Today's Market Surge: Deciphering The 1400-Point Sensex And Nifty 50 Gains

Table of Contents

Analyzing the Reasons Behind the 1400-Point Surge

The 1400-point jump in the Sensex and Nifty 50 wasn't a spontaneous event; it's the culmination of several converging factors, both global and domestic.

Global Market Trends and their Influence

Positive global sentiment played a crucial role in today's market rally. Improved economic indicators from major economies instilled confidence amongst investors worldwide, triggering a ripple effect across international markets.

- Positive US economic data: Stronger-than-expected employment figures and easing inflation concerns in the US boosted global investor sentiment.

- Easing global inflation concerns: Signs of slowing inflation in several major economies reduced fears of aggressive interest rate hikes, encouraging risk-taking behavior.

- Strong performance of Asian markets: Positive performances in other Asian markets, particularly in key economies like China and South Korea, further contributed to the optimistic global outlook. This positive external environment created a fertile ground for the Indian markets to flourish.

Domestic Factors Fueling Market Growth

Beyond global influences, robust domestic factors significantly contributed to the 1400-point Sensex and Nifty 50 gains. Positive economic data from India, coupled with supportive government policies, ignited investor confidence.

- Positive GDP growth projections: Upward revisions in India's GDP growth projections for the current fiscal year instilled confidence in the country's economic strength.

- Government's infrastructure spending plans: The government's continued focus on infrastructure development, with significant investments planned across various sectors, fueled optimism about future growth.

- Strong corporate earnings in key sectors: Robust earnings reports from several leading Indian companies across various sectors demonstrated the health and resilience of the Indian corporate landscape. This positive corporate performance is a key driver of market confidence.

Investor Sentiment and Market Psychology

The surge wasn't solely driven by economic indicators; investor sentiment and market psychology played a pivotal role. Positive news fueled a wave of optimism, driving increased investment activity.

- Increased foreign institutional investment (FII) inflows: Significant inflows of foreign institutional investment (FII) injected substantial liquidity into the market, further propelling the rally.

- Improved domestic investor confidence: Positive economic news and strong corporate earnings boosted the confidence of domestic investors, leading to increased participation in the market.

- Short covering contributing to the rally: Investors who had previously bet against the market (short selling) were forced to buy back shares to limit their losses, further adding to the upward momentum. This short covering amplified the initial positive movement.

Sector-wise Performance: Winners and Losers of the 1400-Point Rally

The 1400-point Sensex and Nifty 50 gains weren't uniformly distributed across all sectors. Some sectors outperformed others, reflecting specific market dynamics.

Top-Performing Sectors

Certain sectors experienced disproportionately large gains, reflecting investor optimism within those specific areas.

- IT sector performance: The IT sector witnessed exceptional growth, driven by strong global demand and positive earnings reports from leading companies.

- Banking sector gains: The banking sector also performed exceptionally well, reflecting confidence in the financial health of Indian banks and expectations of higher interest rates.

- FMCG sector growth: The fast-moving consumer goods (FMCG) sector also saw significant gains, driven by robust consumer demand and positive growth projections.

Underperforming Sectors

Not all sectors participated equally in the rally. Some sectors lagged behind, highlighting different market dynamics at play.

- Pharmaceutical sector performance: The pharmaceutical sector saw relatively muted gains, possibly due to factors such as regulatory uncertainties or slower growth compared to other sectors.

- Real estate sector trends: The real estate sector displayed mixed performance, with some companies performing well while others lagged, reflecting the varied nature of this sector.

- Metal sector fluctuations: The metal sector witnessed fluctuations, influenced by global commodity prices and specific company-related news.

Implications and Future Outlook of the 1400-Point Sensex and Nifty 50 Gains

The 1400-point Sensex and Nifty 50 gains have significant implications for both the short-term and long-term outlook of the Indian market.

Short-Term Predictions

While the rally is impressive, caution is warranted in predicting the immediate future.

- Potential for consolidation: After such a sharp rise, a period of consolidation or minor correction is possible as investors assess the market's sustainability.

- Impact of global uncertainties: Geopolitical events and unforeseen global economic headwinds could impact the market's trajectory in the short term.

- Short-term profit-booking possibilities: Some investors might engage in profit-booking, leading to short-term price corrections.

Long-Term Implications

The long-term implications of this surge are potentially very positive for the Indian economy and stock market.

- Positive impact on overall economic growth: The increased investor confidence and market liquidity could contribute to stronger economic growth in the coming years.

- Increased attractiveness of the Indian market for foreign investors: The rally might attract further foreign investment, boosting economic activity and market capitalization.

- Potential for long-term sustainable growth: Provided the underlying economic fundamentals remain strong, the 1400-point surge could signify the beginning of a period of long-term sustainable growth for the Indian stock market.

