Trump Tariffs And California's Economy: A $16 Billion Revenue Loss Forecast

Table of Contents

The Impact of Trump Tariffs on California's Agricultural Sector

California's agricultural sector, a cornerstone of its economy, suffered significantly under the weight of Trump tariffs. Keywords like agricultural exports, California agriculture, tariffs on agricultural products, farm income, and agricultural jobs highlight the specific challenges faced.

- Significant decline in exports: Retaliatory tariffs imposed by other countries severely hampered the export of key California agricultural products. Almonds, wine, dairy products, and other agricultural goods faced reduced demand in international markets, leading to substantial financial losses for farmers.

- Reduced farm income and job losses: The decline in exports directly translated to reduced farm income, impacting the livelihoods of farmers and farmworkers. This resulted in job losses, particularly in rural communities heavily reliant on agriculture. The ripple effect extended to related industries like transportation and processing.

- Increased costs for farmers: Ironically, tariffs also increased the cost of imported goods used in agricultural production, squeezing profit margins further. Higher prices for fertilizers, machinery parts, and other inputs added to the financial strain on California farmers.

- Case studies of specific agricultural businesses: Numerous case studies illustrate the devastating impact. For example, [insert example of a specific California agricultural business and its documented losses due to tariffs, citing a reliable source]. This highlights the widespread nature of the economic damage.

The Manufacturing Sector's Struggle Under Trump Tariffs

California's manufacturing sector, a vital contributor to the state's economy, also faced significant headwinds due to Trump tariffs. Keywords like California manufacturing, import tariffs, supply chain disruptions, manufacturing jobs, and increased production costs capture the essence of this struggle.

- Increased costs for imported raw materials: Many California manufacturers rely on imported raw materials and components for their production processes. Tariffs on these inputs significantly increased production costs, reducing profitability and competitiveness.

- Supply chain disruptions: Tariffs caused disruptions in global supply chains, leading to delays in the delivery of essential materials. This impacted production schedules, reduced output, and ultimately harmed the bottom line.

- Loss of competitiveness: Increased production costs made California manufacturers less competitive in the global market, leading to lost market share and reduced revenues.

- Job losses in the manufacturing sector: The combination of higher costs, supply chain disruptions, and reduced competitiveness led to job losses in the California manufacturing sector, impacting workers and their families. [Insert example of a specific manufacturing industry in California affected and job losses, citing a reliable source].

Consumer Impact and the Rising Cost of Goods

The impact of Trump tariffs extended beyond businesses, directly affecting California consumers through higher prices and reduced purchasing power. Keywords like consumer prices, inflation, tariff impact on consumers, cost of living, and retail sector highlight these repercussions.

- Increased prices for imported goods: Tariffs on imported goods translated directly into higher consumer prices, impacting everything from clothing and electronics to food and furniture. This increased the cost of living for California residents.

- Reduced consumer spending: Higher prices and economic uncertainty led to reduced consumer spending, dampening economic growth. Consumers tightened their belts, resulting in decreased demand for goods and services across various sectors.

- Impact on the retail sector: The retail sector, already facing challenges, felt the pinch of reduced consumer spending. Retailers struggled with lower sales and profitability, leading to potential job losses and business closures.

- Inflationary pressures: The increased cost of goods contributed to inflationary pressures, eroding the purchasing power of California consumers, particularly those in lower income brackets.

Long-Term Economic Consequences and Recovery Strategies

The $16 billion revenue loss forecast represents a significant long-term challenge for California's economy. Keywords like economic recovery, trade policy, California economic outlook, diversification, and long-term economic impact frame the discussion of long-term consequences and solutions.

- Long-term implications for California's budget: The revenue loss significantly impacts California's budget and its ability to fund essential public services like education, healthcare, and infrastructure.

- Strategies for economic diversification: To mitigate future economic shocks, California needs to diversify its economy and reduce its reliance on international trade in specific sectors. This may involve investing in new industries and technologies.

- Proactive trade policy adjustments: The experience underscores the need for a more proactive and nuanced approach to trade policy, mitigating the potential risks of future trade disputes.

- Supporting affected businesses and workers: Targeted government initiatives are essential to support businesses and workers affected by tariffs, helping them navigate the challenges and recover from the economic fallout. This could include retraining programs and financial assistance.

