Today's Lowest Personal Loan Interest Rates: A Comparison Guide

Table of Contents

Understanding Personal Loan Interest Rates

Before you start your search for the lowest personal loan interest rates, it's crucial to understand what you're looking at. The key term here is APR, or Annual Percentage Rate. The APR represents the yearly cost of borrowing money, including interest and any other fees. A lower APR means you'll pay less overall interest over the life of your loan.

Interest rates are determined by several factors:

- Your credit score: Lenders use your credit score to assess your creditworthiness. A higher credit score (generally above 700) usually translates to a lower interest rate, as it indicates a lower risk to the lender. A poor credit score can significantly increase your interest rate or even disqualify you from getting a loan.

- The loan amount: Generally, larger loan amounts tend to carry slightly higher interest rates than smaller ones. This is because lenders perceive a greater risk associated with larger sums of money.

- The loan term: This refers to the length of time you have to repay the loan. Shorter loan terms (e.g., 12 months) typically result in higher monthly payments but lower overall interest paid, while longer terms (e.g., 60 months) mean lower monthly payments but higher total interest.

- Secured vs. Unsecured Loans: Secured personal loans, which require collateral (like a car or savings account), usually offer lower interest rates than unsecured loans, which don't require collateral. The lender has less risk with a secured loan.

Where to Find the Lowest Personal Loan Interest Rates

Several lending institutions offer personal loans, each with its own advantages and disadvantages:

- Banks: Traditional banks often offer competitive interest rates, but they may have stricter eligibility requirements and a more rigorous application process.

- Credit Unions: Credit unions are member-owned financial cooperatives. They frequently offer lower interest rates to their members, but membership may require meeting specific criteria and their geographic reach can be limited.

- Online Lenders: Online lenders offer convenient application processes and quick funding, but they may have higher interest rates than traditional lenders due to higher operational costs and potentially increased risk assessments.

It's vital to compare rates from multiple lenders before making a decision. This allows you to find the best interest rate and terms for your specific financial situation. Don't settle for the first offer you receive!

Factors Affecting Your Personal Loan Interest Rate

Several key factors influence the personal loan interest rate you'll receive:

- Credit Score: Your credit score is arguably the most critical factor. A higher credit score (above 700) significantly improves your chances of securing a lower interest rate. Aim for a good credit history to get the best rates.

- Debt-to-Income Ratio (DTI): Your DTI ratio represents the percentage of your monthly income that goes towards debt repayment. A lower DTI demonstrates to lenders that you can comfortably manage additional debt, leading to potentially lower interest rates.

- Loan Amount: As mentioned earlier, borrowing a smaller amount typically results in a better interest rate.

Tips for Getting the Best Personal Loan Interest Rate

Getting the best personal loan interest rate requires proactive steps:

- Improve Your Credit Score: Check your credit report for errors and dispute any inaccuracies. Pay down existing debts to lower your debt-to-income ratio. Improving your credit score before applying is a major strategy to lower your interest rate.

- Negotiate with Lenders: Don't hesitate to negotiate with lenders to see if they can offer a lower interest rate, especially if you have a strong credit score and a low DTI.

- Pre-qualification and Shopping Around: Pre-qualifying with multiple lenders allows you to compare offers without affecting your credit score. Shop around and compare at least three different lenders before making a decision. This helps ensure you're getting the best deal.

Conclusion

Finding the lowest personal loan interest rates requires research, planning, and understanding of your financial situation. By comparing offers from different lenders, improving your credit score, and carefully considering loan terms, you can secure a loan that fits your budget and financial goals. Remember, securing a low interest rate on your personal loan can save you significant money in the long run.

Start your search for today's lowest personal loan interest rates now! Use our guide to compare offers and find the perfect personal loan for your needs. Don't delay – securing a low interest rate can save you significant money over time.

