Trump's Billionaire Allies And Their Post-Liberation Day Tariff Losses

Table of Contents

Identifying Key Billionaire Allies Affected

Several prominent billionaires who publicly supported the Trump administration experienced substantial financial losses due to the implemented tariffs. Identifying these individuals and the specific industries they controlled allows for a focused analysis of the economic impact. Note: Due to the complexity of disentangling direct tariff impact from other market factors, precise quantification of losses is challenging. However, we can analyze the trends and likely impacts.

- [Billionaire A]: (Link to relevant news article/financial report) This billionaire's significant holdings in [Industry X, e.g., steel manufacturing] were directly affected by tariffs imposed on [Specific product/material]. The resulting increase in production costs led to [Quantifiable impact, e.g., a 10% decrease in profitability during Q3 20XX].

- [Billionaire B]: (Link to relevant news article/financial report) This individual's investments in [Industry Y, e.g., retail] suffered from the impact of retaliatory tariffs imposed by [Country Z] in response to Trump's trade policies. This resulted in [Quantifiable impact, e.g., increased prices and decreased consumer demand].

- [Billionaire C]: (Link to relevant news article/financial report) This billionaire's real estate portfolio, particularly properties focused on [Specific market segment, e.g., luxury condos], experienced reduced demand due to [Explain reason, e.g., decreased consumer spending resulting from broader economic slowdown caused by tariffs].

Industries Affected: The tariffs impacted a broad range of sectors, including but not limited to manufacturing, agriculture, retail, and real estate. The interconnectedness of the global economy meant that even sectors seemingly unaffected by direct tariffs felt the consequences through supply chain disruptions and reduced consumer spending.

Analyzing the Types of Tariffs Imposed and Their Impact

The Trump administration implemented various types of tariffs, each having a distinct impact on different businesses and sectors. Understanding these nuances is crucial to analyzing the financial fallout for Trump's billionaire allies.

- Import Tariffs: These tariffs, levied on imported goods, directly increased the cost of raw materials and finished products for many businesses. For example, [Billionaire A]'s steel manufacturing business faced higher input costs due to import tariffs on steel components.

- Countervailing Duties: Designed to offset government subsidies provided to foreign producers, these tariffs affected businesses competing with subsidized imports.

- Anti-Dumping Duties: Aimed at preventing the sale of goods at below-market prices, these duties also increased the cost of imported products for businesses reliant on foreign suppliers.

(Insert Chart/Graph here: Visual representation of the impact of different tariff types on various sectors.) This visual aid would clearly demonstrate the disproportionate impact of specific tariffs on certain industries, providing a compelling visual representation of the data.

The Unexpected Economic Repercussions

The economic fallout from the tariffs extended far beyond the initially anticipated effects. The intended protectionist measures triggered a cascade of unforeseen consequences.

- Increased Prices for Consumers: Tariffs increased the cost of imported goods, leading to higher prices for consumers and reduced purchasing power.

- Supply Chain Disruptions: The imposition of tariffs disrupted established global supply chains, causing delays and shortages of essential goods.

- Job Losses in Affected Sectors: Businesses struggling to compete with higher input costs or reduced demand were forced to cut jobs, adding to the overall economic uncertainty.

- Retaliatory Tariffs: Other countries responded to Trump's tariffs with their own retaliatory measures, further exacerbating the economic difficulties.

(Include data and statistics from reputable economic institutions like the Congressional Budget Office or the Federal Reserve to support these claims).

Long-Term Effects and Policy Implications

The long-term effects of the Trump tariffs are still unfolding, but the experience highlights the potential risks of protectionist trade policies.

- Impact on Investor Confidence: The economic uncertainty generated by the tariffs damaged investor confidence, leading to decreased investment in affected sectors.

- Changes in Business Strategies: Businesses were forced to adapt their strategies, such as relocating production facilities or sourcing materials from different countries.

- Policy Recommendations: The experience underscores the importance of carefully considering the potential unintended consequences of broad tariff implementations and the need for more nuanced and targeted approaches to trade policy.

- Comparison to Historical Precedents: The Trump tariff experience can be compared to other instances of large-scale tariff imposition to understand their consistent impacts on global trade and national economies.

Conclusion

Trump's post-Liberation Day tariff policies resulted in significant financial losses for some of his billionaire allies. The unforeseen economic consequences—higher consumer prices, supply chain disruptions, job losses, and retaliatory tariffs—highlight the complexities of protectionist trade policies. The long-term effects continue to unfold, emphasizing the need for careful consideration of the broader economic impacts before implementing wide-ranging tariff measures. We encourage further research into the long-term effects of "Trump's Billionaire Allies and Their Post-Liberation Day Tariff Losses" and invite you to share your thoughts and perspectives on this crucial topic in the comments section below.

Featured Posts

-

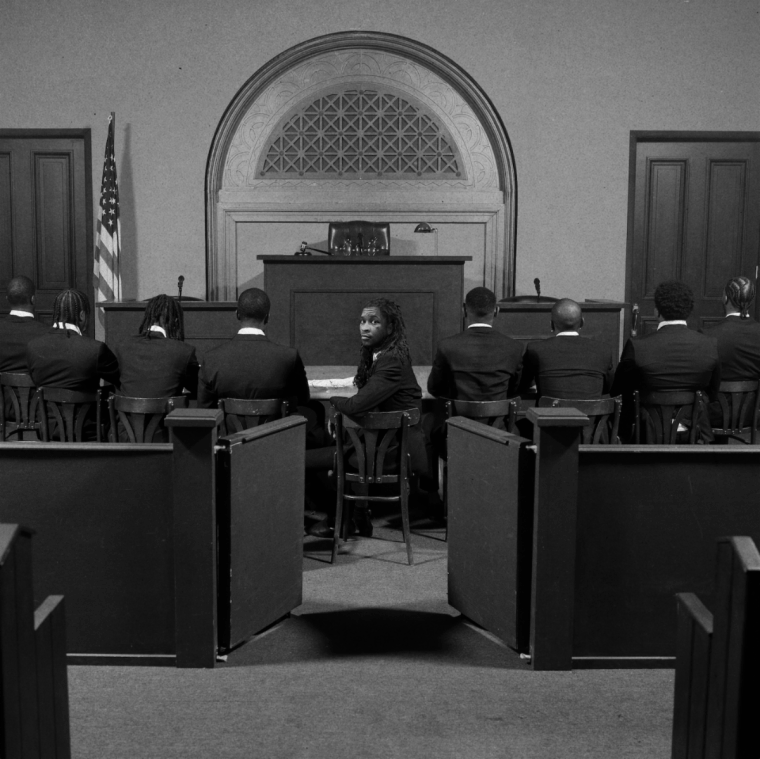

Adam Mosseris Testimony Instagrams Strategy Against Tik Toks Rise

May 10, 2025

Adam Mosseris Testimony Instagrams Strategy Against Tik Toks Rise

May 10, 2025 -

Young Thugs New Song A Promise To Stay Faithful

May 10, 2025

Young Thugs New Song A Promise To Stay Faithful

May 10, 2025 -

Revitalizing City Centers The Role Of Sports Stadiums

May 10, 2025

Revitalizing City Centers The Role Of Sports Stadiums

May 10, 2025 -

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 10, 2025

Woman Kills Man In Racist Stabbing Attack Unprovoked Violence

May 10, 2025 -

Wall Streets Resurgence Upending Bear Market Predictions

May 10, 2025

Wall Streets Resurgence Upending Bear Market Predictions

May 10, 2025