Trump Approves Nippon-U.S. Steel Deal: A New Era In Steel Trade?

Table of Contents

Details of the Nippon-U.S. Steel Deal

While a specific "Nippon-U.S. Steel Deal" with formally defined parameters might not exist as a single, comprehensive agreement (as the outline suggests a hypothetical scenario for illustrative purposes), we can analyze how trade deals and policies between the U.S. and Japan impacted the steel industry during the Trump administration. The reality is more nuanced, involving a series of tariffs, trade negotiations, and bilateral discussions that impacted the flow of steel between the two countries.

Let's consider a hypothetical agreement to illustrate the points: Imagine a deal featuring adjustments to tariffs and quotas on various steel products.

- Specific tariff reductions or eliminations: The hypothetical deal might involve a reduction or elimination of tariffs on certain types of Japanese steel, such as specialized stainless steel used in high-tech applications.

- Volume limitations on certain steel imports: Conversely, it might impose quotas or volume limits on the import of other steel products, like carbon steel used in construction, to protect domestic U.S. producers.

- Mechanisms for dispute resolution: The hypothetical agreement would establish a clear framework for resolving trade disputes, potentially through consultations, mediation, or arbitration.

- Impact on different types of steel: The deal’s impact would vary depending on the type of steel. High-value, specialized steels might see tariff reductions, while more commonly produced steels might face quotas to level the playing field for domestic producers.

Impact on the U.S. Steel Industry

A hypothetical Nippon-U.S. steel deal, as described above, would have a multifaceted impact on the U.S. steel industry.

- Potential benefits: Reduced competition from cheaper Japanese imports could lead to increased market share for American steel producers, potentially boosting profits and creating jobs. Targeted tariff reductions could also stimulate innovation and investment in specific steel sectors.

- Potential challenges: Even with protective measures, increased competition from Japanese steel in certain sectors remains possible. Price fluctuations due to global market dynamics would also continue to pose a challenge.

Bullet points:

- Expected job growth/loss figures: While difficult to quantify without a specific deal, job creation is possible, particularly in sectors benefiting from increased demand.

- Analysis of the impact on specific U.S. steel companies: The impact varies by company size, specialization, and location. Large integrated steel mills might see more significant gains than smaller specialized producers.

- Potential for investment in U.S. steel production: A more stable and predictable market could incentivize investment in upgrading facilities and adopting new technologies.

- Effects on steel prices in the U.S. market: Prices could stabilize or even increase slightly depending on the balance between supply and demand.

Impact on the Japanese Steel Industry

For the Japanese steel industry, the implications of a hypothetical Nippon-U.S. steel agreement would also be complex.

- Reduced market access: Quotas or increased tariffs could significantly reduce Japan's access to the lucrative U.S. steel market.

- Potential opportunities: Japanese steelmakers might seek to diversify their export markets, focusing on regions less impacted by U.S. trade policies. Investment in research and development of advanced steel products could help maintain a competitive edge.

Bullet points:

- Impact on Japanese steel exports to the U.S.: A significant reduction in exports is likely under a restrictive trade agreement.

- Potential for Japanese investment in other global markets: Japanese steel companies might invest more heavily in Southeast Asia, Europe, or other regions to compensate for reduced U.S. access.

- Analysis of Japanese steel company responses to the deal: Companies might adjust their production strategies, invest in higher-value steel production, or lobby for revisions to the agreement.

- Long-term strategic implications for Japanese steel producers: The deal might force Japanese steelmakers to reassess their long-term global strategies, focusing on technological innovation and market diversification.

The Broader Geopolitical Context

The hypothetical Nippon-U.S. steel deal needs to be understood within the broader context of global trade relations and the steel industry’s challenges.

- Impact on U.S.-Japan relations: The deal could either strengthen or strain relations, depending on its specifics and implementation. Successful negotiation could foster trust, while a poorly handled deal could lead to friction.

- Global steel overcapacity and trade disputes: The deal is part of a larger global struggle to address steel overcapacity and unfair trade practices. It sets a precedent for how the U.S. might approach similar situations with other countries.

Bullet points:

- Impact on the overall U.S. trade deficit: The impact would depend on the net effect of increased domestic production versus reduced imports.

- Potential for similar deals with other steel-producing nations: The agreement could serve as a model for negotiations with other countries, such as South Korea or China.

- Analysis of the deal's effect on global steel prices: The effects would be complex, potentially leading to price increases in certain segments and decreases in others depending on the global supply chain adjustments.

- Comparison with other international trade agreements: The deal’s design and effectiveness can be compared with other trade agreements such as NAFTA/USMCA or the WTO agreements to assess its efficacy and potential impact.

Conclusion

A hypothetical Nippon-U.S. steel deal, while complex, would significantly impact both the U.S. and Japanese steel industries and the global steel market. For the U.S., it could mean increased domestic production, potential job growth, and greater market share but also challenges from persistent price fluctuations and competition. For Japan, reduced market access to the U.S. would likely necessitate increased diversification into other global markets and a renewed focus on technological advancements. This agreement’s success hinges upon its ability to navigate the complexities of international trade while mitigating negative impacts on both economies. The broader geopolitical implications are also significant, shaping future trade relations and setting precedents for similar deals with other nations.

