Te Verwacht

May 24, 2025

Analyse Snelle Marktverschuiving Europese Aandelen Vervolg Te Verwacht

May 24, 2025 -

France To Increase Penalties For Young Offenders A Closer Look At Proposed Legislation

May 24, 2025

France To Increase Penalties For Young Offenders A Closer Look At Proposed Legislation

May 24, 2025

Latest Posts

-

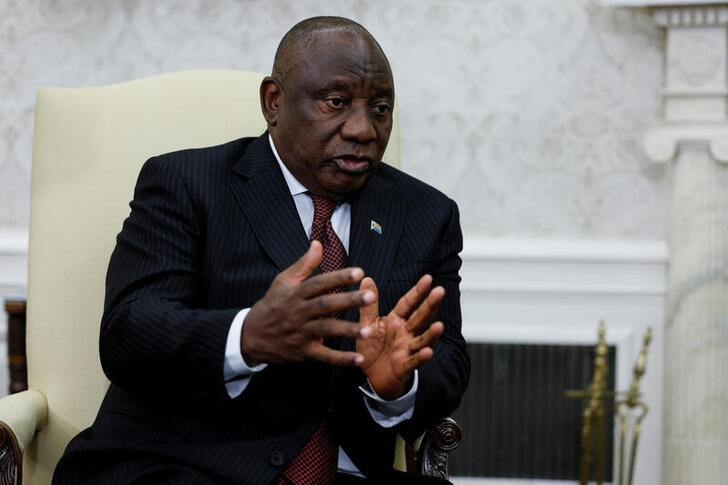

The White House Incident Evaluating President Ramaphosas Actions And Potential Alternatives

May 24, 2025

The White House Incident Evaluating President Ramaphosas Actions And Potential Alternatives

May 24, 2025 -

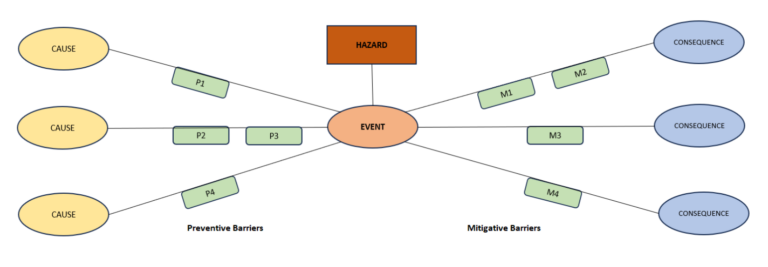

The Reality Of Airplane Accidents Visualizing Risk And Safety Measures

May 24, 2025

The Reality Of Airplane Accidents Visualizing Risk And Safety Measures

May 24, 2025 -

House Approves Trump Tax Bill After Final Revisions

May 24, 2025

House Approves Trump Tax Bill After Final Revisions

May 24, 2025 -

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 24, 2025 -

Analyzing Ramaphosas White House Encounter What Other Options Were Available

May 24, 2025

Analyzing Ramaphosas White House Encounter What Other Options Were Available

May 24, 2025