Tracking The Billions: Net Worth Changes For Musk, Bezos, And Zuckerberg Post-Trump Inauguration

Table of Contents

Elon Musk's Net Worth Trajectory Post-Trump Inauguration

Impact of the 2017 Tax Cuts

The 2017 Tax Cuts and Jobs Act significantly impacted corporate tax rates in the United States. For Elon Musk, this had a multifaceted effect.

- Reduced Corporate Taxes: Lower corporate tax rates potentially boosted Tesla's profitability, increasing its valuation and consequently Musk's net worth.

- Repatriation of Overseas Profits: The act incentivized companies to repatriate profits held overseas. This could have positively influenced Tesla's financial position, although the specific impact on Musk's net worth is difficult to isolate.

- Increased Investment: The tax cuts may have encouraged increased investment in Tesla and SpaceX, further contributing to their growth and Musk's wealth.

While precise figures are difficult to attribute solely to the tax cuts, Musk's net worth saw substantial growth in the period following their implementation. Sources like Bloomberg and Forbes consistently tracked these changes, showing a significant upward trend.

Tesla Stock Performance and its Correlation to Political Climate

Tesla's stock price, and therefore Musk's net worth, proved highly sensitive to the political climate during the Trump administration.

- Trade Wars: The trade wars initiated by the Trump administration created uncertainty in global markets, impacting Tesla's supply chains and sales, causing fluctuations in stock prices.

- Regulatory Changes: Changes in environmental regulations and government incentives for electric vehicles directly affected Tesla's profitability and market position, influencing Musk's net worth.

- Trump's Tweets: Even President Trump's tweets mentioning Tesla or Musk had noticeable impacts on the company’s stock price, showcasing the high sensitivity of Tesla’s valuation to political narratives.

[Insert chart or graph here illustrating Tesla stock performance alongside key political events during the Trump administration.]

SpaceX Success and its Contribution to Musk's Wealth

SpaceX's remarkable successes during this period significantly contributed to Musk's overall wealth.

- Increased NASA Contracts: SpaceX secured lucrative contracts with NASA, boosting the company's valuation and adding to Musk's net worth.

- Successful Launches: Consistent successful launches of Falcon 9 rockets and the development of the Starship program significantly enhanced SpaceX's reputation and market position.

- Commercial Spaceflights: The prospect of commercial spaceflights further contributed to SpaceX's future potential and, consequently, Musk's wealth. Future projections indicate a considerable increase in SpaceX's value as these ventures mature.

Jeff Bezos' Net Worth Fluctuations Post-Trump Inauguration

Amazon's Growth and its Sensitivity to Economic Policies

Amazon's performance during the Trump administration directly correlated with broader economic trends.

- Consumer Spending: Strong consumer spending during periods of economic growth fueled Amazon's sales and profitability, positively impacting Bezos' net worth.

- Inflationary Pressures: Inflationary pressures impacted Amazon's operating costs and profitability, leading to fluctuations in its stock price and Bezos' wealth.

- E-commerce Boom: The pandemic-induced e-commerce boom significantly boosted Amazon's growth, contributing to a substantial increase in Bezos' net worth.

Data from Amazon's financial reports clearly illustrate the correlation between its revenue, profits, and stock price with overall economic indicators during this period.

Regulatory Scrutiny and its Potential Impact

Amazon faced increasing regulatory scrutiny during the Trump administration.

- Antitrust Investigations: Investigations into Amazon's monopolistic practices and their potential impact on competition created uncertainty about the company's future, affecting its stock price and Bezos' net worth.

- Data Privacy Concerns: Concerns about Amazon's data privacy practices and their compliance with regulations also influenced investor sentiment and the company's valuation.

- Labor Practices: Criticism regarding Amazon's labor practices and employee treatment also contributed to negative press and potential regulatory action.

Diversification and its Role in Buffering Net Worth

Bezos' extensive diversification beyond Amazon played a vital role in buffering his net worth against potential risks.

- Blue Origin: Investments in Blue Origin, his space exploration company, provided a hedge against potential downturns in Amazon's stock price.

- Other Investments: Bezos' diverse portfolio of investments in various sectors further mitigated risks associated with reliance on a single company.

- Philanthropy: His significant philanthropic activities, while not directly impacting his net worth in the short-term, offer long-term social and reputational benefits.

Mark Zuckerberg's Net Worth Changes Post-Trump Inauguration

Facebook's Performance and its Sensitivity to Political Discourse

Facebook's performance, and consequently Zuckerberg's net worth, was significantly impacted by political controversies.

- Cambridge Analytica Scandal: The Cambridge Analytica scandal negatively impacted Facebook's reputation and stock price, causing a dip in Zuckerberg's net worth.

- Political Advertising: The ongoing debate about political advertising on Facebook and its influence on elections significantly affected investor confidence.

