Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

The Net Asset Value (NAV) represents the total value of an ETF's underlying assets, minus any liabilities, divided by the number of outstanding shares. Essentially, it reflects the intrinsic worth of a single ETF share. The Amundi MSCI World II UCITS ETF USD Hedged Dist tracks the MSCI World Index, providing exposure to a broad range of large and mid-cap companies globally. The "USD Hedged" aspect aims to minimize the impact of currency fluctuations between the Euro (the base currency of the ETF) and the US dollar.

Where to Find the Amundi MSCI World II UCITS ETF NAV Data

Reliable access to accurate and up-to-date Amundi MSCI World II ETF NAV information is paramount. Several sources offer this data, each with its own advantages and potential limitations:

-

Amundi's official website: This is the most authoritative source for the Amundi MSCI World II UCITS ETF NAV. You'll typically find the most recent NAV, often updated daily after the market closes. Look for dedicated sections on fund factsheets or performance data.

-

Major financial data providers (Bloomberg, Refinitiv, etc.): Professional financial data terminals like Bloomberg and Refinitiv offer real-time and historical NAV data, often with advanced charting and analytical tools. Access to these services usually requires a subscription.

-

Your brokerage account platform: Most reputable brokerage platforms display the current NAV of your held ETFs, including the Amundi MSCI World II UCITS ETF USD Hedged Dist. This is a convenient way to monitor your investment's performance. However, the update frequency might vary.

-

Financial news websites: Many reputable financial news websites provide ETF data, including the NAV. Be aware that the data might be slightly delayed compared to the official sources.

The key difference between these sources often lies in the timeliness of the data. While Amundi's website and professional platforms offer near real-time information, brokerage accounts and news sites may experience slight delays.

Factors Influencing the Amundi MSCI World II UCITS ETF's NAV

Several factors dynamically influence the Amundi MSCI World II UCITS ETF's NAV:

-

Performance of the MSCI World Index: As the ETF tracks the MSCI World Index, the performance of the underlying index directly impacts the NAV. Positive performance leads to NAV increases, and negative performance results in decreases.

-

USD/EUR exchange rate fluctuations (impact of hedging): The "USD Hedged" feature aims to mitigate the risk associated with currency fluctuations. However, perfect hedging is impossible, and residual currency movements can still slightly affect the NAV.

-

Dividend distributions from underlying holdings: When companies within the MSCI World Index pay dividends, these are typically passed on to ETF shareholders. The NAV will typically adjust downwards on the ex-dividend date to reflect the distribution.

-

ETF's expense ratio and management fees: The ETF's expense ratio and management fees are deducted from the assets under management. While these are relatively small, they continuously impact the NAV over time.

Understanding these factors provides context for interpreting NAV movements and anticipating potential changes.

Interpreting and Utilizing Amundi MSCI World II UCITS ETF NAV Data

Using the NAV data effectively involves several key strategies:

-

Comparing NAV to the ETF's market price: The market price of an ETF can deviate slightly from its NAV due to supply and demand. Large discrepancies might signal trading opportunities, but caution is advised.

