Trump Tax Cuts: Key Provisions Of The House Republican Plan

Table of Contents

Individual Income Tax Changes

The Trump tax cuts brought about substantial changes to individual income taxes. These changes aimed to simplify the tax code and provide tax relief for many Americans.

Lower Tax Rates

The plan significantly reduced individual income tax rates across the board. This resulted in lower tax burdens for many taxpayers.

- Rate Reductions: The top individual income tax rate was reduced from 39.6% to 37%. Other brackets also experienced reductions, although the specific percentage changes varied.

- Impact on Income Levels: While all income levels benefited to some degree, higher-income earners generally saw a larger percentage reduction in their tax liability.

- Comparison to Previous Rates: The 2017 tax reform marked the most significant overhaul of the individual income tax system in decades, resulting in the lowest tax rates in many years for many taxpayers.

Standard Deduction Increase

The standard deduction—the amount taxpayers can deduct from their gross income before calculating their taxable income—was substantially increased.

- Increased Amounts: The standard deduction for single filers increased, as did the amounts for married couples filing jointly and heads of household.

- Effect on Itemizing: This increase significantly reduced the number of taxpayers who chose to itemize their deductions, simplifying tax preparation for many. Fewer people needed to meticulously track and document deductible expenses.

Child Tax Credit Expansion

The child tax credit, a tax break for families with qualifying children, was expanded under the Trump tax cuts.

- Increased Credit Amount: The maximum credit amount per child was increased.

- Eligibility Requirements: While some eligibility requirements remained, the expansion made the credit more accessible to a larger number of families.

- Impact on Families: This expansion provided significant tax relief to many families with children, potentially boosting their disposable income.

Elimination of Personal and Dependent Exemptions

A notable change was the elimination of personal and dependent exemptions.

- Rationale: The elimination was partly offset by the increased standard deduction, aiming to streamline the tax code.

- Offsetting Benefits: While the loss of exemptions might seem negative, the increased standard deduction often provided a greater overall tax benefit for many taxpayers.

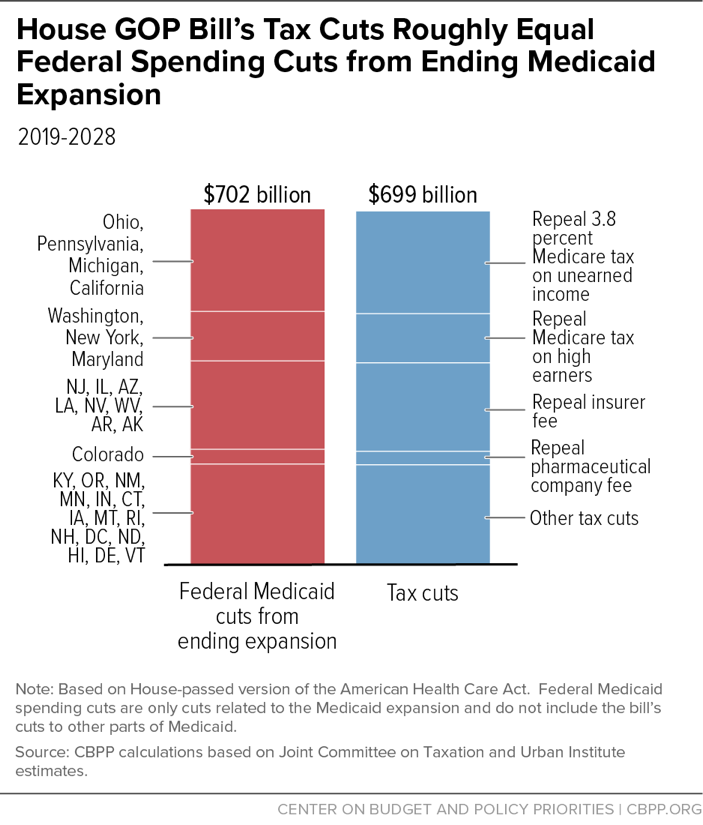

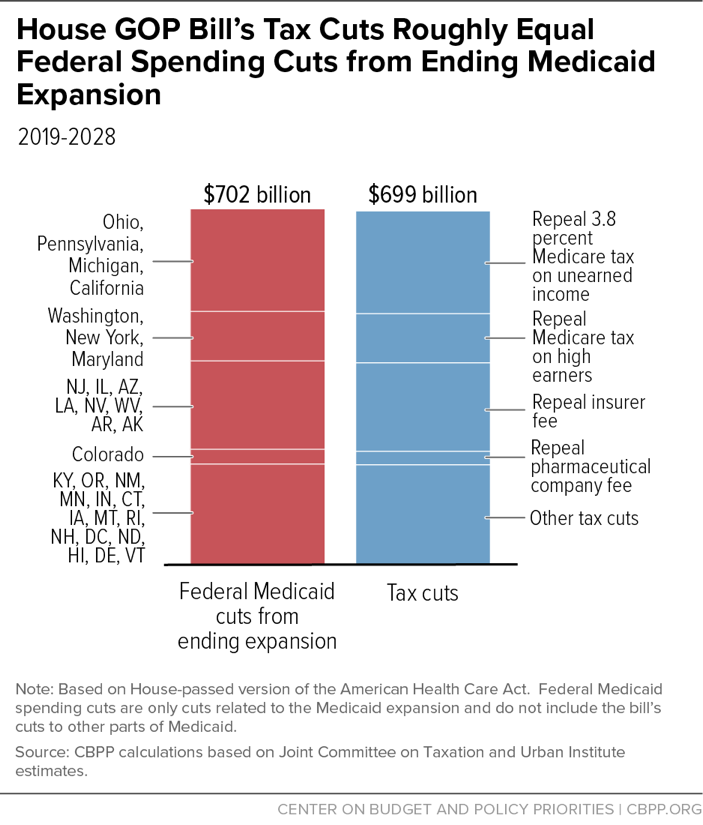

Corporate Tax Rate Reduction

The Trump tax cuts significantly impacted businesses through a dramatic reduction in the corporate tax rate.

