Traders Reduce BOE Cut Bets As Pound Rises On UK Inflation Data

Table of Contents

UK Inflation Data Surprises Market

The recent release of UK inflation figures sent shockwaves through the financial markets. Data significantly deviated from analyst predictions, painting a picture of stronger-than-anticipated economic resilience. This unexpected strength has directly impacted interest rate expectations and the value of the pound.

- CPI (Consumer Price Index) unexpectedly rose to 7.9%, exceeding forecasts of 7.1%. This represents a considerable upward surprise and demonstrates persistent inflationary pressures within the UK economy.

- RPI (Retail Price Index), another key inflation measure, showed a similar upward trend. This reinforces the notion that inflation remains a significant concern for policymakers.

- This signals stronger than anticipated economic resilience. Despite global economic headwinds, the UK economy appears to be holding up better than many predicted, influencing the BOE's likely response.

Pound Sterling Strengthens Against Major Currencies

The unexpected inflation data triggered a noticeable strengthening of the pound sterling against major international currencies. This reflects increased investor confidence in the UK's economic prospects and a reassessment of the need for further interest rate cuts.

- GBPUSD (Pound/US Dollar) rose by 1.2%. This represents a significant gain against the US dollar, highlighting the relative strength of the pound.

- GBPEUR (Pound/Euro) increased by 0.9%. The pound also performed strongly against the euro, further solidifying its recent gains.

- This indicates increased investor confidence in the UK economy. The market's reaction suggests a growing belief that the UK is better positioned to weather economic challenges than previously thought. The strengthened pound makes UK exports relatively more expensive and imports cheaper.

Reduced Bets on BOE Interest Rate Cuts

The surge in the pound and the higher-than-expected inflation data have significantly altered market sentiment regarding the BOE's upcoming interest rate decision. Traders who had placed bets on a rate cut are now reassessing their positions.

- Traders are scaling back bets on a rate cut at the next BOE meeting. The probability of a rate cut has decreased substantially based on current market pricing.

- Interest rate futures contracts reflect a decreased probability of a reduction. These contracts, which are used to speculate on future interest rate movements, clearly indicate a shift in market expectations.

- This suggests a potential pause or even a rate hike in the future. The stronger-than-expected inflation data has reduced the perceived need for further monetary easing by the BOE. A rate hike remains a possibility depending on future economic indicators.

Implications for UK Economy

The recent market shift has significant implications for the UK economy. While a stronger pound benefits consumers through cheaper imports, it also makes UK exports more expensive, potentially impacting economic growth. The reduced expectation of a BOE interest rate cut could lead to higher borrowing costs for businesses and consumers, potentially slowing economic activity.

- Higher borrowing costs could dampen investment and consumer spending. Reduced expectations of further rate cuts imply tighter monetary policy which could ultimately affect growth.

- The UK economic outlook remains uncertain. While the recent inflation data is positive in the short term, sustained high inflation could still pose a significant challenge.

- Inflation control remains a key priority for the BOE. The central bank will likely continue to monitor economic data closely to determine the appropriate monetary policy response.

Conclusion

In summary, unexpectedly high UK inflation figures have led to a stronger pound sterling and reduced market expectations of a BOE interest rate cut. This significant market shift reflects a reassessment of the UK's economic resilience and the potential for a different monetary policy trajectory. The implications for the UK economy, including borrowing costs and economic growth, remain significant and warrant continued observation. Stay updated on the latest developments surrounding the BOE and UK inflation data to capitalize on future trading opportunities related to the pound sterling and interest rate movements. Understanding BOE interest rate decisions and their impact on the GBP is key to navigating the complexities of the UK currency market.

Featured Posts

-

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025

Wordle Today 1 367 Hints Clues And Answer For Monday March 17th

May 22, 2025 -

Blake Livelys Lawyer Allegedly Threatened To Leak Taylor Swift Texts The Full Story

May 22, 2025

Blake Livelys Lawyer Allegedly Threatened To Leak Taylor Swift Texts The Full Story

