Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. It's a crucial indicator of an ETF's performance and intrinsic worth. For investors in the Amundi Dow Jones Industrial Average UCITS ETF, understanding and tracking the NAV is essential for making informed investment decisions. The Amundi Dow Jones Industrial Average UCITS ETF offers investors exposure to the performance of the iconic Dow Jones Industrial Average (DJIA), a benchmark index of 30 large, publicly-owned companies in the United States. This article aims to provide a comprehensive guide on how to effectively track the NAV of this specific ETF.

Understanding the Amundi Dow Jones Industrial Average UCITS ETF Composition and its Impact on NAV

The Amundi Dow Jones Industrial Average UCITS ETF's underlying assets are the 30 constituent companies of the Dow Jones Industrial Average. Changes in the prices of these underlying stocks directly impact the ETF's NAV. If the DJIA increases, the ETF's NAV generally rises, and vice-versa. While the ETF's expense ratio (the annual fee charged for managing the fund) plays a minor role, it slightly reduces the NAV over time.

- Top 5 Holdings (Note: Holdings can change; check the ETF provider's website for the most up-to-date information): While specific holdings fluctuate, you'll typically find major companies like Apple, Microsoft, and others among the top holdings. Consult the Amundi website for current holdings.

- Rebalancing: The ETF undergoes periodic rebalancing to maintain its alignment with the DJIA's composition. This process, which involves adjusting holdings to reflect changes in the DJIA's weighting, can slightly impact the NAV.

- Currency Fluctuations: As the underlying assets are primarily US-based companies, fluctuations in the EUR/USD exchange rate (if you are investing in the EUR-denominated ETF) can influence the NAV reported in Euros.

Sources for Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV

Reliable NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is available from several sources:

- Amundi's Website: The official website is the primary source. Look for investor relations or fund information sections.

- Major Financial Data Providers: Bloomberg Terminal, Refinitiv Eikon, and other professional-grade financial data platforms provide real-time or near real-time NAV information.

- Your Brokerage Account: Many brokerage platforms display the NAV of ETFs held in your portfolio.

NAV updates are typically provided daily, usually at the close of the market.

- Direct Links: (Note: Direct links can change; search the respective websites for the most current fund information.) Always verify links before relying on them.

- Comparison of Data Sources: While official sources (like Amundi) are most reliable, comparing data from multiple sources can help identify any discrepancies.

- Data Delays: Be aware that there might be slight delays in reporting the NAV, especially after market close.

Utilizing NAV Data for Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Tracking the NAV allows you to assess the ETF's performance over time. By comparing the NAV on different days, weeks, or months, you can gauge its growth or decline. This helps in evaluating investment strategies such as "buy low, sell high." The ETF's share price should closely track the NAV, with only minor discrepancies due to trading activity.

- Analyzing NAV Trends: Charting the NAV over time can reveal patterns and trends, helping predict potential future movements.

- Beyond NAV: While NAV is important, consider other factors like trading volume and overall market sentiment. High trading volume can sometimes create short-term discrepancies between the NAV and market price.

- Caution: Never rely solely on NAV for investment decisions. Use it in conjunction with other analytical tools and market research.

Potential Challenges and Considerations When Tracking the NAV

While generally reliable, NAV data may have minor discrepancies due to reporting lags or valuation adjustments. Always ensure you use trustworthy and reputable sources to avoid misleading information. Market closures or trading halts can affect the accuracy and timeliness of NAV reporting.

- Verifying Accuracy: Compare NAV figures from at least two different reliable sources to ensure consistency.

- Market Events: Unexpected events like major economic news or geopolitical instability can significantly impact the NAV in the short term.

- Continuous Monitoring: Regularly checking the NAV (rather than infrequent checks) is essential for effective tracking and informed decision-making.

Conclusion: Mastering NAV Tracking for the Amundi Dow Jones Industrial Average UCITS ETF

Mastering NAV tracking is key to successful Amundi Dow Jones Industrial Average UCITS ETF investing. This involves using multiple reliable sources, such as Amundi's website and major financial data providers, to obtain daily NAV updates. Remember to consider other market factors in conjunction with NAV data to make well-informed investment choices. Begin tracking the NAV of your Amundi Dow Jones Industrial Average UCITS ETF investments today!

