Trade War Resolution? Assessing Market Response To US-China Negotiations

Table of Contents

Impact of Trade War on Global Markets

The imposition of tariffs and trade restrictions during the US-China trade war sent shockwaves through global financial markets. The uncertainty surrounding trade policy significantly impacted investor sentiment and market stability.

Stock Market Fluctuations

Escalating trade tensions directly correlated with significant volatility in major stock indices.

- The S&P 500 and Dow Jones Industrial Average experienced periods of sharp declines during periods of heightened trade conflict. For example, the announcement of new tariffs often triggered immediate sell-offs.

- Conversely, positive developments in negotiations, like the signing of a "phase one" deal, frequently led to market rallies as investor confidence improved.

- The Shanghai Composite Index, a key indicator of the Chinese economy, showed considerable sensitivity to the ebb and flow of US-China trade relations, reflecting the direct impact on Chinese businesses and exports.

- Investor sentiment, heavily influenced by news regarding trade negotiations, became a major driver of stock market fluctuations. Optimistic news spurred buying, while negative developments fostered risk aversion and selling.

Commodity Price Volatility

The trade war dramatically impacted the prices of various commodities heavily traded between the US and China.

- Soybean prices, for instance, experienced significant volatility as Chinese tariffs on US soybeans disrupted agricultural trade. American farmers faced decreased demand and lower prices.

- Steel and aluminum prices also fluctuated, influenced by both tariffs and retaliatory measures imposed by both countries.

- The trade war also impacted the prices of rare earth minerals, highlighting the strategic importance of these resources in global supply chains.

- Businesses employed various hedging strategies, such as futures contracts, to mitigate the risks associated with commodity price fluctuations caused by trade uncertainty.

Currency Exchange Rate Shifts

Trade policy uncertainty significantly impacted currency exchange rates.

- The US dollar initially strengthened against the Chinese yuan during periods of trade escalation, reflecting safe-haven demand for the dollar.

- However, prolonged trade disputes could weaken the dollar, as uncertainty undermines investor confidence in the US economy.

- Fluctuations in exchange rates impacted international trade and investment flows, influencing the competitiveness of exports and the cost of imports for businesses.

- Central banks played a role in managing currency volatility, intervening in the foreign exchange market to stabilize their respective currencies.

Analyzing Market Responses to Negotiation Stages

Market reactions to US-China trade negotiations varied significantly depending on the stage of the process.

Early Stages of Negotiation

The initial phases of trade talks were marked by considerable investor uncertainty.

- Markets displayed cautious optimism, reacting positively to promising signals but remaining wary of potential setbacks.

- Initial concessions or small breakthroughs led to temporary market rallies, reflecting a positive response to perceived progress.

- News coverage played a substantial role in shaping investor sentiment; positive media narratives generally boosted markets, while negative reports fueled uncertainty.

Periods of Escalation

Periods of heightened tension and increased tariffs led to significant market downturns.

- Markets experienced sell-offs as investors moved to safer assets, like government bonds and gold, reflecting increased risk aversion.

- Instances of market panic were observed during particularly contentious periods of the trade war.

- Increased uncertainty surrounding future trade policies made long-term investment planning challenging for businesses.

Positive Developments and De-escalation

Positive developments and breakthroughs in negotiations sparked market rallies.

- Announcements of trade deals or de-escalation efforts were frequently followed by increased investor confidence and market gains.

- The flow of foreign direct investment increased as uncertainty diminished.

- Positive media narratives reinforced investor optimism, contributing to market stability.

Long-Term Outlook: Potential for Trade War Resolution

The long-term implications of US-China trade relations for global markets remain uncertain.

Scenarios for Resolution and Their Market Impacts

Several scenarios could emerge from the US-China trade negotiations, each with different market implications.

- A comprehensive trade agreement could lead to substantial market gains, boosting global trade and investment.

- A partial agreement, addressing some issues but leaving others unresolved, could result in continued market volatility.

- Continued trade tensions or further escalation could cause significant and prolonged negative impacts on global markets.

- The geopolitical implications of any resolution will also influence market reactions, impacting investor confidence in the stability of international relations.

Assessing the Sustainability of Any Agreement

The long-term viability of any potential trade deal is uncertain.

- Factors such as domestic political pressures in both the US and China could lead to future trade disputes.

- The risk of backsliding or further escalation remains a significant concern, hindering long-term market stability.

- The ability of both countries to adhere to any agreement will play a decisive role in its sustainability.

Conclusion: The Future of Trade War Resolution and Market Stability

The US-China trade war demonstrated the significant impact of trade tensions on global markets. Market reactions to trade war resolution efforts varied considerably across different negotiation stages. Understanding these dynamics is crucial for navigating the complexities of international trade and investment. Staying informed about ongoing developments in US-China trade relations is critical for developing effective investment strategies. Continue your research on trade war resolution by exploring resources from reputable financial news sources and economic analysis firms. Understanding the nuances of trade war resolution is essential for future market predictions and informed decision-making.

