To Buy Or Not To Buy Palantir Stock Before May 5th: A Detailed Look

Table of Contents

Palantir's Recent Performance and Financial Health

Palantir's recent performance is a key factor in determining its future prospects. Analyzing its financial health, including revenue growth and profitability, is essential for any potential investor.

Revenue Growth and Profitability

Examining Palantir's financials reveals a complex picture. While the company has shown significant revenue growth, profitability remains a key area of focus. Analyzing key metrics such as revenue growth rate, net income, operating margin, and free cash flow provides a clearer understanding of its financial strength.

- Specific data points: (Insert data from recent Palantir quarterly and annual reports here. Include figures for revenue growth, net income, operating margin, and free cash flow. Cite the source of your information). For example, "Q4 2023 saw a 18% year-over-year revenue growth, reaching X dollars, while the operating margin improved to Y%."

- Comparison to competitors: (Compare Palantir's financial performance to similar companies in the big data analytics sector. For instance: "Compared to competitors like [Competitor A] and [Competitor B], Palantir's revenue growth is [higher/lower], while its profitability is [better/worse].")

- Analyst ratings and price targets: (Include information from reputable financial analysts regarding their ratings and price targets for Palantir stock. For example, "Morgan Stanley has a [Buy/Hold/Sell] rating on Palantir, with a price target of [Price]." )

Government vs. Commercial Contracts

Palantir's revenue stream is significantly diversified between government and commercial contracts. Understanding the growth potential and risks associated with each sector is crucial.

- Revenue breakdown: (Include data showing the percentage of revenue derived from government and commercial contracts. For example: "Government contracts account for approximately Z% of Palantir's revenue, while commercial contracts make up the remaining W%.")

- Contract analysis: (Discuss the status of contract renewals and recent wins. For example: "The recent renewal of a major contract with [Government Agency] indicates strong continued demand in the government sector. However, potential budget cuts in the government sector pose a significant risk.")

- Risk assessment: (Identify potential risks associated with each sector. For example, "Changes in government policy could impact future government contracts. Increased competition in the commercial sector could put pressure on pricing and margins.")

Future Growth Prospects and Catalysts for Palantir Stock

Looking ahead, several factors could significantly impact Palantir's future growth and, consequently, its stock price.

New Product Launches and Technological Advancements

Palantir's continued investment in research and development, notably around Palantir Foundry and AIPlatform, is a key driver of its growth potential. These platforms leverage data analytics, artificial intelligence, and machine learning to offer sophisticated solutions to its clients.

- New product descriptions: (Describe new products and services launched by Palantir. Highlight their features and potential market impact. For example: "The recent launch of [new product] offers enhanced capabilities in [specific area], potentially expanding Palantir's reach into the [target market] segment.")

- Market impact: (Analyze the potential revenue generation from these new products and the overall market impact. For instance: "The introduction of [product] could generate X million dollars in additional revenue within the next year.")

- Competitive advantages: (Explain how Palantir’s technology offers a competitive advantage in the market. For example: "Palantir's proprietary data integration technology provides a significant competitive advantage by offering faster and more efficient data analysis compared to competitors.")

Expansion into New Markets

Palantir's strategy for market expansion involves targeting new geographic markets and industry sectors. This ambitious plan presents both challenges and opportunities.

- Target markets: (Identify the target markets for future growth. For example: "Palantir is actively pursuing expansion into the [specific geographic region/industry sector] market.")

- Challenges and opportunities: (Discuss the challenges and opportunities associated with market expansion. For example: "Expansion into new markets requires significant investment in infrastructure and personnel. However, tapping into these markets offers substantial growth potential.")

- Strategic acquisitions: (Analyze the potential for strategic acquisitions to accelerate market expansion. For example: "Acquiring a company with established presence in [target market] could significantly accelerate Palantir's market penetration.")

Risks and Potential Downsides of Investing in Palantir Stock

Despite its potential, investing in Palantir stock carries inherent risks that need careful consideration.

Valuation and Market Sentiment

Palantir's valuation relative to its peers and the overall market sentiment are significant factors affecting its stock price.

- Valuation comparison: (Compare Palantir's valuation metrics (e.g., price-to-sales ratio) to industry benchmarks. For example: "Compared to its peers, Palantir's price-to-sales ratio is [higher/lower], suggesting its valuation is [overvalued/undervalued].")