- Content Moderation: The challenges of content moderation and the spread of misinformation on the platform also impacted public perception and the company's valuation.

[Insert data here on Facebook's user base, advertising revenue, and stock performance, correlating these to relevant political events.]

Regulatory Changes Impacting Social Media and its Effect on Facebook's Valuation

New regulations concerning social media companies had a substantial impact on Facebook's valuation and Zuckerberg's wealth.

- Data Privacy Laws: The implementation of stricter data privacy laws, such as GDPR, affected Facebook's operations and its ability to collect and utilize user data, influencing its profitability.

- Antitrust Scrutiny: Antitrust investigations and concerns about Facebook's market dominance negatively impacted investor sentiment and the company's stock price.

- Section 230 Debates: Ongoing debates surrounding Section 230 of the Communications Decency Act created uncertainty for social media companies like Facebook, impacting their valuation.

Meta's Diversification Efforts and its Influence on Zuckerberg’s Net Worth

Meta's (formerly Facebook's) diversification into the Metaverse represents a significant strategic shift.

- Investments in VR/AR: Significant investments in virtual and augmented reality technologies reflect Meta's commitment to the Metaverse, shaping its future potential and Zuckerberg's long-term wealth.

- Long-Term Vision: The long-term vision of the Metaverse remains uncertain, making it difficult to predict its precise impact on Meta's valuation and Zuckerberg's net worth.

- Expert Opinions: Expert opinions on the Metaverse's potential vary considerably, influencing investor sentiment and the market's valuation of Meta.

Conclusion

The period following the Trump inauguration witnessed significant fluctuations in the net worth of Elon Musk, Jeff Bezos, and Mark Zuckerberg. Their fortunes were shaped by a complex interplay of factors including tax policies, market conditions, regulatory actions, political controversies, and their companies' individual performance. Understanding these "Net Worth Changes Post-Trump Inauguration" requires a nuanced analysis of these intertwined elements. To stay informed about the ongoing impact of political and economic events on the wealth of these tech giants, continue to follow updates on net worth changes and subscribe to receive alerts on future articles focusing on wealth fluctuations. Stay tuned for further analyses exploring the dynamics of billionaire wealth in a constantly evolving global landscape.