Featured Posts

-

Sabalenkas Roland Garros Win A Contrast To Nadals Farewell

May 28, 2025

Sabalenkas Roland Garros Win A Contrast To Nadals Farewell

May 28, 2025 -

Padres Face Rockies At Coors Field A Potential Blowout

May 28, 2025

Padres Face Rockies At Coors Field A Potential Blowout

May 28, 2025 -

How To Get Free Tickets For The American Music Awards On The Las Vegas Strip

May 28, 2025

How To Get Free Tickets For The American Music Awards On The Las Vegas Strip

May 28, 2025 -

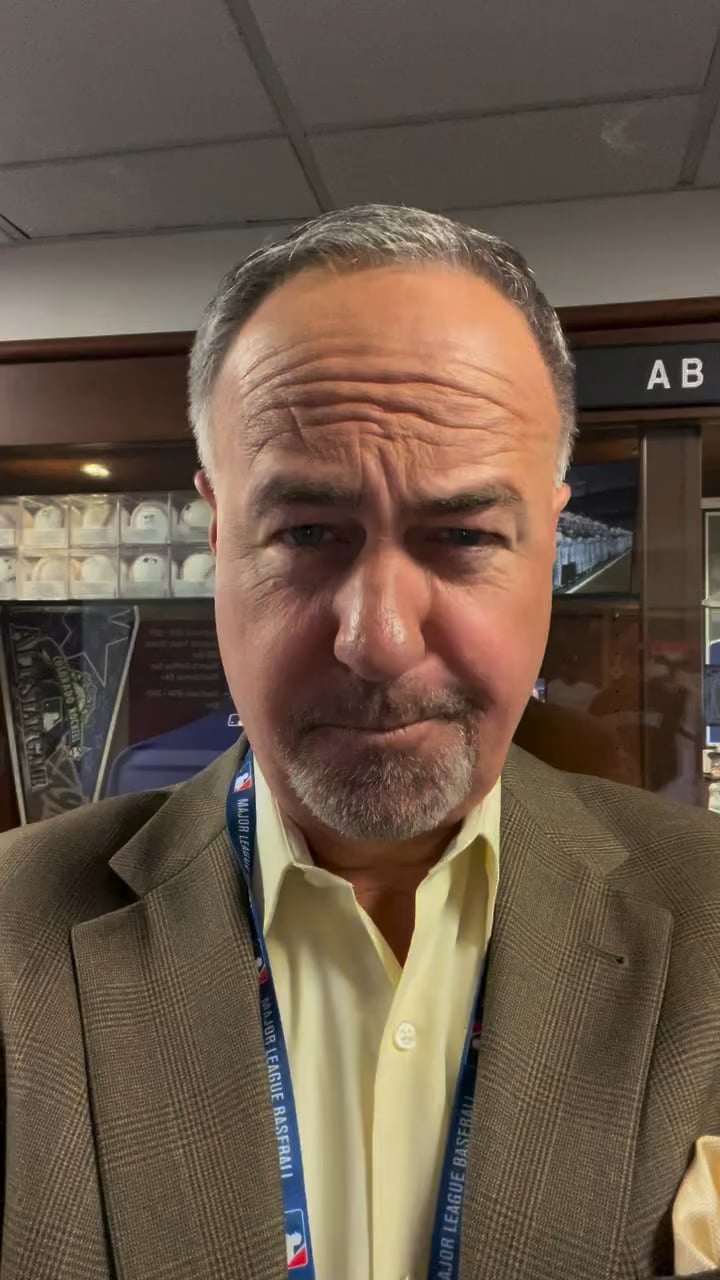

Regresa Jack Sparrow Reunion Entre Depp Y El Productor De Piratas Del Caribe

May 28, 2025

Regresa Jack Sparrow Reunion Entre Depp Y El Productor De Piratas Del Caribe

May 28, 2025 -

Massive 202m Euromillions Jackpot Your Path To Adele Style Riches

May 28, 2025

Massive 202m Euromillions Jackpot Your Path To Adele Style Riches

May 28, 2025

Latest Posts

-

El Chino Rios Un Dios Del Tenis Segun Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Tenista Argentino