Featured Posts

-

Evrovidenie Pobediteli Poslednikh 10 Let Chto Delayut Seychas

May 25, 2025

Evrovidenie Pobediteli Poslednikh 10 Let Chto Delayut Seychas

May 25, 2025 -

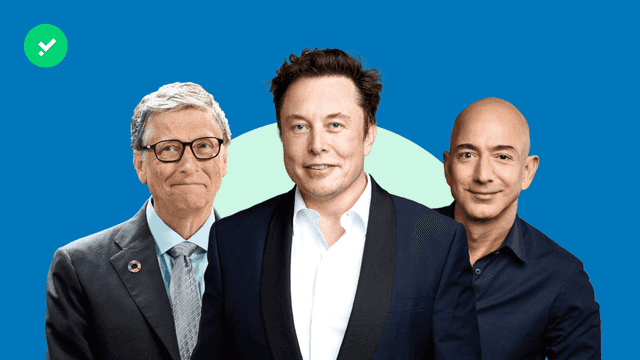

Classifica Forbes 2025 I 10 Uomini Piu Ricchi Del Mondo

May 25, 2025

Classifica Forbes 2025 I 10 Uomini Piu Ricchi Del Mondo

May 25, 2025 -

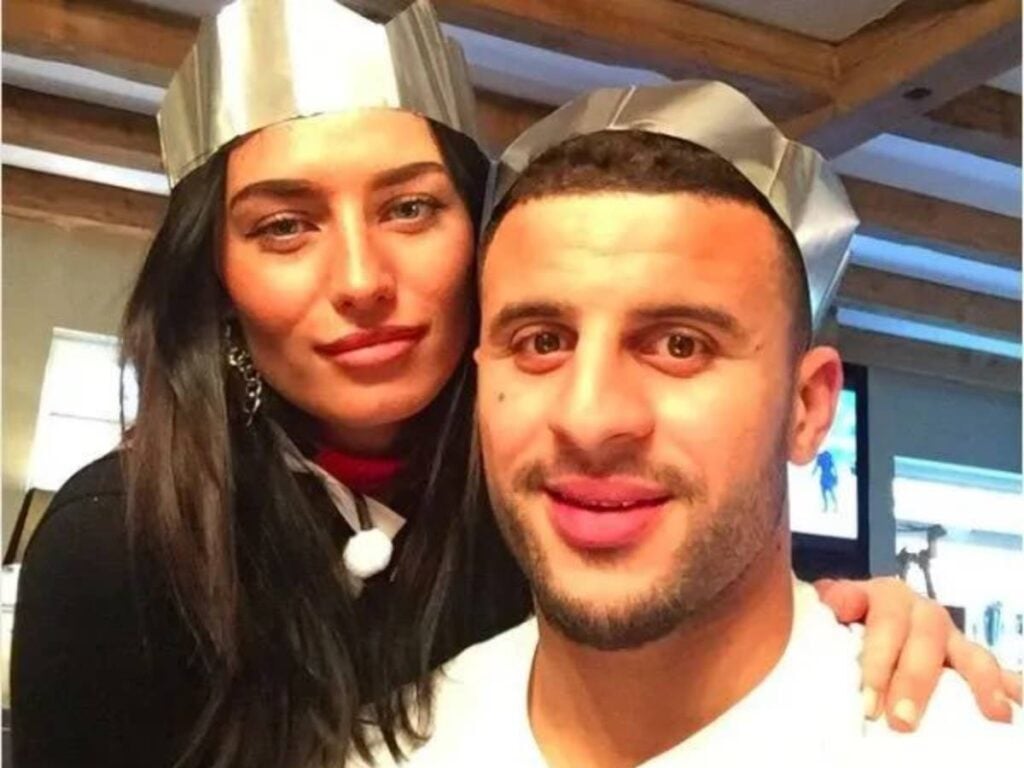

Understanding The Kyle Walker Mystery Women And Annie Kilner Story

May 25, 2025

Understanding The Kyle Walker Mystery Women And Annie Kilner Story

May 25, 2025 -

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos Inside

May 25, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos Inside

May 25, 2025 -

Escape To The Countryside Making The Most Of Rural Life

May 25, 2025

Escape To The Countryside Making The Most Of Rural Life

May 25, 2025

Latest Posts

-

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025

Berkshire Hathaway And Apple What Happens After Buffett Steps Down

May 25, 2025 -

Ces Unveiled Europe Devoilement Des Innovations A Amsterdam

May 25, 2025

Ces Unveiled Europe Devoilement Des Innovations A Amsterdam

May 25, 2025 -

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025

Amsterdam Accueille Le Ces Unveiled Europe Innovation Et Technologie

May 25, 2025 -

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain

May 25, 2025

Retour Du Ces Unveiled A Amsterdam Les Technologies De Demain

May 25, 2025 -

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025

Ces Unveiled Europe Nouveautes Technologiques A Amsterdam

May 25, 2025