- Analyst opinions: (Summarize analyst opinions on Palantir's valuation. For example: "Several analysts believe that Palantir's current valuation reflects its long-term growth potential. However, others express concerns about its high valuation.")

- Economic impact: (Analyze the potential impact of economic downturns on Palantir's stock price. For example: "Economic downturns could negatively impact investor sentiment and lead to a correction in Palantir's stock price.")

Competition and Technological Disruption

The big data analytics market is highly competitive, and technological disruption is a constant threat.

- Key competitors: (Identify Palantir's main competitors and their strengths. For example: "Palantir faces competition from established players such as [Competitor A] and [Competitor B], as well as emerging startups.")

- Technological threats: (Discuss potential threats from emerging technologies. For example: "Advancements in [specific technology] could pose a threat to Palantir's existing technology.")

- Competitive strategies: (Analyze Palantir's strategies to maintain its competitive advantage. For example: "Palantir is investing heavily in R&D to maintain its technological edge and expand its product offerings.")

Conclusion

In summary, Palantir’s financial health presents a mixed picture of revenue growth alongside ongoing challenges regarding profitability. While future growth prospects are promising, driven by new product launches and potential market expansions, significant risks remain in terms of valuation, competition, and economic uncertainty. This analysis regarding Palantir stock before May 5th highlights both the opportunities and challenges associated with this investment. Remember, this is not financial advice. Make an informed decision about whether to invest in Palantir stock before May 5th by conducting your own thorough research based on the insights provided in this article and consulting with a qualified financial advisor. Consider factors beyond this analysis, including your personal risk tolerance and investment goals, before investing in Palantir stock price or buying Palantir shares.

Featured Posts

-

Japa Uk Imposes Stricter Visa Regulations On Nigerians And Pakistanis

May 09, 2025

Japa Uk Imposes Stricter Visa Regulations On Nigerians And Pakistanis

May 09, 2025 -

Investigacao Ativa Mulher Se Apresenta Como Madeleine Mc Cann E E Presa

May 09, 2025

Investigacao Ativa Mulher Se Apresenta Como Madeleine Mc Cann E E Presa

May 09, 2025 -

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025 -

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025

Is Figmas Ai The Future Of Design A Comparison With Competitors

May 09, 2025 -

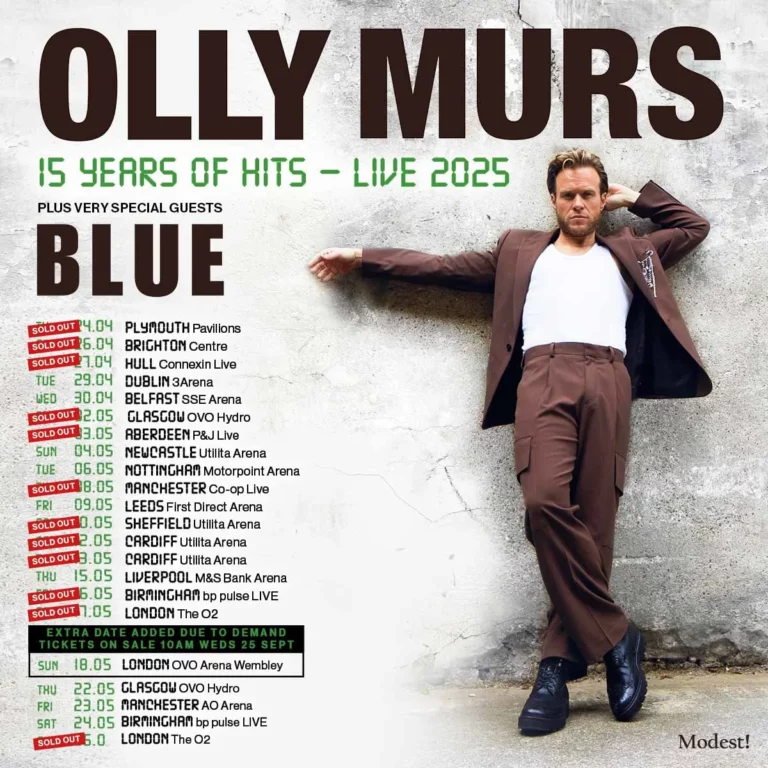

Manchester Castle Music Festival Olly Murs To Perform

May 09, 2025

Manchester Castle Music Festival Olly Murs To Perform

May 09, 2025