Traders Pare Bets On BOE Cuts: Pound Strengthens After UK Inflation Data

Table of Contents

UK Inflation Data Surprises Markets

The recently released UK inflation figures sent shockwaves through financial markets. The Consumer Price Index (CPI), a key measure of inflation, showed a surprisingly lower increase than analysts had predicted. This unexpected drop significantly alters the outlook for BOE monetary policy. Instead of the anticipated continued rate cuts to combat inflation, the data suggests that such aggressive measures may no longer be necessary.

- Unexpected drop in CPI (Consumer Price Index): The CPI rose by [Insert Actual Percentage]% in [Month, Year], significantly lower than the predicted [Predicted Percentage]%. This represents a considerable deviation from previous trends and market expectations.

- Impact on RPI (Retail Price Index): The Retail Price Index (RPI), another key inflation indicator, also registered a lower-than-expected increase, further supporting the conclusion of easing inflationary pressures.

- Market reaction to the figures: The immediate market reaction was a sharp increase in the value of the pound and a noticeable decrease in the implied probability of future BOE rate cuts as reflected in interest rate futures contracts.

Reduced Expectations for BOE Interest Rate Cuts

The market is now pricing in significantly fewer, if any, further BOE rate cuts. This represents a stark turnaround from the prevailing sentiment just weeks ago. Traders, initially anticipating continued easing of monetary policy to stimulate economic growth, are now re-evaluating their positions in light of the lower-than-expected inflation figures. This shift has substantial implications for UK monetary policy, signaling a potential pause or even a reversal of the recent trend towards lower interest rates.

- Changes in interest rate futures contracts: Interest rate futures contracts, which reflect market expectations for future interest rates, have shown a significant shift, indicating a reduced likelihood of further rate cuts.

- Impact on the yield curve: The yield curve, which plots the yields of government bonds of different maturities, has also reacted to the news, flattening slightly as expectations of future rate cuts diminished.

- Analysts' comments and predictions: Leading economists and market analysts have revised their forecasts, suggesting a lower probability of further BOE rate cuts in the near future. Many now anticipate the BOE will maintain its current interest rate or even potentially consider a future rate hike.

Pound Strengthens Against Major Currencies

Following the release of the surprisingly low inflation data, the pound experienced a noticeable strengthening against major currencies. This appreciation reflects the market's renewed confidence in the UK economy and reduced expectations of further BOE rate cuts. A stronger pound benefits some sectors of the UK economy while presenting challenges for others.

- GBP/USD exchange rate movement: The GBP/USD exchange rate saw a significant increase, with the pound gaining [Insert Percentage]% against the dollar.

- GBP/EUR exchange rate movement: Similarly, the GBP/EUR exchange rate appreciated, with the pound strengthening by [Insert Percentage]% against the euro.

- Impact on UK exporters and importers: The strengthening pound makes UK exports more expensive and imports cheaper, potentially impacting businesses engaged in international trade. Exporters may face reduced competitiveness while importers benefit from lower costs.

Potential Future Implications for the UK Economy

The lower-than-expected inflation and the resulting shift in BOE rate cut expectations have significant implications for the UK economy's future trajectory. While lower inflation is generally positive, the implications for growth, employment, and consumer spending require careful consideration.

- Impact on economic growth: The effect on economic growth is complex. While lower inflation can boost consumer spending, reduced expectations for rate cuts might curtail investment, leading to a more muted economic expansion.

- Potential implications for employment: A stable or slightly stronger pound can potentially affect UK employment prospects, impacting sectors heavily reliant on international trade.

- Longer-term outlook for the pound: The longer-term outlook for the pound remains uncertain and dependent on various factors, including global economic conditions and future BOE policy decisions. A continued trend of low inflation might support a stronger pound, but unforeseen economic events could reverse the current trend.

Conclusion: The Future of BOE Rate Cuts and the Pound

In summary, the unexpectedly low UK inflation data has led to a significant reduction in market bets on BOE rate cuts and a corresponding strengthening of the pound. The market's reaction highlights the considerable influence of inflation figures on monetary policy expectations and currency values. The future direction of BOE policy remains subject to evolving economic conditions. However, the current trend suggests a decreased likelihood of further rate cuts in the near term. Stay informed about future BOE rate cut decisions and their impact on the pound by subscribing to our newsletter! Understanding these dynamics is critical for navigating the complexities of the UK financial landscape.