Featured Posts

-

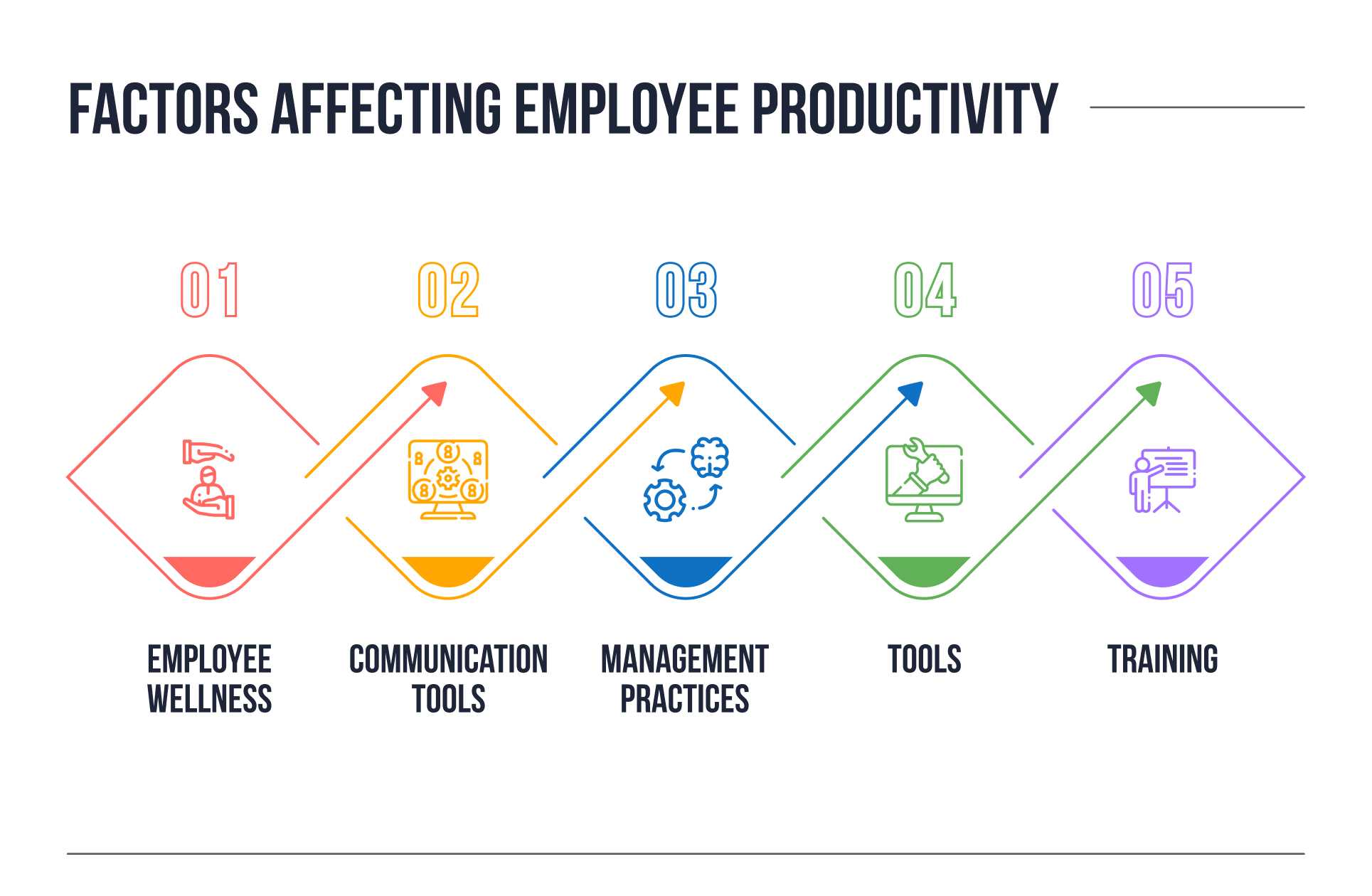

The Importance Of Middle Managers A Key To Improved Productivity And Employee Satisfaction

May 10, 2025

The Importance Of Middle Managers A Key To Improved Productivity And Employee Satisfaction

May 10, 2025 -

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery

May 10, 2025

Edmonton Oilers Playoff Hopes Hinge On Draisaitls Recovery

May 10, 2025 -

Caravan Encampments Fuel Ghetto Fears In Uk City

May 10, 2025

Caravan Encampments Fuel Ghetto Fears In Uk City

May 10, 2025 -

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Drast Halt

May 10, 2025

Ashhr Almdkhnyn Fy Tarykh Krt Alqdm Drast Halt

May 10, 2025 -

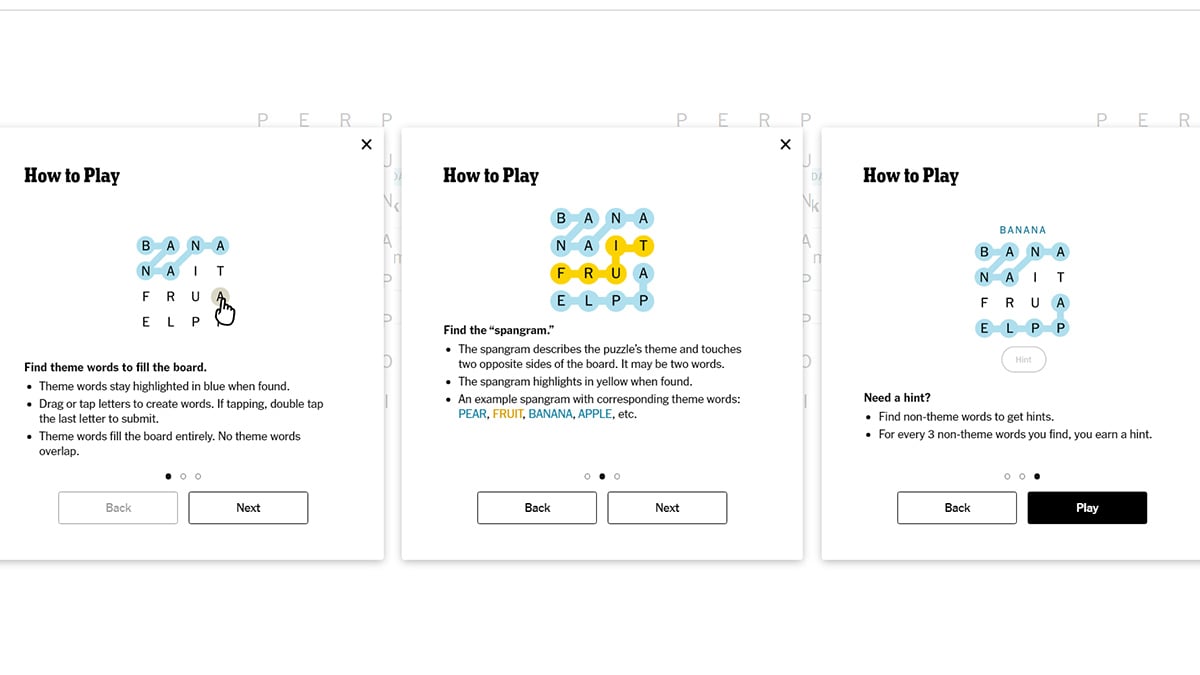

Complete Guide To Nyt Strands Game 349 February 15th

May 10, 2025

Complete Guide To Nyt Strands Game 349 February 15th

May 10, 2025