Treasury Official: US Debt Limit Measures Could Expire In August

Table of Contents

Treasury Department's Warning and its Implications

A senior Treasury official recently warned that the government's extraordinary measures to manage the national debt – measures employed to avoid breaching the US debt limit – could expire as early as August. These measures, which include delaying certain payments and suspending investments, are temporary fixes, providing a short-term solution to a long-term problem. The official expressed deep concern over the potential consequences of exceeding the debt ceiling, highlighting the possibility of a government shutdown and severe disruptions to the global economy.

- Specific date mentioned: While the exact date remains fluid and dependent on various economic factors, the Treasury Department has indicated that August is a critical timeframe.

- Summary of the official's concerns: The primary concern revolves around the inability to meet the government's financial obligations, potentially leading to a default on US debt. This would have profound and far-reaching consequences.

- Potential economic repercussions: A default could trigger a credit rating downgrade, significantly increasing borrowing costs for the US government and impacting interest rates across the board. This could lead to higher costs for consumers and businesses alike.

Political Ramifications and Potential Solutions

The US debt ceiling debate is deeply entangled in partisan politics. Republicans and Democrats hold opposing views on how to address the issue, creating a significant obstacle to finding a bipartisan solution. Republicans are demanding spending cuts in exchange for raising the debt ceiling, while Democrats are urging a clean increase without conditions, arguing that defaulting on US debt would be economically disastrous.

- Positions of key political figures: The positions of key figures like the President and Congressional leaders will play a crucial role in determining the outcome of the negotiations.

- Potential legislative proposals: Various legislative proposals are being considered, ranging from short-term extensions to comprehensive budget deals that address long-term spending.

- Obstacles hindering a resolution: The deep partisan divide and the high stakes involved are major obstacles to finding a timely resolution. Compromise is critical, but reaching a consensus remains a significant challenge.

Economic Impact of a Potential Default

A US government default on its debt obligations would have far-reaching and potentially devastating consequences for the global economy. The impact would extend far beyond US borders, triggering significant market volatility and economic uncertainty worldwide.

- Potential credit rating downgrades: A default would almost certainly lead to credit rating downgrades, increasing borrowing costs for the US government and potentially jeopardizing its ability to finance future operations.

- Impact on interest rates: Interest rates on government bonds and other financial instruments could spike dramatically, leading to increased borrowing costs for businesses and consumers.

- Consequences for the US dollar: The value of the US dollar could plummet, impacting global trade and investment flows.

