Tribal Loans For Bad Credit: Finding A Direct Lender With Guaranteed Approval

Table of Contents

Facing financial hardship with a less-than-perfect credit score can feel overwhelming. Traditional lenders often turn down applications with bad credit, leaving many feeling hopeless. But there are alternatives. Tribal loans, offered by direct lenders, might provide a solution for those seeking emergency funds. This article explores the world of tribal loans for bad credit, guiding you toward finding a direct lender and understanding the realities of "guaranteed approval."

Understanding Tribal Loans and Their Advantages

Tribal loans are short-term loans offered by lending institutions owned and operated by Native American tribes. These lenders operate on tribal land, often providing an alternative lending avenue less restricted by state regulations than traditional banks. They've gained popularity as a potential option for individuals with bad credit.

Advantages of Tribal Loans:

- Accessibility for individuals with bad credit: Many applicants with poor credit history who've been turned down by banks might find tribal lenders more receptive.

- Potentially faster approval processes: Compared to traditional lenders' rigorous processes, tribal loan applications can sometimes be processed and approved more quickly. This speed can be crucial in emergencies.

- Flexible repayment options: Some tribal lenders offer flexible repayment schedules, though this varies widely between lenders. However, be sure to carefully examine these plans to understand the total cost.

Potential Disadvantages of Tribal Loans:

- Higher interest rates: It's crucial to be aware that tribal loans often come with significantly higher interest rates than traditional loans.

- Significant fees: Fees associated with tribal loans can add to the overall cost, potentially making them more expensive than other options.

- Strict repayment terms: While some lenders offer flexible repayment, missing payments can lead to serious consequences.

Finding a Reputable Direct Lender for Tribal Loans

Choosing a legitimate lender is paramount when considering tribal loans. Predatory lenders exist, and it’s vital to protect yourself.

Warning Signs of Predatory Lenders:

- Unrealistic promises of guaranteed approval with no stipulations: Be wary of lenders guaranteeing approval without any conditions or credit checks.

- Excessive fees and hidden charges: Scrutinize the loan agreement for any unclear or unusually high fees.

- Aggressive or high-pressure sales tactics: A reputable lender will provide clear information without pressuring you into a decision.

Tips for Researching Reputable Direct Lenders:

- Check online reviews and ratings: Look for independent reviews on websites like the Better Business Bureau.

- Verify licensing and registration: Ensure the lender is legitimately operating and licensed within the relevant tribal jurisdiction.

- Compare interest rates and terms from multiple lenders: Don't settle for the first offer you see; shop around to find the best terms possible.

The Reality of "Guaranteed Approval" for Tribal Loans

The term "guaranteed approval" is often misleading. While some tribal lenders advertise this, it doesn't imply automatic approval without any checks. Instead, it usually means the lender has a more flexible approval process than traditional lenders, though it is still subject to certain criteria.

Potential Requirements for Approval:

- Minimum income threshold: You'll typically need to demonstrate a minimum income to show you can manage repayments.

- Active bank account: A verifiable bank account is usually necessary for direct deposit of funds and payments.

- Valid government-issued ID: Proof of identity is standard for all financial transactions.

The Application Process for Tribal Loans

Applying for a tribal loan is generally done online. The process is typically straightforward, but efficiency relies on having all the necessary documentation readily available.

Steps in the Application Process:

- Find a lender: Research and select a reputable direct tribal lender.

- Complete the application: Fill out the online application form accurately and completely.

- Provide necessary documentation: Gather your income verification, bank statements, and government-issued ID.

- Await approval: The lender will review your application, and the approval timeline can vary.

- Review the loan agreement: Carefully read and understand all the terms and conditions before signing.

Managing Your Tribal Loan Responsibly

Successfully navigating a tribal loan involves responsible financial management. Creating a realistic budget and adhering to a strict repayment plan is crucial.

Tips for Responsible Loan Management:

- Budgeting: Carefully budget your income and expenses to ensure you can comfortably meet your loan repayments.

- Repayment planning: Create a repayment plan that aligns with your financial capabilities and stick to it diligently.

- Avoid defaults: Missing payments can lead to escalating fees and damage your credit score further.

- Seek help if needed: If you find yourself struggling to make payments, contact your lender immediately to explore possible options, or reach out to a non-profit credit counseling agency.

Conclusion

Securing a tribal loan for bad credit requires thorough research and careful planning. While the allure of "guaranteed approval" is strong, understanding the terms, choosing a reputable direct lender, and managing your loan responsibly are key to avoiding financial pitfalls. Remember, higher interest rates and fees are common with this type of loan; weigh the benefits carefully against potential costs before applying.

Call to Action: Ready to explore your options with tribal loans for bad credit? Start your search for a trustworthy direct lender today. Compare offers meticulously and always read the fine print before committing. Don't let bad credit hold you back – take control of your finances now!

