Today's Stock Market: Analyzing Trump's Tariff Plan And UK Trade Agreement

Table of Contents

Trump's Tariff Plan: Implications for the Stock Market

Donald Trump's tariff policies have introduced considerable uncertainty into the global economy, significantly impacting stock market analysis. The imposition of tariffs, primarily aimed at China, has rippled through various sectors, creating both winners and losers.

Impact on Specific Sectors

Tariffs have had a disproportionate effect on different economic sectors.

-

Manufacturing: The manufacturing sector, heavily reliant on international trade, has faced increased production costs due to tariffs on imported raw materials and components. This has led to reduced profitability and, in some cases, job losses. Companies like Caterpillar (CAT) and Deere & Company (DE) have reported negative impacts on their earnings.

-

Agriculture: The agricultural sector has also been significantly impacted, particularly with the trade war with China. American farmers, facing reduced exports and increased competition, have experienced decreased revenue and falling stock prices. Companies heavily reliant on exports, such as agricultural giants ADM (ADM) and Bunge (BG), have seen their stock valuations affected.

-

Technology: While some technology companies have benefited from reshoring initiatives, others have faced increased costs for imported components and a slowdown in global demand. Companies with significant manufacturing operations in China have faced disruptions to their supply chains.

-

Specific Company Examples:

- Increased Costs: Many companies have reported increased costs due to tariffs, impacting profit margins. This necessitates careful stock market analysis before investment.

- Decreased Exports: Reduced exports to key markets, particularly China, have hit many companies hard, leading to a decline in revenue and stock prices.

- Percentage Change in Stock Prices: A detailed stock market analysis would reveal significant percentage changes in stock prices for companies directly impacted by tariffs. For instance, some agricultural stocks experienced double-digit percentage drops following specific tariff announcements.

The potential for retaliatory tariffs further exacerbates the uncertainty, creating a complex landscape for stock market analysis. Retaliation can lead to a further decline in global trade and intensify negative impacts on affected companies.

Market Volatility and Investor Sentiment

Uncertainty surrounding tariffs significantly affects investor confidence and market volatility. The unpredictable nature of tariff announcements introduces significant risk, leading to increased market fluctuations.

- Investor Confidence: Sudden tariff announcements often trigger immediate market reactions, demonstrating the sensitivity of investor sentiment to trade policy. Negative news regarding tariffs can lead to a sell-off, while positive developments may result in a rally.

- Hedging Strategies: Investors are increasingly employing hedging strategies, such as purchasing put options, to mitigate the risks associated with tariff-related volatility.

- Market Fluctuations: Analyzing historical data reveals a strong correlation between tariff announcements and subsequent stock market reactions. Sharp increases or decreases in major indices often follow significant tariff-related news.

- Examples: The market experienced significant volatility following several major tariff announcements in 2018 and 2019, clearly demonstrating the immediate impact of trade policy on investor sentiment and market behaviour.

UK Trade Agreement: Opportunities and Challenges for the Stock Market

The UK's departure from the European Union and the subsequent trade agreements have presented both opportunities and challenges for the stock market. A thorough stock market analysis is needed to understand the implications.

Post-Brexit Trade Deals and their Impact

The UK's new trade deals are reshaping its economic relationships and creating winners and losers.

- Benefits: Some sectors, such as those focused on exports to countries with new trade agreements, may experience increased revenue and growth.

- Drawbacks: Other sectors, previously benefiting from frictionless trade within the EU, may face higher tariffs and reduced access to European markets.

- Financial Services: The impact on the UK's financial services sector, a significant part of the British economy, is particularly complex and will require extensive stock market analysis.

- Examples: Companies heavily reliant on EU trade have faced challenges post-Brexit, while those finding new markets may show strong performance. This makes continuous stock market analysis critical.

Uncertainty and Investment Strategies

Uncertainty surrounding future trade relations continues to influence investment decisions.

- Adapting to Change: Investors are diversifying their portfolios, focusing on companies with strong international exposure or those less dependent on trade with specific regions.

- Risk Management: Risk management is becoming increasingly important, given the unpredictability of global trade policies.

- Investment Opportunities: The reshaping of global supply chains may create opportunities for businesses and investors willing to adapt to the new landscape, offering intriguing possibilities for stock market analysis.

- Expert Opinions: Market forecasts vary on the long-term effects of Brexit on the UK economy, highlighting the need for careful stock market analysis before committing capital.

Interplay between Trump's Tariffs and the UK Trade Agreement

The impact of Trump's tariffs and the UK trade agreement aren't isolated events; they are intertwined and influence each other.

- Synergistic or Conflicting Effects: These trade developments can either reinforce or mitigate each other's effects depending on specific industry sectors and company strategies.

- Reshaping Supply Chains: Companies are actively adjusting global supply chains to account for both increased tariffs and new trade relationships.

- Company Strategy Adjustments: Businesses are revising strategies to minimize exposure to trade risks and capitalize on emerging opportunities.

- Future Market Movements: The combined effect of these trade policies will continue to shape market behaviour. Observing and understanding this interplay is key for effective stock market analysis.