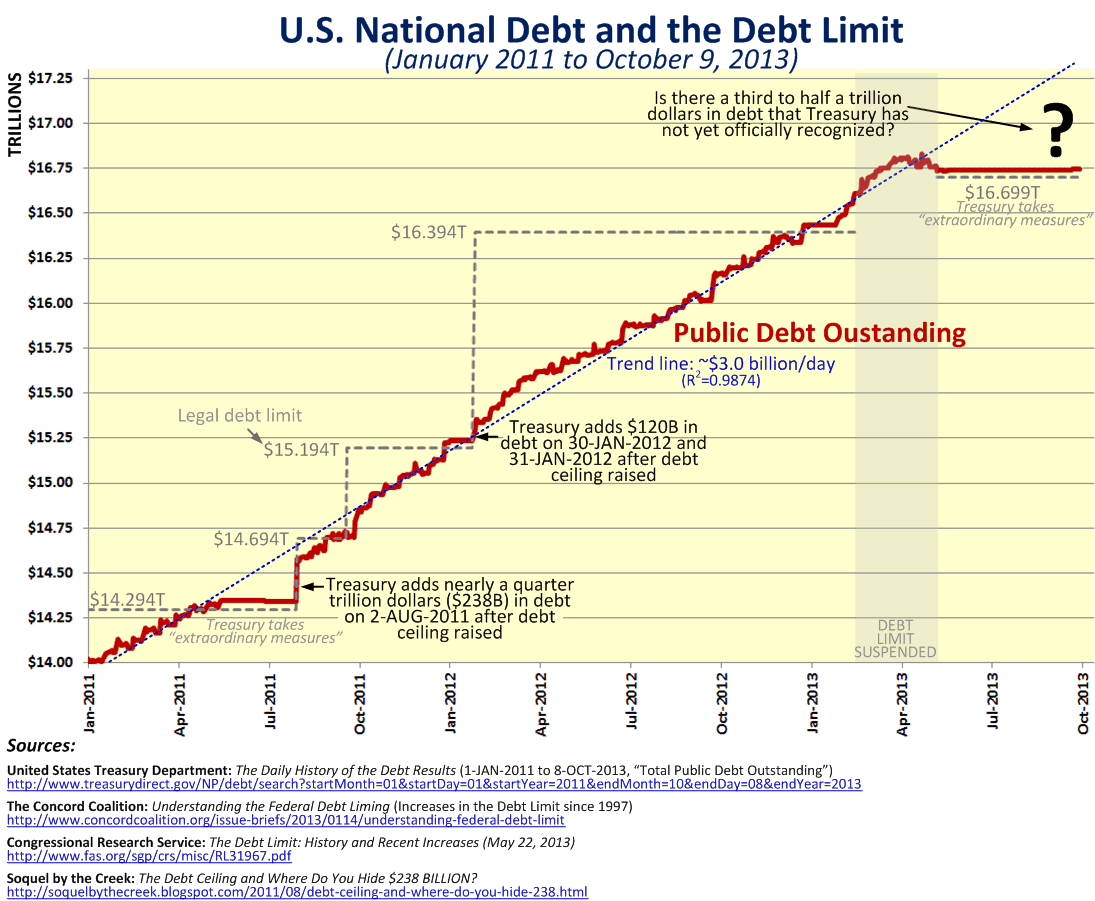

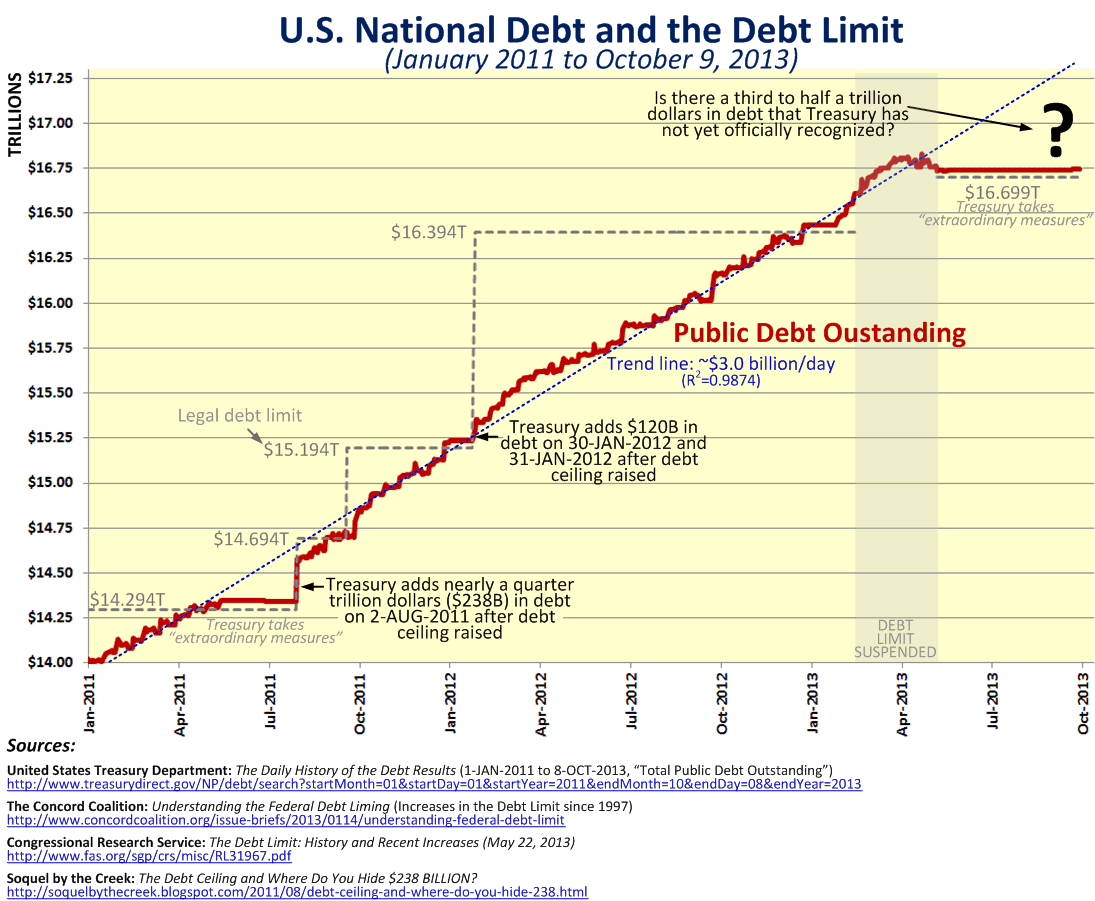

Historical Context: Past Debt Ceiling Crises

The current US debt limit crisis is not unprecedented. History offers numerous examples of similar standoffs, providing valuable insights into potential outcomes. In the past, last-minute deals have often been struck to avert a default, but these often come with political concessions and economic uncertainty.

- Notable past debt ceiling debates: Several significant debt ceiling debates have taken place throughout US history, often marked by intense political gridlock and brinkmanship.

- Outcomes of past negotiations: Past negotiations have resulted in various outcomes, including short-term extensions, budget deals with spending cuts, and sometimes even government shutdowns.

- Key similarities and differences with the current situation: While past crises offer valuable lessons, the current situation presents unique challenges due to the prevailing political climate and the potential for a more severe economic impact.

Conclusion: The Urgent Need for Action on the US Debt Limit

The Treasury official's warning regarding the August deadline underscores the urgent need for Congress to act decisively to raise the US debt limit. Failure to do so could unleash a cascade of negative economic consequences, impacting the US economy and triggering global instability. The potential for a US debt default presents a significant threat to global financial stability. Staying informed about the developments surrounding the US debt ceiling, the debt limit crisis, and its potential impact is crucial. You can consult resources like the Congressional Budget Office and the Treasury Department's website for further information and updates on this critical issue. We must act now to avoid a potential debt limit crisis.

Featured Posts

-

Crazy Rich Asians Tv Series Henry Golding Shares Reunion Details And Future Plans

May 11, 2025

Crazy Rich Asians Tv Series Henry Golding Shares Reunion Details And Future Plans

May 11, 2025 -

Payton Pritchard Key Player In Boston Celtics Opening Playoff Round Win

May 11, 2025

Payton Pritchard Key Player In Boston Celtics Opening Playoff Round Win

May 11, 2025 -

Boris Johnson Y El Incidente Con El Avestruz En Texas Detalles Y Video

May 11, 2025

Boris Johnson Y El Incidente Con El Avestruz En Texas Detalles Y Video

May 11, 2025 -

Cissokho Vs Kavaliauskas Wbc Final Eliminator Showdown

May 11, 2025

Cissokho Vs Kavaliauskas Wbc Final Eliminator Showdown

May 11, 2025 -

1 050 Price Hike On V Mware At And Ts Response To Broadcoms Acquisition

May 11, 2025

1 050 Price Hike On V Mware At And Ts Response To Broadcoms Acquisition

May 11, 2025