Featured Posts

-

Kompany Zware Kritiek En Vernedering

May 12, 2025

Kompany Zware Kritiek En Vernedering

May 12, 2025 -

Analyzing John Wicks Appearances A Look At The Keanu Reeves Franchise

May 12, 2025

Analyzing John Wicks Appearances A Look At The Keanu Reeves Franchise

May 12, 2025 -

Lily Collins And Charlie Mc Dowell A Look At Their Family Life With Daughter Tove

May 12, 2025

Lily Collins And Charlie Mc Dowell A Look At Their Family Life With Daughter Tove

May 12, 2025 -

The Chaplin Factor Ipswich Towns Path To Victory

May 12, 2025

The Chaplin Factor Ipswich Towns Path To Victory

May 12, 2025 -

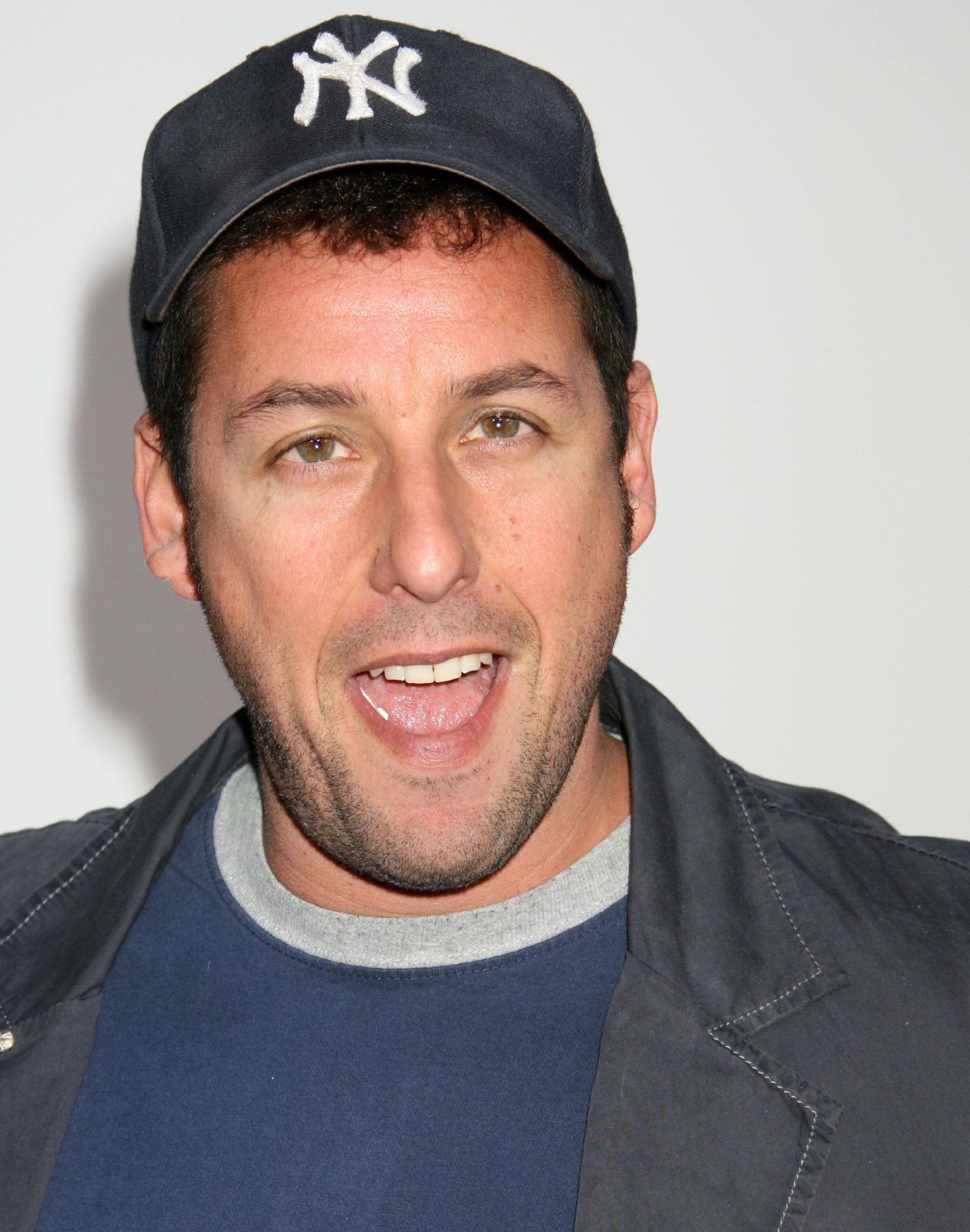

The Adam Sandler Net Worth Story Success In Hollywood Comedy

May 12, 2025

The Adam Sandler Net Worth Story Success In Hollywood Comedy

May 12, 2025