Trade War Intensifies: Another Downturn For Dutch Stocks

Table of Contents

Impact of Tariffs on Key Dutch Industries

The imposition of tariffs as part of the trade war has significantly impacted several key Dutch industries, hindering their growth and competitiveness.

Agriculture: A Withering Bloom for Dutch Agricultural Exports

Dutch agricultural exports, renowned globally for their quality, are facing significant headwinds. The impact of tariffs is keenly felt in sectors like floriculture and dairy.

- Tariff Increases: Increased tariffs on Dutch flower exports to key markets like the US and the UK have resulted in substantial price drops for Dutch exporters.

- Export Decline: The volume of Dutch flower exports has noticeably decreased due to the higher prices and reduced competitiveness in the international market.

- Job Losses: The decline in exports has led to job losses within the Dutch agricultural sector, particularly in flower cultivation and packaging. The reduced profitability is forcing many smaller businesses to close. This situation highlights the vulnerability of Dutch agricultural exports and their sensitivity to tariff changes.

Manufacturing: Supply Chain Disruptions and Increased Costs

Dutch manufacturing companies are heavily reliant on global supply chains, making them particularly vulnerable to disruptions caused by trade wars.

- Affected Sectors: Sectors such as semiconductors and machinery manufacturing are facing increased production costs due to tariffs on imported components and raw materials.

- Supply Chain Disruptions: The imposition of tariffs has led to disruptions in global supply chains, delaying production and increasing costs for Dutch manufacturers.

- Loss of Competitiveness: Higher production costs are eroding the competitiveness of Dutch manufactured goods in the global market, impacting exports and profitability. The need for diversification of supply chains is becoming increasingly crucial for Dutch manufacturers.

Technology: Navigating Global Competition in a Turbulent Climate

The Dutch technology sector, while innovative, is also feeling the pinch of the trade war's impact.

- Impact on Innovation: Uncertainty surrounding trade policies discourages investment in research and development, hindering technological advancements in the sector.

- Access to International Markets: Trade barriers and tariffs limit the access of Dutch tech companies to key international markets, affecting growth prospects.

- Global Competition: The intensifying trade war creates a more challenging environment for Dutch tech firms to compete effectively against companies from other countries.

Investor Sentiment and Market Volatility

The escalating trade war has significantly impacted investor sentiment and increased volatility in the Dutch stock market.

Decreased Foreign Investment: A Flight from Uncertainty

The uncertainty surrounding the trade war has led to a decrease in foreign investment in Dutch stocks.

- Statistics on Decreased Investment: Several financial reports indicate a decline in foreign investment in the Dutch stock market compared to previous years.

- Investor Uncertainty: The unpredictable nature of the trade war creates uncertainty amongst investors, leading them to shift their investments to perceived safer markets.

- Impact on Stock Prices: The decreased foreign investment has contributed to a downturn in the prices of Dutch stocks, affecting the overall market value.

Increased Market Volatility: A Rollercoaster Ride for Dutch Stocks

The trade war's uncertainty has resulted in increased volatility in the Dutch stock market.

- Increased Market Fluctuations: The Dutch stock market has experienced significant price fluctuations reflecting the ever-changing landscape of international trade relations.

- Impact on Investor Confidence: The increased volatility erodes investor confidence, making them more hesitant to invest in Dutch stocks.

- Potential for Further Declines: The ongoing trade tensions pose a significant risk of further declines in the Dutch stock market if the situation deteriorates.

Government Response and Mitigation Strategies

The Dutch government has implemented several measures to mitigate the impact of the trade war on businesses and the economy.

Government Initiatives: A Support Network for Dutch Businesses

The Dutch government has introduced various support programs and initiatives aimed at assisting businesses affected by the trade war.

- Government Support Programs: These programs offer financial aid, tax breaks, and other forms of support to help companies overcome the challenges posed by tariffs and trade disruptions.

- Trade Negotiations: The government is actively engaged in trade negotiations to secure favorable trade agreements for Dutch businesses and to reduce the impact of tariffs.

- Economic Stimulus Packages: To boost the economy and offset the negative impacts of the trade war, government stimulus packages have been implemented to encourage growth and investment.

Effectiveness of Mitigation Efforts: A Balancing Act

The effectiveness of the Dutch government's response is a subject of ongoing debate.

- Positive Aspects: Some of the government's initiatives have provided crucial support to businesses, helping them weather the initial storm of the trade war.

- Limitations: The effectiveness of these measures is limited by the global nature of the trade war and the extent of the impact on various sectors.

- Alternative Strategies: There is a need for diversification strategies, strengthening domestic markets, and exploring new trade partnerships to reduce reliance on affected markets.

Conclusion

The intensifying global trade war is having a significant and detrimental impact on Dutch stocks, affecting various key sectors and negatively impacting investor sentiment. The decline in Dutch stocks reflects the challenges faced by Dutch businesses due to increased tariffs, supply chain disruptions, and reduced global competitiveness. The government's response, while offering some support, faces limitations in mitigating the full extent of the trade war's effects.

Key Takeaways: The trade war significantly impacts Dutch agricultural exports, manufacturing, and the technology sector, leading to decreased foreign investment, increased market volatility, and a general downturn in Dutch stocks.

Call to Action: The escalating trade war presents significant challenges for Dutch stocks. Stay informed about the latest developments and consider diversifying your portfolio to mitigate potential risks associated with continued uncertainty in the Dutch stock market. Consult with a financial advisor to explore suitable strategies for navigating this challenging economic climate.