Conclusion

The $16 billion revenue loss forecast starkly illustrates the severe impact of Trump-era tariffs on California's economy. The agricultural and manufacturing sectors have been disproportionately affected, resulting in job losses, reduced income, and increased consumer prices. The long-term consequences demand immediate attention and the implementation of proactive strategies for economic recovery and diversification.

Understanding the devastating effects of Trump tariffs on California's economy is crucial for advocating for sound trade policies and supporting the recovery of affected businesses and communities. Let's work together to mitigate the long-term impact of these tariffs and ensure a more resilient and prosperous future for California's economy. Learn more about the devastating impact of Trump tariffs and advocate for better trade policies.

Featured Posts

-

Analyzing Jeremy Arndts Role As Negotiator In Bvg Discussions

May 16, 2025

Analyzing Jeremy Arndts Role As Negotiator In Bvg Discussions

May 16, 2025 -

Toronto Maple Leafs Playoff Clinch Within Reach Against Panthers

May 16, 2025

Toronto Maple Leafs Playoff Clinch Within Reach Against Panthers

May 16, 2025 -

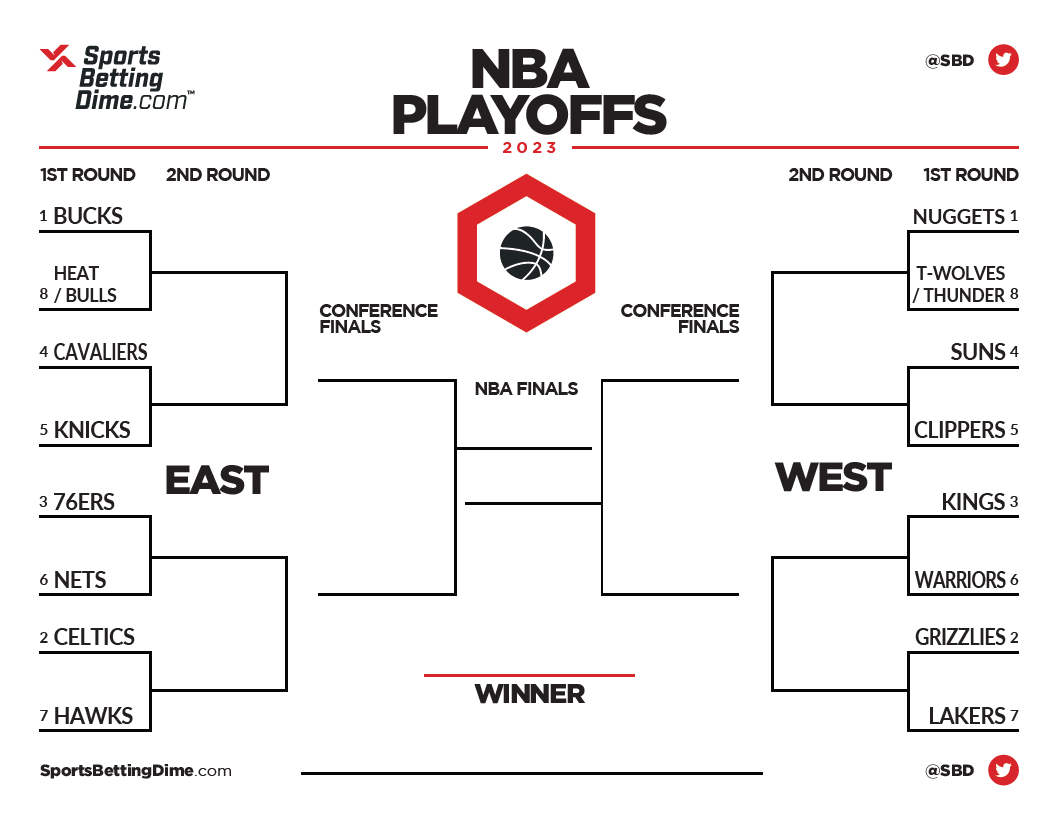

Best Bets Round 2 Nba And Nhl Playoffs

May 16, 2025

Best Bets Round 2 Nba And Nhl Playoffs

May 16, 2025 -

Decoding The Gop Mega Bill Provisions Protests And Prospects

May 16, 2025

Decoding The Gop Mega Bill Provisions Protests And Prospects

May 16, 2025 -

A Tense Situation Student Reactions To The Gsw Lockdown

May 16, 2025

A Tense Situation Student Reactions To The Gsw Lockdown

May 16, 2025