Trump Administration Seeks Tariff Reductions And Rare Earths Relief From China

Table of Contents

Tariff Reductions: Easing Trade Tensions with China

The Trump administration's push for tariff reductions stemmed from its belief that excessive tariffs hampered US competitiveness, increased consumer prices, and contributed to an unfavorable trade balance with China. The stated goals included boosting American businesses, lowering costs for consumers, and rebalancing trade relationships.

The Rationale Behind Tariff Reductions

The administration argued that high tariffs imposed by both the US and China created a cycle of economic hardship. The goal was to negotiate a reduction in these tariffs, aiming for a more balanced and mutually beneficial trade relationship.

- Specific examples of tariffs targeted for reduction: Tariffs on agricultural goods (like soybeans), manufactured products (steel and aluminum), and consumer goods were all subject to negotiation and potential reduction.

- Sectors affected: Agriculture, manufacturing, and the retail sectors were significantly impacted by the tariff battles. The fluctuating prices of imported goods had a ripple effect throughout the US economy.

- Economic data: Economic data showing decreased consumer spending and slower GDP growth in specific sectors, partly attributed to tariffs, fueled the argument for tariff reduction.

Negotiating with China

Negotiations with China were complex and often fraught with tension. The talks involved high-level officials from both countries, focused on achieving reciprocal concessions.

- Key figures involved: Robert Lighthizer (US Trade Representative) played a crucial role in the negotiations. On the Chinese side, key figures included Vice Premier Liu He.

- Specific agreements: While some limited agreements were reached, full-scale tariff reductions remained elusive throughout the Trump administration's term. “Phase One” of a trade deal saw some tariff reductions, but broader goals remained unmet.

- Challenges faced: Significant challenges included disagreements over intellectual property theft, forced technology transfer, and persistent trade imbalances. China's retaliatory tariffs added further complexity.

Impact of Tariff Reductions

The actual impact of tariff reductions (or lack thereof) remains a subject of debate among economists.

- Positive impacts (potential): Reduced tariffs could have led to lower consumer prices for certain goods and increased competitiveness for some US businesses.

- Negative impacts (potential): Retaliatory tariffs from China could have negatively impacted US exporters and certain industries. Some economists argued that the uncertainty surrounding tariffs hindered investment and economic growth.

- Predictions from economists: Economists offered varied predictions, with some suggesting positive impacts from reduced tariffs and others highlighting potential downsides and lingering trade imbalances.

Rare Earths Relief: Diversifying Supply Chains and Reducing Reliance on China

China's dominance in the rare earths market presented a significant geopolitical and economic challenge for the US. Rare earths are crucial for various high-tech applications, and China's near-monopoly raised concerns about supply security and national security.

The Strategic Importance of Rare Earths

Rare earth minerals are essential components in various industries, making them strategically vital. China's control over their production presented a significant vulnerability for the US.

- Specific applications: Rare earths are critical for the manufacturing of electronics (smartphones, computers), defense systems (missiles, radar), and renewable energy technologies (wind turbines, electric vehicles).

- National security concerns: The US's reliance on China for these critical materials raised concerns about potential supply disruptions during geopolitical tensions or conflicts.

Strategies for Rare Earths Independence

The Trump administration pursued several strategies to reduce reliance on China for rare earths.

- Specific policies/programs: The administration explored initiatives to incentivize domestic rare earth mining and processing, including government funding and tax breaks for companies investing in this sector.

- Government funding/incentives: Federal funding was allocated towards research and development aimed at improving rare earth extraction and processing techniques.

- Partnerships with other countries: The administration sought to develop partnerships with other countries possessing rare earth resources to diversify supply chains.

Challenges in Diversifying Rare Earth Supply

Achieving rare earth independence from China proved to be a significant challenge.

- High production costs: Mining and processing rare earths can be expensive and environmentally demanding.

- Environmental concerns: The extraction and processing of rare earths raise environmental concerns, requiring stringent regulations.

- Geopolitical complexities: Securing reliable alternative sources of rare earths requires navigating complex geopolitical landscapes and international trade agreements.

Conclusion: Assessing the Legacy of the Trump Administration's Trade Policy on China

The Trump administration's efforts to secure tariff reductions and rare earths relief from China yielded mixed results. While some limited tariff reductions were achieved, the broader goal of a significantly more balanced trade relationship remained elusive. Similarly, efforts to diversify rare earth supply chains faced considerable challenges.

The long-term implications of these policies on US-China relations and global trade are still unfolding. The impact on US businesses, consumers, and national security will likely continue to be debated for years to come. To gain a deeper understanding of these complex issues, further research into the specific details of the Trump administration's trade policies, including the nuances of tariff reductions and rare earths relief efforts, is essential. You can find additional information through reports from organizations like the US Trade Representative's office and various economic think tanks. Continue your exploration into the intricacies of this significant period in US-China relations and the global economy.