Featured Posts

-

Hujan Petir Di Jawa Timur Prakiraan Cuaca 29 Maret 2024

May 28, 2025

Hujan Petir Di Jawa Timur Prakiraan Cuaca 29 Maret 2024

May 28, 2025 -

Foinikiko Sxedio I Nea Tainia Toy Goyes Anterson Stis Aithoyses

May 28, 2025

Foinikiko Sxedio I Nea Tainia Toy Goyes Anterson Stis Aithoyses

May 28, 2025 -

Wwii Veteran James Loyds Daywatch A Story Of Improbable Return

May 28, 2025

Wwii Veteran James Loyds Daywatch A Story Of Improbable Return

May 28, 2025 -

A Visitors Guide To Wrexham

May 28, 2025

A Visitors Guide To Wrexham

May 28, 2025 -

A Century Of Progress Remembering Chicagos 1933 Worlds Fair

May 28, 2025

A Century Of Progress Remembering Chicagos 1933 Worlds Fair

May 28, 2025

Latest Posts

-

El Chino Rios Un Dios Del Tenis Segun Tenista Argentino

May 30, 2025

El Chino Rios Un Dios Del Tenis Segun Tenista Argentino

May 30, 2025 -

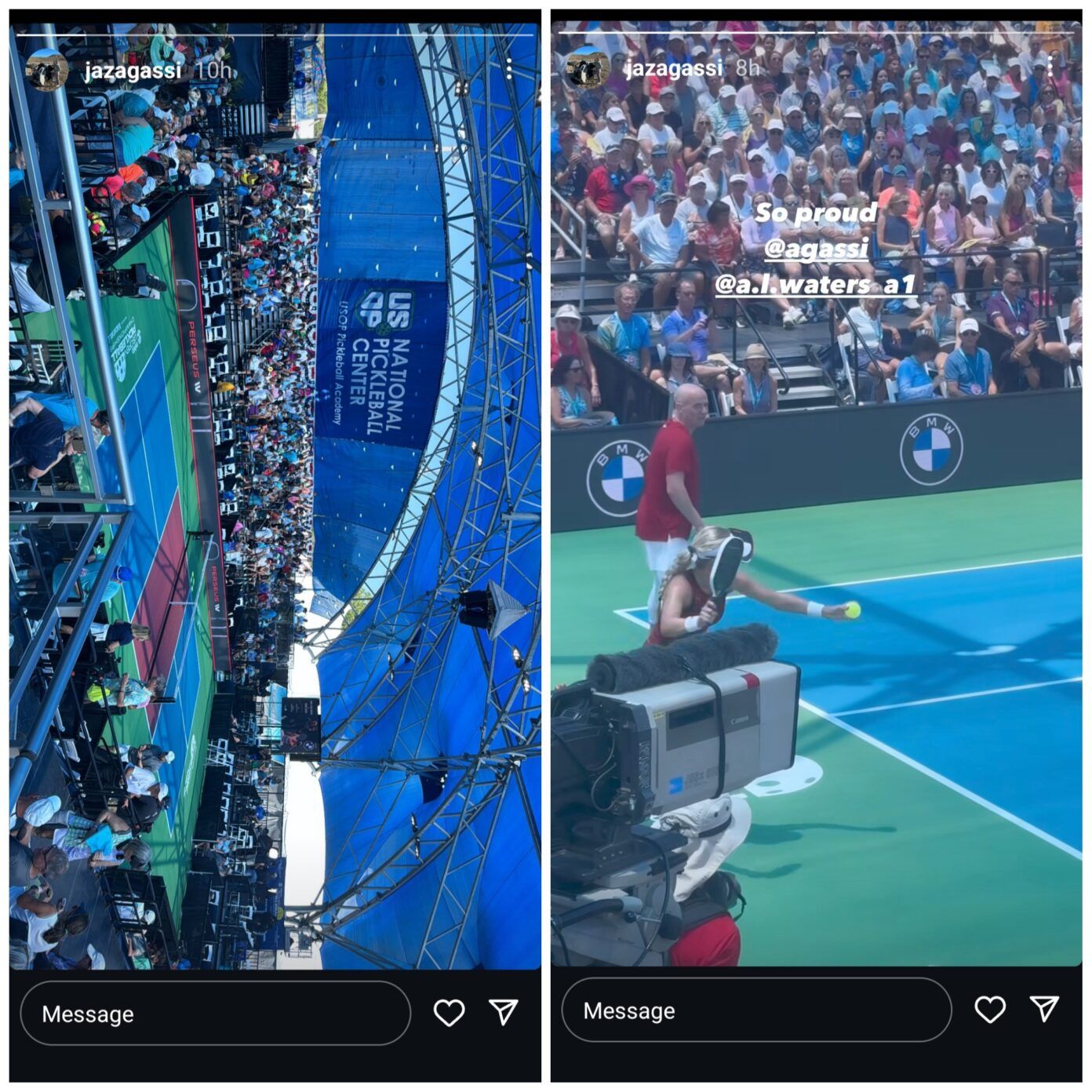

Das Erfolgsgeheimnis Von Steffi Graf Und Andre Agassi Im Pickleball

May 30, 2025

Das Erfolgsgeheimnis Von Steffi Graf Und Andre Agassi Im Pickleball

May 30, 2025 -

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025

Steffi Graf Und Andre Agassi Ihr Pickleball Erfolg Tipps Und Tricks

May 30, 2025 -

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025

Andre Agassis Professional Pickleball Debut Tournament Details

May 30, 2025 -

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025

Ira Khans Agassi Meeting An Unexpected Revelation

May 30, 2025