Featured Posts

-

Euronext Amsterdam Stocks Surge 8 After Trumps Tariff Pause

May 25, 2025

Euronext Amsterdam Stocks Surge 8 After Trumps Tariff Pause

May 25, 2025 -

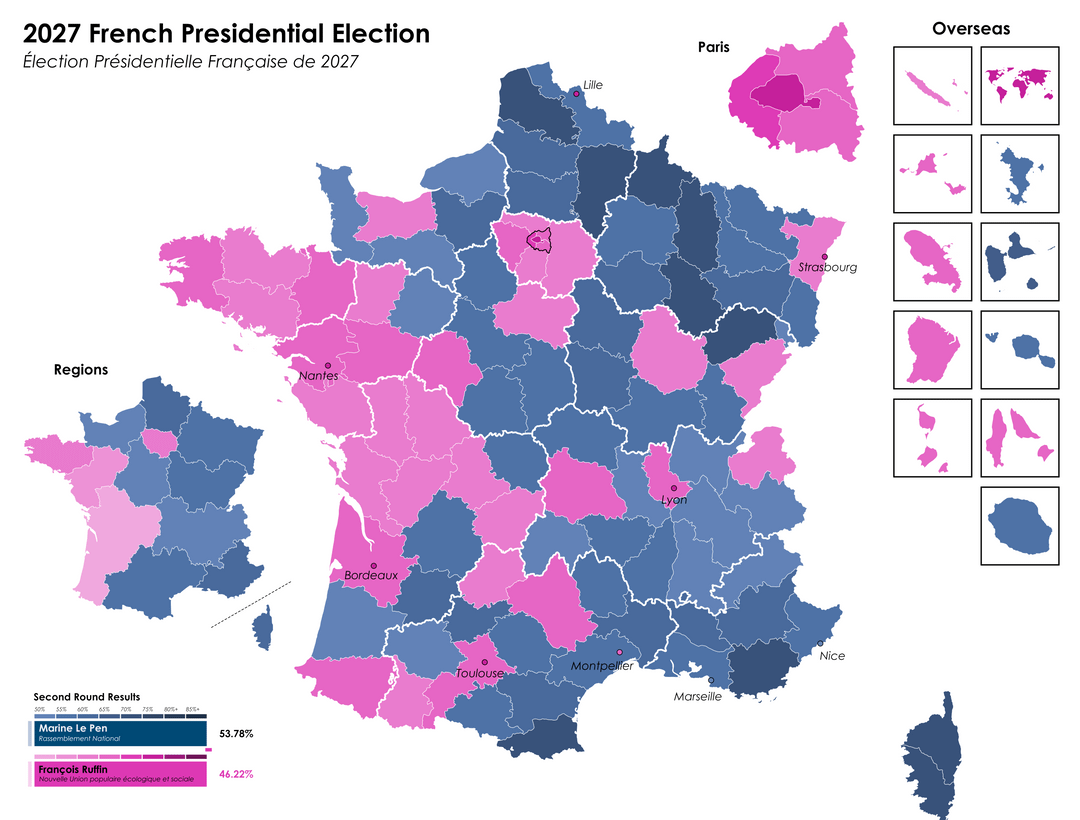

Bardellas Bid For Power A Look At The 2027 French Elections

May 25, 2025

Bardellas Bid For Power A Look At The 2027 French Elections

May 25, 2025 -

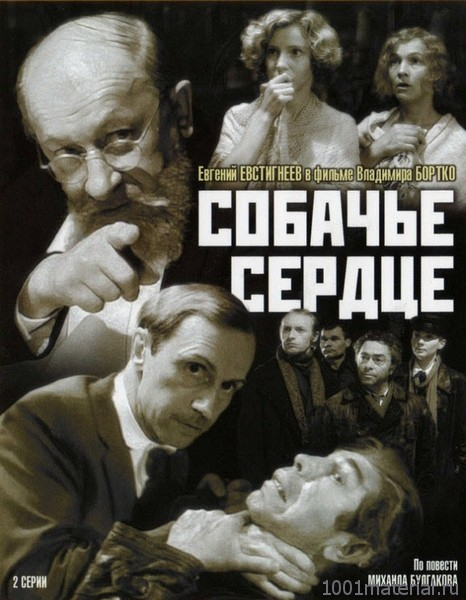

Istoriya Sozdaniya Filma Garazh Mest Myagkovu I Vliyanie Plenuma

May 25, 2025

Istoriya Sozdaniya Filma Garazh Mest Myagkovu I Vliyanie Plenuma

May 25, 2025 -

Dad Rows For Sons 2 2 Million Treatment A Cnn Story

May 25, 2025

Dad Rows For Sons 2 2 Million Treatment A Cnn Story

May 25, 2025 -

Thlyl Adae Daks 30 Tjawz Dhrwt Mars

May 25, 2025

Thlyl Adae Daks 30 Tjawz Dhrwt Mars

May 25, 2025

Latest Posts

-

Will Elon Musk Continue To Support Dogecoin

May 25, 2025

Will Elon Musk Continue To Support Dogecoin

May 25, 2025 -

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 25, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Tests

May 25, 2025 -

Elon Musks Dogecoin Stance An Analysis

May 25, 2025

Elon Musks Dogecoin Stance An Analysis

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025 -

Dogecoins Future Elon Musks Involvement

May 25, 2025

Dogecoins Future Elon Musks Involvement

May 25, 2025