May 30, 2025 -

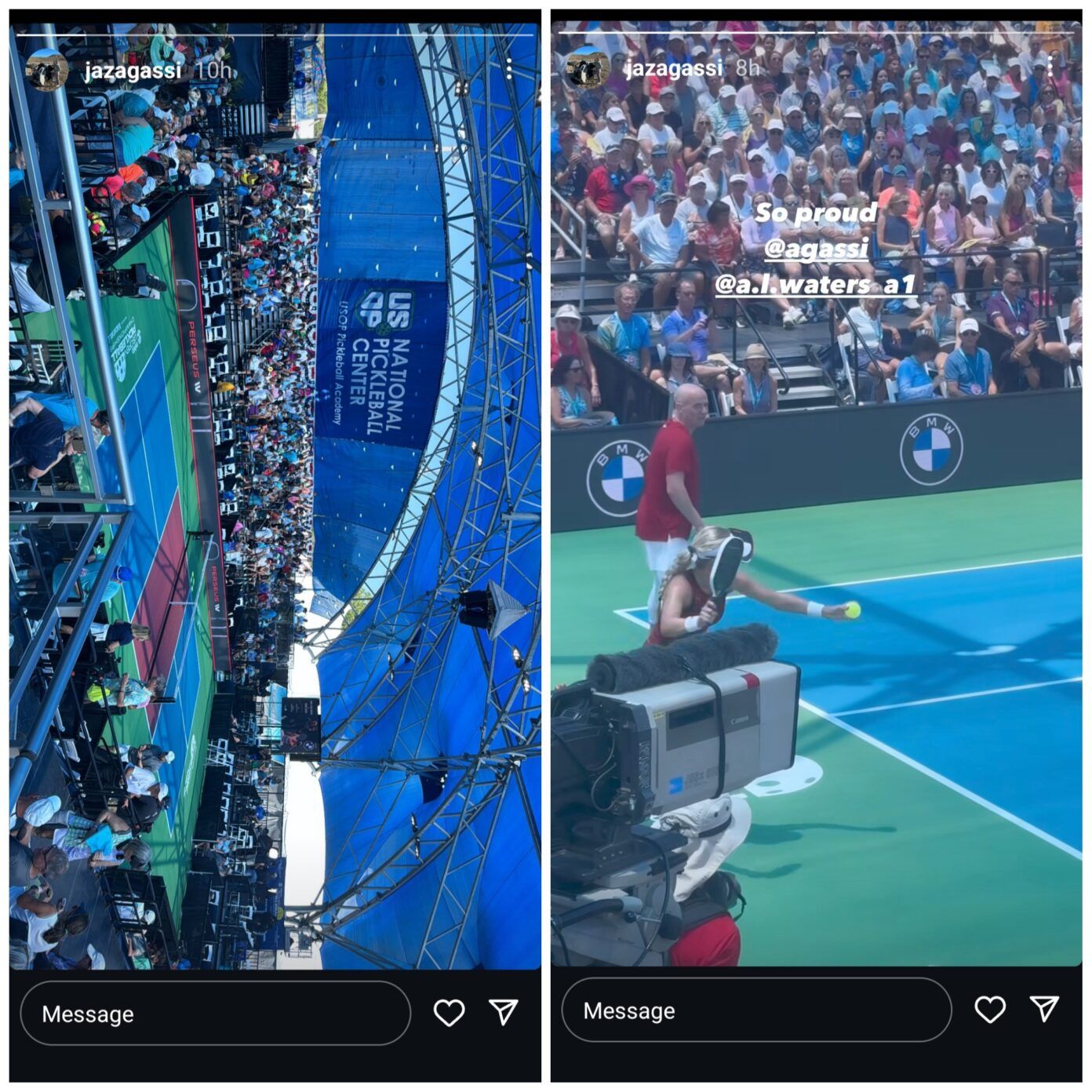

Das Erfolgsgeheimnis Von Steffi Graf Und Andre Agassi Im Pickleball

May 30, 2025

Das Erfolgsgeheimnis Von Steffi Graf Und Andre Agassi Im Pickleball

May 30, 2025 -

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025 -

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025