Significant Reduction

The corporate tax rate was lowered from 35% to 21%, a substantial decrease.

- Reduction from 35% to 21%: This was one of the most publicized aspects of the 2017 tax reform, intended to boost business investment and competitiveness.

- Impact on Corporate Profits and Investment: Proponents argued the lower rate would lead to increased corporate profits, stimulating investment and job growth. The actual effect remains a subject of ongoing economic debate.

- International Implications: The change in the corporate tax rate also had international implications, affecting the competitiveness of American businesses in the global market.

Pass-Through Business Deduction

A new deduction was created for pass-through businesses—sole proprietorships, partnerships, and S corporations.

- Definition of Pass-Through Businesses: These businesses pass their income directly to their owners, who report it on their individual tax returns.

- Details of the Deduction: The deduction allowed qualifying pass-through businesses to deduct 20% of their qualified business income.

Other Key Provisions

Beyond individual and corporate tax changes, the Trump tax cuts included other notable provisions.

Estate Tax Changes

Modifications were made to the estate tax, which taxes the transfer of assets upon death.

- Increased Exemption Amount: The exemption amount was significantly increased, meaning a larger estate could be passed on tax-free.

- Impact on High-Net-Worth Individuals: This change primarily benefited high-net-worth individuals, shielding a greater portion of their assets from estate taxes.

Alternative Minimum Tax (AMT)

Changes were made to the AMT, which was designed to ensure that high-income individuals pay at least a minimum amount of tax.

- Explanation of the AMT: The AMT has complex rules and calculations; the reforms aimed to simplify its application.

- How Changes Affected Taxpayers: The adjustments to the AMT affected the number of taxpayers subject to this tax and the amount they owed.

Expensing of Capital Expenditures

Businesses were allowed to immediately deduct capital expenditures, rather than depreciating them over time.

- Effect on Business Investment and Economic Growth: This provision was intended to incentivize business investment and contribute to economic growth.

- Comparison to Previous Depreciation Rules: Prior to the 2017 tax reform, businesses had to depreciate capital expenditures over a period of years, reducing the immediate tax benefit.

Conclusion

The Trump tax cuts, implemented through the Tax Cuts and Jobs Act of 2017, significantly altered the US tax code. Key changes included lower individual and corporate tax rates, an expanded child tax credit, and a higher standard deduction. While these cuts stimulated economic activity in the short term, their long-term effects and impact on income inequality remain subjects of ongoing debate and economic analysis. Understanding these core provisions of the Trump tax cuts is essential for anyone navigating the complexities of the current tax system. To further explore the implications of these changes, research the Tax Cuts and Jobs Act of 2017 and consult with a tax professional for personalized advice. Don't hesitate to research further into the intricacies of the 2017 tax reform to fully grasp its impact on your personal financial situation.

Featured Posts

-

Britain And Australias Myanmar Policy Double Standards On Sanctions

May 13, 2025

Britain And Australias Myanmar Policy Double Standards On Sanctions

May 13, 2025 -

Wnbas Las Vegas Aces Make Roster Cut During Training Camp

May 13, 2025

Wnbas Las Vegas Aces Make Roster Cut During Training Camp

May 13, 2025 -

Sicherheitsalarm An Braunschweiger Schule Aktuelle Informationen

May 13, 2025

Sicherheitsalarm An Braunschweiger Schule Aktuelle Informationen

May 13, 2025 -

Celebrity Income Analyzing The Earnings Of Colin Jost And Scarlett Johansson

May 13, 2025

Celebrity Income Analyzing The Earnings Of Colin Jost And Scarlett Johansson

May 13, 2025 -

A Look At Eva Longorias 50th Birthday Fiesta In Miami

May 13, 2025

A Look At Eva Longorias 50th Birthday Fiesta In Miami

May 13, 2025

Latest Posts

-

John Barrys From York With Love An Everyman Film Event

May 14, 2025

John Barrys From York With Love An Everyman Film Event

May 14, 2025 -

The Get Off My Lawn Vibe Barry Bonds And His Comments On Shohei Ohtanis Success

May 14, 2025

The Get Off My Lawn Vibe Barry Bonds And His Comments On Shohei Ohtanis Success

May 14, 2025 -

Everyman Cinema Presents John Barry From York With Love

May 14, 2025

Everyman Cinema Presents John Barry From York With Love

May 14, 2025 -

Bonds Vs Ohtani A Generational Talent Comparison And The Get Off My Lawn Controversy

May 14, 2025

Bonds Vs Ohtani A Generational Talent Comparison And The Get Off My Lawn Controversy

May 14, 2025 -

Seven Players On Amorims Man United Transfer Wish List

May 14, 2025

Seven Players On Amorims Man United Transfer Wish List

May 14, 2025