Conclusion

This analysis of Trump's tariff plan and the UK trade agreement reveals a complex interplay of factors significantly impacting today's stock market. Understanding the nuances of these trade policies is paramount for investors seeking to navigate the current climate. The volatility and uncertainty necessitate careful consideration of investment strategies, including diversification and risk management.

Call to Action: For a deeper understanding of these issues and to make informed decisions about your stock market investments, stay tuned for further analysis and updates on our website. Continue to follow our regular stock market analysis for the latest insights.

Featured Posts

-

Holstein Kiel From Bundesliga Hopefuls To Relegation

May 11, 2025

Holstein Kiel From Bundesliga Hopefuls To Relegation

May 11, 2025 -

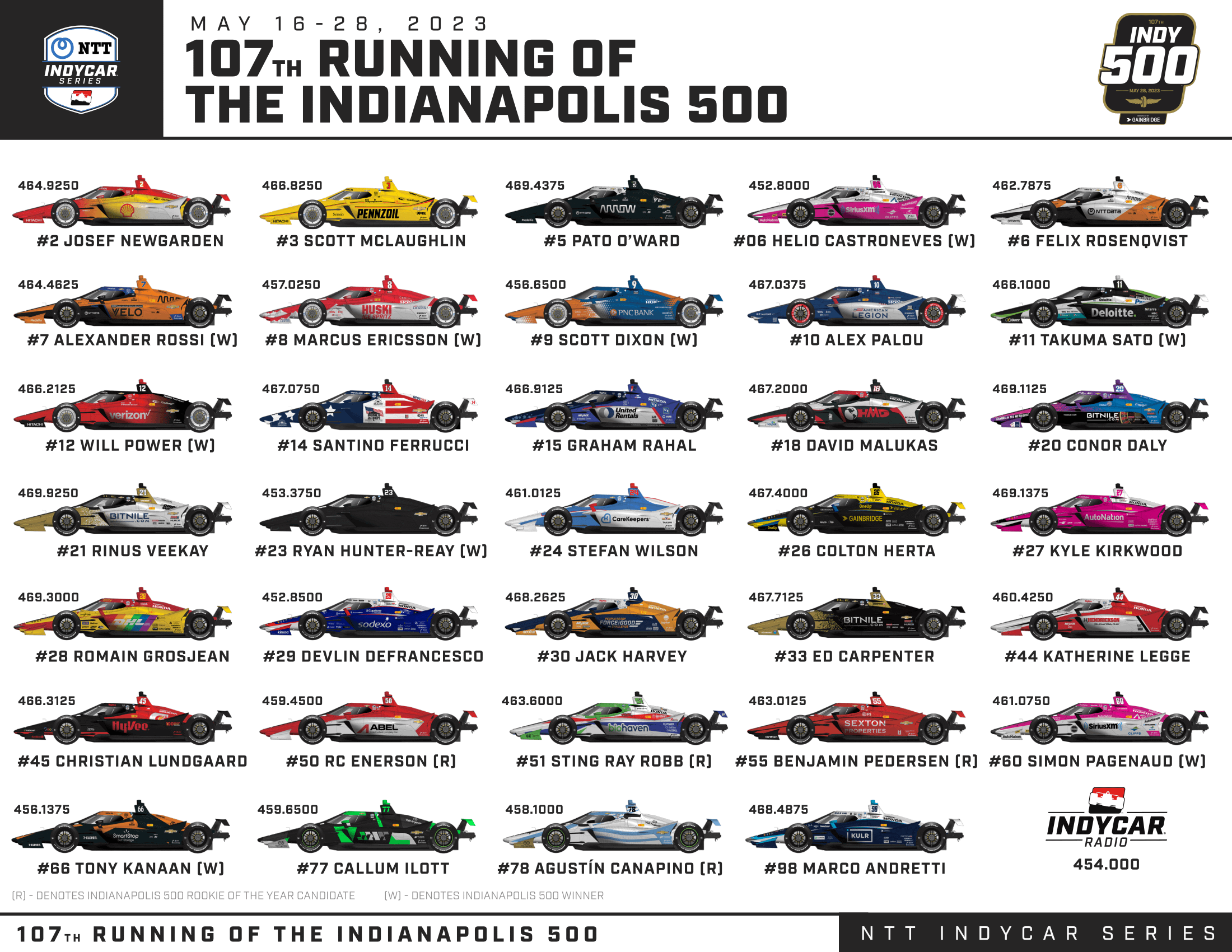

Indy Car 2025 5 Drivers Potentially Missing The Indianapolis 500

May 11, 2025

Indy Car 2025 5 Drivers Potentially Missing The Indianapolis 500

May 11, 2025 -

26 Eama Qst Elaqt Twm Krwz Wana Dy Armas Almthyrt Lljdl

May 11, 2025

26 Eama Qst Elaqt Twm Krwz Wana Dy Armas Almthyrt Lljdl

May 11, 2025 -

Chaplin Ipswich Towns Path To Victory

May 11, 2025

Chaplin Ipswich Towns Path To Victory

May 11, 2025 -

The Apple Google Connection A Deeper Dive Into Their Intertwined Success

May 11, 2025

The Apple Google Connection A Deeper Dive Into Their Intertwined Success

May 11, 2025