-

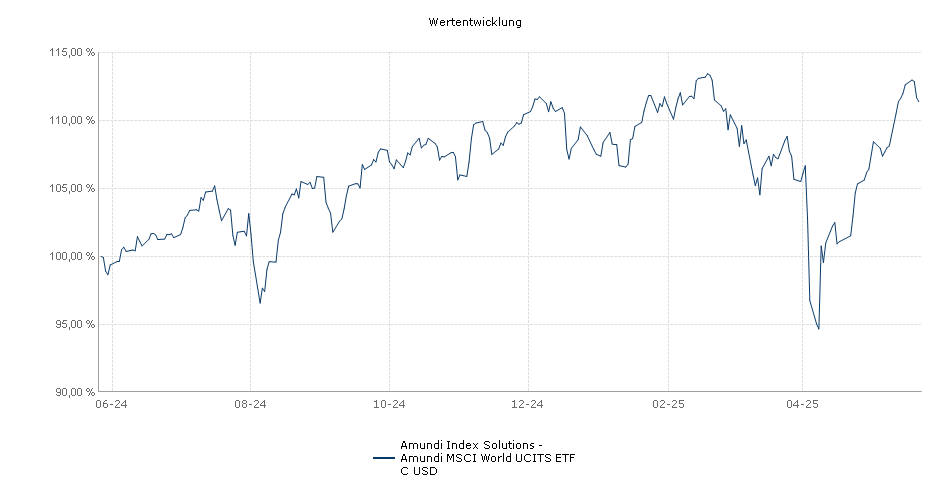

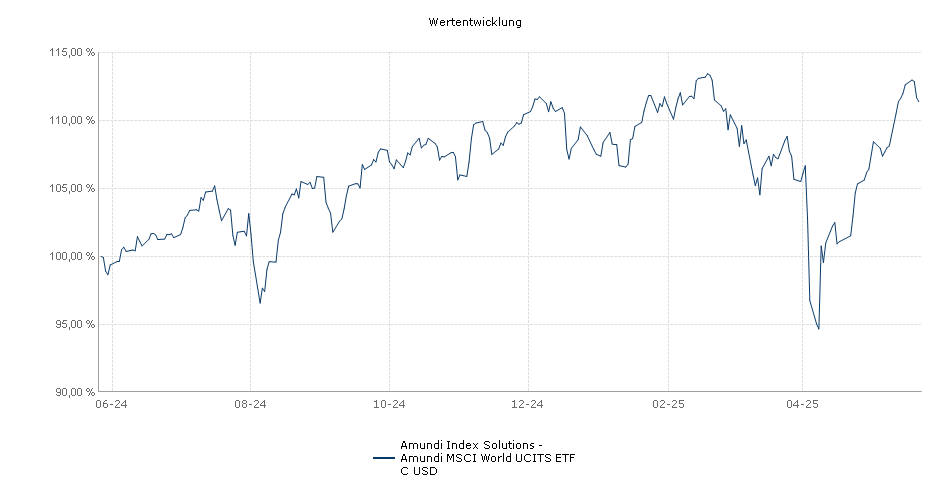

Calculating returns based on NAV changes: Tracking NAV changes over time allows you to calculate your returns, essential for performance evaluation and investment decision-making.

-

Analyzing long-term NAV trends: Studying the long-term NAV trend helps assess the overall performance of the ETF and inform long-term investment strategies.

-

Using NAV for portfolio diversification strategies: Regular monitoring of your Amundi MSCI World II UCITS ETF NAV allows you to rebalance your portfolio to maintain your desired asset allocation.

Remember, while NAV is a vital indicator, it shouldn't be the sole factor in your investment decisions. Trading volume and bid-ask spread should also be considered.

Understanding the implications of the 'Dist' designation

The "Dist" in "Amundi MSCI World II UCITS ETF USD Hedged Dist" signifies that this ETF distributes dividends to its shareholders. These dividend distributions are deducted from the NAV on the ex-dividend date. It's crucial to understand the tax implications of these distributions in your jurisdiction. The dividend payments impact your overall return but also lead to a temporary reduction in the NAV.

Conclusion: Mastering Amundi MSCI World II UCITS ETF NAV Tracking

Tracking the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist requires utilizing reliable sources like Amundi's official website, financial data providers, your brokerage account, or reputable financial news sources. Understanding the factors that influence the NAV, such as the performance of the underlying MSCI World Index, currency fluctuations, and dividend distributions, is key to interpreting the data effectively. Remember to consider other market factors alongside the NAV for comprehensive investment decision-making. Stay informed about your Amundi MSCI World II UCITS ETF investments by consistently tracking its NAV using the reliable sources outlined above. Effective NAV tracking is crucial for maximizing your returns from this important USD Hedged ETF.

Featured Posts

-

H Nonline Sk Hospodarsky Pokles V Nemecku Dosledky Pre Zamestnancov

May 24, 2025

H Nonline Sk Hospodarsky Pokles V Nemecku Dosledky Pre Zamestnancov

May 24, 2025 -

Planning Your Memorial Day Trip Best Flight Dates For 2025

May 24, 2025

Planning Your Memorial Day Trip Best Flight Dates For 2025

May 24, 2025 -

West Hams Transfer Pursuit A Bid For Kyle Walker Peters

May 24, 2025

West Hams Transfer Pursuit A Bid For Kyle Walker Peters

May 24, 2025 -

Allt Um Nyju Porsche Macan Rafmagnsutgafuna Upplysingar Og Eiginleikar

May 24, 2025

Allt Um Nyju Porsche Macan Rafmagnsutgafuna Upplysingar Og Eiginleikar

May 24, 2025 -

Daxs Rise A Wall Street Recoverys Potential Impact

May 24, 2025

Daxs Rise A Wall Street Recoverys Potential Impact

May 24, 2025

Latest Posts

-

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025

Kyle Walker And Serbian Models Partying In Milan After Wifes Flight

May 24, 2025 -

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025

Footballer Kyle Walker Seen With Models In Milan After Wifes Trip Home

May 24, 2025 -

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025

Kyle Walker Night Out In Milan Following Wifes Uk Departure

May 24, 2025 -

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025

Kyle Walkers Milan Party Details Emerge After Wifes Return

May 24, 2025 -

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025

The Kyle And Teddi Dog Walker Incident A Heated Confrontation

May 24, 2025