Featured Posts

-

Juan Sotos Post Kay Interview Surge Coincidence Or Causation

May 11, 2025

Juan Sotos Post Kay Interview Surge Coincidence Or Causation

May 11, 2025 -

Adam Sandlers Wealth Proof That Comedy Can Make You Rich

May 11, 2025

Adam Sandlers Wealth Proof That Comedy Can Make You Rich

May 11, 2025 -

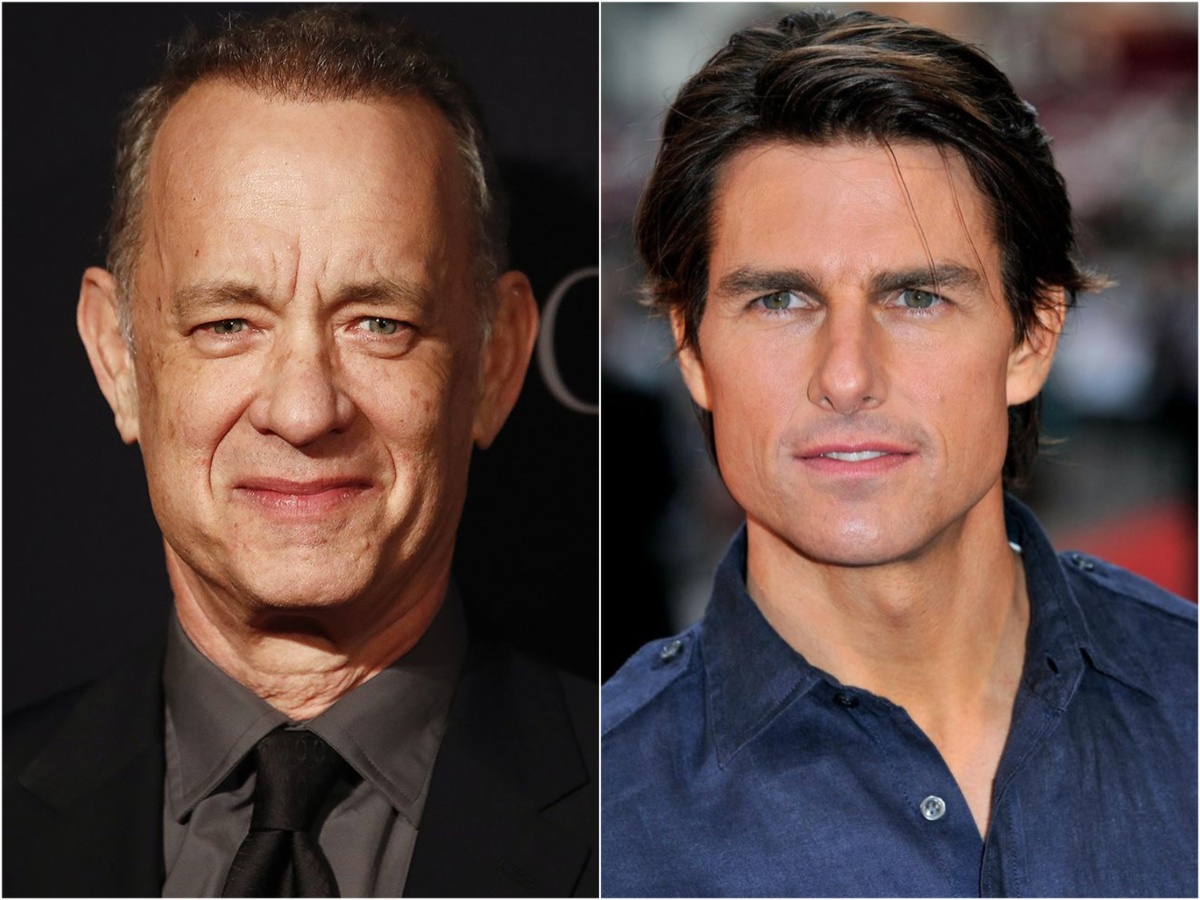

Tom Cruise Still Owes Tom Hanks 1 The Story Behind The Unpaid Debt

May 11, 2025

Tom Cruise Still Owes Tom Hanks 1 The Story Behind The Unpaid Debt

May 11, 2025 -

Fin D Une Epoque Thomas Mueller Quitte Le Bayern Munich

May 11, 2025

Fin D Une Epoque Thomas Mueller Quitte Le Bayern Munich

May 11, 2025 -

Shevchenko Fiorot Ufc 315 Fight A Deep Dive

May 11, 2025

Shevchenko Fiorot Ufc 315 Fight A Deep Dive

May 11, 2025