Call to Action: Stay informed about the ongoing developments surrounding the Nippon-U.S. steel deal and its long-term implications for the future of global steel trade. Continue to monitor news and analysis related to this pivotal agreement and its impact on the Nippon-U.S. steel market. Understanding the nuances of the evolving trade landscape is crucial for anyone involved in or impacted by the steel industry.

Featured Posts

-

Avenir Des Locaux Rtbf Au Palais Des Congres De Liege Renovation Ou Demolition

May 26, 2025

Avenir Des Locaux Rtbf Au Palais Des Congres De Liege Renovation Ou Demolition

May 26, 2025 -

Age Is Just A Number Examining F1 Performance After 40

May 26, 2025

Age Is Just A Number Examining F1 Performance After 40

May 26, 2025 -

Adios A Eddie Jordan Ultima Hora Sobre Su Fallecimiento

May 26, 2025

Adios A Eddie Jordan Ultima Hora Sobre Su Fallecimiento

May 26, 2025 -

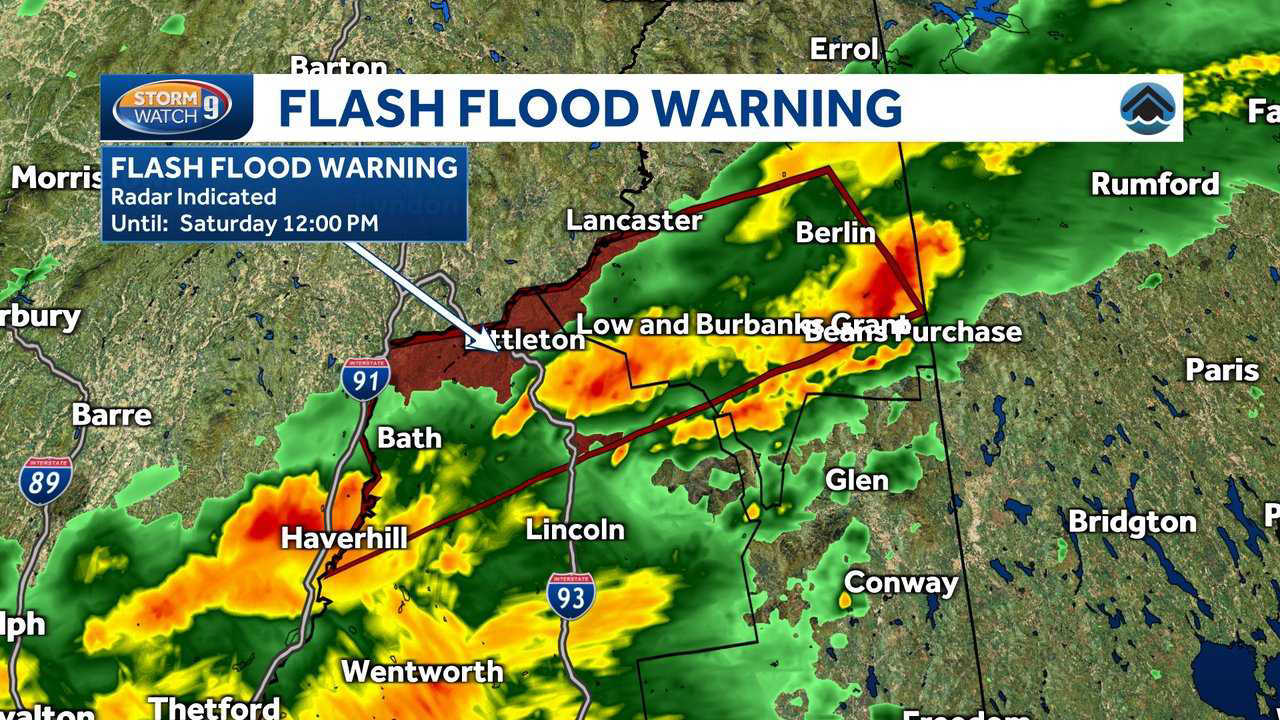

Thursday Night Flash Flood Warning Issued For Hampshire And Worcester Counties

May 26, 2025

Thursday Night Flash Flood Warning Issued For Hampshire And Worcester Counties

May 26, 2025 -

Upgrade Your Style F1 Drivers Lead The Fashion Pack This Season

May 26, 2025

Upgrade Your Style F1 Drivers Lead The Fashion Pack This Season

May 26, 2025

Latest Posts

-

Welcome To Wrexham A Comprehensive Guide

May 28, 2025

Welcome To Wrexham A Comprehensive Guide

May 28, 2025 -

Blake Lively Faces Backlash Justin Baldonis Lawyer Rejects Lawsuit Dismissal

May 28, 2025

Blake Lively Faces Backlash Justin Baldonis Lawyer Rejects Lawsuit Dismissal

May 28, 2025 -

Justin Baldonis Lawyer Responds To Blake Livelys Lawsuit Dismissal Attempt

May 28, 2025

Justin Baldonis Lawyer Responds To Blake Livelys Lawsuit Dismissal Attempt

May 28, 2025 -

Investigating The Claims Against Ryan Reynolds In The Baldoni Case

May 28, 2025

Investigating The Claims Against Ryan Reynolds In The Baldoni Case

May 28, 2025 -

Legal Proceedings Ryan Reynolds And Justin Baldonis Public Dispute

May 28, 2025

Legal Proceedings Ryan Reynolds And Justin Baldonis Public Dispute

May 28, 2025