May 22, 2025 -

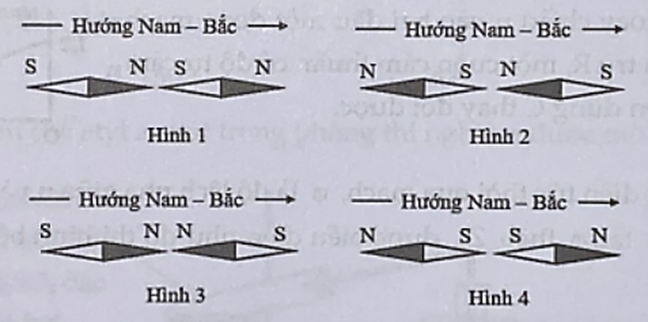

Ket Noi Hai Vung Dat Hon 200 Van Dong Vien Chay Bo Tu Dak Lak Den Phu Yen

May 22, 2025

Ket Noi Hai Vung Dat Hon 200 Van Dong Vien Chay Bo Tu Dak Lak Den Phu Yen

May 22, 2025 -

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025

Appeal Pending Ex Tory Councillors Wife Faces Decision On Racial Hatred Tweet

May 22, 2025 -

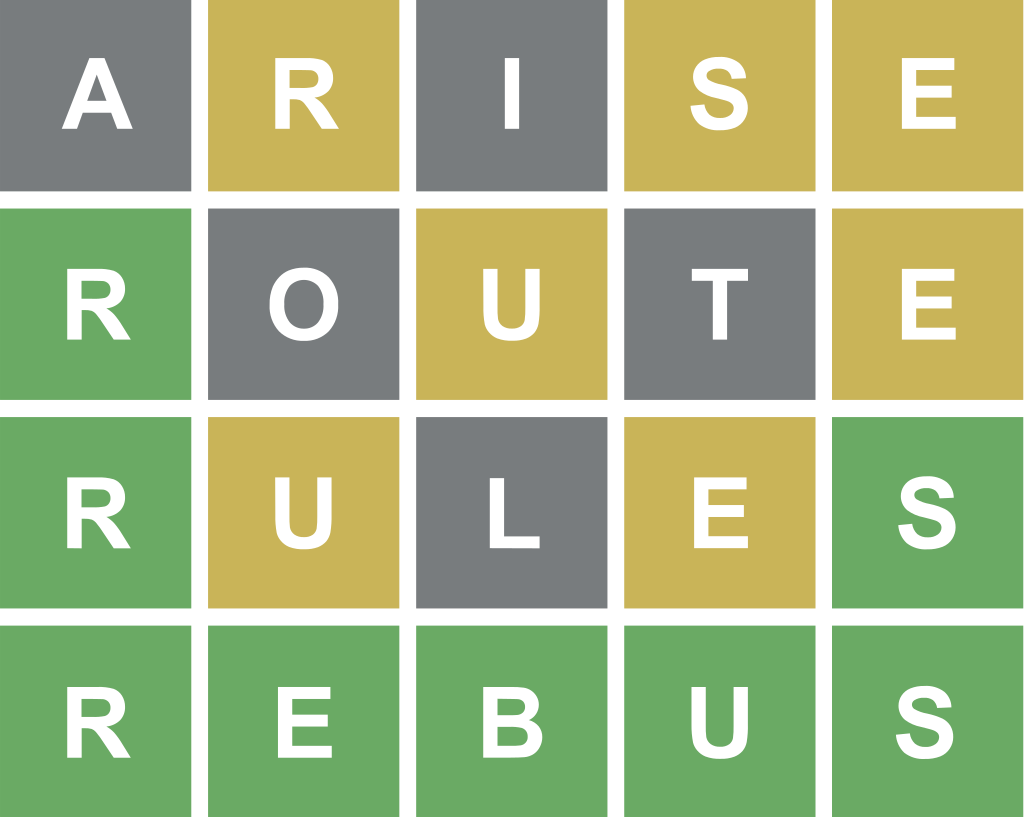

Wordle 1393 April 12 Nyt Puzzle Hints And Solution

May 22, 2025

Wordle 1393 April 12 Nyt Puzzle Hints And Solution

May 22, 2025

Latest Posts

-

Zagrozi Ta Mozhlivosti Analiz Vidnosin Putina Ta Trampa

May 22, 2025

Zagrozi Ta Mozhlivosti Analiz Vidnosin Putina Ta Trampa

May 22, 2025 -

Sanktsiyi Proti Rosiyi Lindsi Grem Pro Novi Zakhodi Senatu S Sh A

May 22, 2025

Sanktsiyi Proti Rosiyi Lindsi Grem Pro Novi Zakhodi Senatu S Sh A

May 22, 2025 -

Zagroza Sanktsiy Vid Grema Rosiya Ta Yiyi Agresiya Proti Ukrayini

May 22, 2025

Zagroza Sanktsiy Vid Grema Rosiya Ta Yiyi Agresiya Proti Ukrayini

May 22, 2025 -

Strategiyi Ta Taktiki Putin Ta Tramp U Politichniy Gri

May 22, 2025

Strategiyi Ta Taktiki Putin Ta Tramp U Politichniy Gri

May 22, 2025 -

Senat Pidtrimaye Zhorstkishi Sanktsiyi Proti Rf Zayava Lindsi Grema

May 22, 2025

Senat Pidtrimaye Zhorstkishi Sanktsiyi Proti Rf Zayava Lindsi Grema

May 22, 2025