Conclusion

The remarkable 1400-point Sensex and Nifty 50 gains are a result of a confluence of factors, including positive global trends, robust domestic economic indicators, strong investor sentiment, and sector-specific performances. While a short-term correction is possible, the long-term outlook appears positive, potentially leading to sustained economic growth. Stay updated on the latest market trends and continue your analysis of the 1400-point Sensex and Nifty 50 gains to make the most informed investment choices. Understanding the nuances of these significant market movements is crucial for navigating the complexities of the Indian stock market.

Featured Posts

-

Attorney Generals Fentanyl Display A Deeper Look

May 09, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 09, 2025 -

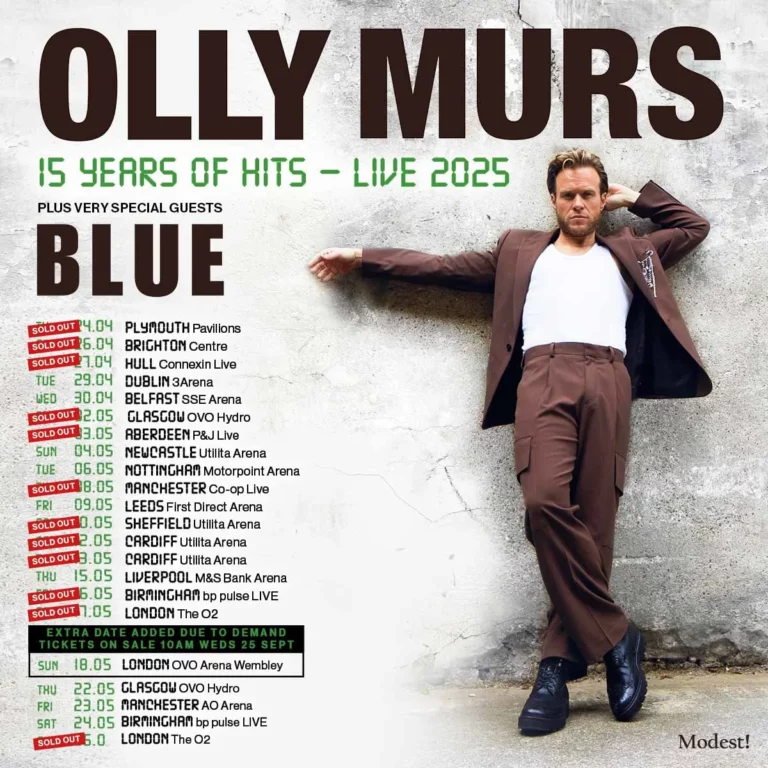

Manchester Castle Music Festival Olly Murs To Perform

May 09, 2025

Manchester Castle Music Festival Olly Murs To Perform

May 09, 2025 -

Trumps Dc Prosecutor Pick Jeanine Pirro And The Fox News Connection

May 09, 2025

Trumps Dc Prosecutor Pick Jeanine Pirro And The Fox News Connection

May 09, 2025 -

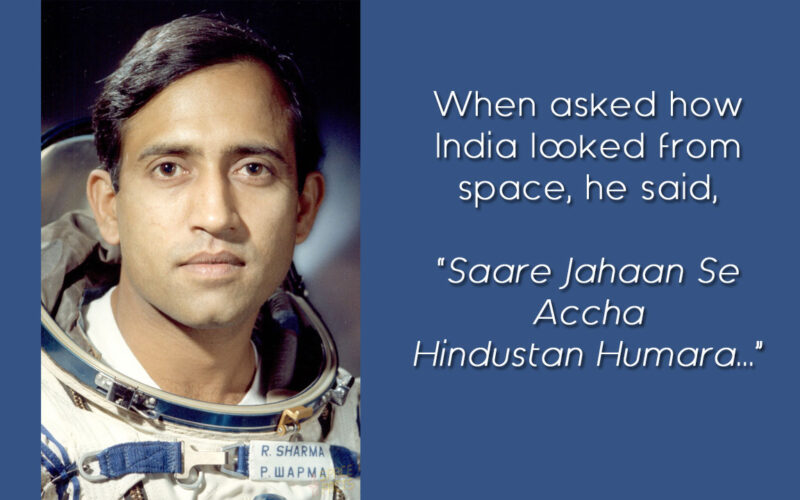

Indias First Astronaut Rakesh Sharma His Post Space Career

May 09, 2025

Indias First Astronaut Rakesh Sharma His Post Space Career

May 09, 2025 -

Madhyamik 2025 Result How To Check Your Merit Position

May 09, 2025

Madhyamik 2025 Result How To Check Your Merit Position

May 09, 2025