Featured Posts

-

Gideon Glick The Star Of Amazon Primes Etoile

May 26, 2025

Gideon Glick The Star Of Amazon Primes Etoile

May 26, 2025 -

Hells Angels Structure Membership And Activities

May 26, 2025

Hells Angels Structure Membership And Activities

May 26, 2025 -

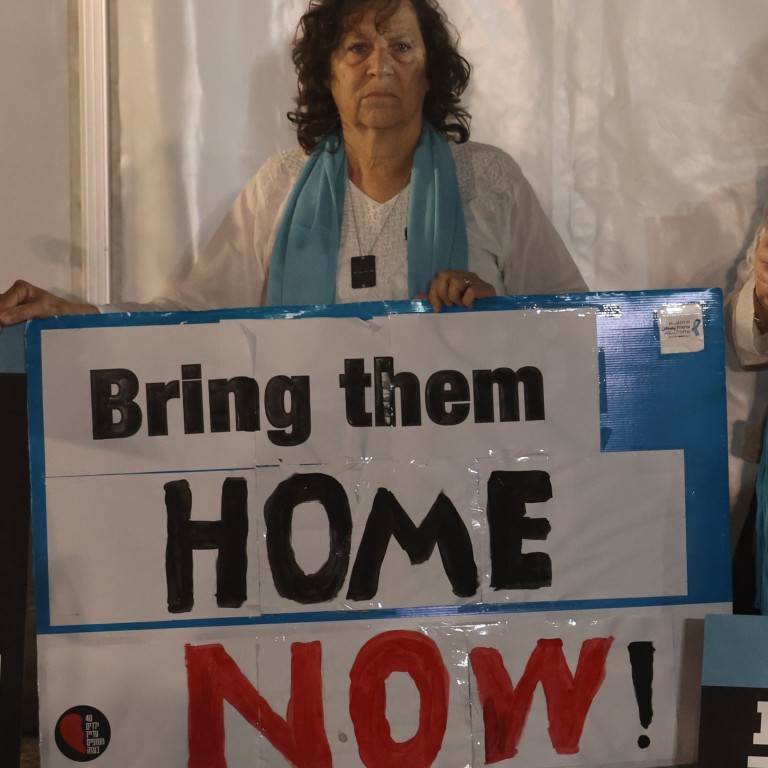

Former Israeli Female Soldiers Demand Gaza Captive Release

May 26, 2025

Former Israeli Female Soldiers Demand Gaza Captive Release

May 26, 2025 -

Police Arrest Made In Fatal Myrtle Beach Hit And Run

May 26, 2025

Police Arrest Made In Fatal Myrtle Beach Hit And Run

May 26, 2025 -

Dc Black Pride Where Culture Protest And Celebration Intersect

May 26, 2025

Dc Black Pride Where Culture Protest And Celebration Intersect

May 26, 2025

Latest Posts

-

Analysing Liverpools Transfer Strategy Winger Targets And Salahs Contract Renewal

May 28, 2025

Analysing Liverpools Transfer Strategy Winger Targets And Salahs Contract Renewal

May 28, 2025 -

Arsenal Vs Newcastle Battle For Young Ligue 1 Talent

May 28, 2025

Arsenal Vs Newcastle Battle For Young Ligue 1 Talent

May 28, 2025 -

Liverpool Transfer News Focus On Wingers As Salahs Future Remains Uncertain

May 28, 2025

Liverpool Transfer News Focus On Wingers As Salahs Future Remains Uncertain

May 28, 2025 -

Arsenal And Newcastle Vie For Ligue 1 Starlet

May 28, 2025

Arsenal And Newcastle Vie For Ligue 1 Starlet

May 28, 2025 -

Salah Contract And Liverpools Winger Search Evaluating Potential Transfers

May 28, 2025

Salah Contract And Liverpools Winger Search Evaluating Potential Transfers

May 28, 2025